Forex trading is often a time-consuming and tiresome process. However, not all traders are engaged in trading professionally.

They cannot monitor their trading accounts or trade manually round the clock.

For that reason, automated trading came along. In this article, you will learn all about automated trading.

What is automated Forex trading?

Trading robots, or expert advisors, are special programs that can trade without involving a trader. Automated trading on exchanges and Forex is carried out using these programs.

Trading robots can make the life and work of a trader much easier. It is important to remember that their work is based on two key principles.

Firstly, trading robots do not develop trading strategies. They only follow algorithms set by traders.

A robot starts implementing your trading strategy when all the necessary parameters are set but we will talk about it later.

Secondly, to achieve success in automated Forex trading, you need to understand what your robot is designed for.

Each trading robot has its predominant features. Its operations are aimed at achieving certain results.

There is plenty of expert advisors. Make sure you learn how they work before using any of them for trading on a live account.

Some trading robots can be tested before the purchase. This way, you can see whether a robot is suitable for you and can fulfill the required tasks.

In addition, you can test a trading robot on a demo account or quote history. In fact, you can use data on quote history for several years at once.

Do not worry if some of the trades opened by a trading robot are unprofitable. The main thing here is that you make a profit for a certain period.

Anyway, a trader must have knowledge and experience to succeed in automated trading. It is not an easy task for beginners to understand and customize the program right away.

Advantages and disadvantages

Expert advisors have numerous advantages as well as a number of disadvantages. Here are the pros and cons of algorithmic trading.

The main advantages of trading robots are:

- They save time. Traders do not have to be glued to their computers and monitor the market non-stop.

- They are resistant to emotional distress. A computer program never makes decisions impulsively but always relies on set algorithms.

- In addition, trading robots can be used for analyzing the market and receiving signals, while trading can be carried out manually.

- Round-the-clock operation and analysis. It is an impossible task for people.

- Testing on a demo account or quote history.

- From a variety of trading advisors, you can pick the most efficient one to satisfy your trading needs.

- If you can’t find the right robot, you can create one yourself or ask a programmer to do it for you.

The main disadvantages of trading robots are:

- Trading advisors do not analyze news, speculations, and market expectations due to the absence of adaptation mechanisms. Only a trader can do that.

- Past results of a trading robot do not guarantee future success. In some cases, the program should be readjusted or replaced.

- Robots require uninterrupted access to the Internet and a special paid VPS server.

- It requires programming skills. Not all traders know how to customize a trading advisor, especially when following complex individualized strategies.

- Sometimes, cheap or free expert advisers are no longer relevant and effective. In fact, that is why they appear in the public domain.

- Excessive or constant use of trading robots can cost traders their knowledge and skills.

Where to find trading robot

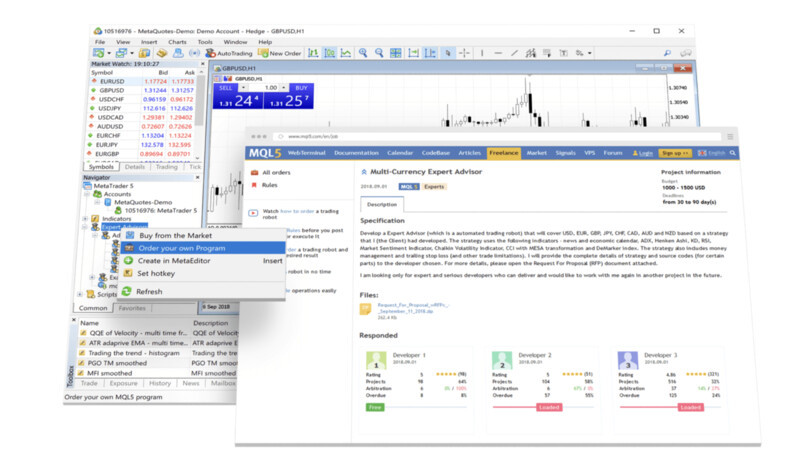

Free and paid robots are built into trading platforms. At the same time, you can create one yourself or ask a programmer to do it for you.

You can also download and use third-party programs. In such a case, there is a high risk of becoming a victim of scammers or paying for nothing.

Forex trading robots can cost $5 to $500, and sometimes even $1,000. However, expensive robots are not always effective.

When choosing a trading robot, make sure you read user feedback. Remember that some developers pay for reviews to get their robots downloaded more often.

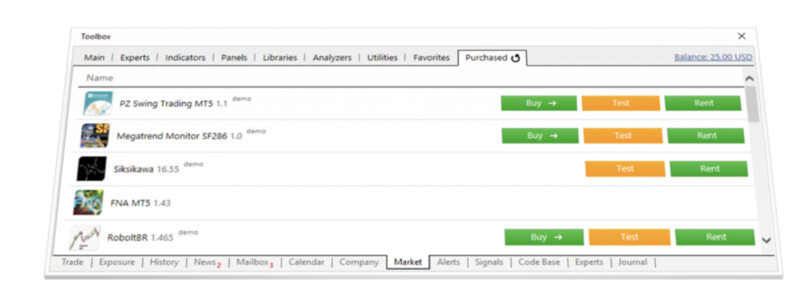

Here is how you can acquire a trading robot on MetaTrader 5. The trading platform offers clients over 10,000 expert advisors, signals, and indicators.

Thanks to MetaTrader Market, you can purchase or rent any trading advisor for a period of a month to a year.

You can test a robot before buying it. Expert advisors can be tested based on a trading strategy.

As a rule, a robot is tested on quote history. Testing results show users the following data:

- total number of trades made

- profit/loss ratio

- other valuable information

Optimization is the next stage after testing. It requires the use of other time frames, currency pairs, and settings for the robot.

Remember that you can’t rely on tested data 100% because it relies on history and not actual quotes.

MetaTrader Market also provides access to free programs. They are available for download and allow newcomers to get the hang of automated Forex trading.

How to create trading robot

Modern trading software allows traders to develop robots all by themselves. However, it requires certain programming knowledge and skills.

Make sure you have an efficient trading strategy before you create a trading advisor because the program will operate based on it.

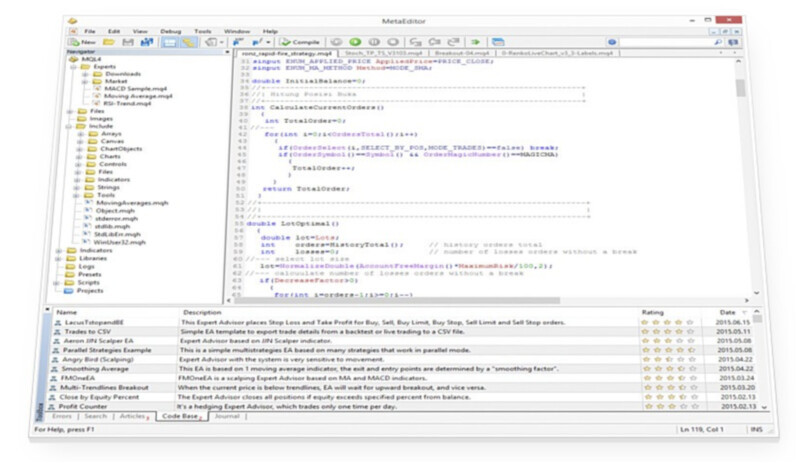

MQL5 is a programming language that allows traders to develop robots and technical indicators.

It runs on C++, a widely-used programming language, but with a narrower focus and helps to solve certain problems.

MetaEditor is used to create robots. It helps users write a program code by giving some valuable hints, which enables them to speed up the development process.

If you want to create your own expert advisor, but you lack sufficient programming skills, the MQL5 Wizard app will assist you with that.

Almost all programs for algorithmic trading have three main elements: signals, money management, and a trailing stop.

These three components can be combined in different ways to obtain various types of expert advisors.

You set the required parameters, select the components you need, and MQL5 Wizard does the rest.

MQL5.community is a platform for traders where they can communicate with each other on multiple issues and solve various problems.

With the help of the community, you can also find programmers who can create trading advisors for you.

Customizing trading robots

Profits from automated trading always depend on the chosen strategy and the level of acceptable risk. The higher the risk, the bigger the profit or loss in case of failure.

You should use Forex trading robots posing lower risks if you are a beginner or need to test a new strategy.

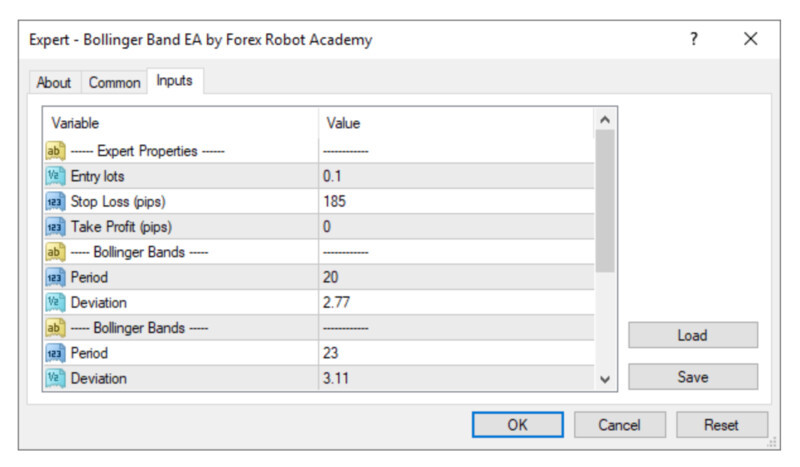

In order to start using a robot, simply drag the selected adviser to the chart. A settings window featuring the General parameters and Input parameters tabs will appear.

Only one robot can run on one chart. As soon as you start using another expert advisor, the previous one will be automatically disabled.

The robot’s main settings are in the Input parameters section. Here you enter the main parameters of the adviser.

In order to set the correct settings, you should test the robot on quote history first.

You can also disable advisers in the settings when you change accounts, for example, when switching from a demo account to a live one, as well as when you go to another profile.

There are two settings options when it comes to automated trading: allow fully automatic trading or add manual confirmation.

In the first case, the adviser trades without a trader involved. In the second case, a trader can confirm or cancel the trades of the robot.

There is also the function of using external expert advisors, which allows the robot to receive and use additional data from the library or from other robots.

Nevertheless, you should always monitor how the trading adviser operates and combine algorithmic trading with manual trading.

Difference between algorithmic trading and copy trading

Many users think algorithmic trading and copy trading are synonyms. However, this is not entirely so.

Copy trading is a type of social trading. It is carried out via special social networks where users can communicate and exchange data with each other.

Copy trading means copying the trades of more experienced and successful traders. It is also called the trading signal service.

A trader, who is a signal provider, registers on a special platform and offers signals for subscribers.

This option is beneficial for such traders because it allows them to receive passive income from each subscriber.

A subscription to one or more traders will give you an opportunity to earn money without investing additional time and energy in trading.

You can also master skills and improve your trading experience by watching how more successful and professional traders work.

However, this does not mean you will be immune to losses: if a signal provider incurs losses, you will also lose money by copying his unprofitable trades.

In such a case, experienced users say it is important to create a kind of investment portfolio. That is, you need to subscribe to the trading signals of several professionals and distribute funds between them.

You can also set restrictions to copy only particular trades of a savvy trader.

The major difference between copy trading and algorithmic trading is that the copied trades are made by a real person, not a robot.

Best trading robots

One best trading adviser suitable for everyone simply does not exist.

Experience in automated trading shows that traders use various trading strategies.

Traders should pick a suitable robot with an acceptable level of risk to meet all their trading goals.

To do this, you need to sort out expert advisors according to the deposit size, the 6-month profit, and the maximum drawdown.

The main types of robots or common strategies they operate on are the following:

- Grid trading. It is the most widely-used strategy where robots open a series of trades in a certain direction using the wavelike nature of the market.

- Intraday trading. It is based on opening positions within one day. The advantage here is immediate trading results. However, such an approach requires more complex settings for a robot.

- Martingale trading. It implies that you increase the position size after the previous losing trade. This way, you can cover previous losses with bigger future profits.

- Scalping. It is a strategy where you can make a profit from smaller price fluctuations. The main goal here is to make as many profitable trades as possible, while their size is not important.

- Fundamental trading is somewhat different from all previous strategies. This trading approach requires analyzing data on global events, news, the general well-being of a particular country, and so on.

Here is a list of some effective expert advisors:

- Ilan 2.0: one of the most popular free Forex robots. It trades using two main indicators: the RSI (Relative Strength Index) and CCI (Commodity Channel Index). The robot’s settings are quite flexible and allow you to place orders, like take profit, trailing stop, and stop out.

- Forex Fury: a low-risk intraday scalper. Profit averages 93% and is constantly updated.

- Trio Dancer: an expert advisor that works based on Martingale averaging. It trades using three strategies and five indicators for analysis at once. It is suitable for any time frame.

- Generic A-TLP: a trading robot operating on the Scalping strategy. It is believed to be one of the safest robots because it does not apply the Grid and Martingale principles.

- Equilibrium: a reliable advisor running on the Trend strategy. It does not apply Averaging or Martingale strategies. The potential return is as low as the risk of losses.

Final thoughts

This article is about the basics of automated Forex trading as well as its advantages and disadvantages.

When used properly, trading robots can bring not only profit but also help novice traders improve their trading skills.

Before customizing and using an expert adviser, make sure you have an efficient trading strategy and clearly understand how trading robots work.

Remember that the difference between algorithmic trading and copy trading is that real people copy trades, not robots. A trader provides signals, and other users copy them.

There is no ideal adviser suitable for all traders. So, everyone can pick one to their taste.

Choose a trading advisor taking into account its potential risks and profits as well as possible drawdowns.

If you can’t find the right robot among those in the market, you can always try to create one yourself or ask professional programmers to do it for you.

Back to articles

Back to articles