There are approximately 19,000 cryptocurrencies in the world today. Such a vast choice can be bewildering for any beginner in cryptocurrency trading. In this article, we will discuss the first steps in crypto trading, consider the most suitable crypto assets for trading, and study in detail profitable strategies for trading cryptocurrency ideally suited for beginners.

The first and perhaps the most important advice for a beginner cryptocurrency investor is to study the actions of professional traders and try to replicate them initially.

Professional traders differ, depending on the type of search for trading signals. They can be:

- Professionals in technical analysis, i.e. those who primarily use technical analysis in their work.

- Professionals in specific niches: those who study the trends of specific trading instruments and make transactions mainly when identifying fundamental reasons.

Now let's consider the essential steps necessary for trading cryptocurrency.

First, choose a timeframe for trading. If you intend to open a trade and keep it for several days, choose trading on M30, H1, and H4 timeframes. If you prefer scalping, your choice should be M1, M5, and M15.

"M" stands for minute, and "H" for hour. Thus, M15 means that each candlestick we see on the chart reflects information for 15 minutes.

On average, about 350-450 candlesticks fit on the screen. Therefore, if you open an H1 timeframe, you will have access to the history of the last 18 days. If you open M1, you will see the history of the last 8 hours. If you choose a larger timeframe, you get more accurate information. For instance, H4 is larger than H1.

The second step is to focus on specific cryptocurrencies. Select a couple of trading crypto instruments and study them in detail. It's important to know who created them and for what purpose. Find out the average trading range of your chosen cryptocurrencies over a specific period. Think out the prospects that open up for you when investing in these assets.

We recommend focusing your efforts on a limited number of cryptocurrencies – ideally three to five. By choosing this limited number, you can devote more time and effort to them, which will give you a more comprehensive understanding of how these particular cryptocurrencies fluctuate throughout the day.

Don't forget to implement proper risk management methods – setting stop-loss orders to limit potential losses, as well as locking in profits at predefined levels.

Next, look for the best patterns in historical data. Review the historical data and determine which patterns perform best. This can be done manually or with automated programs.

In this picture, you can see a graphical pattern created by the automated program AutoChartist

This program is capable of analyzing a large number of trading instruments, forming graphical patterns, and then alerting the trader about them. The chart displays the complicated Gartley Butterfly pattern, which consists of waves. It signals an upcoming rise in the trajectory.

The next important step is to start testing the patterns on real data and, actually, start earning. Those who primarily use technical analysis in trading believe that history is always cyclical, meaning that events always repeat. Once you have identified historical data that certain analytical models or graphical patterns indicate a continuation or reversal of the trend, confidently test them in practice.

Most-traded cryptocurrencies

For success in crypto trading, it's important to choose the right trading instrument. As we've already mentioned, there is a countless number of digital assets available today, and it's quite challenging to pick a specific cryptocurrency that could be successful for investment. Nevertheless, we have compiled a list of the most promising crypto assets – those that are likely to grow and trade more steadily.

In compiling the list, we considered the dynamics of digital currencies over the last few years, current market capitalization, and trends in the market.

We decided not to include such stablecoins as Tether or Binance in this list, as their market quotes always depends on the movement of the US dollar.

The undisputed flagship of the crypto market is Bitcoin. The widespread popularity of DeFi projects, the spread of NFT infrastructure, the legalization of Bitcoin as a payment method in El Salvador, and the launch of ETFs on the exchange in the US – all these factors undoubtedly increase the growth prospects of the main cryptocurrency.

Bitcoin’s growth throughout its history is simply staggering. Over the last 6 years, it has soared on average by 270%. However, in 2022, the world's leading cryptocurrency fell in value by about 64%.

Next on the list of popularity is Ethereum. Experts still lean towards the opinion that this cryptocurrency has great growth potential in the long term thanks to the volume of tokens used and various opportunities. For example, with Ethereum, you can store funds, send them, invest, deposit, and so on.

Here are a few reasons why everyone likes Ethereum.

- There has been an increase in the burning of tokens in circulation since the activation of the EIP-1559 update.

- The network has become more efficient, consuming less electricity for mining.

- Rewards have increased.

- Staking (validation) programs have become more generous.

Next on the list of popular crypto assets is Ripple. It was created to increase the speed of transactions between banks using blockchain technology. Ripple's quotes are rising due to the growth in the number of unique addresses, as well as the implementation of new products and the buyback of tokens by the company itself.

Another popular crypto asset is Stellar. It has greatly simplified monetary transactions between countries. The Stellar network is a digital platform that allows the integration of all cryptocurrencies in one wallet. It enables the exchange of crypto assets for fiat currencies.

Next on the list is Monero. This asset is focused on preserving the confidentiality of its users, distinguishing it from Bitcoin and Ethereum, which have transparent blockchain technology.

Currently, global financial regulators are looking for any ways to control or regulate cryptocurrencies, against which Monero is gaining a potentially advantageous position. Additionally, Monero is designed in such a way that it simply cannot be traced.

The cryptocurrency Polkadot was created to solve the problem of scalability, where the number of users significantly increases, but the performance and functionality greatly suffer. Polkadot network is capable of processing a large number of transactions simultaneously from different chains. This principle has been a real revolution in the crypto industry.

Polkadot offers a platform that can support smart contracts and is well-suited for the development of decentralized applications (DApps). Furthermore, Polkadot has a much simpler approach than Ethereum in terms of design, programming, and application. This is why the odds are that it will become one of the best cryptocurrencies for investment.

Best strategies to trade crypto

A crucial condition for successful cryptocurrency trading is choosing an appropriate and well-thought-out trading strategy. Let's delve into more details about them.

High-frequency trading (HFT) is a strategy managed by automatic mathematical algorithms. With this trading method, a trader's requests are executed in fractions of a second based on pre-set criteria. Algorithms can handle a large volume of orders, profiting from even the slightest price movement, which can occur within seconds or fractions of a second. Understandably, this high speed necessitates the involvement of specialized trading bots in the trading process. High-frequency trading is effective as it minimizes transaction costs and leads to profitable transactions.

Another strategy is the long straddle. It's used to profit from market volatility. This approach involves buying both put and call contracts for a particular cryptocurrency with the same strike price and expiration date. The long straddle assumes that if one side of the trade results in losses, the profit from the successful position will offset these losses, leading to overall net profit.

Scalping, though not the simplest strategy for beginners, can be quite profitable with proper risk management. This method involves capitalizing on short and rapid price movements during the day. To profit from minor price fluctuations through reselling, traders often turn to automated bots that significantly increase the frequency of transactions.

Scalping involves two approaches:

- Conducting a large number of trades with significant volumes, characterized by brief and rapid price movements.

- Executing fewer trades, resulting in a slower trading process, but with larger price movements and a longer holding period.

The next trading strategy is range trading. This strategy involves capitalizing on consolidation periods, aiming to profit from a pre-defined price range. The price range is determined by key support and resistance levels, often represented on charts by classic consolidation patterns such as rectangles or symmetrical triangles. Traders following this strategy try to open a short position or close a long one at the range's resistance (where resistance is faced), or open a long position or close a short one at the bottom of the range, around the support level.

Another variant of cryptocurrency trading strategy is arbitrage crypto trading. This involves traders seeking to profit from short-term discrepancies in exchange rates between crypto exchanges. This means buying a specific cryptocurrency on one exchange and quickly selling it on another at a higher price. Speed is crucial, so automated tools are often used to rapidly exploit arbitrage opportunities across exchanges.

Technical analysis is another trading strategy, primarily based on chart patterns. This strategy operates on principles that:

- The market discounts everything.

- Prices move in trends and counter-trends.

- History is cyclical, and events tend to repeat.

The essence of the strategy lies in the fact that prices tend to repeat their values through regular recurring patterns. This knowledge can be utilized when navigating the markets. There are two main approaches to using technical analysis: trend following and contrarian trading.

Trend followers aim to capture the trend, with the type of trend depending on the main timeframe, which can be short, intermediate, or long-term. Contrarian traders, on the other hand, seek to profit from corrections within larger trends. This approach is more risky than trend trading, as traders are going against the dominant force (upward or downward) at a particular moment.

Another cryptocurrency trading strategy is following market sentiment. Market sentiment refers to the overall attitude of investors and traders towards a particular financial asset or the market as a whole. The sentiments of market participants can influence changes in supply and demand, and thus prices. Market sentiments are measured by criteria such as:

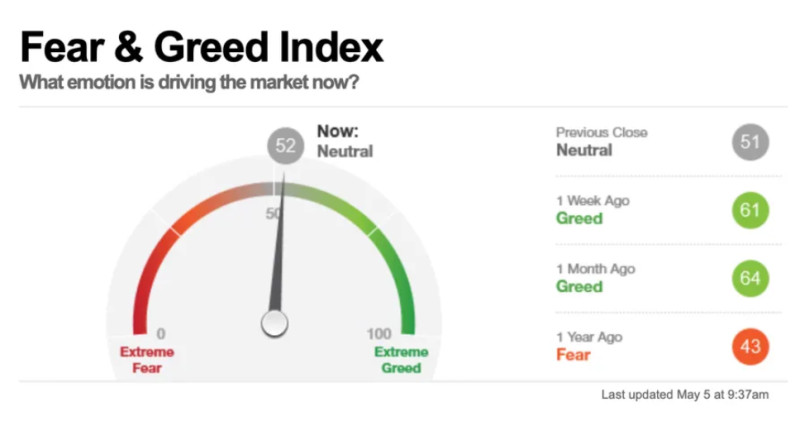

- The fear and greed index

- Bitcoin dominance ratio

- News

- Social media

- Google Trends

The fear and greed index is an emotional gauge that determines market mood on a scale from fear to greed. Its extreme readings can predict price movements. A higher fear indicator suggests a buying opportunity, as human sentiment tends to change quickly. Meanwhile, extreme greed indicates bullish sentiments in the market, which can lead to a price correction.

The Fear and Greed Index is formulated based on data such as coin dominance, momentum and volume, social media, and Google Trends.

The Bitcoin Dominance Ratio shows Bitcoin's market value relative to the overall market capitalization of the cryptocurrency market. Bitcoin's capitalization influences the entire market, as the price of many cryptocurrencies tends to follow its trend. For instance, the lower the ratio, the stronger altcoins tend to perform.

Monitoring the news is one way to assess market sentiment. There are news services that use complex computer algorithms to search for significant news stories that could lead to price changes in a particular crypto token.

Social media also helps track the sentiments of market participants. Special can be used for such monitoring, for example, TweetDeck for Twitter, which can classify and organize channels and track actions from various sources. Social media sentiment indicators gather information from various social media accounts, analyze it, identify trends, or measure activity related to a crypto asset, industry, region, or country.

Google Trends is important to understand which topics and tokens are most frequently searched on Google at a given time. For example, a search query like "optimism about Bitcoin" can indicate a trend towards a price increase.

Google Trends is essential to understand which topics and tokens are most frequently occurring in Google search queries at a given time. For example, a search query like "optimism about Bitcoin" can indicate a trend toward a price increase.

Cryptocurrency trading strategies also include the breakout strategy. It works as follows: breakout traders aim to enter a trade when the price overcomes a certain level, trying to profit from the instantaneous acceleration. Breakouts can occur in both upward and downward directions (breakthrough). The setups can include:

- Trend reversal breakouts or continuation patterns

- Price breaking through a moving average

- Prices forming a new high or low of the trend

The pullback strategy involves recognizing trends and patterns. In this strategy, traders try to open positions when the trend is about to resume its main direction. This strategy is relevant in both upward and downward trends.

The above-mentioned cryptocurrency trading strategies do not make up the full list, but they demonstrate the multitude of different strategies of crypto trading, with the choice of the suitable one always being yours.

There is no one-size-fits-all strategy. Each one depends entirely on your unique profile and the goals you pursue.

Back to articles

Back to articles