Why is it worth using MultiTerminal?

MultiTerminal is a component of the MetaTrader trading platform intended for simultaneous management of multiple accounts.

This platform is suitable for both managers working with investor accounts and traders who use multiple accounts simultaneously. There is no need to switch from one account to another.

MultiTerminal allows users to open and close positions in one or more accounts with a single click.

MultiTerminal: what is it and how does it work?

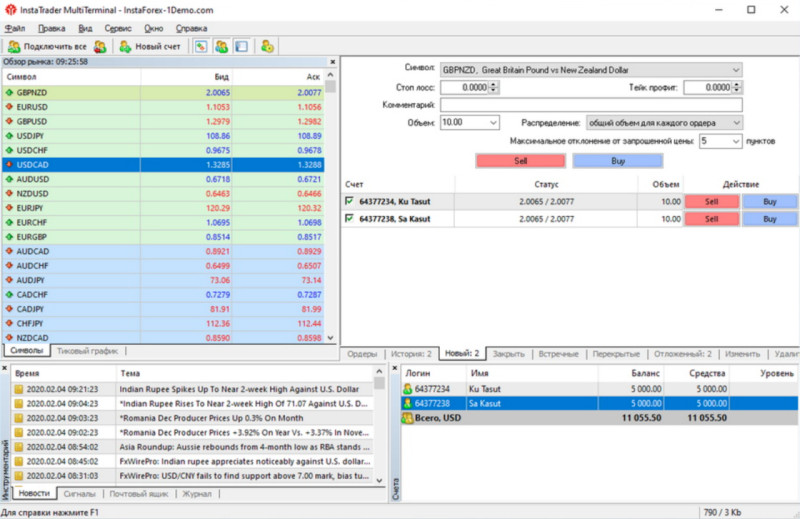

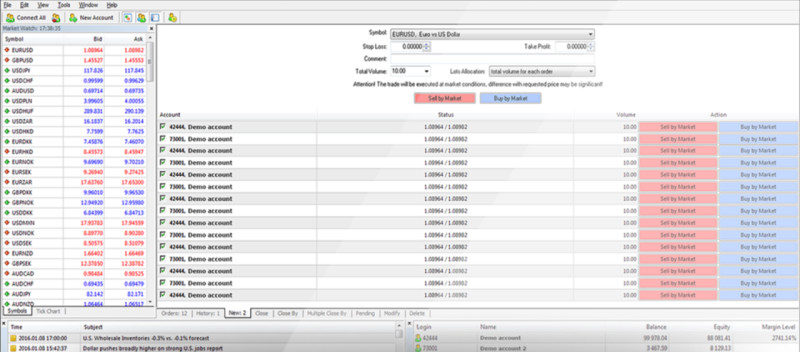

The functionality and interface of MultiTerminal is almost similar to that of the MetaTrader platform. The main difference is that MultiTerminal displays multiple trading accounts at once and allows traders to manage them simultaneously.

At the same time, open positions may be of the same or different volume. There are various ways to allocate the volume to different accounts:

- The Predefined volume option allows users to set trading volume for each account;

- The total volume for each order is set and applies equally to all allocated accounts;

- The Equal parts method allows investors to equally divide the total volume between all accounts;

- Methods based on the ratio of funds and free margins help allocate the total lots to accounts by the equity ratio or by the free margin ratio.

Like the MetaTrader platform, MultiTerminal includes such tools as signals, news, a mailbox, as well as an account history.

MultiTerminal supports placing both market and pending orders.

The Market Watch function allows users to see a list of all available trading assets.

MultiTerminal records the history of all transactions in all accounts in a special section.

To protect customer data, the trading platform uses 128-bit encryption. The second degree of protection is the system of electronic digital signatures.

Digital signatures work through two keys: public and personal. They are stored on a computer's hard drive.

The public key is freely available and confirms the authenticity of the signature made by the private key. At the same time, the possession of the public key does not make it possible to decode the private one.

How to set up and use MultiTerminal

The first thing you need to do is to select and connect to a server. The server provides a continuous stream of data.

The data coming from the server includes news and quotes. Without this information, the proper functioning of the platform is impossible.

Next, you need to add accounts to the platform. They will be displayed in a table. Initially, to add an account, you will need to enter a login and password for each account separately.

You can save this data on your hard drive so you do not have to re-enter it each time you connect.

Notably, all serviced accounts must be connected to the same server. It is not possible to work with accounts located on different servers through MultiTerminal.

Before starting to trade, you need to configure the settings in the appropriate tabs. These parameters will make the order placing process easier.

The Volume Distribution function allows you to choose one of 5 possible ways to split the total number of lots between accounts. We discussed the methods of volume distribution earlier.

The Deviation function enables users to set the permissible deviation between the price of the prepared order and the market one. The program itself will be able to modify the order within the established limits and open a position.

In the Events section, you can monitor the operation of the platform using special notifications. The system can signal a successful or failed server connection, completed trades, and so on.

Opening and closing positions

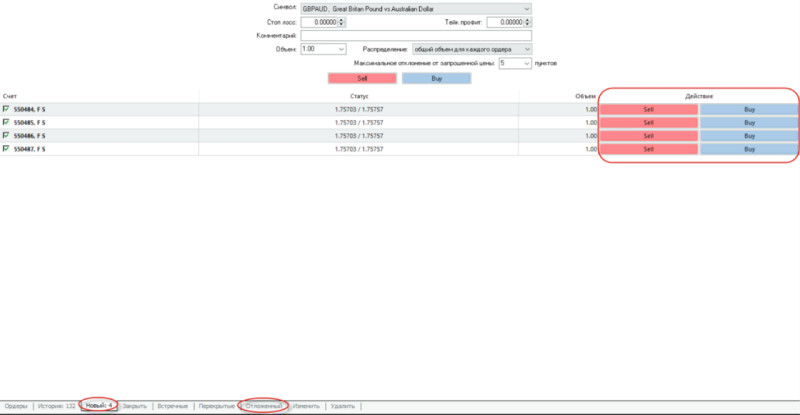

To open a position on MultiTerminal, first select an order type: new or pending.

Then you must specify all the parameters of a trade such as a symbol, lot size, and maximum deviation. Besides, if desired, you can set the Stop Loss and Take Profit levels.

MultiTerminal allows you to open opposite positions in one account.

All active trade operations are displayed on the home screen of MultiTerminal as a table.

To modify an already placed order, use the special Modify tab. Traders can select the orders they wish to modify and enter the new details for all or certain accounts, clicking on the Modify button to complete the update.

Use the Delete tab if you want to delete all or selected orders in all or selected accounts.

To close a position on MultiTerminal, click on the built-in Close button, select an instrument, and confirm your decision.

After choosing a certain instrument on the list of active accounts, the table will show only those accounts that have open trades in this category.

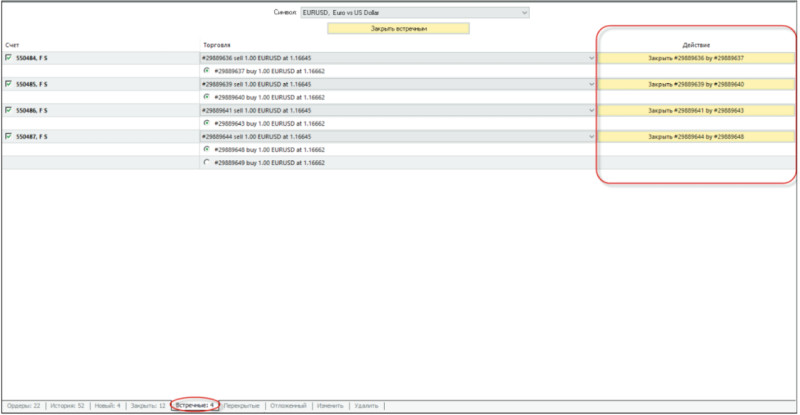

MultiTerminal also offers two additional ways to close trades: by a counter position and overlapped positions.

A position on the same asset opposite to the chosen position is called a counter one. Such trades can be closed simultaneously.

When you go to the "Counter" tab, the program will display a complete list of all accounts that have open counter positions. To close them, you can select one or more positions in one or more accounts.

If there is a difference in lot size between counter trades, the smaller one will be closed, while the larger one will remain open. In this case, the trade size of the remaining one establishes the difference between counter positions.

In the Overlapped tab, you can see the list of all accounts that have such trades. It implies not two opposite positions on one trading instrument but several at once.

Advantages and disadvantages

The main advantages of MultiTerminal are the following:

- Ability to manage 128 live and 10 demo accounts simultaneously

- Simultaneous opening of trading positions in multiple accounts

- Ability to open positions of the same or different volumes in multiple accounts

- All types of orders, including pending ones

- Ability to lock positions

- Reports on completed transactions

- Access to transaction history for one or all accounts in the platform

- Easy-to-use interface

- Multilingual interface

At the same time, experienced traders have noted several disadvantages when using MultiTerminal.

The first of them is the sequential method of order execution that may lead to serious delays in a dynamic market.

Another major drawback is that the platform does not allow traders to use advisors or robots.

MultiTerminal is intended for manual trading only and does not support automated one as the platform does not have built-in charts.

In this regard, some traders prefer to use the PAMM service or trade coping tools, which we will deal with below.

Comparison with PAMM system

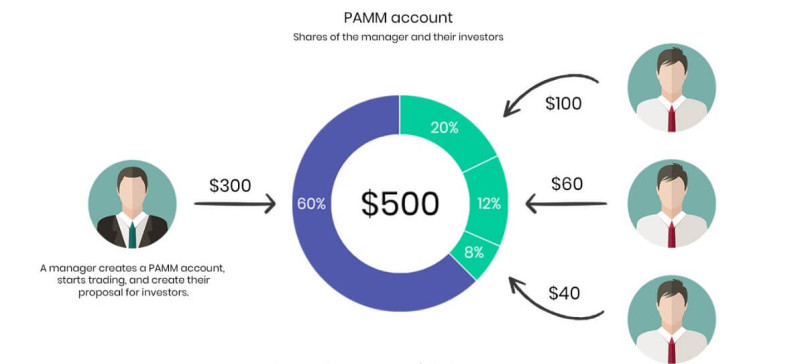

Investing in PAMM accounts is based on trust management of funds. Funds are transferred by an investor to the selected trader’s account.

An account holder independently manages funds and opens trades. The profit earned from trading is divided between a managing trader and investors depending on the size of deposits.

By using PAMM accounts, investors do not need to trade on their own. The system allows them to save time and receive additional income.

An account holder receives a commission from each investor who follows his/her account.

However, experienced users recommend that investors diversify their funds with the help of a PAMM portfolio. That is, it is worth allocating investments among several accounts rather than investing all the money in an account of one trader.

This reduces the risk of losing a large amount of funds at once. A PAMM portfolio enables traders to create the optimal ratio of profitability and risk.

As for the main difference between the PAMM system and MultiTerminal, the latter allows traders to manage multiple accounts, none of which may belong to them.

Account holders create PAMM accounts in their own names. Besides, they are responsible for their own money and the funds deposited into their accounts by investors.

Comparison with trade copiers

Using trade copiers is somewhat similar to trading with the help of MultiTerminal. The most significant difference is that trading is carried out not through one platform but through several ones.

In other words, this method also allows users to trade and manage multiple accounts. However, it requires them to install several platforms on a PC or use multiple devices.

Indeed, it is technically possible to install several platforms on one PC. To do this, one needs to download the installation files to different folders.

At the same time, the number of downloads and installations on one device is unlimited. That is, you need to download one platform for each individual opened or managed account.

Next, you need to sign in to the account in each of the platforms using your login and password.

No matter how many accounts you have, you need to select the main one - Master Account. The bulk of the work of a trader or managing manager will be carried out through this account.

All transactions to be made in this account will be automatically copied by client accounts.

To do this, the platform offers an opportunity to install a trade copier, which allows you to synchronize the dominant account with all the others. This function must be configured for each account separately.

In our opinion, it is rather inconvenient to use trade coping tools. This method suffers by comparison to the use of MultiTerminal. The latter enables you to manage a large number of trading accounts from one device and using one platform.

Conclusion

In this article, we have outlined the main features and functions of MultiTerminal. This service is worth your attention especially if you manage multiple own or client accounts.

We believe this is a great alternative to the PAMM system or trade copiers.

When using a PAMM account, both a managing trader and investors risk their own funds. The use of trade copiers causes numerous difficulties with the installation and configuration of separate platforms for each account.

MultiTerminal addresses these challenges as it makes it possible to trade in 128 live and 10 demo accounts using one platform and one device. At the same time, none of the accounts may belong to a trader.

Back to articles

Back to articles