Some traders find it hard to wait for a suitable time to make a trade. This type of trader needs to be right here and right now. They enjoy that adrenaline rush they get from trading.

If you are this kind of person, this article is for you.

You can also find out more about trading strategies, their benefits and drawbacks, in the article “Forex strategies for beginners.”

Forex Scalping strategy

Scalping is the shortest-term trading strategy.

Using this trading style, traders make a lot of transactions in a short period of time taking small profits from each of them. However, a large volume of such trades can generate considerable profit.

Scalping is usually used on the M1 time frame as well as on other lower time frames such as M5 and M15. In addition, traders may use several charts simultaneously to get a clearer picture of what is happening in the market.

The M1 time frame shows market noise that distorts the price data. Usually, this chart may demonstrate a lot of false trading signals.

Therefore, one should use other lower time frames to reduce the influence of market noise on trading decisions. For example, the M15 time frame contains considerably less market noise. One can effectively apply technical analysis when trading using this type of chart.

At the same time, when trading on the M15 chart instead of the M5 one, possible profits may be decreased.

In addition, your toolbox should include more than one indicator because such an approach is more efficient when making analyses.

To make your analysis more precise, it is recommended to implement different indicators, e.g. moving averages and stochastic oscillators.

As a rule, scalpers have a significantly limited period of time to make a trading decision. This means that traders need to have a strict trading plan. For this reason, scalpers use a trading system that considers a wide range of trading rules.

Apparently, traders should have a plan that fits their trading style, personal preferences, available time for trading, etc.

Types of scalping

The Forex scalping strategy has a lot of types. Here we classify them for you to make a deeper understanding of each type.

Depending on the time frames and trade duration, there are several types of scalping:

- High-frequency trading (HFT) is used only for automated trading. Transactions are completed in a split second.

- Pipsing is usually applicable for the M1 chart. It usually takes from several seconds to a minute to make a transaction.

- Mid-term trading is carried out on the M5 time frame. Traders keep their positions open from 5 to 15 minutes.

- A more classical method uses an M15 time frame with transactions carried out within 30 minutes.

Depending on the chosen trading strategy scalping can be divided into the following types:

- Intuitive strategy supposes the opening of positions without any analysis. This strategy is based on the trader’s intuition and experience

- Indicator strategy is the opposite of the intuitive strategy. Traders open and close positions after analyzing the market using technical indicators

- Correlating assets trading strategy implies several assets where one of them can influence the value of the other. In this case, one of the assets may lag behind, and this is what scalpers benefit from. Usually, this strategy is used for cross-currency trading.

- Multiple chart Forex scalping strategy allows traders to get a deeper understanding of the situation in the market. As a rule, the 60-minute time frame is used for analysis, and the M15 time frame is applicable for trading.

- The fundamental strategy is based on the use of the news release. Here, positions are opened just before the news release or a few minutes after it.

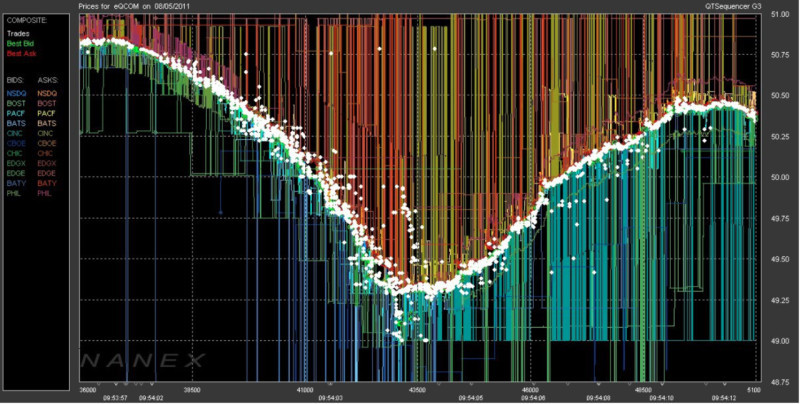

- Market Depth strategy is the most popular one among traders. The so-called “order book” is used as a reference. Traders monitor the potential trend, i.e. where the largest number of orders is.

Scalping strategies also have two trading styles:

- Aggressive style suggests a high level of risk reaching 5%

- Classical style represents a low-risk style where a trader risks from 0.5 to 2-3%

Advantages and drawbacks

Scalping, being one of many trading strategies, has its pros and cons. Let’s analyze them.

We will start with the positive sides of scalping.

- Scalping is a high-paced strategy. Traders do not spend a lot of time waiting for the right moment to open a position. They use small swings in the price and do not expect it to hit the low or high level to make transactions.

- Large profits. By opening a large number of trades, each bringing a small profit of a few pips, traders can earn a decent amount of money. Some traders say that it is possible to earn up to 30% of the initial deposit per day.

- Small deposit size. Unlike long-term strategies, scalpers do not need large amounts of money to start trading. It is possible to invest a completely small amount and make a decent profit on it.

- Instant trading results. Traders know the result of the transaction in a few seconds or minutes and can immediately continue trading. There's no need to worry, no need to stay up all night thinking about how the market will turn tomorrow. Scalpers focus on the present moment here and now.

- A good chance to gain experience. Scalping involves a considerable number of transactions, so the trader gains trading experience faster than those who use long-term strategies. One month of using scalping equals a year, or even a year and a half of trading using long-term strategies.

However, scalping has several disadvantages.

- Large commissions. The broker charges a commission on every transaction made. Accordingly, the more trades you make, the higher the total amount of commissions to be paid.

- High level of stress and workload. The Forex scalping strategy is very intense and requires traders to stay as focused as possible. It takes a lot of energy and effort, which is why scalping cannot be used for a whole day long.

- A high level of risk. Along with the possibility of high profits, scalpers are also exposed to the highest risks. Scalping is probably the most high-risk trading strategy.

- Limited range of assets. Assets for scalping must be highly liquid and have high volatility. Otherwise, they will not have the frequent fluctuations that scalpers seek. Also, it is necessary to choose assets with narrow spreads so that commissions do not cover all the profits.

- Use of large leverage. Scalpers want to earn as many profits as possible, but do not always have enough deposits for that. This problem is solved by leverage. In turn, it also increases the level of risk. It is possible to lose not only the sum of the transaction but the entire deposit.

Scalping is not for everyone

We have mentioned above that scalping has its advantages and disadvantages. This means that not everyone can benefit from this type of strategy.

As it usually happens, inexperienced traders use scalping to quickly generate a lot of profit. In fact, scalping is not for beginners.

You can't open trades relying only on your intuition to make considerable profits from scalping trading.

It is necessary to understand the basics and principles of the forex market to make good use of scalping. Therefore, you need to get sound knowledge in this field. In addition, you can find a lot of information in the public domain.

At the same time, you can try your hand at scalping on a demo account. This way, you can get a better understanding of whether this strategy fits you or not.

The theory is as important as practice. It is believed that only experienced traders can achieve good results using scalping.

Your attitude to risk and stress tolerance also play an important role. Scalping is the riskiest strategy, so your ability to risk makes all the difference.

You need endurance and a high tolerance for stress because this highly intense strategy is quite exhausting.

In addition, scalping best fits people with a certain type of character and temperament. A trader should be active enough and prefer an aggressive trading style.

This strategy is definitely not suitable for people who are too cautious in making decisions and can hardly tolerate losses.

If you do not like to wait and would like to see the result right away, scalping is for you. Optimistic and active people can easily cope with negative situations so they can also try scalping.

People with good self-control and emotional stability can try any trading style because they do not make hasty decisions under the influence of their emotions.

Scalping vs. day trading

Both of these trading types are short-term strategies. In some ways they have similarities, but they also have many differences.

When using an intraday strategy, you have to wait for the trend to form and look for trading patterns. Sometimes, you may wait several hours for the right moment to open a trade.

Scalping does not make you wait for hours. While intraday traders are waiting for the right time, scalpers can already make dozens of trades.

On average, a day trader can make from 5 to 10 trades during one trading day, while a scalper makes from 10 to 30 trades during the same period.

However, both strategies suggest that all transactions are completed within the same trading day.

At the same time, day traders use a wider set of tools for analysis. There are a lot of developed techniques for intraday trading.

On the contrary, scalpers use fewer tools for trading, applying only a few indicators for analysis.

For a day trader, it is very important to determine the trend and open positions according to it.

For a scalper, a trend is not so important. Scalpers focus on small changes in price in any direction.

However, both of these types of traders need to have a clear trading plan that prescribes when to open and close positions. Traders need to strictly adhere to their trading plan because they usually do not have much time to make decisions. Not to mention scalpers who have very little time.

Traders should follow their trading plan to avoid hasty and emotional decisions. Usually, such traders achieve more than those who trade without a plan.

Risk management

Scalpers should know how to handle risks and protect their deposits against them.

There are several rules that need to be followed when trading.

First of all, there are several types of risks:

- Market risk occurs since the price of an asset is constantly changing. The price may change opposite to the direction in which you anticipated and opened the position. Given this type of risk, you can reduce the possible losses.

- Currency risk arises from the change in exchange rates. They directly affect the currency quotes.

- Risks associated with a brokerage company. Your choice of broker is extremely important because it is the intermediary between you and the exchange. Your potential income or losses largely depend on the credibility and stable work of the broker.

Secondly, it is necessary to use such lot volumes, which will not reduce your deposit to zero in a short period of time. There is a limit that can be used in one transaction.

You should estimate the maximum lot volume that can be used for a single transaction. At the same time, it should not exceed 30% of your total deposit. As a rule, scalpers use smaller lot sizes.

The level of acceptable risk should be between 0.5% and 3%, although some traders apply risk of up to 5%. This value suggests a more aggressive trading style.

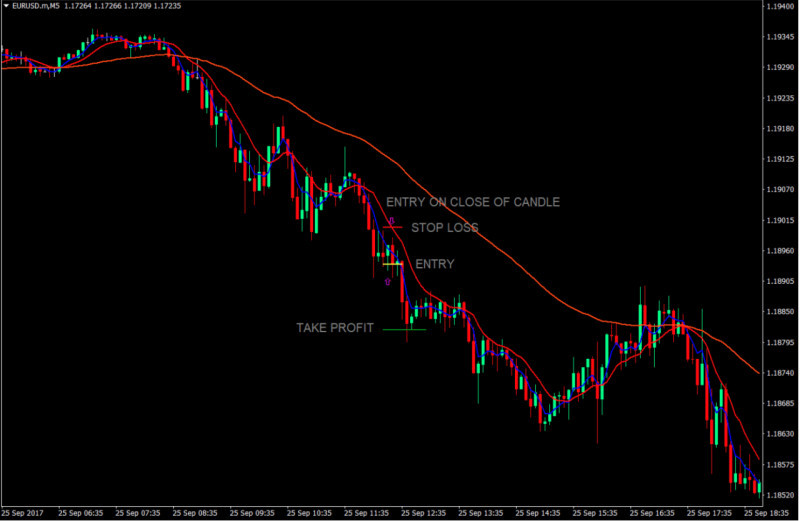

Thirdly, it is important to set Stop Loss and Take Profit orders. Using the Stop Loss order, you can open several trades at once.

Thus, you will limit possible losses on transactions if the price of the asset unexpectedly changes, influenced by many factors.

Fourth, you need to diversify your portfolio to minimize risks, and this applies not only to long-term strategies. Similarly, it is possible to use different tools for short-term trading plans.

This rule is less relevant for scalpers because it is quite difficult to follow the charts of several trading instruments simultaneously. However, it does not make it less important.

Indicators for scalping

Scalping requires not only a quick reaction from a trader but technical analysis to make trading decisions.

As a rule, the analysis is carried out with the use of technical indicators. Although their signals may lag behind real-time developments in the market, it is still important to be able to use them.

You can use different indicators that complement and filter out each other's readings to avoid false signals and lags.

Scalping does not suggest using the indicators to find the moment to enter the market. This makes it different from other trading strategies.

Scalpers use the depth of market indicator as a reference for opening trades. This indicator provides information about orders placed in the market.

Let's explore what indicators scalpers should have in their toolbox.

- Trend indicators show a possible direction in which the price may go. Moving averages are the most popular among the type. Usually, traders use more than three moving averages when trading.

2. Oscillators are working ahead of the curve, allowing traders to determine the moment of the price reversal. The stochastic oscillator is most often used in scalp trading. However, it is better to use it with trend indicators to avoid false signals.

3. Bollinger Bands is an indicator based on moving averages. This indicator allows traders to determine a volatility level in the market. If the bands are narrowing, they indicate a low level of volatility. On the contrary, their expansion shows high volatility in the market.

Traders should wisely use several technical indicators at the same time. One can simply get confused with signals of a large number of instruments when double-checking indicators’ values.

Optimal trading implies using two or at most three indicators on one chart. Optimal trading implies using two or at most three indicators on one chart. Then the information that can be extracted from them will be more precise and not so confusing.

Scalping and automated trading

As we mentioned above, scalping requires a quick reaction, a high level of mental and physical endurance from a trader.

Therefore, traders can use trading robots as an assistance tool. These robots are perfectly suitable for scalping. Let's find out why.

Trading robots are computer programs used for automated trading. They can be automated or semi-automated.

Semi-automated robots, also known as expert advisors, analyze the market according to preset parameters and give the trader a signal to open or close a position.

Fully automated robots make the necessary analysis, as well as independently perform transactions on behalf of a trader.

When using a Forex scalping strategy, robots have several advantages. They do not get tired, they are not affected by emotions and stress.

In addition, they can process and analyze large amounts of information in a few minutes.

Furthermore, robots can be used for high-frequency trading making it possible to transact a lot of orders in fractions of a second. This method takes human decision and interaction out of the equation.

Trading robots use mathematical models and algorithms to make decisions. This is both its advantage and its disadvantage.

The advantage is that the robot strictly follows the prescribed algorithm, without deviating from it under any circumstances.

At the same time, this is also a disadvantage because it cannot flexibly react to changing market conditions. The market situation may change, and the robot will continue to trade according to the same parameters.

This is why experienced traders prefer expert advisors to fully automated robots. They make their own trading decisions, receiving signals from the robot.

Basic rules for using a scalping strategy

If you decide to use scalping, you need to follow several important rules.

Assets for scalping should be highly liquid and have high volatility. Scalpers are interested in any price fluctuations, even the most insignificant ones, which is why they should choose instruments with constantly changing prices.

As a rule, scalpers prefer to trade currencies, and futures on commodities or indices, as well as cryptocurrencies and stocks.

You should also pay attention to the choice of a broker, an intermediary between you and the exchange. There are several reasons for this:

- Not all brokers allow the use of scalping strategies. It may not be explicitly stated on their website but you will see it by certain restrictions that brokers impose. For example, such brokers do not allow you to take profits from trades shorter than 15 minutes.

- Every broker has its own spreads and other commissions. Scalpers are interested in the lowest spreads possible because the large size of the commissions wipes out a considerable share of the scalper's profits. Some brokers allow traders to use floating commissions.

- The reliability of the broker and the stability of his work will allow you to make seamless transactions, as well as evade troubles with deposits or withdrawals. Choose proven and reliable brokers with a good reputation in the market.

No matter how profitable this strategy may seem, it is not recommended to open trades with large lots.

You also need a good understanding of a chosen instrument and experience in trading it. You need to understand its specifics, under what conditions it can change, what affects it the most, and so on.

Conclusions

This article presented to you one of the most popular trading strategies - scalping.

This strategy is very attractive because it may generate high profits in a short time.

In addition, traders can use the scalping strategy even with small deposits in their accounts.

At the same time, scalping carries big risks and has other disadvantages, such as emotional burnout, high commissions, and other drawbacks.

You should apply risk management and follow your trading plan to benefit from this strategy.

Some traders prefer a more aggressive trading style. However, this approach usually bears high risks, and higher risk does not always mean higher returns.

When opening positions, many scalpers use information from the depth of market indicators, rather than technical analysis. Although there are indicators that can help analyze the market.

Traders use computer programs - trading robots - to make such an intensive type of trading a bit easier. Robots can independently analyze the market and give signals for transactions.

Read more

Forex swing trading strategies

Intraday stock trading strategy

Back to articles

Back to articles