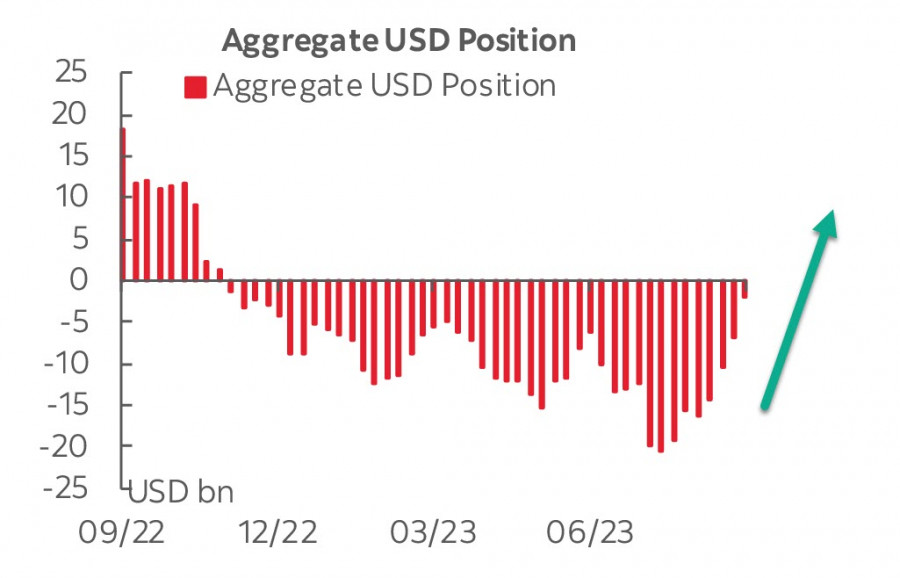

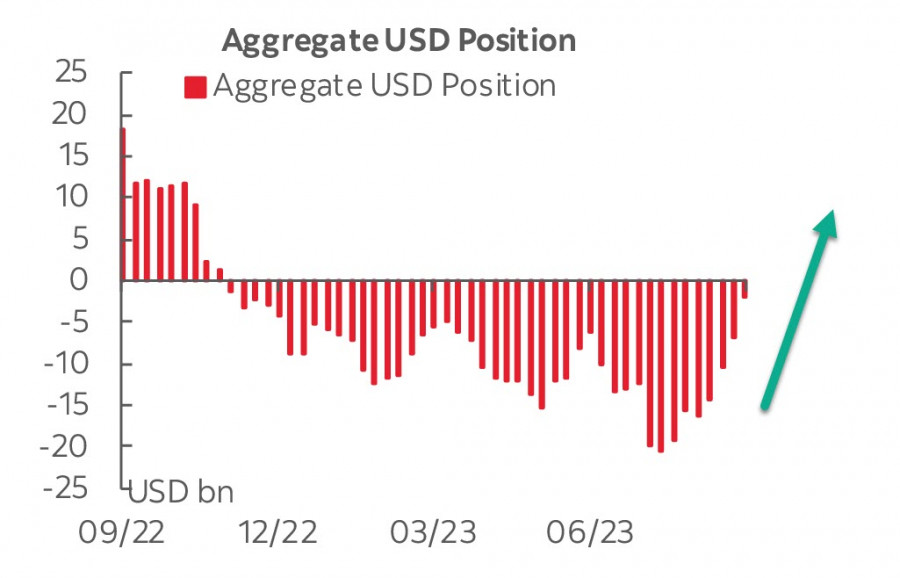

Traders significantly reduced their net short position on the US dollar last month. The latest Commodity Futures Trading Commission (CFTC) data shows that funds cut their net short dollar position against the major currencies by $1.9 billion for the week ending Tuesday. This is the smallest bearish bet on the US dollar in the last 10 months.

US economic reports have turned out mixed. The preliminary reading of the sentiment survey dropped to 67.7 in September from 69.5 in August, the University of Michigan said. This was due to deteriorating current assessments among consumers. Expectations for 5-10 year price increases fell to 2.7% in September, down from 3% the previous month. The data also reveals that consumers anticipate a 3.1% rise in prices over the next year, a drop from last month's expectation of 3.5%. This should ease the pressure on the FOMC, making it less likely to continue raising rates as real interest rates effectively decline with lower inflation expectations. Consequently, there is slightly less bullish pressure on the dollar.

At the same time, a series of manufacturing indicators, including industrial production volume in August, came in above expectations, and amid declining inflation, this could be the main driver for increased demand for the dollar.

Market activity is likely to be muted as participants await the outcome of the FOMC meeting.

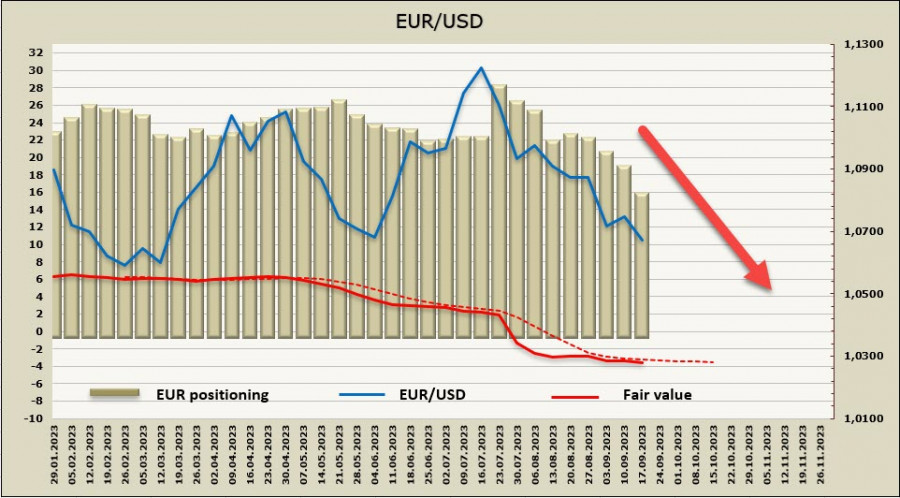

EUR/USD

As expected, the European Central Bank raised interest rates by 25 basis points, bringing the deposit rate to 4.0%, and inflation forecasts were also revised upward. However, market reaction, despite what seemed to be a hawkish decision, was not based on the rate hike itself but on the likelihood that this increase is the final one.

The ECB noted in its press release that "...the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target level." The statement also mentioned that decisions will depend on data, and during the press conference, ECB President Christine Lagarde stated that a "firm majority" is in favor of hiking rather than pausing and emphasized that the recommendations are based on the current assessment, which can change. Lagarde said, "The focus will probably be a bit more on the duration now, but we can't say – because we can't say – that we are now at the peak."

Nevertheless, markets interpreted the meeting's outcomes as if this rate hike is the last, and as a result, the euro significantly declined by the end of the week, reaching a local low of 1.0634. We cannot confirm if the price will be able to quickly overcome this support, and that a technical double bottom pattern will not form first, but one thing is clear – bearish pressure is increasing, and there is very little reason for a significant bullish correction.

The net long euro position fell by $3.06 billion to $15.2 billion this week, the lowest since November 2022. While the net long euro position is still the highest among G10 currencies, the trend that investors have turned bearish on the euro is gaining momentum. The price is below the long-term average, and there are no signs of a bullish reversal.

The euro, as expected, tested the support zone at 1.0605/35, but the single currency did not fall further. Nevertheless, we expect that after a brief consolidation, it will breach this support, and the euro will move lower, with the next target being the local low of 1.0514. Any potential corrective rise is limited by the zone at 1.0685/0715, where bearish pressure may resume. There is currently very little basis for a more pronounced upward movement.

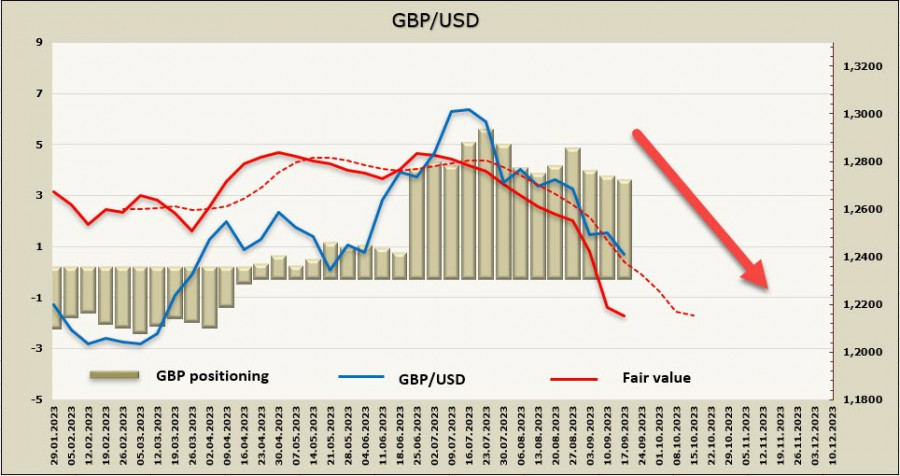

GBP/USD

The Bank of England will hold its next meeting on Thursday, September 21. Markets expect that the interest rate will be raised by 0.25%, although the release of the August inflation report a day before this meeting may have an impact. This meeting will not be accompanied by a press conference or an update of forecasts, so it is unlikely to cause a spike in volatility.

The current rate is 5.25%, and the market sees the peak rate at 5.60%, meaning there are still slight chances of another rate hike by the end of the year. The accompanying statement is expected to be moderately dovish, with usual formulations such as "the current stance of monetary policy is restrictive." For the pound, this would imply a loss of reasons for growth, as approaching the rate peak rules out a yield spread increase in its favor. If inflation is higher than in the US at the same time, we might see an increase in bearish expectations.

Following the previous decision, economic reports have turned out mixed. The unemployment rate increased to 4.3% in July, PMIs for August have decreased, indicating further slowdown in the coming months, and wage growth remained elevated, increasing inflation risks amid economic deceleration.

The net long pound position decreased by 38 million to 3.6 billion over the reporting week. Although the pound is confidently holding its ground against the dollar, the price continues to fall, so we can expect it to weaken further.

A week ago, we saw the first target at 1.2440, and as expected, the pound fell below this level. Next in line is the support area at 1.2290/2310. We anticipate that by the end of the week, after the BoE's meeting, the pound will test this area. However, it needs more reasons to move lower. Since there is no data for inflation in August and no accompanying statement for the meeting yet, it is too early to make a long-term forecast.