Currently, digital currencies still can’t be used for purchasing goods or paying for services in all countries, as they are not universally accepted as a means of payment. Therefore, users worldwide search for various ways to generate income from cryptocurrencies.

Trading cryptocurrencies is one of the ways to earn from digital assets. However, trading can be done in different ways, and not every transaction involves the actual transfer of crypto assets. In some cases, agreements may not imply the transfer of assets but only the difference in their value at a given moment and some future date. These instruments are known as derivatives, and that is what we will discuss in this article.

To learn more about what digital currencies are, how blockchain works, and other ways to earn from crypto, check out our article How to understand cryptocurrency.

Basics of financial derivatives

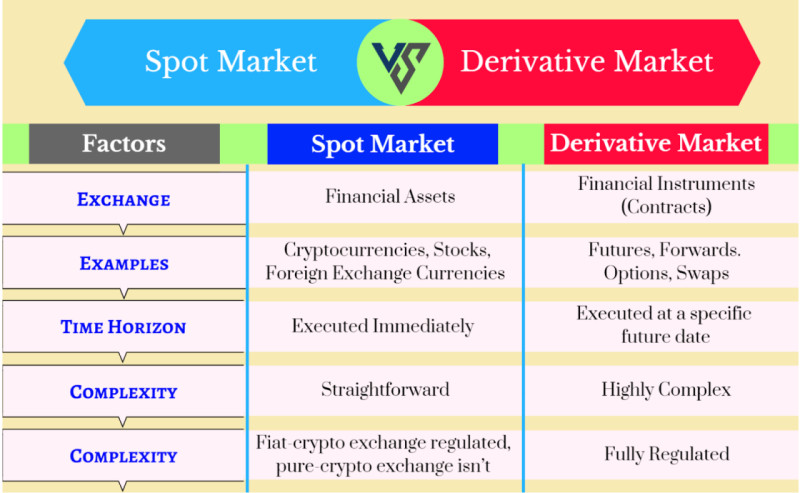

In a buy/sell agreement in commodity markets, the buyer transfers money to the seller in exchange for receiving a product. Trading in financial markets can occur in various ways, and not always does such an exchange happen between a buyer and seller as it does in commodity markets.

For instance, parties may agree in advance to sell an asset in the future at a fixed price. Alternatively, the transfer of the subject of the contract may not happen at all, with the transaction being based on price changes alone. These agreements, whose value is tied to the price of another asset, are called derivatives.

These derivative instruments (derivatives) are widely used in financial markets. They are considered derivatives because their price is directly linked to the value of an underlying asset, such as currencies, bonds, stocks, commodities, and so on.

Moreover, such agreements often serve as a hedge against possible risks caused by future fluctuations in the asset's value, as they allow the buyer or seller to secure the contract’s subject at a pre-agreed price. Additionally, these agreements have a specified time frame for their execution.

Since the deal is not settled immediately, both parties seek guarantees that the counterparty will fulfil their part of the agreement. To secure this, the buyer typically makes a deposit or contribution, which confirms their intention to complete the transaction. If the buyer changes their mind, this sum is forfeited to the seller.

Derivatives are often used in speculative trading strategies. Essentially, users place bets on price changes of an asset. However, this requires serious analysis and calculation rather than mere guesswork. If speculators can correctly predict how the asset’s price will change, they can benefit from the transaction. Otherwise, they risk losing money.

What are derivatives in cryptocurrency?

Digital currencies fascinate people from all over the world due to the opportunities they offer for generating income. This can be done in various ways, each with its own balance of potential risk and return. Every user can choose the instrument that best suits them. One such instrument is crypto derivatives, where the underlying assets are digital currencies. In this case, users can profit without actually owning the asset.

Derivatives are not only an excellent hedging tool for investors but also a good opportunity to diversify a portfolio. For investors, it is crucial to build a portfolio that includes assets with varying levels of risk and return.

There are several main categories of derivatives:

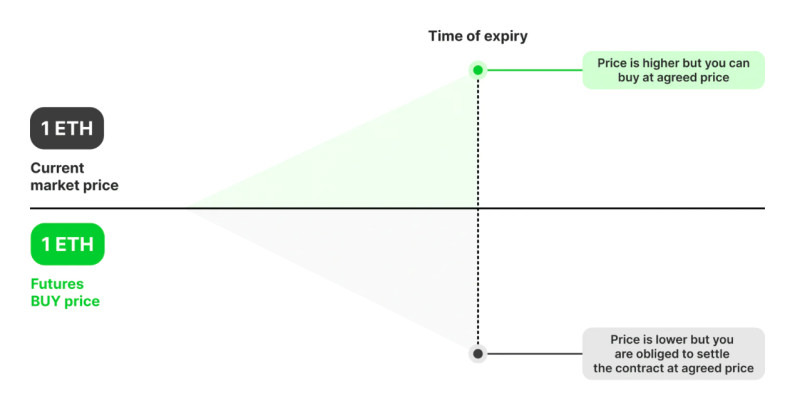

- Futures contracts are an agreement obligating the buyer to purchase crypto assets at a predetermined price in the future. When the contract is signed, the full amount is not paid upfront; only a margin deposit is made, which can be up to 20% of the total sum.

- Forward contracts are similar to futures in essence, but these contracts are traded over-the-counter (OTC) and do not have a standardized form, central counterparty, or margin requirements.

- Contracts for difference (CFDs) are a popular agreement in the cryptocurrency sector. The settlement between parties is based on the price difference at the time the contract is opened and closed. If the price increases, the buyer profits; if it decreases, the seller benefits.

These types of agreements have both similarities and significant differences. We will examine each type of derivative in detail in the following sections.

Futures contracts

To start understanding what derivatives in cryptocurrency are, let’s begin with futures contracts. Futures have several characteristics that are common to all such agreements:

- Standardized form;

- Traded on exchanges;

- Presence of a central counterparty guaranteeing execution;

- Margin requirements.

One of the key advantages of such contracts is that they allow users to earn from both rising and falling asset prices. If a user believes that the price of a cryptocurrency will decrease, they can open a futures contract to sell and make a profit in a bear market. This means one can earn even without owning any cryptocurrency, essentially speculating on the future price of assets without actually buying them.

This is especially relevant in cases where the asset is too expensive, such as Bitcoin, which costs more than $70,000. By purchasing a futures contract, the user doesn’t buy the Bitcoin itself, meaning they don’t have to spend a large sum on the actual asset. If the user believes that Bitcoin’s price will rise, they can buy a futures contract at the current price and later sell it at a higher price, with the difference being their profit.

Additionally, users can use leverage when trading futures. This allows them to increase the size of their initial investment and potential profit. However, it also increases the risk, so leverage should be used wisely, with a clear assessment of one's capabilities.

Types of futures contracts

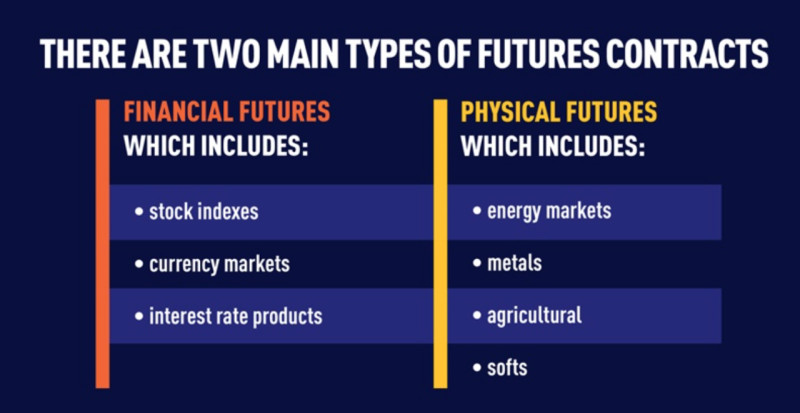

There are several types of futures contracts. All futures are divided into two main categories:

- Deliverable contracts. These are used in transactions where the asset can be physically delivered from the seller to the buyer, such as commodities, precious metals, etc.

- Cash-settled contracts. These are used when assets cannot be physically transferred, such as stock indexes. In these cases, when the contract expires, the difference between the price at purchase and the price at settlement is calculated.

In terms of execution time, futures are categorized into:

- Standard contracts. These have a predetermined expiration date. This category includes both deliverable and cash-settled futures. The difference is that, upon settlement of deliverable contracts, the asset itself is transferred, whereas, with cash-settled contracts, only the profit (or loss) is transferred.

- Perpetual contracts. These have no expiration date, so they can be traded nonstop. Profits on such contracts are calculated based on the funding rate, also known as funding fees, which are periodic payments the user receives based on the difference between the contract price and the spot market price.

All futures contracts are standardized, and regardless of their type, each must include the following sections:

- Contract name;

- Type of agreement;

- Quantity of the underlying asset;

- Expiration date;

- Delivery date.

Forward contracts

Forward contracts resemble certain other derivative financial instruments (DFIs), but they have unique characteristics. Forward contracts cannot be overlooked when discussing derivatives in cryptocurrency. Let’s explore what they are and what key features set them apart.

Forwards are quite similar to futures since they also represent a contract between a buyer and a seller for the future delivery of an asset at a predetermined price. However, unlike futures, forward contracts are traded over-the-counter (OTC). This is just one of several distinctions that follow from the fact that such contracts are not traded on exchanges.

Due to their OTC nature, forwards do not have a centralized intermediary to guarantee that both parties fulfil their obligations. Additionally, these contracts do not involve margin requirements. Furthermore, forward contracts lack a standardized form, meaning that the parties involved must independently determine the contract terms, tailoring them to both parties' needs. However, once the agreement is in place, it is binding and cannot be changed or cancelled.

To better illustrate the concept, consider the following example: currently, a cryptocurrency asset is priced at $100 per unit, its spot price. The buyer enters into a forward contract with the seller to purchase the asset at $140 in six months, which becomes the forward price. If, after six months, the cryptocurrency price exceeds $140 by more than $40, the buyer benefits since they can purchase the asset at a lower price. However, if the price does not reach $140 or even decreases, the seller profits.

Contracts for Difference (CFD)

Another popular type of derivative is the contract for difference (CFD). In this section, we will explain what derivatives in cryptocurrency are by examining CFDs, which stand for Contract for Difference.

The uniqueness of these contracts lies in the ability to earn from the price change of an asset between the opening and closing of a trade. These contracts can apply to any asset, including digital currencies. However, in this case, the contract is made between a client and a broker, not between two traders.

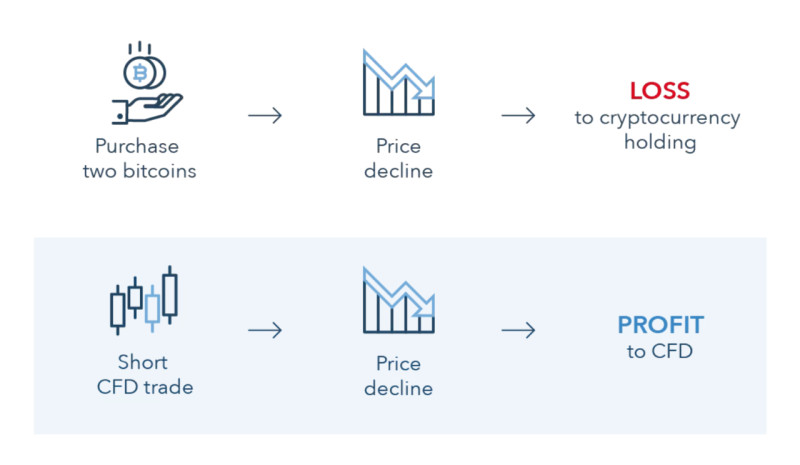

One of the primary features of CFDs is that users can profit from both the increase and decrease in the price of a cryptocurrency. If a trader believes the price will rise, they open a long position; if they think it will fall, they open a short position.

Cryptocurrencies are highly volatile, meaning their prices can fluctuate significantly even within a short period, for example, in a single day. This makes them ideal assets for trading CFDs, which are primarily traded in pairs, such as BTC/USD (Bitcoin against the US dollar).

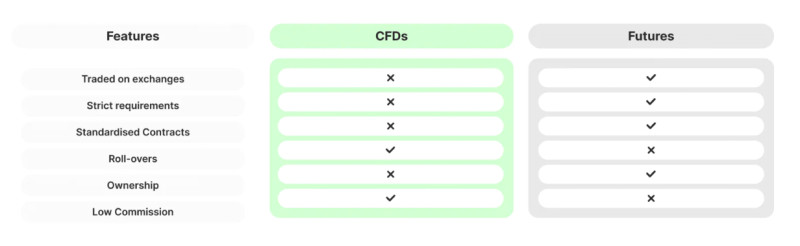

Compared to futures contracts, the key difference with CFDs is that they have no expiration date and do not involve the actual delivery of the asset at a specified time. Instead, a CFD follows the price movement of the underlying asset.

As with futures trading, CFDs may involve leverage, allowing traders to make larger trades with smaller initial capital. However, traders must carefully assess risks, not just potential profits.

Which derivative to choose

Now that we've examined what derivatives in cryptocurrency are and discussed the features of each type, it's time to compare them. When choosing a trading instrument, every user has their own criteria.

Comparing futures and forwards, futures tend to be more reliable: they are standardized and traded on exchanges, while forwards are not standardized and are traded OTC.

This leads to another distinction: the exchange acts as a guarantor of the obligations in futures contracts, so the risks in forward agreements are higher. However, the costs are lower for forwards, as they involve only the intermediary's commission.

Another advantage of futures over forwards is their flexibility. Futures contracts can be easily closed before their expiration, allowing users to open a new position. With forwards, this is more difficult since the terms are custom-tailored to the parties’ specific requirements.

CFDs, like forwards, are traded OTC and thus carry more risk than futures. Moreover, the market size and volume of futures contracts significantly exceed those of CFD contracts.

However, this is more of a benefit than a disadvantage since CFD trading can be done with smaller initial investments. Additionally, both futures and CFDs can employ leverage to attract extra financing.

Another distinction is that futures and forwards are contracts between clients, while CFDs are agreements between a client and a broker. Furthermore, the first two contracts may involve the physical delivery of assets, whereas CFDs do not.

Advantages and disadvantages

Like any other trading instrument, derivatives have both positive and negative aspects. Therefore, discussing cryptocurrency derivatives and which one to choose, let's review their advantages and disadvantages. The pros and cons of these contracts are summarized in the table below:

| Derivative | Advantages | Disadvantages |

| Futures | • Low entry barrier compared to other derivatives; • Lower fees; • Ability to profit from both rising and falling asset prices; • Leverage can be applied; • Portfolio diversification and risk hedging; • Exchange-based contracts offer reliability; • Liquidity – can be resold or easily find another counterparty. | • High level of risk, especially with leveraged trading; • Delivery futures require asset transfer upon expiration; • A complex instrument – not suitable for beginner traders. |

| Forward | • No initial margin required to enter the contract; • Flexibility in contract terms, tailored to individual party needs. |

|

| CFD |

|

|

How to start trading crypto derivatives

After discussing what cryptocurrency derivatives are, let's explore what is needed to start trading them. There are differences depending on the instrument used. Let’s first consider trading futures.

To start trading futures, you need to register on any exchange that handles digital currencies. It’s important to carefully choose an exchange to avoid scammers and losing all your funds.

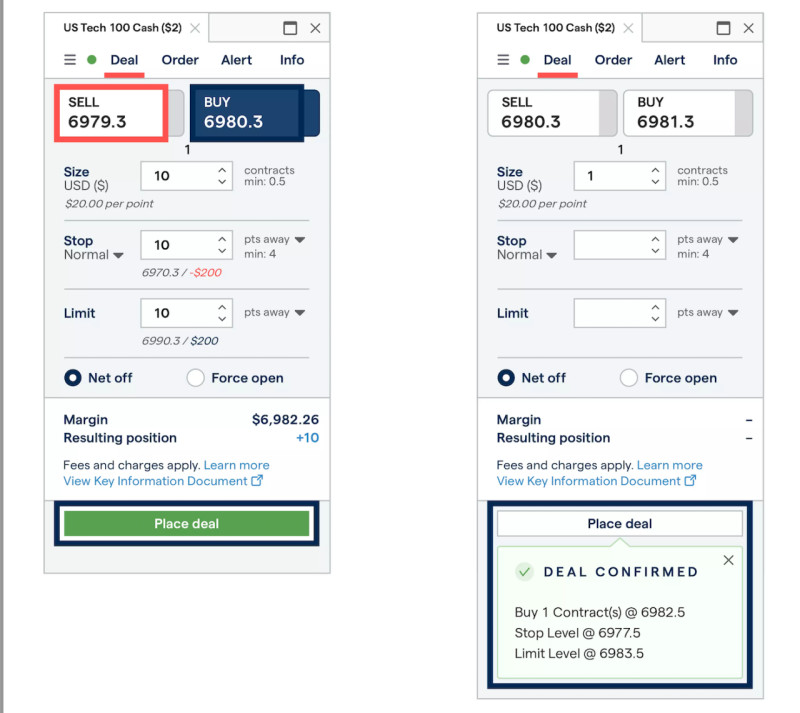

Before trading, you must deposit funds into your wallet to be used as collateral. Then the trader can open positions: if they believe the underlying asset’s price will rise, they open a long position, and if they think it will fall, they open a short position.

Leverage can be used if needed, but it’s important to remember that the potential risk increases along with the potential profit. You can also set the desired order type: limit or market. In the former case, the trade is executed when the specified price is reached, while in the latter, it’s executed at the current price.

As mentioned earlier, CFD trading involves a client and a broker, with the latter paying the former the difference in the asset’s price between the opening and closing of the position. Here, clients can also open long positions if they expect the currency’s price to rise or short positions if they expect it to fall.

To start trading, you need to choose a reliable broker and register an account. You don’t need to hold cryptocurrency in a wallet since trading is based on speculating on price changes rather than the asset itself.

Regardless of the instrument a user chooses for trading, they must have a clear strategy. This strategy should include market analysis, identifying entry and exit points, capital management, risk management, and other critical factors.

Conclusion

In this article, we have examined what cryptocurrency derivatives are and how they can be used to profit from cryptocurrencies. Also known as derivative instruments, their value correlates with changes in the price of the underlying asset.

The main types of crypto derivatives include futures, forward contracts, and contracts for difference (CFDs). Each has its unique characteristics that differentiate it from other instruments.

For example, futures are standardized and only traded on exchanges. As a result, they are more reliable because there is an intermediary that guarantees both parties will fulfil their obligations. They also have high liquidity, making it possible to resell them or find another counterparty before the contract’s expiration.

Forwards are similar to futures but are OTC and lack standardized terms. These contracts allow parties to independently set the deal terms, but this reduces flexibility as it becomes much harder to find another counterparty.

Another OTC contract is the CFD, where the parties are not two users but a client and a broker. These agreements allow users to profit from the changing prices of digital currencies between the opening and closing of a trade.

Back to articles

Back to articles