To succeed in a certain field, you need knowledge and training. If you have decided to try your hand at trading, start by reading the article Types of Trading where you can find answers to the most frequent questions.

Meanwhile, we have prepared an article about high-frequency trading. This article will tell you how HFT appeared, what its essence is, and who uses this type of trading most often.

Understanding high-frequency trading

The acronym “HFT” has become popular over the last decade. It stands for “high-frequency trading” and refers to trading, which is characterized by three main features:

- Very high speed of trading. Each operation takes fractions of a second. About 15 years ago, it took several seconds;

- Automation. All operations from scanning the market to making transactions are done by robots;

- Algorithmization. The whole process is based on special programs that make it possible to conduct trading correctly.

As you can see, HFT requires the fastest possible connection to the exchange, as well as powerful equipment. Only when these two conditions are met it is possible to trade with high frequency.

The distinctive features of high-frequency trading are:

- large trading volumes, which are provided by a large number of transactions and the high speed of their conclusion;

- completion of a trading day without open positions. In rare cases, their insignificant quantity is allowed;

- use of special computer programs for forming orders. Human participation in this process is not required;

- short-term nature of all transactions without exception;

- use of the latest technology, which provides the owner of the algorithms to be competitive in the market;

- small profit from each completed transaction. Large profits are received due to the high frequency of small-volume trades;

- use of elements of artificial intelligence, which form the basis of the developed algorithms;

- minimum delays in trading.

Traders who use high-frequency trading principles have a number of advantages over other market participants. The main ones are the ability to trade very fast, to operate with large volumes, and to maximize profits through the speed of transactions.

Thus, HFT is a kind of algorithmic trading, and it relies on speed and a large number of transactions. Robots in this case act as intermediaries between buyers and sellers.

Profits of high-frequency traders are formed mainly due to a small difference in the value of assets, which exists for a very short period of time. Regular traders may not notice it at all, and to be more precise, they do not have either technical or financial capabilities for that.

We will tell you more about this later.

Here is an example from ordinary life, with the help of which you can understand this type of trading.

Let's imagine a market with three vendors selling pears. They all have the same price - $1 per kilogram.

Suppose a wholesaler came there and bought all the pears from the first seller. While the buyer was paying, the seller informed his colleague from the neighboring pavilion about the big purchase.

He wasted no time in buying back all the pears from the third seller and raised the price of the fruit to $1.3 per kilogram. After all, he knew that no one else was selling them.

Thus, the second seller had the necessary data to maximize the profit from the sale. His fast action played an important role as he bought out all the goods before the wholesale buyer.

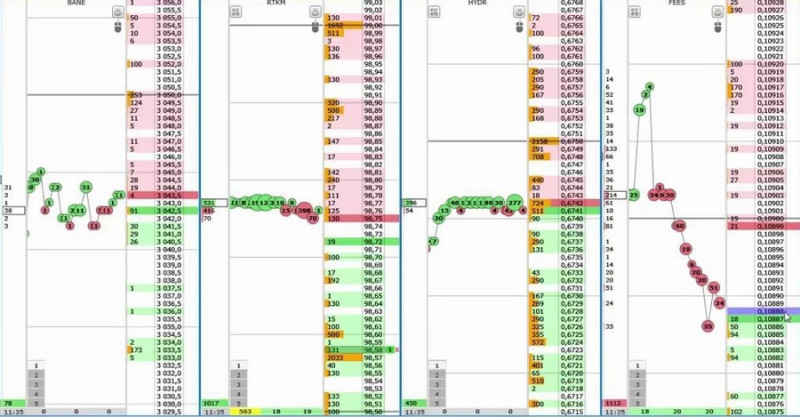

If we return to high-frequency trading, traders also have access to important information that allows them to react quickly. For example, if we are talking about stocks, this role is played by the order book.

This is a kind of table, which contains data on limited bids for the purchase and sale of assets.

History of HFT

Nowadays, high-frequency trading is associated with powerful computers and complex algorithms, which include elements of AI. The main purpose of all this is to predict the direction of quotes to make successful transactions.

It is difficult to imagine, but the methodology of such activity appeared in the Middle Ages. Back then, people who bought and sold various goods sought all available means to predict the future price of products.

For example, they used telescopes to find out what goods ships were bringing to their region. If the same product was in their possession, they sought to sell it quickly.

This had to be done as quickly as possible before the ships arrived at their destination with a new shipment of goods and the high supply lowered the price.

Clearly, robots and computers did not exist at that time.

In the modern sense, the high-frequency version appeared at the end of the last century. Its founder is believed to be computer specialist Steve Swanson.

At the end of the 1980s, he came up with the idea of making money on exchanges using powerful computers. Swanson assured that it was possible to create a program that could independently forecast asset prices in a 30-second perspective and make transactions.

Forecasts were based on special formulas. Swanson and his friends created their first program - BORG - in their garage, and received information about the course of trading with the help of a satellite dish.

Each transaction brought a small profit, which was counted in cents. But due to the fact that they were very frequent, the profits were large by the standards of that time.

Later, Swanson co-founded the first HFT algorithm company.

After 10 years, high-frequency trading has reached a new, official level. The US regulator SEC gave the green light to electronic transactions.

Back in the 1970s, the first marketplace where trading was considerably automated was launched. We are talking about NASDAQ.

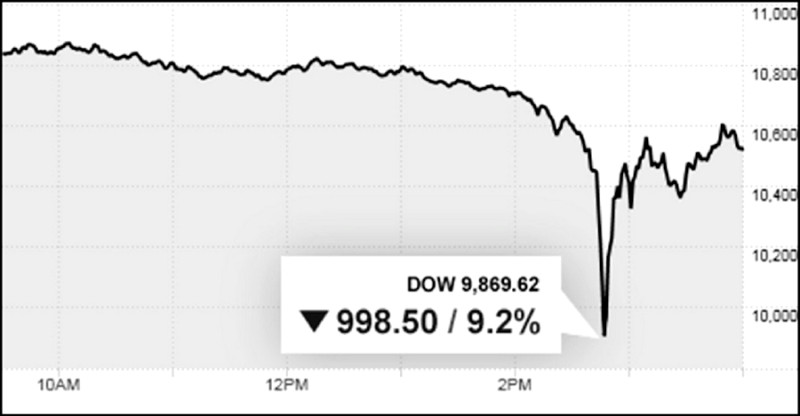

In 1987, the so-called Black Monday occurred. On that day, the stock market literally collapsed because many transactions were carried out with the help of computer programs.

By the way, a similar case happened in 2010 with the Dow Jones index.

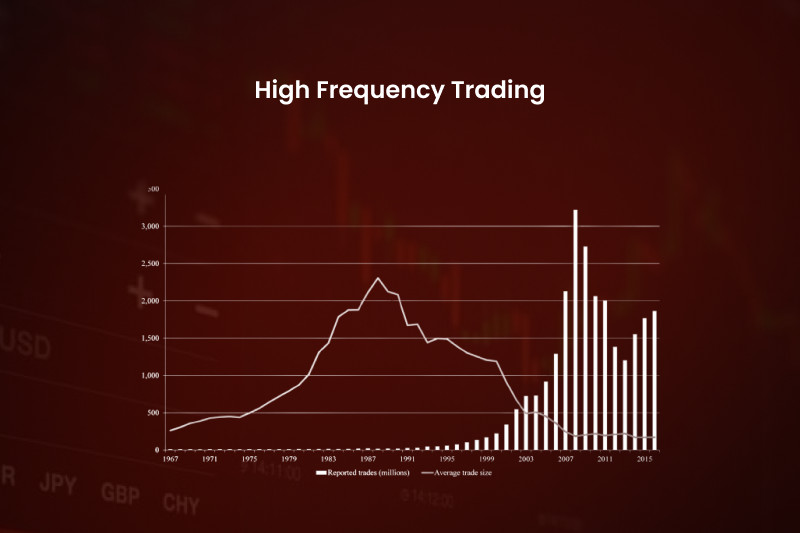

At the beginning of the 20th century, high-frequency trading became very popular. For example, in 2010 its share in the US markets exceeded 60%, and in Europe - 40%.

At the same time, additional measures were taken to regulate this type of trading. European and US authorities have tightened personal data protection regulations and established requirements for HFT platforms.

In 2012, the high-frequency trading market began to decline. Specialists noted a decrease in the efficiency of this type of trading and many major players left this sphere.

According to statistics, from 2009 to 2012, the profits that these companies made decreased by about five times. In addition, more and more money was required to maintain the infrastructure required for high-frequency trading.

Since 2017, the situation began to stabilize, and trading with high frequency began to gain in popularity again. Today, it is most common in the securities and futures markets.

Market evolution

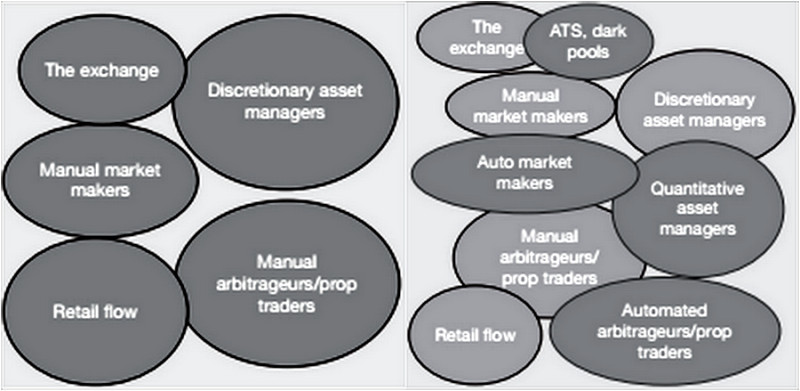

In order to appreciate the contribution that HFT algorithms have made to shaping modern trading, let's tell how trading was conducted. In the 1970s, trading was very different from what it is now, even without HFT.

Then it was built on the following steps:

- Broker representatives called their clients by phone and offer to buy assets. For example, securities;

- In order to give consent, the trader only had to confirm it in a conversation with a manager. Considering that there were many managers and they worked in one room, inaccuracies occurred due to extraneous noise;

- If the broker was big, they executed the order themselves, if not - he waited until the necessary volume was formed. As a rule, for large players the price was more attractive than for small ones;

- Employees of exchange processed orders. Quite often at this stage, there were trading costs, which were then borne by the clients;

- Broker’s managers called the client and informed them that the order was executed. Exchange employees received a commission for their work, which was withheld from the client.

Nowadays. trading has undergone significant changes. First, computers have replaced telephones. Second, orders are executed in the shortest possible time and automatically. Thirdly, commissions have been reduced several times.

Technological evolution has contributed to the fact that trading platforms have become more accessible and more functional. At the same time, trading has become not only more advanced but also more complex.

This can be seen by analyzing the direction of financial platforms in the 1970s and now.

How HFT works

Supporters of high-frequency trading primarily benefit from speed. It takes a hundredth or a thousandth of a second to execute a single operation.

That is how long it takes for a powerful computer to process a request and send it to another device. Robots scan the market literally in fractions of a second.

Even the most experienced traders can perform transactions at such speed. That's not surprising as all actions are performed by robots, not real people.

Features of High-frequency trading:

- High speed. In one second, there can be several dozens or even hundreds of transactions;

- High trading volumes. Considering the fact that large players are engaged in this type of trading, the turnover is quite high and it increases due to the number of transactions;

- Short term of asset holding: given the high frequency of trading, it does not stay long in one's hands;

- Fast profit making, which is provided by the high speed of making transactions;

- Opportunities for arbitrage transactions. We will tell you more about arbitrage later.

All this is achieved by automating the entire process. Special algorithms created by trading experts first scan the quotes.

While it takes a certain amount of time for people, minutes, or even hours, in the case of high-frequency trading, it takes instants. After scanning, robots automatically open positions: in large numbers and in fractions of a second.

Their main goal is to find triggers (e.g. a new trend) and bring the maximum profit to the user. During this time, users do not need to monitor the quotes.

Thus, the algorithms of high-frequency trading are aimed at an in-depth analysis of charts. After all, profits are formed precisely due to the differences in value, which can disappear in a blink of an eye.

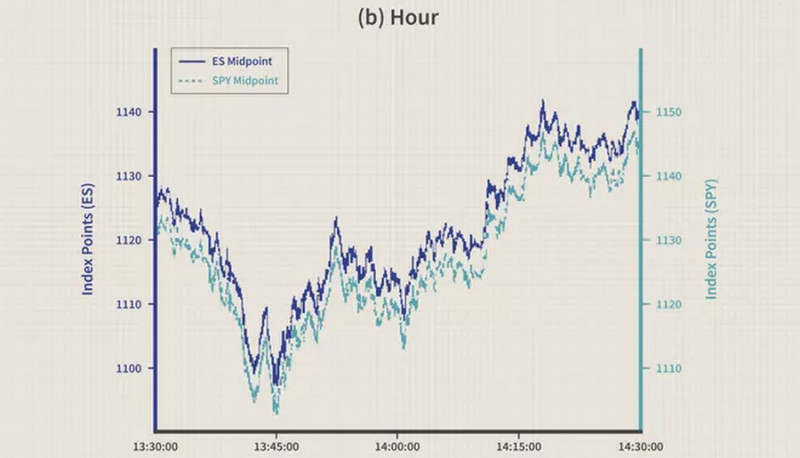

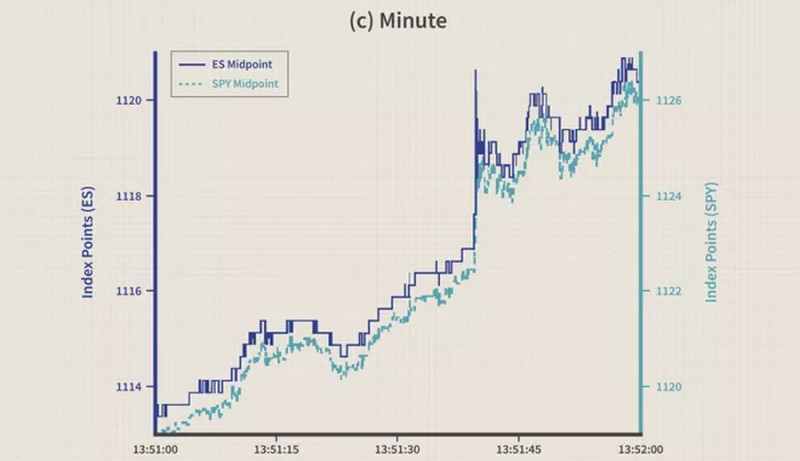

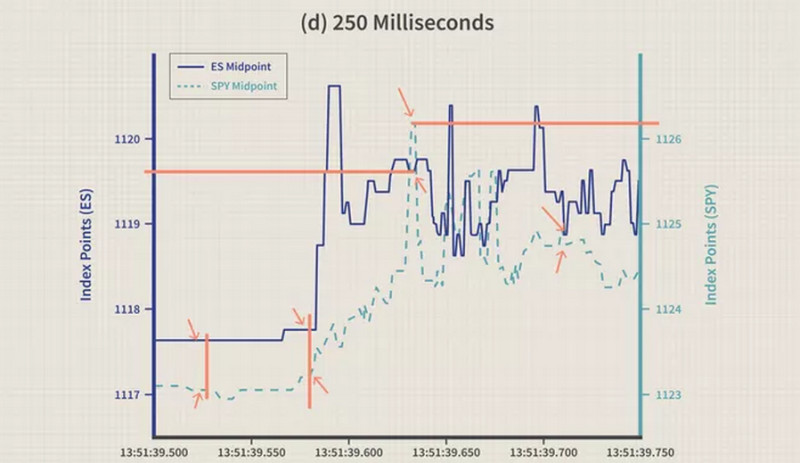

On the charts of the same futures, shown below, you can compare the tick correction of their prices at different time frames. Here you can clearly see that the higher the time frame, the higher the profit potential.

Who conducts HFT

Theoretically, anyone versed in computer technology and trading can create a robot that would analyze the market and make trades. However, due to the fact that it is quite expensive, not every trader will undertake it.

Another factor is the need to have the technology for direct access to the exchange and to know a high-level programming language. This is even more problematic for most private investors.

In addition, the process is not limited to the creation of the robot. It has to be maintained, technical conditions for its functioning have to be created, and this requires additional costs.

That is why this type of trading is used by large companies as they have technical and financial capabilities.

- Prop trading firms are financial companies for which the trading of various assets is the main type of activity. They exist due to the profit they make.

They invest exclusively in their own funds, choosing different financial markets;

- Brokers have their own subdivisions for trading with high frequency and speed. Most often they are subsidiaries of brokers.

Trading is also done with the company's money while the client and the proprietary trading are two separate lines of business;

- Hedge funds: they gain profits by applying arbitrage strategies. For this purpose, such funds select suitable financial instruments and use nuances in their pricing.

In addition to the above-mentioned organizations, HFT is very popular among banks and investment institutions. All of them have the following features in common:

- Substantial capital invested in trades;

- Trading with own funds, not clients' money;

- Good financial performance: HFT is only practiced by successful companies.

As a rule, algorithms used by organizations for high-frequency trading are kept secret. They are not publicly available and cannot be used by anyone.

Notably, such algorithms have recently become more affordable for users in terms of cost. However, beginners should understand that they will have to deal with significant price spikes, which can sometimes be unexpected.

The best solution is to gain skills during intraday trading and then switch to high-frequency trading.

HFT: pros and cons

This type of trading is primarily beneficial to those who apply it in their activities. As we have already mentioned, these are large companies, banks, hedge funds, etc.

Due to the large number and high frequency of transactions, HFT allows these market participants to obtain the maximum profit.

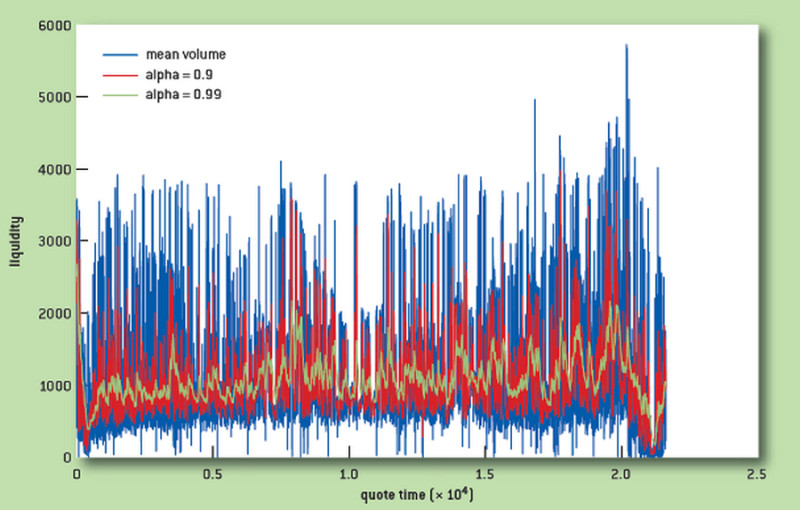

In addition, many experts agree that HFT has a positive effect on the liquidity of many assets. This makes them more attractive to many players, including private ones.

Also, high-frequency trading eliminates the factor of so-called missed opportunities. Its essence is that sometimes traders do not have the opportunity to open a trading platform to make a profitable transaction.

For example, trader A has a share in a corporation, and trader B plans to buy the security at $10.

If the two traders find each other in time, the transaction will be made and the share price will be the market price or close to that value. If there is no "meeting", trader A will have to reduce the price of the stock to $9, for example, in order to sell it.

This value will no longer be a market price. It means that the price equilibrium will be broken. Thus, HFT speeds up "meetings" of buyers and sellers, balancing the market.

You can analyze how this activity deals with pricing inefficiencies on the charts below. The blue line is the price of futures on the S&P 500 stock index, and the green curve is the volume of trades made.

They should correlate with each other. If you look at the 1-minute chart, you can see that this is actually the case.

However, if we analyze the 250-millisecond time frame, this feature is faded. The situation is corrected by high-frequency players.

However, this type of trading has its opponents. They are critics who give the following arguments in favor of their position:

- Artificial increases in volatility, market noise, and the formation of a false surge of supply or demand in the market. These three factors are especially dangerous to other market participants who do not use high-frequency trading;

- Taking a profit from a price that does not exist in reality. To clarify this point, let us assume that the EUR price is $1.1020.

At some point, the value decreases to 1.0020 on the exchange in London. It takes about 0.5 seconds for this change to reach the exchange in New York.

That is, within a few moments there is a difference in price. It is used by HFT traders who have time to make lots of transactions and take a profit within those 0.5 seconds.

This has a negative effect on the market. In addition, the ethics of such trading is highly questionable;

- Numerous facts of fraud are possible because private players do not know the nuances of this type of trading. That is why opponents of high-frequency trading insist on its restriction and even prohibition;

- The impact of frontrunning. Many HFT robots make trades moments before big players enter the market. As a result, the balance in the market is disturbed and HFT traders benefit;

- Robots fighting each other. While private traders do not seek to compete with them, there is a serious struggle among HFT robots.

As a result, the implementation of complex schemes often results in reduced liquidity of assets;

- Large costs. The infrastructure required for HFT is expensive but it is not always justified.

For example, to build the fiber optic line that connected Chicago and New York, it was necessary to make holes in the mountains. All the work cost $300 million.

All this was needed to reduce the execution time of one transaction by three milliseconds.

Thus, HFT has its strengths and weaknesses. That is why it is impossible to say that it is a good or a bad solution.

HTF and cryptocurrencies

Many traders use digital money as a tool that can be used in the implementation of HFT methods. By and large, traders have the same opportunities as when trading stocks and other assets.

At the same time, cryptocurrencies have some very important features that must be taken into account:

- High volatility. Digital currencies are characterized by volatile values, private and sometimes significant price changes that cannot always be predicted;

- Decentralization. The network does not have a single management body, and its functionality is maintained through the participation of multiple users.

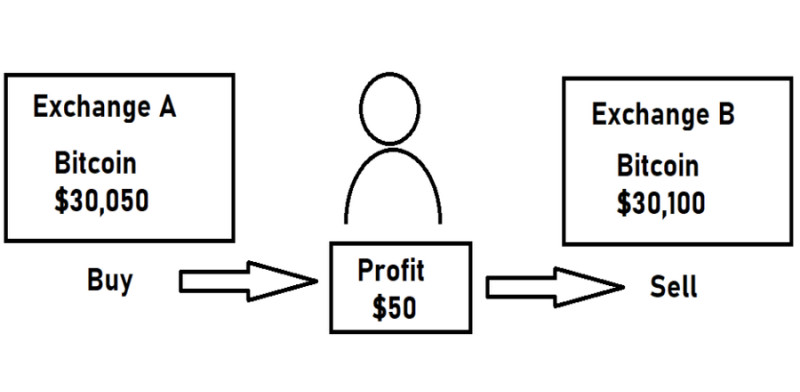

The most popular strategies used when working with cryptocurrencies are arbitrage and market making. In the first one, the robot buys coins at one marketplace and in a moment sells them at another one, where their price is higher.

When implementing market making, a trader places buy and sell orders, taking profits from the imbalance between supply and demand.

At the same time, many experts note that when using cryptocurrencies as a trading instrument, traders may face additional risks and difficulties.

Here are some of them:

- impact of the speed of formation of each block in the blockchain. In this case, even minor delays can negatively affect the speed and frequency of transactions;

- peculiarities of digital money infrastructure. Fragmentation of liquidity should be noted here in the first place;

- possibility of unpredictable slippage. Because of this, a transaction may be closed at a less attractive price than planned;

- the threat of the so-called sandwich attacks, when unscrupulous market players are ahead of the game. They adjust the sequence of transactions in such a way that a competitor faces a slippage.

However, this does not mean that cryptocurrencies should not be used in high-frequency trading. First, risks exist with all instruments, not just digital ones.

At the same time, the high volatility of digital coins, if used correctly, can bring traders high profits.

Potential risks of HFT

For those who are planning to use this type of trading, it is important to understand that it carries significant risks. Let us list the main of them.

1. Technical failures of devices or trading networks. Even insignificant faults can lead to losses instead of expected profits.

For example, in 2012, Knight Capital hedge fund lost more than $450 million in one hour because of a technical error made by the developers when updating the algorithm. It made loss-making trades for more than 40 minutes, and it was only possible to find this fact due to automation after a large negative balance was formed on the account.

Since then, the legislation regulating the risks in High-frequency trading has been updated but such risks are not completely ruled out;

2. The possibility of artificial manipulation of the market leads to an unexpected financial outcome for smaller players. For example, such a fact was revealed in 2009 when one of the funds manipulated the value of securities on the NASDAQ;

3. Retail traders distrust the market. Not every player will dare to continue trading and take a risk on a platform where the share of HFT is high.

Importantly, all existing risks can be divided into those related to HFT traders and those related to other market participants. In the second case, we are talking about the very fact of existence of this type of trading.

As for the first category, the main reason for all sorts of negative consequences is the inability to control the algorithms.

- Reason No.1: the speed of their work is so high that it is even physically difficult for a person to keep track of the process;

- Reason No.2: algorithms, as a rule, do not limit the amount of money that can be used in trading. As a result, you can lose all the money in your account;

- Reason No.3: Any algorithm becomes outdated over time and needs to be revised. Otherwise, more advanced competitors will overtake it, and the robot will become irrelevant.

HFT algorithms

When we talk about high-frequency trading, we mean very fast and frequent trades made by robots. They function according to specially developed algorithms.

Notably, not all algorithmic trading is high-frequency trading.

Algorithms are complex programs, which are created by first-class programmers. Most often they are based on Java, C++, and other languages.

They give the opportunity to make trades in a matter of moments, bringing the maximum profit.

Thus, the HFT algorithm performs the following actions:

- It scans quotes and identifies patterns that are embedded in them;

- Makes decisions about the direction of the transaction to make as much profit as possible. For this purpose, it “looks ahead” for 40-60 seconds, making a short-term forecast about the price of an asset;

- Forms, places, and executes orders.

All algorithms belonging to the category of high-frequency have the following features:

- operations with a single order take several milliseconds. The shorter this period, the better;

- traders are not involved in trading;

- programs have direct access to the exchange or a channel designed for it;

- the trading day ends without open trades.

The algorithm's underlying mechanism is designed to ensure that its owner makes a profit. This goal can be achieved in two ways:

- Market Making: in this case, a trader receives remuneration from the exchange for maintaining the liquidity of assets at the optimal level;

- Arbitrage: the algorithms find markets where the same asset has a different price and resell them.

HFT robot: features

We have already described that the main advantage of high-frequency trading is the ability to make a huge number of trades in a short period of time. Trading with such a high frequency cannot be done by traders.

That's why all the work is done by robots. Here are a few facts about their effectiveness:

- It takes almost 6.6 milliseconds to transmit data over 1,300 kilometers via a fiber optic cable;

- Using radio waves, the speed is even higher: the same distance is covered in 4.3 milliseconds;

- According to statistics, a robot gets a profit of almost 0.1 cents per transaction;

- Robots make about 10,000 trades within 500 milliseconds;

- The maximum speed of high-frequency trading at the moment is more than two dozen that of exchange stations within 4 milliseconds.

In fact, robots, which are used in high-frequency trading, replace traders. The latter need only obtain an algorithm (develop it or buy it) and analyze the results of market activity.

Importantly, the main competitor of any high-frequency trading robot is not a retail investor but another robot. There is a constant struggle between them, and those who have higher speed and more stable results win.

Hence, the costs of updating and upgrading existing algorithms are growing. There is also the creation of new variants based on them, which are more competitive.

At the same time, this opposition to robots leads to the fact that ordinary market players - real people - are often simply forced out of the market. This sets the stage for the assertion that it is high-frequency trading is the future.

HFT strategies

The more data a particular trader has about the trading plans of other market participants, the easier it is for them to build their strategy and make a profit. This requires analysis of prices, trading volume, and conditions of transactions.

As we have already mentioned, in the case of high-frequency trading, robots do it all. They set up algorithms using this information.

Methods of high-frequency trading are based first of all on getting profit from the market inefficiency. That is, the tactics that focus on large movements of the value, go into the background here.

Let's focus in more detail on some HFT strategies.

1. Different types of arbitrage. This particular option is the most common and involves the resale of different assets.

- static: the algorithm finds a discrepancy in the prices at different platforms linked to each other. After that, it concludes a profitable trade;

- news: the program analyzes announcements of important news events and forms an order before or at the moment of their release;

- delayed: traders get profits from the fact that they receive important information from the exchange earlier than others. For example, due to the short distance from the server to the exchange's data center;

2. Market Making: in this case, algorithms maintain the liquidity of a particular asset and maintain the necessary spread size. For the placement of multiple orders on the right side, the exchange remits remuneration; this is a passive variant of market making.

The platform becomes more attractive to traders, which is why it uses the services of HFT traders.

Another source of profit in this case for high-frequency traders is the resulting imbalance between supply and demand. They receive profits on the basis of the difference between the buy and sell prices;

3. Frontrunning: the robot looks for large orders that other traders are planning to make and forms an order before they do. The main thing is to make a trade as early as possible when favorable conditions appear.

Here is an example to show how this strategy works.

At first, the algorithm analyzes the largest bid. If the price meets the specified requirement and is confirmed by the appropriate volume, the algorithm forms an order one step above this bar.

All these manipulations are focused on the fact that after the completion of a large bid, the price will change in favor of the high-frequency trader;

4. Finding liquidity: the program identifies large bids before bidding even begins. To do this, it generates small bids and analyzes their execution time, thus determining the time of a large trade;

5. Momentum: robots provoke other traders to make trades in a particular asset. As a result, there are value spikes, and the imbalance between the buy and sell prices grow.

This increases the possibility of obtaining profits.

Another classification suggests the following types of high-frequency trading strategies:

- arbitrage: the essence of these techniques we have already described in our review;

- structural: it involves obtaining trading information before competitors do;

- passive: the creation of buy and sell orders of a certain volume, which will have a positive effect on liquidity;

- discretionary: the creation of orders that induce other players to make transactions.

HFT for retail traders

Large funds, banks, and companies practicing high-frequency trading do not need to study HFT charts drawn by algorithms. Visually they seem quite complicated but the process of their analysis is taken over by robots.

As for retail traders who can not afford to buy ready-made algorithms, they can create it themselves. However, this requires compliance with a number of factors:

- Having in-depth knowledge of computer technology, programming, and trading. For this purpose, it is not enough to have rich experience in trading, it is also necessary to be trained as a developer;

- The ability to technically connect to the exchange, which must be as fast as possible;

- Willingness to update and upgrade algorithms. Here we are talking about both the technical and financial components;

- Computer equipment with high power.

It can be concluded that the independent development of such algorithms is not only a time-consuming and complex task but also a costly one.

Nevertheless, there is a way out for retail traders who cannot use HFT algorithms against large companies but really want to. Experts believe that they can test their trading skills as scalpers.

This type of trading involves making a large number of transactions during a trading session. Scalping is also possible to use with the help of robots.

The only thing in which scalping is considerably inferior to HFT is the speed.

It is important to understand that this type of trading is not suitable for all market participants. It should not be used by people who are not ready to spend much time trading and who are not able to react quickly.

When scalping, it is necessary to be selective in the choice of assets. They should have high liquidity. Otherwise, trading will not bring the expected financial results.

In order to start scalping a trader needs:

- Register with a broker that offers small timeframes for trading. For example, InstaForex is an optimal solution;

- Download and install the trading platform offered by the broker;

- Open an account and make a deposit;

- Start trading, the main goal of which is to make quick transactions: buy at a low price and sell at a higher one.

To avoid losing real money at the start, you can use a demo account. A training account is offered by most brokers, including InstaForex.

Conclusion

Thus, over the years, high-frequency trading has occupied its own niche in the market. At different periods the interest in this type of trading gained momentum and, on the contrary, decreased greatly.

However, the fact is that it exists and is in demand by a certain category of market participants. Some enthusiasts are even confident that HFT is the future of exchanges.

Despite the criticism, it is proved that HFT helps to maintain liquidity, increase trading volumes, and narrow the spread between the bid and ask prices. All this increases the efficiency of pricing of many assets that are traded in the market.

On the other hand, this type of trading is available only to large institutional traders. They make the most profit, and most often at the expense of smaller market participants.

You may also like

Full Guide to Quantitative Trading

Back to articles

Back to articles