It's no secret that before starting to do something, one needs to study the subject to gain extensive knowledge of theory and crucial details. Trading is no exception to this rule.

The easiest way is to search for information on the Internet. You can read various articles or you can turn to trading books where all the basic information is well structured. As a rule, you can find all the necessary information in such books. In our article, we will give you examples of the best books you can use before starting your journey to the world of trading.

If you learn more about trading and how to apply your knowledge, which technical devices you need, you can read the article What do you need for Forex trading.

Where to start?

When someone at some point decides to try their hand at forex or stock trading they wonder where to start. The answer is simple. You should start with training, However, what exactly should you learn?

Therefore, the first thing to do is to study the types of trading in markets. It will enable you to understand which assets to buy and in what markets to trade them.

In order to determine the level of your training as well as which type of trading is more suitable for you, you can take a test. It will help you find out which trading tools and strategies you should apply when trading.

Having decided on what assets you are going to trade, you can start looking for information about the market and assets. There are various options for training: self-search for articles on the Internet, trading books as well as all kinds of webinars, and online courses.

Each trader can choose what is more suitable for them. They should take into account the financial aspect. Some speculators cannot afford expensive courses but have sufficient discipline to study the material by themselves.

For others, on the contrary, it is quite difficult to understand everything without help, especially when it comes to complex technical issues. To do this, they need the help of professionals. To begin with, you can try reading trading books written by experienced traders for newbies.

If this still does not seem enough, you can save money and buy online courses or individual training from savvy traders. Brokers often offer such options, e.g. paid or free courses but only to their clients.

During the training, regardless of how it is carried out, a potential trader needs to get as much information as possible about the assets selected for trading, methods of analyzing them as well as trading.

It is necessary to study the trading strategies developed by other investors that are designed for a particular asset. First, you can use well-known strategies and then develop your own, which will be perfect for you.

In addition to developing a trading strategy, it is crucial that you develop a trading plan, which also includes risk and money management. Determine the amount of money you are willing to risk and what amount in case of losses.

After all these steps, you should choose a brokerage company and a trading platform. Each intermediary offers its own terms of cooperation and trading platforms that differ in their functions and opportunities for trading.

At the same time, many trading platforms are available on many other sources as they are not developed for a specific broker but by third-party developers. Therefore, they can be used when trading with any intermediary, which is very convenient for the user.

One should also organize the workplace, buy and configure all necessary equipment for trading. To begin with, speculators need a PC with one monitor or a laptop. Later, they can buy other monitors and different gadgets.

The final stage is to open an account. Experienced traders recommend opening a demo account first and trying your hand at it. In this case, there is no risk of losing real funds since trading is carried out with virtual money.

Finally, after trading on a demo account, you can switch to a live one. If you go through all the above stages thoughtfully, you can be certain that trading will be convenient and profitable.

Information search

As we have already mentioned, currently there is a huge number of opportunities to learn anything, including trading. You can do this yourself as a large amount of information is available on the Internet.

Of course, you should conduct a search for training materials as deliberately and thoroughly as possible. After all, apart from the useful information, you can also find lots of useless or outdated articles.

If you do not carefully select information and check its reliability, then the most valuable resource – time – will be wasted. Later you will have to search for information and retrain.

Many resources offer "the most complete guides" on trading a particular instrument or trading in general. Such headlines are very attractive, especially for beginners because it seems to them that after reading one article, they will get all the necessary information.

It is quite logical that the user wants to get down to practice as soon as possible. Therefore, many do not pay due attention to training, hoping that they will be able to improvise and pick up skills while trading.

However, this is quite difficult to do so in trading as it is impossible to trade successfully without the ability to read and analyze charts. Profitable trades can sometimes be made by chance but long-term successful trading cannot rely on random trades.

There is also another drawback - "endless" training when users study information for a long time but do not start real trading. This can happen for various reasons: fear of failure, self-doubt, or other factors.

Nevertheless, if novice investors feel that they have already gained all the crucial facts about trading, they should try to start trading.

Trading books

So, how do books differ from articles and other sources of information? What are their advantages and disadvantages? Let's discuss it.

Firstly, the book contains more complete and structured information than any article or guide on the Internet. In the book, more detailed information is given, while in articles, it is provided in a more concise form.

Secondly, the book is a more budget-friendly way of gaining information than buying a trading course in an online or offline format or attending various webinars, and lectures.

Thirdly, when using books for training, you can choose the pace that suits you, without hurrying to understand all the nuances. In addition, you can read books in your free time, even while on public transport, tube, or bus. Listening to online courses in such an environment is more difficult.

However, there are some disadvantages. One of them is the lack of contact with the author. When reading a book, traders cannot ask any questions if they struggle to understand something. They have to figure everything out by themselves.

What is more, the book can be written in professional language. In such a situation, novice traders simply will not be able to master the material on their own. Such books are more suitable for people with a degree in finance, economics, and so on.

At the same time, when attending online courses or lectures, traders have the opportunity to directly contact the teacher, ask questions, and get answers to them.

Naturally, individual training is the best way to obtain experience. Investors can study in a format and pace convenient for them, constantly be in touch with the teacher, asking for help if needed.

Another drawback of books, especially printed ones, is that you should check the year in which the book was written and published. By doing so, you make sure that the information is up-to-date and not outdated. Otherwise. there will be no benefit from reading it.

Physical books vs audiobooks. What to choose?

Audiobooks have become quite popular as it is a convenient format for perceiving information. You can drive a car or do some chores and listen to audiobooks at the same time.

There are plenty of audiobooks for traders and many users find this way of training quite effective. Let's see if this is really the case.

One should understand that learning to trade is a rather complicated process. Not all investors can perceive information by listening. Perhaps some of the most essential knowledge can be learned by listening while doing other things in parallel.

However, for a more detailed and in-depth study of trading, a high concentration on the information you are studying is necessary. Even if it is an audiobook, you need to listen to it carefully and thoughtfully.

If we talk about books written by professional traders, they may contain more complex terminology, descriptions of formulas and strategies, examples and exercises for practical implementation, and much more.

Novice traders will hardly be able to understand all this information in audio format. Moreover, for the best understanding of information, you need to see things, the charts for example. After reading the text, you can look at the charts and see everything that is indicated in the text.

Therefore, the convenience of using audiobooks in mastering trading is nothing more than an illusion. But if you really want to, you can try. However, you may not be able to get a really in-depth understanding of the topic.

Best books for trading

What books are really suitable for learning how to trade? What should they contain? Let's discuss it.

To start with, the book should be well structured. It will help you understand the information better. Otherwise, you will have more questions than answers.

As a rule, the authors are professional traders with extensive experience in this field. Their main goal is to share their knowledge and skills gained over many years of trading.

The book makes it possible to highlight the main aspects, especially if it is a printed version, to reread some paragraphs as many times as it is necessary to understand them. Reading is more effective than listening for learning.

Despite the fact that books, especially for beginners, are usually written in easy-to-understand language, they contain professional terminology.

Investors will have to use the terms in real trading, so it is better to learn them from the very beginning. It is good if the terms are not just popped up in the text but their meaning is explained.

Another crucial thing is the availability of formulas and their descriptions as well as trading strategies for different trading styles. Readers should learn about various trading styles and choose the one that is more suitable for them.

Books should also contain illustrations and examples so that traders can see how it works in real life.

A high-quality book should have practical exercises for honing skills. It is important for the user not just to study the theory but to understand how all this can be applied in practice.

Books also need to include information and at least basic training on the use of technical and fundamental analysis. Readers should understand why a particular method is applied when they need it, how to use it, and what are the pros and cons of each method.

A good book should teach you how to work with trading platforms. This part of the training has many technical aspects and may seem difficult to grasp but it is necessary to master it.

Books for novice traders

Among the huge number of books for beginners, it is quite difficult to choose specific ones. To begin with, let's try to identify the criteria that a good book for beginners should meet:

1. Easy-to-understand information. As we have already said, books for speculators are often written by professional traders. However, the information should be delivered in the simplest and most understandable language for any person who picks up a book. If the book is written in complex language, it will not bring any benefit to the reader;

2. Focus on specific methods and strategies. It is quite difficult to cover everything in one book and it is almost impossible to do it effectively. Therefore, it is better if the author focuses on one or more issues but explains them more thoroughly. For example, it could be a separate book about a trading strategy developed by the author and another edition devoted to technical or fundamental analysis, and so on;

3. Concise information. The reader wants to get specific information without too many excessive facts. This is why the information in the text should be concise and should help the reader to better understand the subject. At the same time, it is always great when there are examples from real life as well as illustrations. They make the text more understandable to the reader;

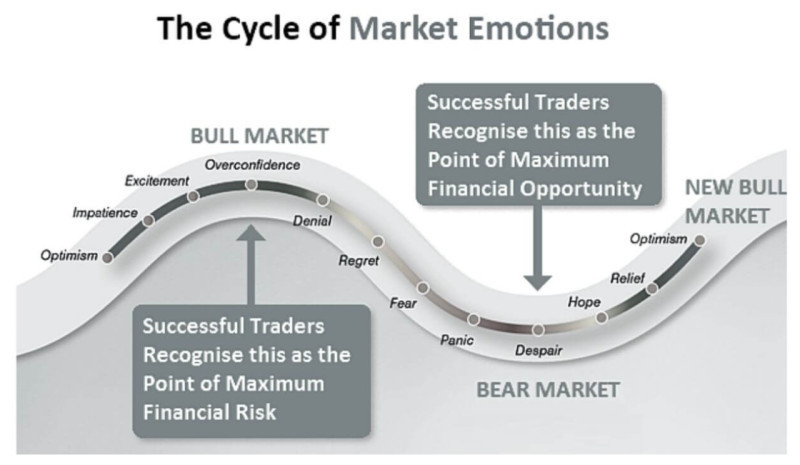

3. Psychology plays a huge role in trading. For this reason, this knowledge is necessary for all beginners as it is very easy to succumb to emotions and stress and lose control of the situation. The user needs to know how to cope with difficulties and keep a "cool head".

4. Money and risk management. Novice traders often have no idea how to allocate their finances for trading. They also do not know that they should avoid trading with the last or borrowed funds. There are lots of other things that they definitely need to learn about.

Investing books

Investing belongs to long-term trading strategies. By choosing this trading option, investors need to know that they will not make money in a short period of time.

The most important decision for a potential trader is the choice of an asset to invest in. The result will largely depend on this decision.

Investment is about putting money in assets that have high growth potential and provide the opportunity to receive additional payments (dividends, for example).

One should also remember the diversification of the investment portfolio to reduce possible risks. If some assets bring losses, other assets, on the contrary, will be profitable.

You can learn more about this and many other things from the best books that teach the basics of investing. Here are some examples of such books.

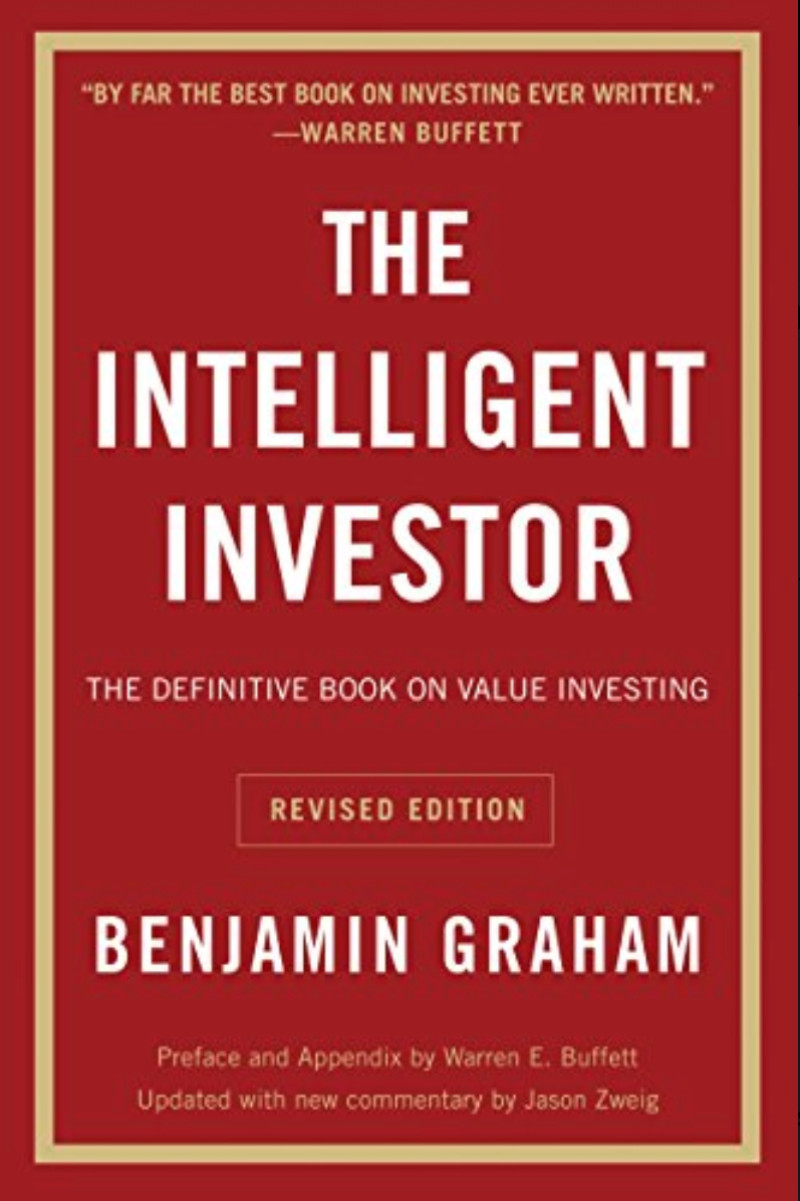

1. Benjamin Graham "The Intelligent Investor". This book gives a real understanding of how stock markets work without any glamour. The author gives clear instructions on how to choose shares for investment as well as a trading strategy. In addition, the author gives many examples from real trading that help to better understand his ideas.

2. Philip Fisher "Common Stocks and Uncommon Profits". This is a fascinating and easy-to-read book. The author suggests a slightly different approach to the selection of stocks than Benjamin Graham but no less interesting and efficient. Fischer mainly worked with stocks of growing companies. Fisher revealed his investment philosophy and his methods in vivid detail in his classic 1958 book Common Stocks and Uncommon Profits.

3. Glen Arnold The Great Investors. In this book, the author provides biographies of the most experienced and well-known investors in the world, including Soros, Buffett, Lynch, and others. By referring to investor biographies, the author talks about various strategies, rules, and principles of successful investment.

Books to learn technical analysis

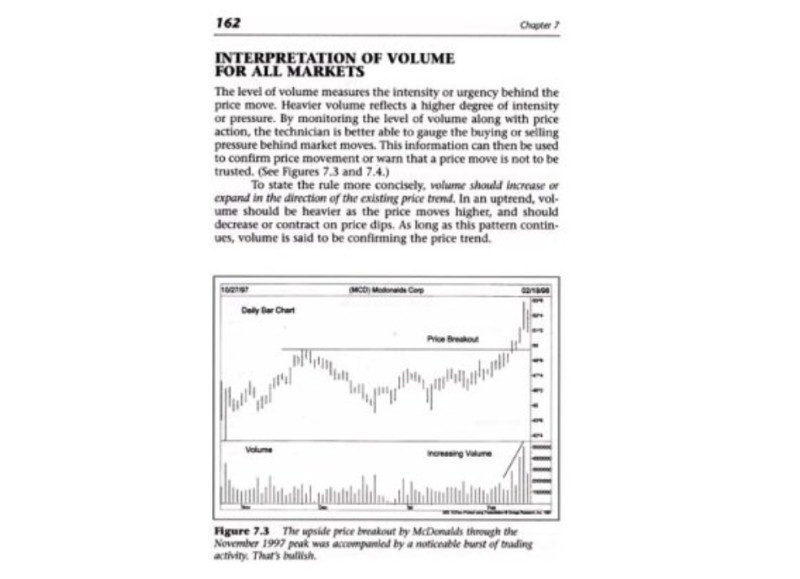

You will hardly achieve any success in trading without knowledge of the basics of technical analysis. Speculators need to be able to analyze charts using special tools to determine the current trend and potential reversal levels.

Based on the information obtained through the analysis, traders can predict further price moves and make a decision to open a trading position.

You can learn about the methods of how to identify price moves and use technical indicators and charts from trading books that teach technical analysis. Here are some examples of such books.

1. Michael Kahn "Technical Analysis: Plain & Simple". This book is a perfect tool for novice traders. It describes in simple language the basic concepts as well as techniques and methods of market analysis. The reader will be able to use the information obtained from this book to trade any assets although it is about stock trading.

2. Jack Schwager "Technical Analysis. The Complete Course" is a fairly voluminous book that is suitable for both beginners and professionals. The main emphasis is on charts. The author explains different patterns on charts. The author is a trader with extensive experience.

3. V. Yakimkin "Financial Trading. Technical Analysis" is one of the few books written in Russian and aimed at Russian readers. The author talks about not only well-known technical indicators but also his own developments as well as examples of successful strategies to determine market sentiment.

4. John J. Murphy "Technical Analysis of the financial markets" is considered one of the best books on this topic. It is written in simple language and has many illustrated examples, which makes it easier for the reader to gain information. The author describes all the main tools for analysis as well as various trading strategies.

Is it possible to trade without training?

Many beginners think that learning takes too much time. Some people assume that if they really want to trade and make trading their own source of income, they can skip training.

There are options for making money by trading or investing without training. As a rule, they are a source of additional or passive income.

There are several methods. Let's look at the main features of each of them in more detail.

The first option is trust management. It is suitable for those who have free funds but do not have the time or desire to figure out where it is best to invest them.

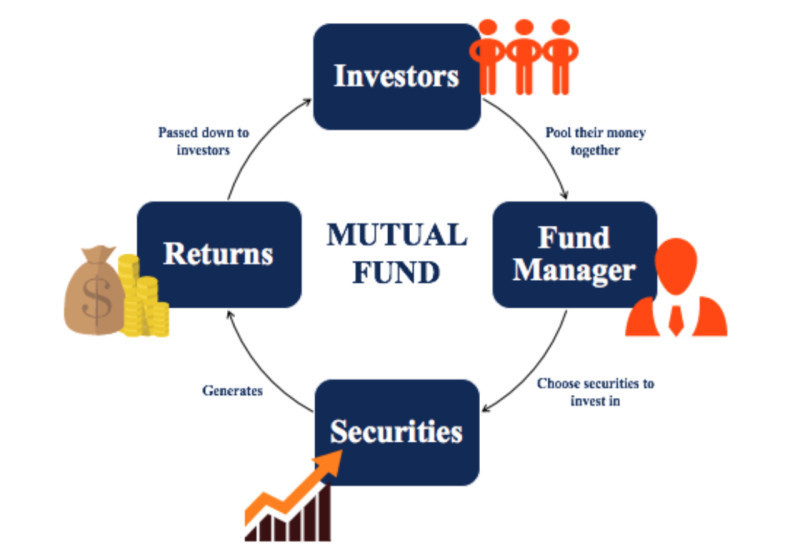

A fund manager is a person who manages a person's funds or property in order to reap the highest profit for the latter.

There are options for trust management with ready-made investment strategies that are offered to all clients and there are individually selected for each specific investor.

In addition, there are organizations such as mutual funds where one company manages the funds of many depositors. This is the most affordable option for trust management for beginners.

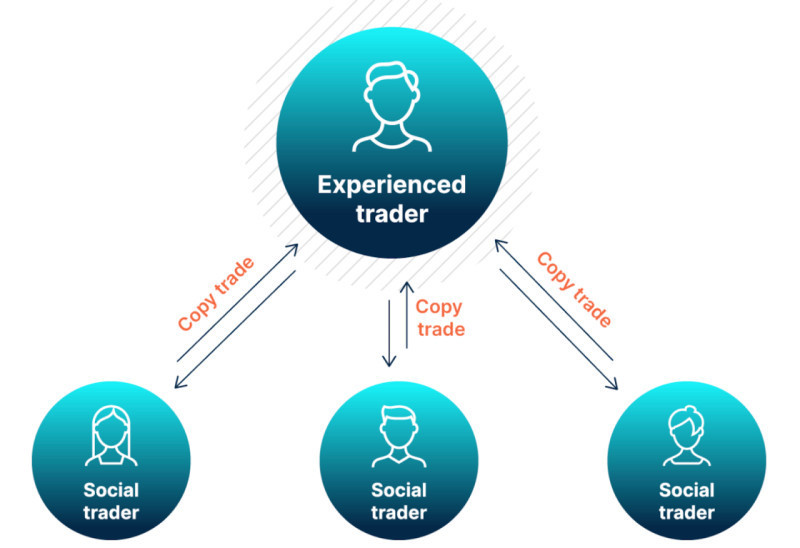

The second way is to copy transactions. This is one of the types of so-called social trading. Investors automatically copy to their account all the transactions that a more experienced and successful trader makes.

To do this, you need to choose such a trader or several ones for different accounts and earn income from each profitable transaction. However, both successful and unsuccessful trades are copied. So, there may be losses.

This method helps a novice trader to better understand the market by watching the actions of savvy investors.

The third way is algorithmic trading. You can entrust trading to special computer programs – trading robots. They open positions according to a certain trading strategy implemented in them.

The main advantage of trading robots is that they are not affected by emotions and stress, do not get tired, and can trade around the clock. However, they are not able to adapt to changing market conditions. It is recommended to constantly monitor their work and make adjustments if necessary.

Conclusion

In this article, we have discussed the best books that may help you to learn how to trade. Audio or printed books have both their pros and cons in comparison with other ways of learning.

Trading books are a more affordable way of learning than online courses. At the same time, they contain more structured information than articles from the Internet.

Nevertheless, books require discipline and a high concentration on the subject of study.

Therefore, many traders do not recommend using audiobooks for these purposes and do not mix the learning process with other activities.

Books make it possible to visualize information, provide examples from real trading and illustrations that make the text easier to understand.

When choosing books for training, you need to pay attention to the fact that they are written in simple language, contain all the necessary information on a specific issue, for example, a trading strategy or analytical tools.

You may also like:

How to choose a broker for Forex trading

Trading signals WhatsApp

Trading tools

Best monitors for stock trading

Back to articles

Back to articles