We continue to discover the world of trading and today we will tell you about different trading platforms. This article describes the software offered in the market, how trading has evolved, and what you need to consider when choosing a platform.

Beginners may also find the article What do you need for Forex trading quite helpful. This article contains a lot of useful information on where to start preparing for trading, how not to miss the most important things, and without what tools trading is impossible.

How trading platforms work

You need a platform to make a profit while trading. This term refers to special software that is created primarily for making trades.

This software has many other features but we will talk about them later.

There are a lot of trading software solutions today. The offered platforms fully satisfy the existing demand.

Firstly, the computer development industry is rapidly expanding. Secondly, new companies are appearing in the market, offering customers the latest developments and being ready to meet any demands.

Perhaps, some beginners do not understand how the trading platform is built and how it works. Let's explain it by describing the main stages of trading.

- Liquidity providers send information about asset values to brokerage companies. These can be the prices of currency pairs, shares, cryptocurrencies, etc.

The providers are banks, specialized organizations, and financial institutions. The essence of their work is to simultaneously buy and sell assets, thereby providing liquidity for the latter.

Liquidity means the ability to quickly sell an asset at an attractive price. So, if the liquidity is high, the transaction can be made instantly and without any obstacles;

- The information that comes in turns into a powerful flow, because there are so many of them, and the ratio of supply and demand is constantly changing;

- On the broker's server, the data is systematized and consolidated. A comparison of offers from different liquidity providers is performed there.

A special program filters the most profitable prices, and the broker puts a commission for the provision of services;

- The next stage is the transfer of structured information to the platform’s server. Simply put, now all quotations begin to be displayed on the user's screen.

Despite the fact that all of the above-mentioned stages involve a lot of actions, they all take a few moments. High speed of data transfer is essential in trading;

- When a trader wants to sell or buy an asset at a specified price, a corresponding order will be sent to the brokerage server. It is not executed immediately as a certain amount of time is spent on security checks.

After the check is completed, the order is sent to the liquidity provider for execution;

- The liquidity provider executes the order. At the same time, all information about the trade is sent to the clearing department.

Each trade receives a specific number and a list of individual characteristics. All this is sent to the brokerage company and the trader;

- The trader sees the completed transaction and the result it has led to.

As we can see, software plays an important role in trading.

History of trading platforms

Nowadays, trading is based entirely on the use of computer programs, i.e. software. However, this has not always been the case.

It is believed that the history of trading platforms in the modern sense of the term dates back to the 1980s. In fact, it all began much earlier.

Thus, until the middle of the 19th century, exchange trading was not conducted as we do today. People wishing to buy or sell securities gathered in the street near the exchange building.

Brokers announced the information on assets from the exchange’s windows to the traders. Everything was going on in a flurry, and sometimes there were even conflicts between people as everyone wanted to stand closer to the building.

In 1869, the so-called ticker tape machine was invented, which made a real breakthrough in trading. A special typewriter printed out quotes on paper tapes. After that, a telegraph was used to transmit data from the machine.

Nevertheless, such trading conditions were far from ideal.

The fact is that only the wealthiest people had ticker tape machines. Therefore, the rest of the traders recorded the necessary information in their notebooks.

The next important event was the launching of television recorders in the 1930s. They received data from the main platform and displayed it on a special scoreboard, which was placed in the center of the halls and trading buildings.

The viewers could see the quotes of various securities, which were marked with individual symbols also known as tickers.

In the second half of the 20th century, computer technology began to develop. This also contributed to the development of platforms and the information was transmitted faster.

However, operators were still very busy because all the data had to be entered manually.

It was the case until the 1980s when portable terminals and computers began to be used in trading.

Over time, special computer programs appeared and made it possible to synchronize with exchange servers and track the value of assets.

Lately, they were improved and received functions of transactions and technical analysis.

Different types of trading platforms

Nowadays, time and mobility are especially valued. This applies to trading as well.

After all, every second is essential to receive maximum profits. Timely executed actions are important to not miss the optimal point to open or close a position, and the terminal should be always at hand.

This rule is especially important when it comes to short-term trading.

The most common classification of software includes two types:

- Web-based platforms, which are operating in the browser. That is, users can start trading after authorization in the system by following the link;

- Software that requires downloading. These are programs for PCs, laptops, and smartphones, which are first downloaded and then installed on the device.

The type is characterized by accessibility and simplicity as traders do not need to spend time installing and unpacking the program. In addition, they do not take up space in the memory of the computer or laptop.

At the same time, some critics point out that there is a risk of delays in operation when traffic is increased.

The second type is used more often. It is important to know that the process of downloading and installing it is very simple and takes only a few minutes.

Another classification is based on the types of devices from which trading is performed. These can be mobile and desktop versions.

The former run on PCs and laptops and the latter are powered by smartphones and tablets.

As a rule, desktop versions have wider functionality. At the same time, mobile versions can be used anywhere and anytime.

The optimal option is to use the desktop platform for your main work, and the mobile platform when your PC is not at hand. On a regular basis, the latter is mostly needed by scalpers who need to constantly monitor the market.

How to choose trading platform

Experienced traders who have had years of practice and tried out different software know what to pay attention to when choosing a trading platform. Beginners usually have problems with it.

Let's describe some points which should not be ignored while analyzing software:

- Interface features. First and foremost, convenience and comfort are valued here. For example, some versions have an additional desktop function and the ability to change themes. The interface language also plays an important role. If the list of available ones is not suitable for you, it will be difficult to understand the platform, especially at the beginning;

- Services for the minimization of possible losses and compliance with risk-management requirements. For example, it is important for the trading platform to provide the formation of protective orders;

- Speed and performance. The platform should not freeze on any device, even if not quite new, and not allow failures and delays in executing transactions;

- Accuracy of quotes. Incorrect data may give false signals, which in turn lead to wrong actions;

- Functionality. This is one of the most important and voluminous criteria. This can include lists of available indicators, time frames, charts, and the possibility of automatic trading;

- Mobility. It is quite handy if the platform has an application for smartphones, especially if we are talking about intraday trading;

- Security. It implies transparency of operations and their confidentiality. This is provided by the broker but the protection of the platform itself is also important.

Notably, there is no software that is the unconditional leader by all of the above criteria. Each solution in some ways outperforms its competitors and in some ways inferior to them.

Therefore, each trader should decide which characteristics are fundamental and which are secondary.

Software solutions for trading

As it was mentioned, there are many trading platforms in the market. They may differ from each other in terms of functionality, interface, and services.

Here are the most popular trading platforms:

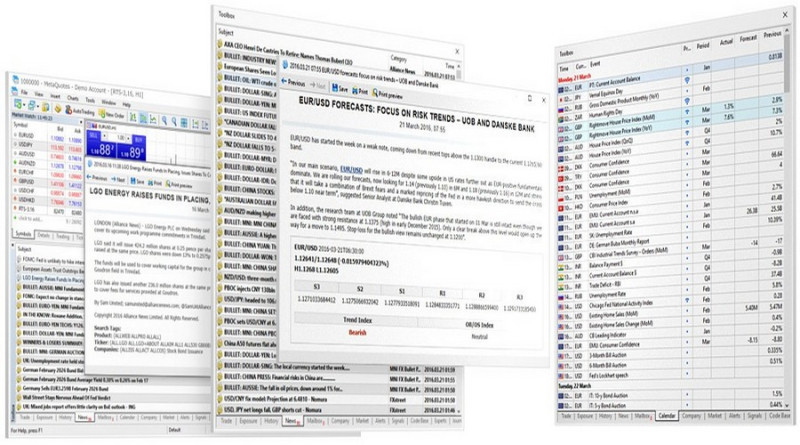

1. MetaTrader, which is available in the fourth and fifth versions. According to statistics, most brokers use these platforms: MT4 or MT5, or both at the same time.

Firstly, Metatrader software is notable for its reliability, which is confirmed by many years of experience. MT4 was launched in 2005, and MT5 appeared in 2010.

Secondly, they allow not only to make transactions. The software allows traders to analyze the market, apply indicators while trading, change time frames, and use different charts.

Thirdly, both versions can be used by beginners and experienced traders.

The main differences between MT4 and MT5:

- trading instruments: in MetaTrader 4 these are only currency pairs while MetaTrader 5 also offers securities and futures;

- incompatible development languages: MQL4 and MQL5;

- 3 and 4 modes of order execution respectively, 4 and 6 types of pending orders respectively;

- 9 timeframes in MT4, and 21 in MT5;

- 23 and 44 analytical tools respectively;

- 30 vs. 38 built-in indicators;

- both versions have a news feed, and MT5 also has an Economic Calendar;

- in MT5, it is possible to transfer money from one account to another, and in MT4 there is no such feature;

2. QUIK is a Russian product that allows trading on foreign stock exchanges as well. It is used in different versions: as a mobile application, browser, and desktop versions.

Main functions of QUIK:

- transmission of data on quotes in online mode;

- services for transactions compliance with risk management rules;

- creation of market and pending orders;

- possibility of automatic trading;

- news agenda;

- communication of traders by means of the specially created chat;

- market analysis on the basis of the book of orders;

- three types of charts (line, candlestick, or bar);

- allows users to create trading robots.

3. Thinkorswim (TOS) is considered one of the best programs for trading on US stock exchanges. You can also use it to make money on futures, and other assets.

The platform can be used on different devices: desktop computers, laptops, smartphones, and tablets.

TOS has two versions - demo (free) and Live Trading, for the use of which it is necessary to pay money.

The platform is characterized by a variety of settings and the ability to use different types of charts to filter assets. It includes more than 30 technical indicators, and you can create your own.

The platform is also equipped with a strategy tester and five chart designs;

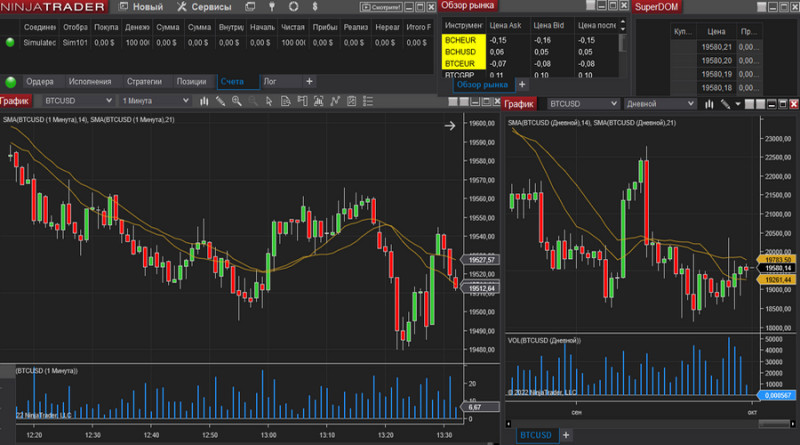

4. Ninja Trader is software created by NinjaTrader LLC from the USA. It is designed for trading currency pairs, securities, CFDs, and cryptocurrencies.

The Ninja Trader interface has five windows, each with a specific function. These are the formation of orders, market information, the order book, etc.

There are chart trading options, with over 100 indicators built into the platform. NinjaScript’s programming language allows traders to create their own algorithms and indicators.

The software provides an extended list of alerts and access to the trading history of any traded asset. In addition, the platform offers the ability to conduct algorithmic trading and test strategies.

5. Zulu-Trade is a trading platform that is similar to MT4 in therm of functionality. First of all, this platform is focused on passive income.

A beginner can copy trades of experienced traders to make a profit. Professionals also earn by sharing their strategies with less experienced users.

The trading instruments include currencies, CFDs, and cryptocurrencies.

Zulu-Trade is considered one of the best platforms for automated trading and is used by many brokers.

Let's briefly touch on some other trading terminals:

- Mirror Trader is similar to Zulu-Trade. It is primarily focused on passive profits;

- ATAS is focused on professional market participants;

- Libertex is quite often used by beginners;

- Rumus is distinguished by its extensive analytical base;

- cTrader was designed for professionals;

- R Trader is aimed at experienced market participants;

- Quantum AI is designed for automated trading;

- SB-Pro is one of the best programs for market analysis.

The platforms we have listed represent only a small fraction of all that exists.

Cryptocurrency trading platforms

Software for digital asset trading is developing as rapidly as the cryptocurrency industry itself. New solutions often appear in the market that can benefit traders.

Conventionally, all software for digital asset trading can be divided into three groups.

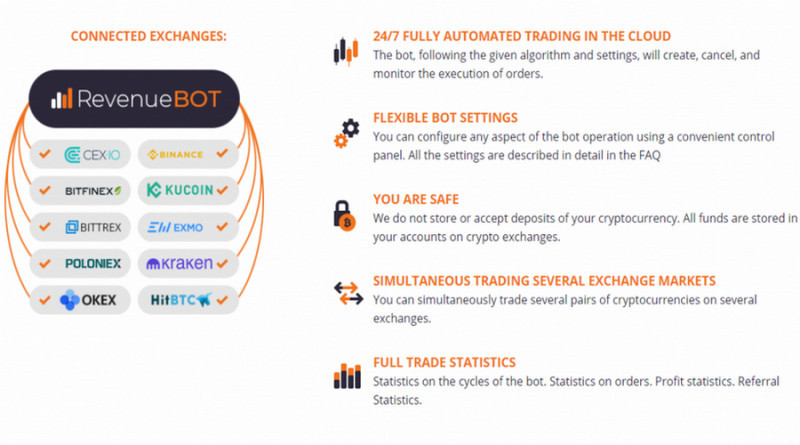

1. Special bots add elements of automation to trading or make cryptocurrency trading completely automatic. They are programs that essentially play the role of a trader in the market.

For example, when a buy signal appears, they instantly open a long position, even if the user is away from the trading platform at that moment.

An example of such a software product is Revenue Bot, which has an interface in Russian and English and is connected to many popular cryptocurrency exchanges. Bot (or bots - there can be up to 100 of them) works on the Martingale system.

You can use the software after completing the registration on the developer's website. Commissions are charged only on profitable transactions.

You can also automate cryptocurrency trading with Crypto Hopper, Shrimpy, Trality, and other bots. Almost all bots are paid and the maximum cost can reach $300 per month.

The disadvantages of this software are:

- total dependence on the Internet connection. When it is disrupted, the result can be unpredictable;

- the need to monitor their performance from time to time;

- potential security risks;

- knowledge and experience to configure them correctly.

Besides, this software also has advantages:

- no psychological factor. The bot will not open trades on emotion or try to win back losses. People lose money quite often due to their inability to control their psychological state;

- Increased efficiency. Unlike humans, bots will not be able to miss an important signal and make a profitable trade. The main thing is to configure it correctly;

- high speed of reaction to a trading signal;

- simultaneous trading of a large number of assets.

2. Trading platforms through which transactions are made. The most popular and reliable ones are:

- TabTrader is one of the very first platforms for digital asset trading;

- CScalp is software that suits best for scalpers;

- Coiniginy allows you to register a demo account;

- Margin allows you to trade with the help of bots;

- ATAS is designed mainly for professional traders;

- IFXBIT is an InstaFintech Group solution;

- Moonbot suits for manual and automated trading;

- Traderbox has the ability to connect multiple accounts;

- Capico has its own bot and the function of averaging trades.

3. Special software for market analysis and monitoring. For example, these include the Moonitor application - a kind of online observer of digital assets.

The following products are also popular:

- FTX (Blockfolio) is a platform that allows you to track the fluctuations in the value of various cryptocurrencies;

- Coinmarket allows you to analyze the value and capitalization of all kinds of digital assets;

- CoinGecko is one of the largest and most popular information aggregators of digital coins. It allows you to track the quotes, capitalization, and trading volume of more than 10,000 assets.

Of all the above software, only trading platforms are essential for cryptocurrency trading. However, all other programs will help to make trading more efficient.

Trading terminals: first steps

The main purpose of trading platforms is to organize trading. At the same time, they also help to increase the efficiency of trading with the help of built-in indicators, the ability to use different strategies, etc.

In order to generate income, you need investments. If there is no money on your account, you will not be able to trade.

What about newcomers who want to learn trading but do not want to risk their money because they do not have a lot of experience?

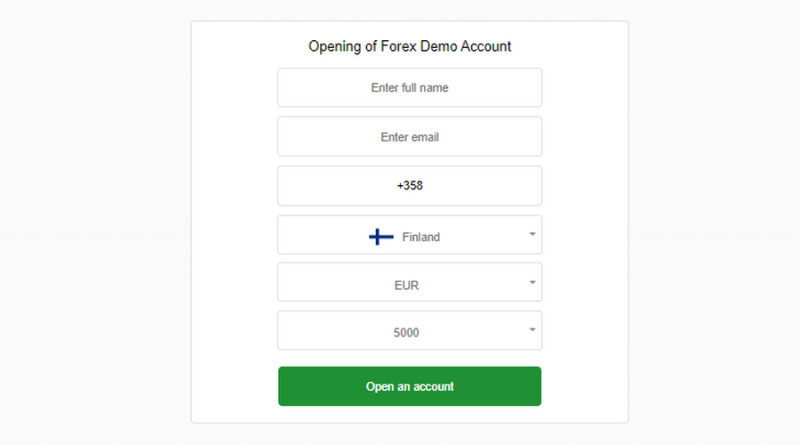

The best option is to open a demo account instead of a live one. It gives traders access to the platform and allows them to study the specifics of its work and functions.

That is, traders can open and close transactions without investing any funds.

If trades turn out to be unprofitable, they lose nothing. At the same time, if the trades do bring profits, the gained sum will also be only virtual.

Demo accounts are offered by most brokers, including InstaForex.

There are three simple steps to get a practice account:

- Fill in the registration form;

- Download the trading platform (for example, MT4 by InstaForex);

- Pass authorization by indicating the login and password received to your e-mail.

When all steps are completed, your demo account will have a certain amount of money (it can be changed). This is the starting capital, which you can invest in trading.

The demo account allows you to:

- evaluate a broker's trading conditions;

- understand the principle of trading and the structure of the market;

- master the platform's functionality and learn how to use its basic and additional tools.

How to use trading platforms

We have told a lot about trading software: its types, characteristics, and distinctive features. However, beginners may have a question: where to find these platforms and how to open and close transactions.

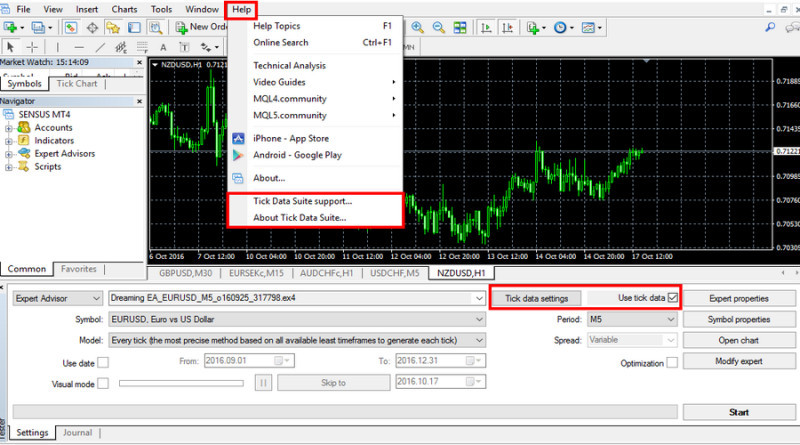

Let's describe the main steps of this process on the example of MT4.

1. Choosing a broker and downloading a platform. The broker is the intermediary between traders and markets, so the first thing to do is to register with a broker and open a live trading account.

After that, it is necessary to download the trading platform. You do not need to search for links - they will be provided by the broker.

Before downloading the program, it is important to pay attention to the device and operating system. For example, if the operating system of your computer is Windows, the terminal version for MacOS will not work for you.

After downloading, unzip the archive and install the platform on your device. When the corresponding shortcut appears on your desktop, it means everything is done correctly and the installation is completed;

2. Learning the functions of the trading platform. You can start trading after you have funded your account, and brokers set different requirements for the minimum deposit.

Of course, if you have a demo account, you do not need to replenish the deposit.

The main menu of MT4 (in live and demo versions) consists of the following sections:

- File. It contains commands for managing charts, trading history, profiles, etc. For example, you can use the File tab to open a chart of a new asset or create a demo account;

- View. This section is used to select the language and manage the working windows and the toolbar. Thus, here you can enable or disable the full-screen mode, start and fold the navigator, and so on;

- Insert. All objects that can be added to charts are included here. They can be patterns, text, indicators, lines, or channels - the whole list appears in the drop-down menu;

- Charts. Use this section to change a time frame and chart type, control indicators, and correct imposed objects. There is also a possibility to add trade volume and change the scale to the chart;

- Tools. This is where the service commands and the main platform settings are collected. For example, with the help of this tab you can form a new order, use the editor of advisors, and change the parameters of the platform;

- Window. This section is designed for the control of the working windows. For example, it is possible to choose a scheme of arrangement of windows, arrange collapsed ones, or create new ones;

- Help. In this section, you can find information about the software.

The platform also has 4 toolbars, you can show and hide each of them in the View tab, which we have already talked about. The toolbars contain the same commands as the main menu but they are presented as active buttons and systematized.

The largest part of the trading space on the screen is occupied by the so-called working area. Here there are online charts and instruments that traders use for trading (their list and number can be adjusted).

One can view statistical data (open trades, limit orders, account balance) in the Trade tab.

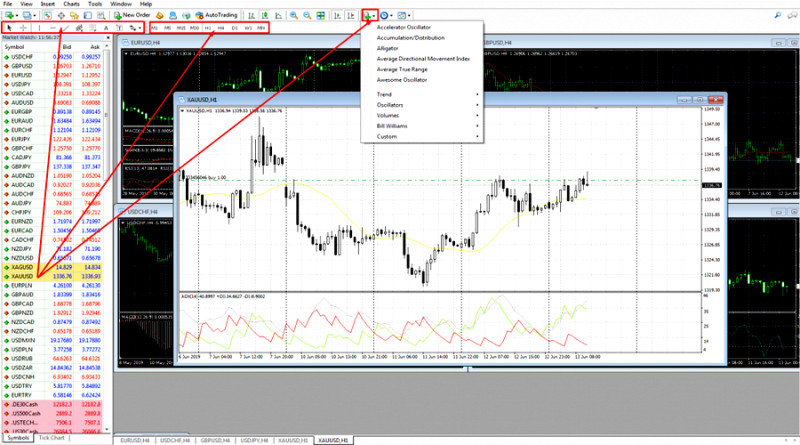

3. Analysis of the market and fulfillment of transactions. Here we have two directions: a study of the chart and trading.

In this respect, different trading platforms are similar to each other. Almost all offer a choice of chart types, and the process of opening/closing positions is almost the same.

As for charts in MT4, a user can simultaneously work with quite a large number of them - up to 100. It is possible to select a chart type, print it, overlay indicators, etc.

To open a new chart, you can go to File in the main menu and select the appropriate command from the drop-down list. If you want to change the color of the chart, scale, or time frame, this should be done in the Charts tab.

The main menu also allows you to apply suitable indicators.

If you have adjusted all the necessary settings and want them to be automatically activated when you open new charts, you can create a template. This can be done in the Charts tab.

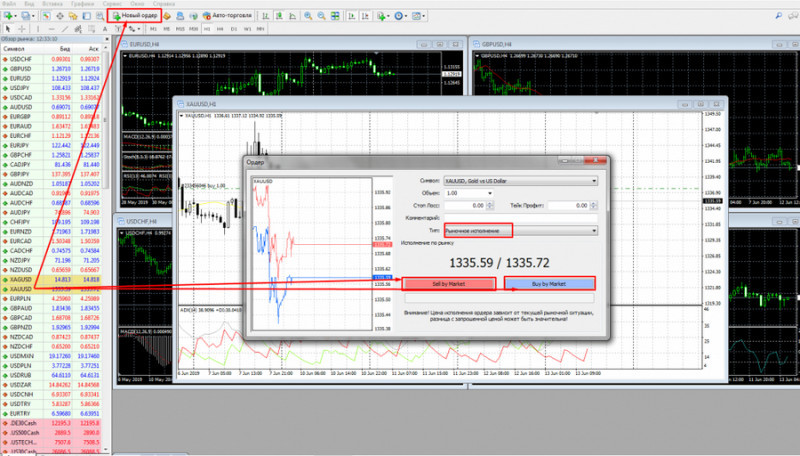

As for making trades, you can open a new position in two ways: using the main menu or using the Create order button in the toolbar.

You will see a new window in which it will be necessary to specify the name of the asset (a ticker, i.e. symbol) and the volume of the position. Here it is also possible to adjust orders and select the type of order - market or pending, i.e. limit.

In the first case, the position will be opened at the market price. Notably, the buy price and the sell price are almost always different. It can be seen in the window.

In the second case, the order is triggered only when the price of the asset reaches a certain level. This level is set by the trader.

Thus, if the market orders can be of two kinds - on purchase and on sale, then the pending orders have much more options.

Buy Limit - such an order implies the purchase of an asset at a value that will be lower than the current value. For example, if a share costs $50.45, and you want to buy it cheaper, the Buy Limit can be set at $50.40.

Buy Stop also implies buying, but at a higher price than the current one.

Sell Limit is an order that sells an asset at a price that exceeds the current one. Sell Stop assumes a sale at a lower price.

Market orders are executed immediately, and pending orders are executed when the price reaches a specific value. In the second case, the order can be corrected or even canceled.

To make a profit, open positions should be closed, that is, an operation in the opposite direction should be concluded. For example, if you have bought an asset, it should be sold in order to make a profit on the price change.

The position can be closed manually or automatically. Automatic closing occurs when the stop-loss or take-profit orders are triggered, and in the second case, traders select the appropriate command in the Terminal - Trade tab.

Sometimes a position can be closed by a broker. This happens when a Stop Out triggers, that is, the money on the deposit becomes insufficient to keep the position open.

Tips for beginners:

- It is necessary to start live trading only when you have prepared and thoroughly studied the trading platform. It is better to start with a demo account, and then switch to a cent account: if you lose, your losses will be less than in the case of a standard account;

- If any questions or gaps in knowledge arise during trading, you can contact the support team of your broker. By the way, you can test the efficiency of this service before making transactions;

- Start with a single trading instrument: for example, a specific cryptocurrency or currency pair. It should be an asset you are familiar with, you should be aware of its value fluctuations, features, and factors influencing the price.

After that, you can increase the number of traded assets, thus diversifying your investment portfolio;

- Do not overload charts. Sometimes traders use a large number of available tools for analysis. They apply as many of them as possible.

However, the quantity of tools does not guarantee the quality of trading. On the contrary, using a whole set of indicators at the same time can confuse beginners;

- Do not use platform features that you are not familiar with: experiments are only allowed on practice accounts. Before you click any button or send a command, find out what it means from the instructions;

- Choose a device on which you plan to trade. First, if it is not a browser version, it should meet the technical parameters of the trading platform. They can be found in the instructions for the platform.

Second, the size of the screen is important, so you can easily see all the information without ruining your eyesight. For example, computers and laptops have a screen diagonal of more than 19 inches, and smartphones' screens should have at least 5.5 inches.

Software for trading

The list of programs created for trading is not limited to trading platforms only. For example, there are many websites that may become handy for traders.

Such websites include the following:

1. StockBeep is an assistant to those interested in trading profitable stocks. Here you can find a list of securities with the highest trading volumes and filter assets by market capitalization;

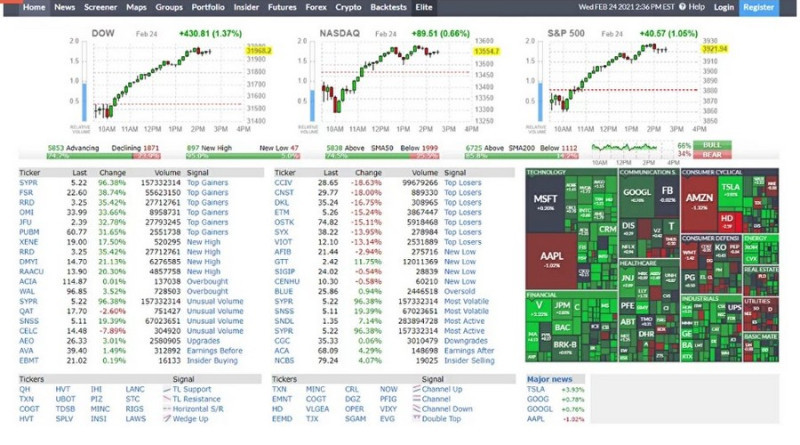

2. Finviz is a portal also related to securities, as well as currencies and futures. The website provides detailed information on assets for comprehensive analysis.

Users are offered filters to sort the content. One of Finviz's important features is a map reflecting market sentiment;

3. TradingView is not only a useful website for market participants but also a platform for communication. It is considered one of the best platforms for market analysis.

One can find charts of different assets (shares, currency pairs, cryptocurrencies, and so on), many indicators, as well as recommendations. The website has versions in different languages;

4. TipRanks is a platform, which combines ratings of securities, formed by the leading stock exchanges, and forecasts from experts. That is, with its help you can find the most attractive shares for investment and check how effective the recommendations of a particular analyst are;

5. MarketWatch is a portal that publishes the most important news from the world of finance, compiles stock market analysis, and provides statistical information;

6. Investing is a website that contains information about the quotes of many assets, news content, and an economic calendar. In addition, technical analysis is available for visitors.

Anyway, it is up to the trader whether to use additional software and websites or not. Much depends on the platform chosen by a trader.

For example, if they are MetaTrader products, their functionality allows trading without the use of third-party software. However, if the capabilities of the platform are limited, additional programs are necessary.

Conclusion

In our review, we told you all the most important things you need to know about trading software. At the same time, you should understand that there is no universal platform that is ideal for all traders.

That is why it is important to choose a platform that suits your needs and helps in trading terminals. Convenience and functionality are the two main characteristics to consider when choosing a platform.

Finally, any software seems very complicated at first. Beginners should not get upset and give up on their intention to conquer the financial market.

After a day of use, the platform will become easier for you, and in a week you will easily navigate its functions. To avoid risking your money while you are learning and practicing, use a demo account.

In addition, you can open a demo account with several brokers at the same time. This allows you to compare not only the trading conditions but also the way different platforms work.

You can open a demo account for free, and in most cases, it can be used for an unlimited period.

You may also like:

How to choose a broker for Forex trading

Trading signals WhatsApp

Trading tools

Back to articles

Back to articles