Do you want to learn all the basics about trading in the financial markets? Then the article about the types of trading is a must-read for you. It will provide you with answers to the most popular questions.

In this review, we focus on the spoofing trading. Read on to learn what this concept means, why this strategy is banned in some countries, and how spoofers organize their work.

What is Spoofing?

When trading in financial markets, all traders, without exception, aim to get the maximum profit. Some traders are responsible, so they conduct their trading activities honestly and openly.

But there are also those who use various tricks, breaking common rules of honest trading. Spoofing is one of such cunning schemes. It is actually aimed at deceiving other market participants.

To explain what spoofing in trading is, we will provide an example from history that will help you understand the specific features of this trading method. In 2012, one of the American traders came up with a seemingly new way of making a profit in trading.

For several hours, Igor Ostaicher was sending many orders for the purchase and sale of assets to his brokerage company. The assets were oil futures, and the number of orders amounted to tens of thousands. Mr. Ostaicher used bots for that purpose.

But the trick was not the automatization but the fact that the trader cancelled his orders right after placing them. It took him merely a second.

This way, the trader created an illusion of increased demand for futures. In turn, the high demand, although artificially boosted, increased the asset price.

Taking advantage of a higher price, Igor Ostaicher sold the futures he had at that moment. As a result, he received hefty profits.

This style of trading later became very popular with some market participants and was called spoofing. This term means a delusion, swindle.

Although one of the first large-scale cases of spoofing is associated with the name of Osticher, in fact such manipulations have been used since the financial markets appeared.

The important feature of spoofing is that the process is controlled by robots in most cases, because a person cannot create and cancel orders in a split second. Thus, spoofing can be attributed to a variety of high-frequency trading (HFT).

At the same time, some traders apply such tactics manually, without the use of algorithms. However, it cannot be refered to as high-frequency trading, but rather scalping.

Spoofing is most widespread in the stock and commodity markets, as well as in the cryptocurrency markets. In fact, this method can be used in any financial market without exception.

Spoofing in a nutshell

To better understand what spoofing is, first you need to understand a few notions.

So, any trading exchange includes a huge number of orders. There are either market or pending orders.

The market orders are executed at the current value, that is, the market price. For example, if a trader has created a market order to buy an asset, it is immediately executed at the price that exists at the moment.

Meanwhile, pending orders are triggered only when the price reaches the specified level. This level is determined by traders themselves.

Sometimes limit orders can take minutes to execute, and sometimes they don't get executed at all because the price doesn't reach the target.

The lowest sell order forms the Ask price, while the highest buy order forms the Bid price. That is, they comprise the supply and demand ratio.

The basic features of limit and market orders are reflected in the image below, where a glass of juice is presented as a figurative asset.

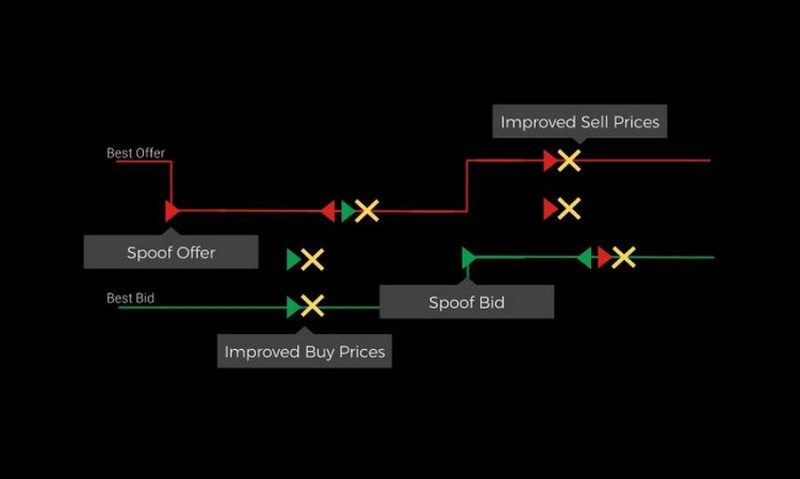

Traders who apply the spoofing strategy act in the following way:

- They place a pending order of a big volume (or several orders at once) beyond the Ask and Bid ranges of a particular asset. This way, they artificially boost demand or supply while other market participants get signals of a price change.

- The trend reverses either to the upside or downside, depending on what type of orders a spoofer places (to buy or to sell).

- At the same time, a spoofer sends counter market orders. They close at a better price than if there were no limit order.

- A spoofer cancels the pending order and makes profit thanks to the fake price change. As soon as the initial order is canceled, the price returns to the original levels.

In a trading process, the sequence of points #3 and #4 may change.

This is the algorithm that users follow when intending to influence price changes artificially. The target assets can be securities, currencies, including digital ones, metals, raw materials, and other.

Counter-spoofing actions

It is important to understand that spoofing involves artificial change in quotes, as orders get cancelled before execution. To be precise, a trader does not need these orders to be executed.

That is why this style of trading is banned in many countries across the globe, such as the UK and the USA.

The penalty for this misdoing may be:

- Fines amounting to several millions of US dollars;

- Cancellation of issued trade licenses;

- Trade ban that can sometimes last for about five years;

- Damage to reputation.

At the same time, it is actually difficult to recognize this scheme and punish manipulators. After all, it is almost impossible to prove that a high-frequency trader placed orders, knowing in advance about their cancellation.

In theory, the spoofing trading can be identified by analyzing the order flow. If large bids are canceled before execution, it is most likely the case of price manipulation.

But the problem is that this fact can be revealed only after some time, when this information does not matter anymore.

After all, even conscientious and honest traders quite often cancel created orders. Most often, this happens in the following situations:

- Publication of the news that changed the market situation or can affect it in the near future;

- A trader's decision to change their trading strategy;

- Sudden changes in the market, such as technical reversal of the underlying trend.

At the same time, there are cases when spoofers were found and punished. For example, in 2015, UAE traders were fined $2.7 million by the US CFTC for price manipulation of precious metals futures.

In the same year, US citizen Michael Koshia was sentenced to three years in prison for trading with the use of spoofing. In fact, it was the first time in history that a trader was sentenced for price manipulation.

Remarkably, in two and a half months of trading, he managed to earn about $1.4 million using a tricky trading scheme. He was engaged in manipulative trading on several exchanges at the same time.

Another resonant case occurred in 2017. Citigroup was proven to be engaged in spoofing in the futures market, for which it was fined $25 million.

In 2020, JPMorgan faced a similar accusation. But in that case, the fine amounted to $920 million.

There were also cases of punishment of some American and European banks.

Features

Although spoofing is illegal and risky, the temptation to make profits out of thin air is very strong. That is why some traders, ignoring all the risks, engage in this type of market manipulation.

The key features of spoofing are:

- Limit orders are of a rather big volume (sometimes millions of US dollars). Such orders are placed with no targets and with no intentions of executing them. The key aim is to increase the liquidity.

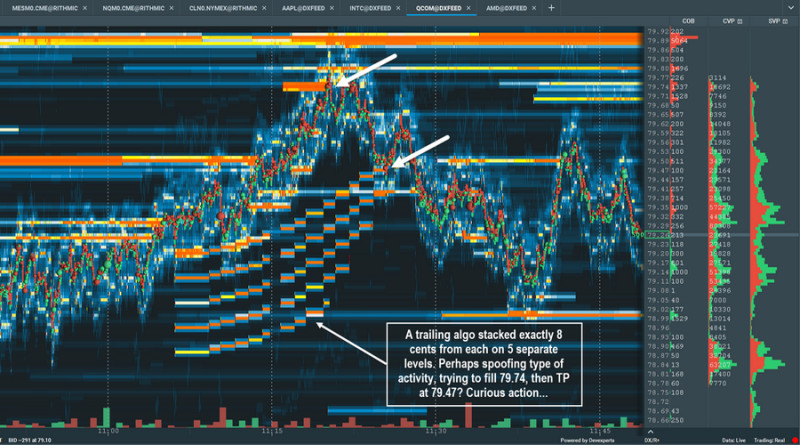

- Large orders appear suddenly and for no good reason. In most cases, it happens in a particular period of time, for example at the start and the end of a trading session, as shown on the screenshot below.

- Large orders are placed at a price that prevents too fast execution of the orders.

- Simultaniously or right after the cancellation of large orders, counter orders are placed. They are of a smaller volume than the previous ones.

- A spoofer takes advantage of price fluctuations amid increased liquidity.

- Limit orders are fixed as the price of an asset changes. An example of such a situation is presented in the screenshot below.

At the same time, it is a false belief that price manipulation works well at any period and in any market.

Thus, spoofing brings the desirable results when spoofers place their orders near support and resistance levels. Let us provide an example of bitcoin spoofing.

Suppose the resistance level of this digital asset is set at $20K. This level is considered a cap that is most suitable for selling the cryptocurrency.

If the price rebounds from the resistance level, which happens in most cases, then BTC will likely continue falling. Therefore, sell trades in such a case will bring a smaller profit. In case the price breaks the level, then it is most likely to start rising.

If the level of $20K turns out to be a strong resistance level, then spoofing bots will place orders above this level. As a result, other traders will see large sell trades above the level of $20K and refrain from buying the asset at this price level.

Then, the price will decline, spoofers will cancel their pending orders and buy bitcoin at a better price.

Importantly, spoofing can have an impact in different markets where an asset is traded. Specifically, it refers to both spot and derivative trading.

However, spoofing can be ineffective and even too risky. This happens when the market or asset is characterized by uncertainty and unpredictability.

One of the scenarios in this case is the rapid execution of large spoofer orders before they are cancelled.

Algorithms used by spoofers

Spoofers are traders who apply the spoofing method of trading. It can be one person or even a team or a company who practice price manipulations.

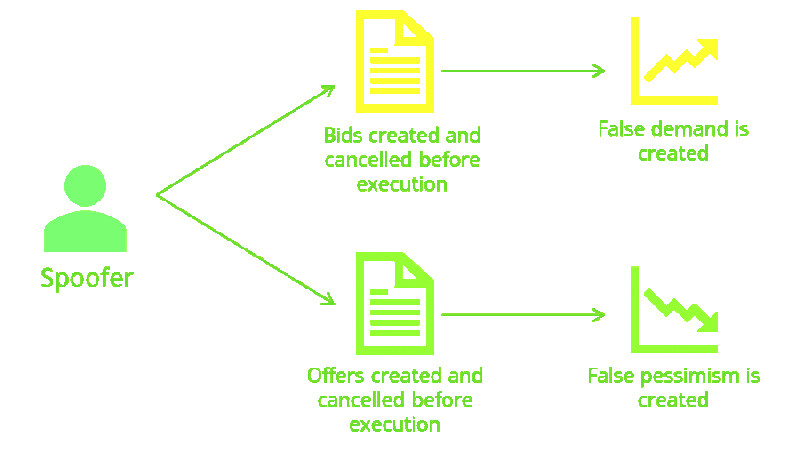

The key task is to create an illusion of an increased demand or supply for a particular asset. False limit orders can be both to buy and to sell.

For other market participants, it may seem a real market situation, so they react to it.

As a result, the price moves in the direction that is favorable for a spoofer.

A large limit order that mislead other traders is cancelled as was planned beforehand. At that moment, a spoofer places smaller counter orders.

As a rule, to achive their trading goals, spoofers use special trading robots. Automated and high-frequency trading algorithms took spoofing to a new level.

In most cases, not only spoofers' actions are considered dishonest, they also have a damaging impact on the market. Spoofers create a false impression of demand and supply.

In turn, it affects the sentiment of market participants, both bulls and bears. They have to react to the false changes in quotes while spoofers take advantage of that.

This is how spoofing looks like in real trading:

- Suppose some asset is traded at $50.65 per unit.

- A spoofer wants to buy 20 lots at $49.55 and then sell it at a higher price.

- To push the quotes down, a spoofer needs to create an illusion that the price of $50,65 is too high. For that, they place large limit orders to sell over 200 lots at a lower price, thus misleading other market participants.

- Other traders see this tendency and assume that the asset price is really declining, and it will be difficult to sell it at $50.65. So, they also push the price to $49.55 or even lower.

- A spoofer cancels their limit orders and buys 20 lots at the lowest price. An illusion that there is a large buyer on the market dissapears, and the price returns to an average value.

- A spoofer can sell the asset at once or pump its price up to even higher levels. In this case, they get bigger profits.

Notably, an individual investor cannot tell a spoofer from a regular trader. Spoofers have become common participants in the stock and forex markets.

Some analysts believe that spoofing has the same impact on quotes as fundamental factors.

Regulators and large companies are taking certain measures in order to counter spoofing trading. These measures include scanning players' correspondence to identify spoofers, developing special programs, and other.

For example, many regulators use the SupTech system. It scans the market information and provides details about trades, transactions, and so on.

It enables them to identify suspicious actions that can turn out to be price manipulations.

However, practice shows that these measures cannot bring 100% results and disguise all dishonest traders.

Key risks of spoofing

The trading strategy described in this article poses certain risks to all market participants. For spoofers, it is a risk of being identified and punished which is unlikely. For other traders, risks are notably higher.

In most cases, traders have no idea of being involved in price manipulations, and make trading decisions that cause them losses.

Spoofing has the following consequences:

- Assets become more volatile, and price fluctuations become unpredictable.

- The dynamics of price changes becomes chaotic. Prices change for no good reason.

- The market situation gets tricky for beginning traders.

- The market confidence decreases. Honest traders understand that they are fooled, so they become more cautious in their future trading steps.

Given the specifics of spoofing, it poses a greater risk to scalpers and swing traders. When trading in a long term, traders can reduce the risk of being affected by price manipulations.

This is why, when developing a trading strategy, it is important to factor in the possibility of price changes contradicting the forecast.

Here are some methods enabling traders to avoid falling victims to price manipulations:

- Use longer time frames (at least 15-minute ones). This will enable you to filter the market noise, as well as all high-frequency fluctuations.

- Wait until the price reaches support and resistance levels (either breaks them or rebounds).

- Diversify your investment porfolio. If you happen to incur some losses due to spoofing, the rest part of your capital won't be affected.

- Factor in not only the current trades data but also historical data.

- Analyse the balance of long and short trades. If it diverses greatly from the normal value, it is a clear sign of price manipulations.

- If you are a beginning trader, you'd better apply medium- and short-term trading strategies. Spoofing poses a greater risk for short-term traders, so the longer periods you use, the safer your trading will be.

- Follow your self-developed trading plan strickly.

- Analyse the quotes flow all the time. A sharp and unfounded increase in the number of orders can be a sign of spoofing.

The use of these protection measures in trading will not save you from all possible risks, but at least they will help you to reduce the negative impact.

Other manipulation methods

Importantly, spoofing is not the only method of price manipulation. Besides that, there are the following wide-spread methods:

- Pump and dump is a scheme involving coordinated actions of a group of traders aimed at a rapid increase in prices and a consequent sharp fall. They select a particular asset (cryptocurrency, stocks, and other)and buy it in trades of a small volume.

After that, tricksters do everything possible to make this asset price grow. They start actively promoting this asset in social networks, thus creating positive news background. It prompts other market participants to buy this asset, and the price grows as a result. Pumpers sell the asset at the highest price, get profit, and dump the price to its previous levels. Consequently, other traders incur losses. Notably, there can be several stages of the pump-and-dump scheme, and the last one is often the strongest. At this very moment, manipulators sell the biggest part of their assets. - Wash trading involves artificial increase in trading volumes. In fact, trading volume reflects demand for a particular asset.

Traders who manipulate prices gather in groups and start selling and buying an asset actively, thus increasing the volume. Meanwhile, other market participants get a wrong belief that demand for a cryptocurrency or a stock is actually increasing, so it provides good trading opportunities. Ordinary traders start buying the asset, its price increases, and tricksters get profits by selling the asset at a favorable price. - When using media tactics, tricksters publish information about the asset price rising or falling. Sometimes, they increase the significance of some minor piece of news in social networks.

In some cases, price manipulators post fake news that can contribute to disbalance between supply and demand.

Importantly, manipulators always trade against the market. This way, they manage to achive their key trading goal, i.e. get profits.

However, one should clearly understand that such cunning schemes lead to negative consequences in most cases.

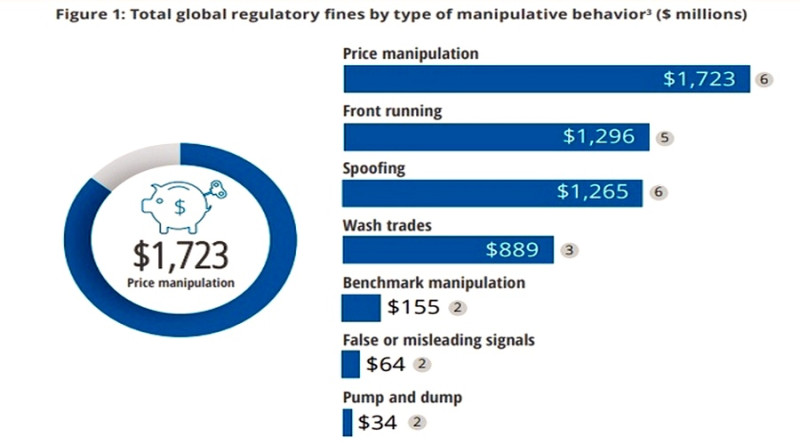

In the sceenshot below, you can see the total amount of fines imposed by regulators for various types of price manipulations in the period from 2018 to 2020.

Conclusion

Spoofing is a price manipulation scheme used by dishonest traders to achive their goals. The use of such tactics may be profitable for a spoofer, but it causes losses to other market participants.

The main purpose of this scheme is to mislead other traders, increase the asset price artificially, and make use of it in order to get profits. Spoofers try to mask their activity and improve their schemes, so other market participants should be cautious.

This recommendation is expecially valuable for beginners who are making their first steps in trading.

Back to articles

Back to articles