The first blockchain networks quickly gained popularity among users. However, as the number of users and transactions they conduct grows, the networks struggle to cope with such a volume of operations, leading to delays in their execution.

Therefore, for some of the major blockchains, "helpers" were devised - networks designed to reduce the load on the main chain and take on some transaction processing functions themselves. One such platform is the Polygon network, which we will discuss in this article.

To find out how other networks cope with scalability issues using various tools, and how thanks to their innovative developments these blockchains manage to rank high in digital currency rankings, you can read the article "Cryptocurrency rankings."

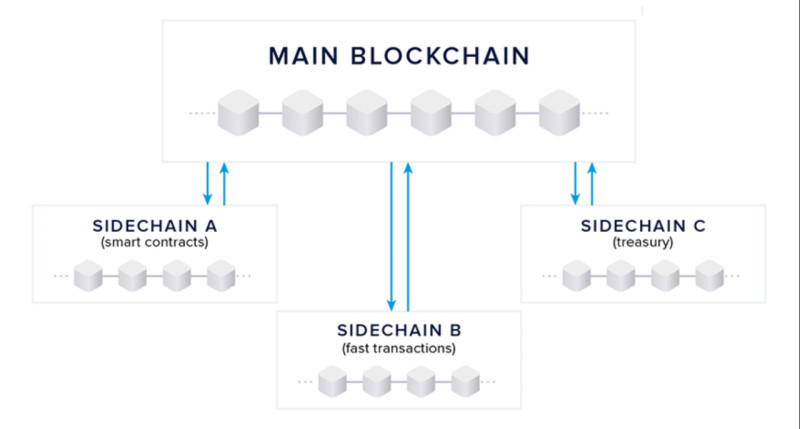

Understanding sidechain

As more and more users join the blockchain, it becomes overloaded. This results in transactions taking more time to process and an increase in transaction fees.

Different chains approach solving this issue differently. One option is to create auxiliary networks that take some of the load off the main chain, performing a set of functions, such as sidechains.

Sidechains, or separate blockchain networks, are designed to move cryptocurrencies from the main platform, perform operations with them, and subsequently transfer them back to the main network.

On the one hand, these are autonomous blockchains. On the other hand, they have a clear connection to the main blockchain through a two-way peg. This linkage allows for token exchange between the main and side chains.

Sidechains are intended to address the scalability issue of blockchains by taking on some of the work and functions that should be performed by the main network. This makes the main blockchain more efficient.

To conduct a transaction in a sidechain, a user needs to transfer digital assets to its address, after which these funds are locked. This is done to prevent the user from using them again.

After completing a transaction in the sidechain, the user can return the coins to the main blockchain. To do this, they send them to a special output address, where they are locked again for a certain period before being transferred to the main network.

If the connection between the blocks is set up correctly and works efficiently, such interaction can lead to scaling up. One example of such chains that we will discuss in this article is the Polygon platform, which serves as an auxiliary blockchain for Ethereum.

Blockchain layers

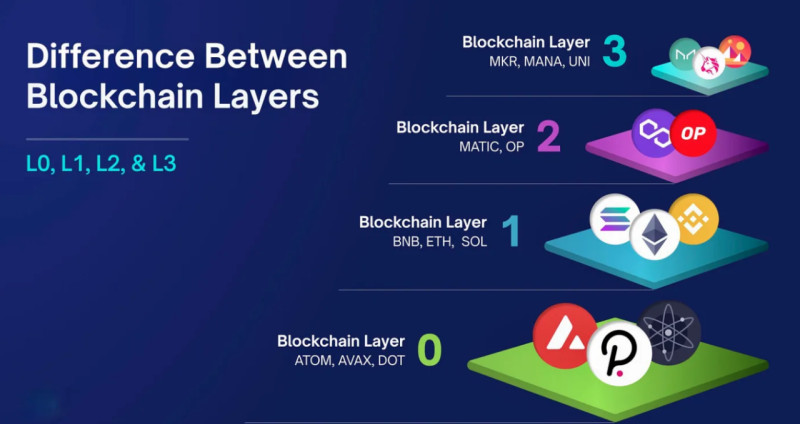

Often in the description of any blockchain network, you can see a characteristic such as layer: first layer chain or second layer chain. For example, Polygon and its utility token, MATIC cryptocurrency, are considered second-layer chains. What do these terms mean and how are they related to each other?

What are the layers of blockchain and how are they denoted? There are a total of 4 layers, and they are denoted by the letter L and the corresponding number from 0 to 3. Each layer has distinctive features, let's consider them in more detail.

At the core of the security of each blockchain is the principle of decentralization, which means that information is simultaneously stored on various independent servers. Moreover, the more of these servers, or nodes, the more secure the network is considered, as a large number of nodes are difficult for attackers to hack.

However, in this case, another problem arises: since all operations in the blockchain are processed by a multitude of these nodes and then sequentially linked into one chain, as the number of nodes increases, the processing speed of transactions goes down. As a result, the overall network bandwidth decreases.

Developers of new, modern chains try to solve this problem with various approaches: they come up with innovative consensus mechanisms, etc. One solution to the scalability problem is to divide blockchains into layers.

The first layer denoted as L1, includes the first major networks, such as Bitcoin and Ethereum. Networks in this category are fully independent chains that can conduct transactions independently, without any additional chains. However, they suffer more from the aforementioned problems than others.

Zero-layer blockchains (L0) are networks that facilitate interaction between other chains, for example, to transfer crypto from one network to another. In addition, they provide the opportunity to reduce transaction costs.

The second layer (L2) includes the so-called auxiliary chains, specifically designed to relieve the first-layer networks. They can process operations faster and with lower costs. This group includes sidechains, which we mentioned earlier, with Polygon being one of their representatives.

Third-layer chains (L3) are application networks where operations are not performed directly. This layer hosts protocols that ensure the functioning of applications.

What is Polygon network

Since we have defined the blockchain layers, described sidechains, and understood what they are needed for, let's examine them more closely using a specific example - the Polygon blockchain and its token, the MATIC cryptocurrency.

Polygon was originally called the Matic Network, hence the name of its currency. This project was developed as a way to address the scalability issues of the Ethereum chain, which aimed to solve some complex issues such as low transaction processing speed and rising fees.

During the initial development of the Polygon platform, it was referred to as a second-layer blockchain or a supporting network. Blockchains of this layer do not compete with other networks but rather extend their capabilities and improve their functioning.

Today, Polygon is something more than this. It includes several chains and enables the development of new ones compatible with Ethereum. The main idea of the platform is to create a whole ecosystem of blockchains, independent of each other but capable of exchanging data without roadblocks.

It is these ambitious plans of the developers that led to the rebranding of the blockchain from Matic Network to Polygon. Analogs of this platform can be found in other equally well-known ones such as Polkadot, Cosmos, and others.

However, there is one significant difference between them: the latter projects try to compete with the Ethereum network, while Polygon tries to build an ecosystem around it, thus contributing to the improvement of the main chain's functioning.

So, Polygon is a modular system that enables the development of new networks aimed at "offloading" Ethereum. Thanks to these additional platforms, the congestion of the main chain is reduced, its throughput is increased, and the cost of fees is reduced.

How Polygon works

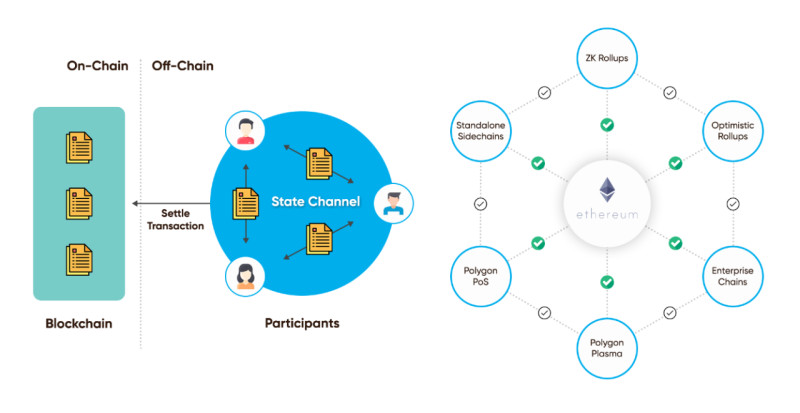

As mentioned earlier, the Polygon platform has a wide range of modules designed for easy and fast creation and modification of new chains. These modules include consensus mechanisms, network management guides, and virtual machine execution environments.

The blockchains developed on this platform apply the PoS consensus mechanism. Its difference from the PoW algorithm, which is used in the Ethereum chain, lies in the fact that all operations are verified by a network of validators rather than miners. This significantly reduces fees and increases processing speed.

One component of Polygon is the Matic sidechain, operating on the PoS algorithm. In this chain, the Polygon token - MATIC cryptocurrency - is used, which we will discuss in more detail later. These tokens are used for staking, rewarding validators, and allowing holders to participate in governance through voting.

Polygon offers several scaling mechanism options for developers:

- Plasma Chains is a technology that allows assets to be moved between main and child chains. Transactions are grouped into blocks, combined, and sent to the main Ethereum network.

- ZK-rollups allow multiple transfers to be bundled into a single operation for recording in the main blockchain. The technology is based on the principle of zero-knowledge proofs: each operation is first verified and then grouped based on validators.

- Optimistic rollups are technologies that enable the scaling of smart contracts. It operates "on top" of the Ethereum network and enables almost instant operations.

All these solutions are aimed at reducing transaction costs and minimizing all entry barriers. Thus, the platform applies a comprehensive approach to solving the scalability problem.

Polygon network architecture

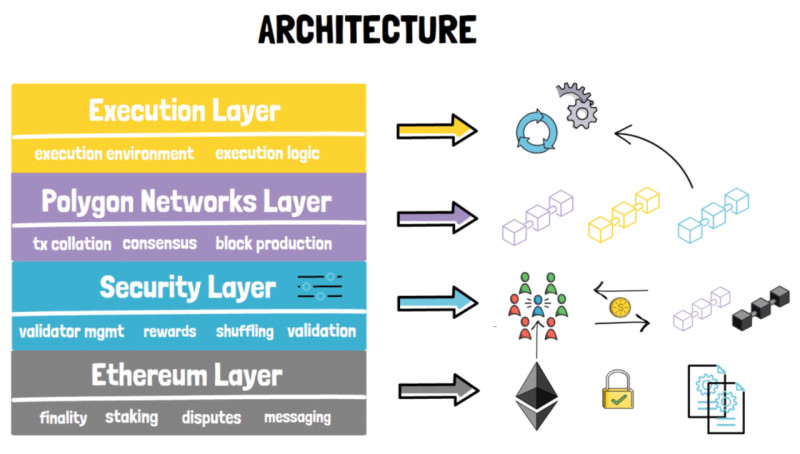

The structure of the Polygon network consists of several layers, each with specific functions in the system. Let's take a closer look at these layers and what purposes they serve.

The base layer is the Ethereum layer, which Polygon uses to ensure high reliability. This layer consists of a set of smart contracts and is used for staking, resolution methods, and data exchange between the aforementioned platforms.

The second layer is the Security Layer, which allows the use of third-party validators to verify transactions or add blocks for a fee.

The next layer is the Polygon Networks Layer. It includes several independent blockchain networks capable of autonomously reaching consensus and producing blocks.

And finally, the Execution Layer is responsible for executing transactions, i.e., the direct implementation of smart contracts. It has two sub-layers in its structure.

The first two layers are optional, while the last two are mandatory. Developers can choose which solutions are needed to implement their projects. Additionally, projects can be moved from one layer to another during their development.

All chains on Polygon are compatible with each other and can interact both among themselves and with the Ethereum network while maintaining their autonomy. The platform supports two main types of chains:

- Secured chains are blockchains that use the services of third-party validators instead of their pools. They can receive such services through Ethereum or a collective pool of validators.

- Autonomous chains or sidechains are completely autonomous chains with their validator pool. Such blockchains are responsible for their security.

MATIC cryptocurrency

We have already discussed enough about the Polygon platform and its capabilities. Now let's delve into one of the tools that implements some functions and features of this network in more detail.

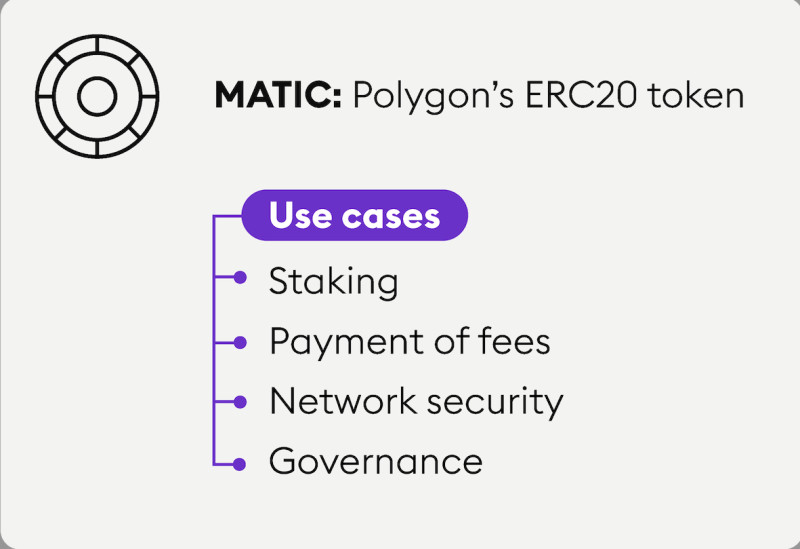

We are talking about Polygon's native blockchain currency, which is the cryptocurrency with the ticker MATIC. This token performs several important functions on the platform:

- Purchase and Exchange: This currency can be freely purchased and exchanged on many centralized and decentralized exchanges.

- Fee Payment: All transaction fees within the network are paid with Polygon's native currency.

- Token Staking: Involves holders transferring tokens to support the operation of the entire system in exchange for rewards.

- Storage or Investment: Involves acquiring currency with the expectation of its future value growth. In this case, tokens are stored in specialized wallets and not used for any other purposes.

In the future, this currency may also be used to incentivize users who wish to participate in platform development or support its operation. For this purpose, tokens may be transferred in exchange for performing certain actions, such as block validation, for example.

Mining of this cryptocurrency is not possible because the network in which it is used employs a different consensus mechanism – PoS. Validators, not miners, participate in the process of verifying transactions and adding them to blocks. To become a validator, one needs to lock a certain amount of tokens in the chain's wallet.

However, to become a validator in Polygon, a fairly large number of tokens need to be locked. Not all users have such capabilities, so there is another category of users in this blockchain – delegators.

Delegators transfer their tokens to selected validators they trust and indirectly participate in the staking process. They receive rewards for transferring their currency, but if the chosen validator acts incorrectly and makes mistakes, the delegator may lose their funds.

Since its release, the value of this token has increased by several thousand percent. Currently, it stands at just over 80 cents. A total of 10 billion units of currency have been issued, with over 95% of tokens in circulation.

Polygon cryptocurrency: advantages and disadvantages

Thanks to its multifunctionality, the Polygon platform and its native token, MATIC cryptocurrency, have many advantages, but they also have their drawbacks. Let's take a closer look at the pros and cons of this blockchain.

The key advantages of the Polygon chain are the following:

- Significant scalability potential due to a comprehensive approach to solving this problem and the development of various mechanisms to address it.

- High transaction speed, reaching 65,000 transactions per second.

- Small transaction fees – the fee for one operation in this chain is almost always $0.01 regardless of the transaction amount.

- Ease of use – compatibility with EVM allows for easy migration of data and applications from Polygon network blockchains to Ethereum.

- Constantly growing ecosystem. Thanks to support for decentralized applications, the project attracts a large number of developers, strengthening the platform's position in the market.

Among the disadvantages of this platform, experts highlight one most significant:

- High competition in this market. New developments emerge in this field practically every day, each trying to come up with its own ideas to solve the most important blockchain complexities.

- Dependence on the Ethereum network. The chain was developed as a second-layer network for Ethereum, so any problems that may arise in the main chain will also affect Polygon and its reputation.

- Narrow specialization of the MATIC token – this currency is rarely used for trading or investments and is specifically used as an auxiliary token for Polygon for fee payment and other purposes.

Polygon cryptocurrency prospects

The positive aspects possessed by the Polygon ecosystem and its native currency - MATIC cryptocurrency, provide its users with a vast number of opportunities for its utilization. Therefore, this platform has tremendous potential for further development.

The topic of decentralized finance and decentralized applications is gaining increasing popularity. The Polygon platform has all the necessary tools for developers gathered in one place. The more projects that are implemented on the platform, the more in-demand it will become.

The platform provides the opportunity to create new blockchains thanks to its modular structure. Over 50 new digital currencies have already been issued on this platform, including such well-known projects as USDT, USDC, and DAI. The number of active addresses exceeds 150 million, and this number continues to grow.

Polygon has already launched and continues to seek new ideas to address the scalability issue of chains. This is a very promising direction, as many networks suffer from this problem. Today, Polygon offers opportunities to implement projects compatible with the Ethereum network on third-party blockchains.

At the same time, project development and transaction fees are significantly cheaper, and transaction speed is significantly higher. Currently, the network allows for over 4 million operations per day, and this figure is only increasing.

The company invests funds in the development of new projects and areas of activity, such as NFT development and blockchain gaming. Over 3,000 projects are already being implemented on the platform, and this is far from the limit, as its capabilities are constantly expanding.

Undoubtedly, the tie of the Polygon platform to the Ethereum network can both positively and negatively affect its further development. As long as Ethereum is trending and developing successfully, so will Polygon. However, if any difficulties arise with the Ethereum network, it will also affect Polygon.

Nevertheless, experts are confident that the Polygon project will continue to develop. And along with it, the value of its native currency - MATIC, will grow. Therefore, this token can be considered as an investment option.

Conclusion

In this article, we have discussed the key features, structure, and mechanism of operation of the Polygon platform and its native currency - MATIC cryptocurrency. This project is a vivid example of how from a small blockchain, which was developed as a sidechain of the Ethereum network, an entire ecosystem has grown.

The multifunctional Polygon platform offers developers tools for creating new blockchains and other projects in the field of decentralized finance. The platform structure is modular, so each developer can choose exactly the details they need from the constructor.

New chains have already been created in this ecosystem, which are independent but have a connection with each other and the main blockchain - Ethereum. This allows for transactions and other projects on third-party chains with lower costs and subsequently transferring them to the main network.

The digital currency MATIC serves a utility role in Polygon, used for fee payment within the network. There are no miners in this chain. It is serviced by validators who verify transactions and add new blocks, receiving a reward for it. To become a validator, one should participate in staking, meaning to lock a certain amount of MATIC in their account. However, if a participant does not have such an amount but wants to participate in staking, they can become a delegator and transfer their funds to a validator. In return, they receive their share of the reward.

Back to articles

Back to articles