Computer technologies have long become common in our day-to-day life. Today, we can hardly do without computers and smartphones.

Technologies make our lives easier, helping us solve various everyday and work problems.

This trend is also common in trading. With the advent of automated trading, traders can now partially rely on expert advisors.

In the article “Automated Forex trading,” you will find out how algorithmic trading makes traders’ lives easier.

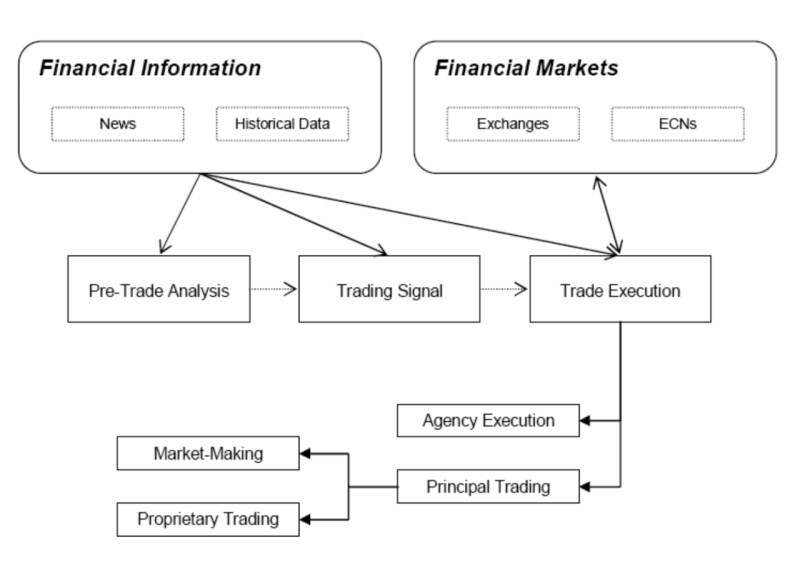

How trading robots work

Many users still do not trust trading robots. Firstly, people have always been suspicious about everything new and unknown.

Secondly, in an attempt to save money, they sometimes run into scammers or get an inefficient and outdated robot and give up on algorithmic trading.

By understanding how trading robots work, you will be able to pick the right one and feel positive about them in general.

Developers create robots that are based on either technical indicators or probability theory.

Programmers then select one or several indicators and fully automate their operations. This is done to make the program take decisions on its own.

Robots are divided into narrower categories depending on indicators and mathematical models they are based on:

- trend

- countertrend

- netters

- scalpers

- averaging, etc.

The next step is the integration of an expert advisor into a trading platform.

Developers are now trying to add elements of intuitive trading, which is common only to people, to the most advanced versions of robots.

In order to achieve this, they use self-learning neural network algorithms that could self-adapt to changing market conditions.

So far, their attempts in this field have been fruitless. Therefore, any unusual situation that arises when trading is oftentimes misinterpreted by robots.

A human brain is more flexible and can adapt to unexpected changes in the market, and therefore can adjust the trading strategy in time. Meanwhile, the program will keep on operating as usual, which may ultimately lead to the loss of funds.

Can trading robots completely replace people on Forex?

With imperfections in some aspects, trading robots are still one step ahead of humans in other aspects.

As we now know, robots are unable to adapt to uncommon or changing situations in the market. Their operating algorithms do not allow them to have such flexibility.

This is typical only for people. That is why savvy traders never rely on auto trading robot only.

Robots are not capable of analyzing how fundamental factors, like news, global events, and speculations, can affect the price of an asset.

Therefore, traders should monitor their operations and adjust their settings if necessary.

At the same time, robots can conduct certain operations faster and more efficiently than the most developed human brain.

For instance, they can process large amounts of data in shorter periods of time and analyze the market using one or several indicators.

Traders should take advantage of this capability of robots as it can save them time and effort.

Traders can use this time to solve more global issues, for example, to develop or improve a trading strategy, and so on.

On top of that, the same robot can be readjusted to work with another asset and other time frames, which also gives certain freedom of choice.

Why do Forex robots lose deposits?

Many traders deal with the situation when a trading robot, even a paid one, makes a profit for some time and then stops working, with trading gradually shifting to the red zone.

There are a number of reasons for that. Firstly, even the most advanced robots are developed by people.

A person simply cannot foresee and take account of all possible situations for which the algorithm of an expert adviser is being developed.

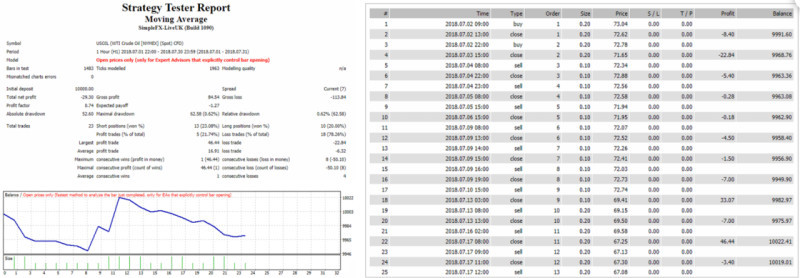

Secondly, traders start to use trading robots immediately without a preliminary test.

With modern trading platforms, traders now can test robots on historical data or on demo accounts.

It helps traders to see the efficiency of their robots and whether they need to be readjusted.

Lastly, it can be that an expert advisor is set up wrong. All robots have built-in settings, which can be changed if necessary.

For example, if you choose a different time frame or another asset, you need to change this in the robot settings.

In order to minimize losses traders should withdraw profit earned by the expert adviser in time. Profits can be partially withdrawn and partially reinvested.

Money can also be divided between several accounts/expert advisors in order to save the initial deposit.

In case of unsuccessful trading, one of the expert advisors would lose just part of the deposit.

Diversification of investment portfolios is always a good idea for both small and large investments.

Optimization of trading robots

Let’s now talk about testing and optimization of trading robots. They are essential if you want to use a trading robot.

Testing, as a rule, is carried out on historical data with those assets and time frames that will be used when actually trading.

Testing can help you identify the robot’s weak spots and change its settings to improve performance. Such tests can be carried out for as long as needed to achieve the desired result.

Optimization of auto trading robots is one of the keys to success in automated trading. Each robot has a number of customizable parameters that can and need to be changed.

By resetting various parameters and trying their different combinations, you can find the exact option that gives the best result under given conditions.

So, expert advisers adapt to the real conditions in the market.

Optimization is needed when:

o robot brings less and less profit every time

o total number of transactions decreases

o there is a loss instead of a profit

o increase in the drawdown amount

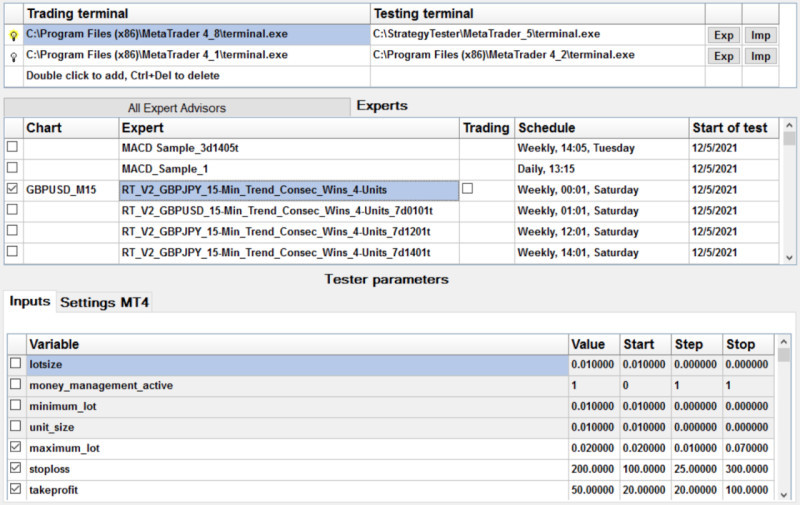

Clearly, making settings adjustments manually takes plenty of time since each changed parameter requires testing. This entire process can take up to several months.

Therefore, trading platforms offer automated mechanisms for optimizing auto trading robots to make traders’ lives easier.

In order to optimize a robot, you should select one of the specified criteria and choose the necessary parameters in the robot settings.

Based on input data, the program selects the ideal settings that would meet the optimization goal.

It takes the program a few hours to optimize the robot, while manual optimization takes a person up to several months.

Final thoughts

In this article, you can get a picture of what trading robots are and how they are created.

So far, expert advisors have been unable to replace people as they do not have intuition and can’t analyze the effect of fundamental factors on prices.

At the same time, trading robots have obvious advantages and traders should definitely benefit from them. For example, they can process large amounts of data quickly.

You should constantly check the efficiency and accuracy of your trading robot. If its efficiency gets worse, you need to find out why this happens.

To do this, testing and optimization are carried out to readjust the robot to new market conditions.

Traders use special programs to reduce optimization time to a few hours.

Read more:

Automated trading on stock exchange: TOP robots and programs

Auto Trading Software

Experience in automated trading on Forex and stock exchanges

Back to articles

Back to articles