Is MT5 worthy of attention? Its main advantages and disadvantages. Feedback from real traders

Some traders complain that the MetaTrader 5 platform lacks helpful features. In practice, it turns out that the underlying reason for such complaints is the lack of knowledge and experience that prevents people from trading on MT5 with the utmost efficiency.

For a start, the article MetaTrader 5 for newbies is a must-read before you make the first steps on this popular trading platform. The article expands on all its features and lays down guidelines.

MetaTrader5: feedback from users

When we were working on this article, we got to know an array of reviews from real MT5 users. Now let’s judge whether they are unbiased and fair.

Oftentimes, MT5 users underscore faults of the trading platform, but in fact, they are largely due to an oversight of brokers. For example, there are a lot of complaints about fraudulent malfunction of the trading platform.

However, the platform itself is not able to rip off your money. It is trading software. So, transactions are carried out through a broker and its server. The threat comes from crooks cunningly disguised as brokers but not from the trading platform itself. Thus, if you do not want to fall prey to scammers, choose a broker with a fine reputation.

Another common complaint is sparse functions on MetaTrader 5. Actually, in most cases complaints are left by rookie traders who are unaware of all features that MT5 offers.

Therefore, it is essential to sharpen trading skills and find out the nuts and bolts of the trading platform. A smart trader would never make such a complaint.

The kernel of truth is that trading software of MT5 is getting obsolete. The last version of MT5 was released more than 10 years ago. Developers of other trading platforms have come up with more advanced versions over this stretch of time.

MetaTrader 5 is free of charge for an end user. Unlike other popular paid trading platforms, this software is provided at a broker’s expense. Perhaps experienced users might choose something from paid trading software. However, beginners would rather make their first steps on a free trading platform.

Forex indicators for Android

Lots of users frequently mention indicators in their feedback. They do not like that MetaTrader 5 contains a plethora of indicators and all of them should be paid for. Let’s try to figure out whether it is true and what these indicators are like. The mobile app of MetaTrader 5 enables users to trade and analyze the market directly on their smartphones. Analysis is carried out by means of technical indicators.

A technical indicator is a mathematical calculation that can be applied to price and volume data. The goal is to anticipate future changes in prices.

Bearing technical indicators in mind, traders decide on opening or closing positions. The mobile app for Android gadgets offers an arsenal of 30 indicators which are divided into 4 basic groups.

1. Trend-following indicators

2. Oscillators

3. Volume indicators

4. Bill Williams indicators

Particular settings are required for every indicator. Settings are applied when indicators are placed on a chart. For a start, not all indicators are fee-paying. There are a number of classical indicators that are provided at no cost. Nevertheless, most of such indicators were invented long ago. The market is evolving because of new catalysts and trends. Modern strategies come into being. To invent more helpful and cutting-edge indicators, developers spare energy and knowledge. No wonder, they want to gain a reward for their work.

Oftentimes, paid indicators represent a computer program and serve as trading robots. The next chapter is devoted to expert advisers.

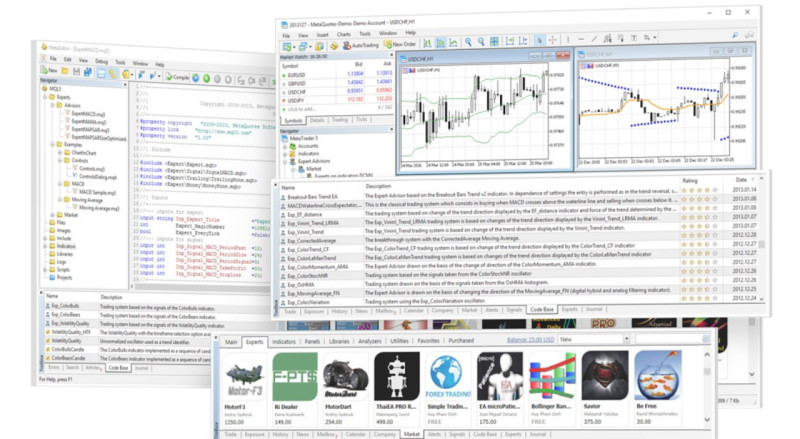

MetaTrader 5: algorithmic trading

Algorithmic trading runs on a special computer program which automates technical analysis and trading as such. These programs are also known as trading robots or expert advisors.

Trading robots are able to analyze asset prices and manage trades on their own on Forex and stock markets. Expert advisors operate according to algorithms of market research and managing buy/sell orders.

Trading robots have obvious advantages such as:

- Lack of emotions and immunity to stress

- No fatigue

- Prompt response to any market change

- Strict obedience to guidelines

A trader can make good use of algorithmic trading without possessing computing skills. MetaTrader 5 offers a wide range of ready-to-use trading robots that can be downloaded for free or purchased.

A trader can make good use of algorithmic trading without possessing computing skills. MetaTrader 5 offers a wide range of ready-to-use trading robots that can be downloaded for free or purchased.

The MT5 trading platform includes a store of trading applications: MetaTrader Market. If you have not found the right trading robot to suit your requirements, you can place an order with professional e-types.

The MT5 platform also allows users to program a tailor-made expert advisor. Savvy developers have access to several features such as

· MetaEditor

· Strategy tester

· Execution module

· MQL5.community

The function of testing strategies enables a trader to check a newly-developed strategy before running it in real market conditions. Parameters of a new strategy go through backtesting.

The tool for testing strategies is all in one. It means that it can check a strategy for efficiency with a few trading instruments, employing all available resources of your computer.

MQL5.community is a web portal for traders and IT specialists. The web recourse is a mine of information for developers of trading robots. Apart from professional articles, e-types join a forum for communication with their colleagues.

Smart traders recommend that a trading robot should not be left without supervision. A trader has to monitor a market situation and fine-tune the robot’s settings following changing conditions.

Still, a lot of users do not believe in opportunities for expert advisors and do not trust them to manage positions without human involvement. At the same time, traders widely use signals generated by robots in market analysis, though trading decisions to buy/sell assets are made by humans.

There is another method of earning in financial markets that perfectly suits beginners. We will expand on Copytrading in the next chapter.

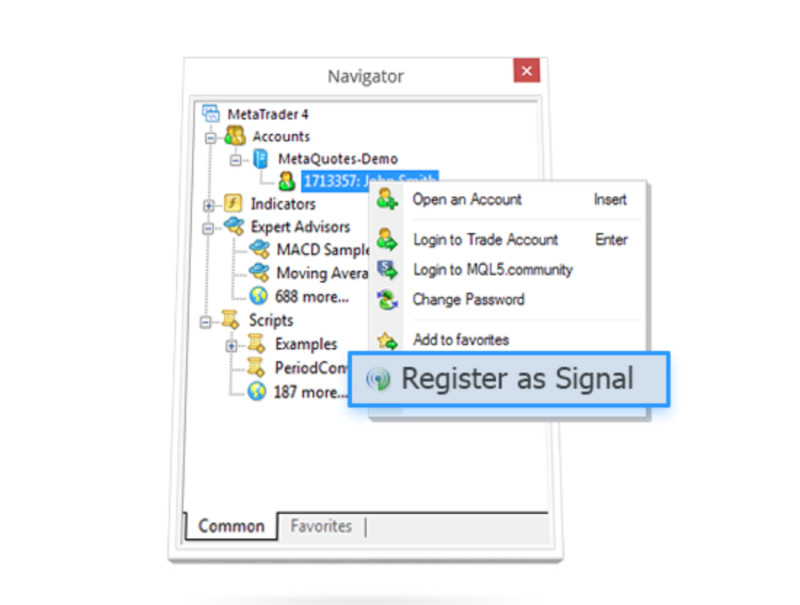

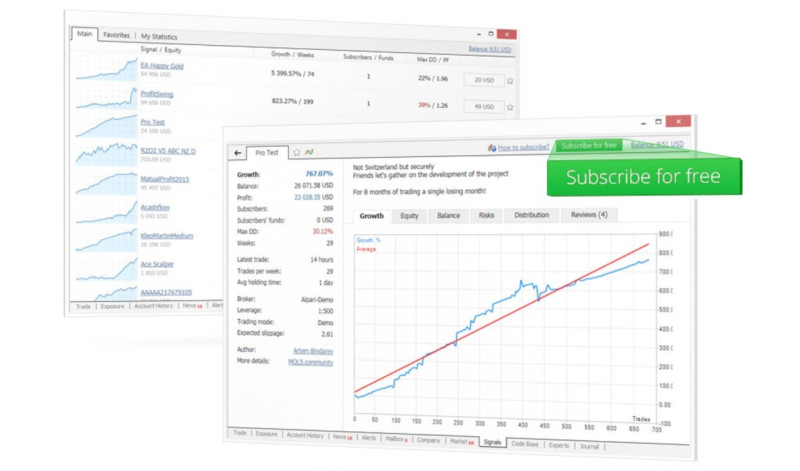

Trading signals and Copytrading

With MetaTrader 5, users are able not only to earn from trading but from selling signals. This feature is called Copytrading. Both rookies and professionals can profit through cooperation. Using trading signals, beginners can increase their gains by duplicating positions of successful traders. Besides, they can learn trading from professionals, scrutinizing their positions.

Reputable traders gain extra profits by selling their signals. In addition to earnings from trading, professionals get a reward allowing others to copy their trades.

A trader gains access to trading signals through the Trade Alerts service. The service enables a user to subscribe to one or several traders and determine a risk level. The service is integrated into the MetaTrader 5 platform, so trading signals are generated without a delay. Positions are duplicated and executed promptly which is especially important when trading in the currency market.

All signals available for sale on the MT5 trading platform have to be carefully checked. After close scrutiny, the most efficient strategies are displayed at the top of the list. Less efficient ones are deleted.

Before subscription, make sure you learn enough information on every signal. The platform provides data on a number of followers, gains, and an ultimate drawdown. Beginners should not neglect extra opportunities to minimize risks such as:

1. To allocate for Copytrading a part of funds in an account, not the whole deposit;

2. To spend funds until a pre-set limit. Once it is reached, no more positions can be opened.

Users agree that Copytrading gives beginners an excellent opportunity to make a successful debut on Forex. The service is crafted for newcomers with little market knowledge and experience.

Users recommend that you should not put all your eggs in one basket for your confidence and the safety of your funds. It would be a wise decision to subscribe to several experienced traders, not just one.

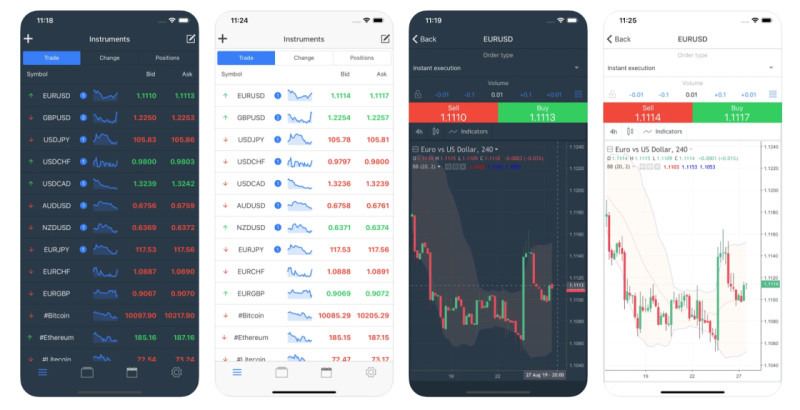

Pros and cons of trading on MetaTrader 5 mobile app

Modern mobile trading apps are not inferior to desktop versions. Traders can manage positions on mobile trading platforms and get access to their accounts in one click.

Users praise the following features of a mobile platform:

· Interactive graphic tools to make analysis more vivid

· 30 technical indicators that can be applied to main charts

· Audio alerts

· Free of charge

· Convenient user interface

Apart from that, users highlight some disadvantages of a mobile platform such as:

· A connection could fail when a mobile platform is beyond a range of coverage or in a subway. Such failure entails losses.

· A mobile app runs slower than a desktop version.

· Fewer trading robots are built in.

· Expert advisors are not compatible with MetaTrader 4.

The bottom line is that the mobile app is not designed for permanent use. It is mainly aimed for occasional supervision of a trading account and executing intraday trades. The comment on connection failure is not fair because it depends on the quality of services provided by a telecommunications operator.

The fact that expert advisors developed for MetaTrader 4 are incompatible with the MT5 trading platform is indeed a serious drawback. It causes trouble for those who want to give up an old trading platform in favor of a more advanced version.

At the same time, we have already told you that MetaTrader 5 allows a user to create tailor-made expert advisors to suit any needs and trading strategies. Therefore, this nuisance can be fixed with no sweat.

The comment on slower running is worthy of consideration because prompt execution of orders matters a lot when managing positions.

Conclusion

In this article, we summed up the most frequent remarks about MetaTrader 5. Having analyzed these comments, we can judge that not all of them are fair.

Pick a reliable broker to ensure safety of your savings.

To exploit all features of the trading platform, please upgrade your trading skills.

To gain passive income and extra earnings, make good use of trading robots or the Copytrading service. Nevertheless, trading robots require monitoring on a regular basis. Besides, it is a bad idea to trust one managing trader with all of your funds and rely entirely on Copytrading.

MetaTrader 5 is the platform to manage positions anytime at any place on the go. However, be aware that your trading efficiency depends on the quality of telecommunications services of your operator.

Back to articles

Back to articles