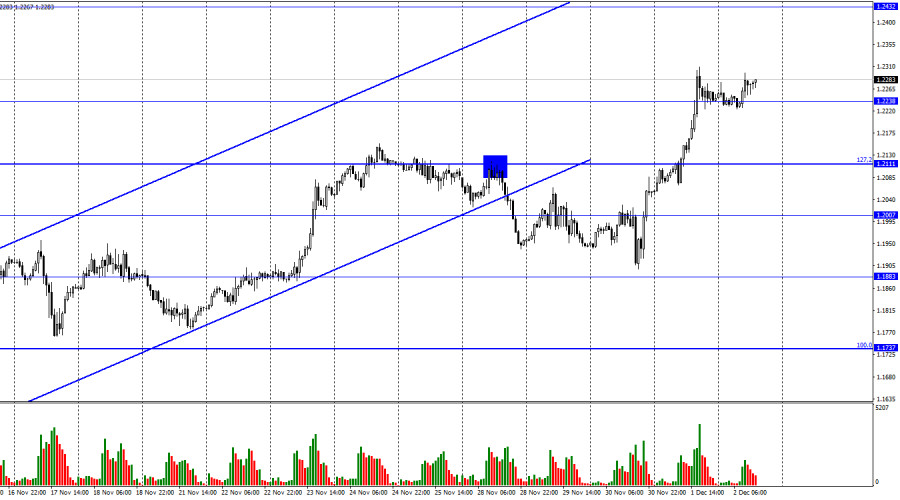

On Thursday, the GBP/USD pair continued to grow and fixed above the level of 1.2238 on the hourly chart. Thus, GBP might continue to climb towards 1.2432. If the price fixes below 1.2238, it may decline toward the Fibo level of 127.2% - 1.2111.

As it was mentioned earlier, there is no reason why the US dollar has been so weak in the last two days. If the US currency drops today, and it cannot be ruled out as we expect the US non-farm payroll report, there will be more questions about this move. The USD is falling unfairly now. This means that it may soar in the future, and traders will wonder why the USD is growing if there is no information background for it. Currently, the information background does not work properly in the market. On Wednesday, traders could sell the US currency after Powell's speech. So, why has the sell-off persisted on Thursday? Today, the correction after the two-day growth has not started yet.

Let's get back to the non-farm payroll report. This report may turn out to be even better than predicted, as it has been seen many times that the Non-Farm Employment Change and ADP reports do not show the same performance. The unemployment rate will also play a major role. If it shows growth, it may become a new reason to sell the US currency, though the US dollar is down enough already that it should be up at least a little bit now. Anyway, there is no logic in the pair's behavior right now. It seems that the week will end nervously, and the market will return to the balance next week. In December, there will be three central bank meetings at once, so there are a lot of interesting events waiting for us.

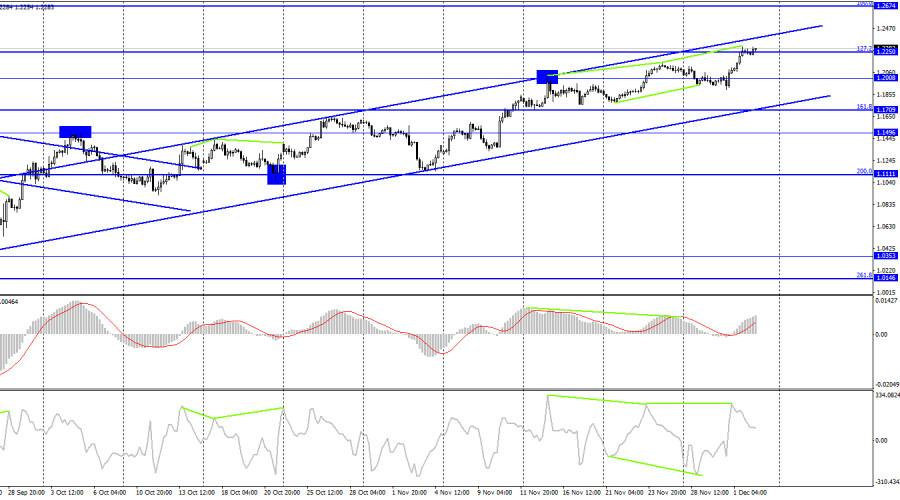

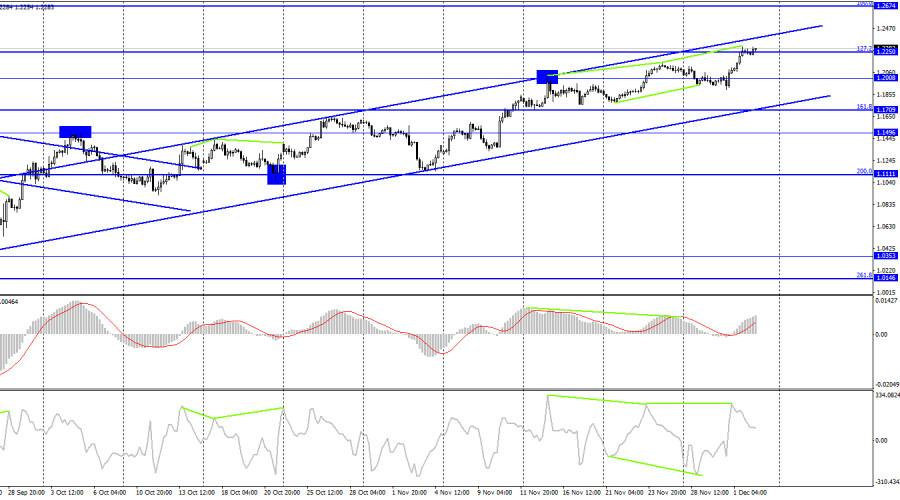

On the 4-hour chart, the pair reversed and this supported the British pound. After that, it resumed growth. At the moment, the price reached a correction level of 127.2% - 1.2250 and the CCI indicator is showing a bearish divergence. If the price rebounds from 1.2250, the US currency may be supported and the price may start falling toward the levels of 1.2008 and 1.1709. However, the upward trend channel still confirms that the traders' sentiments is bullish.

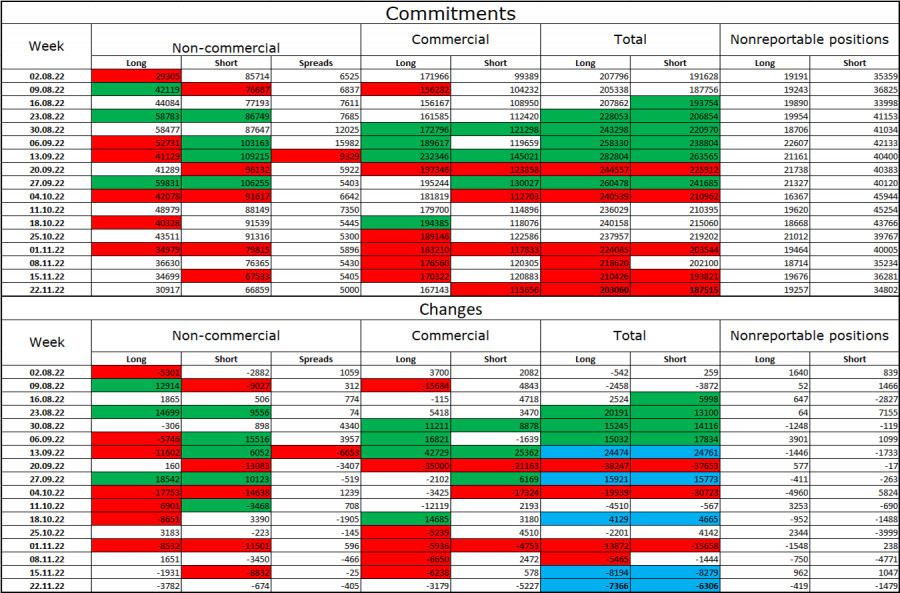

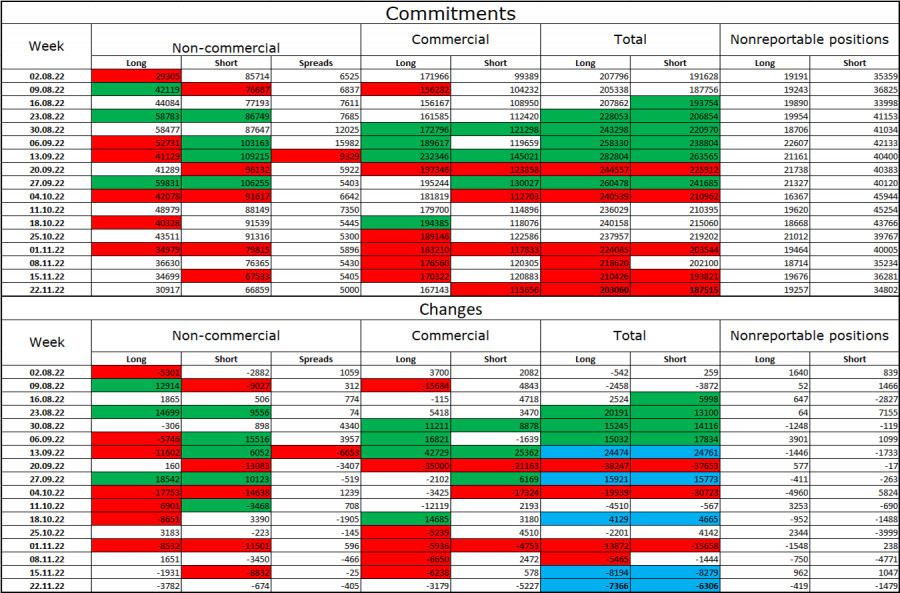

COT report

Last week, the sentiment of non-commercial traders became less bearish. The number of speculators' long positions decreased by 3,782, and the number of short positions dropped by 674. However, the sentiment of big players remains bearish, and the number of short positions is still very much higher than the number of long ones. Thus, big players continue to remain bearish on the British pound for the most part but their sentiment has been gradually changing towards bullish in recent months. At the same time, this process may take a lot of time. It has been going on for months, and the number of sales is still twice as high. The British currency might continue rising because the graphical analysis and the trading channel on the 4-hour chart support this scenario. Considering the information background, the situation is ambiguous. The growth factors for the US dollar are also may appear. Nevertheless, now we see the price increasing, and this growth was expected for many months. Meanwhile, this surge has no solid grounds.

US and UK economic calendar:

UK - Average Hourly Earnings (13-15 UTC).

US -Non-Farm Employment Change (13-30 UTC).

US - Unemployment Rate (18-30 UTC).

The US economic calendars have two important events on Friday. The UK calendar is almost empty. The influence of the information background on the market may be strong.

GBP/USD forecast and recommendations for traders:

One may sell the British pound with a target of 1.2111 and 1.2007 if the price closes below 1.2238 on the hourly chart. Now it would be better to refrain from buying GBP, as a new decline is possible.