The market of digital currencies is becoming increasingly popular, with new players emerging on it daily. Each new coin declares its intention to surge ahead and outperform competitors in certain characteristics or parameters.

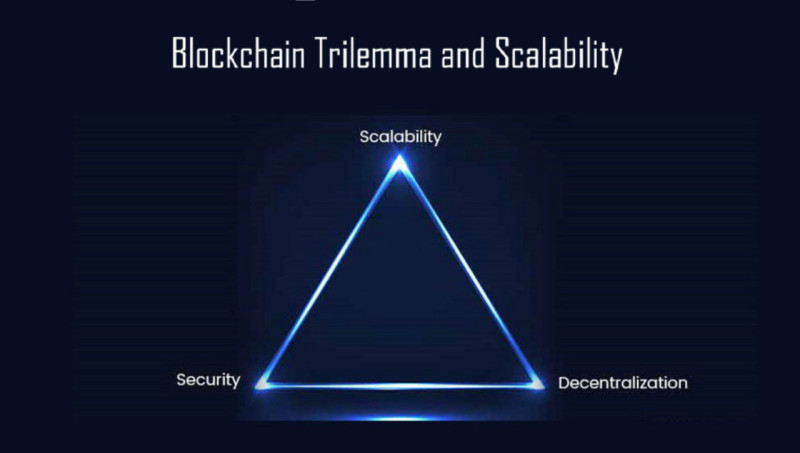

One of the most common issues modern blockchains attempt to solve is scalability. This parameter includes the ability to conduct a greater number of transactions per second, thereby increasing transaction processing speed and, consequently, their volume.

Developers of the EOS platform have been working on solving this problem. To learn more about other digital assets, their key features, and their advantages over competitors, you can read the article "Cryptocurrency rankings."

Competition in cryptocurrency market

Since the emergence of the first digital currency - Bitcoin - more than 15 years have passed. However, neither it nor its "eternal companion," Ethereum, which appeared several years later, has lost its position and popularity among users.

However, as these major blockchains attract more users and transactions, they experience congestion. This has resulted in slower transaction processing and increased transaction fees.

These problems remain unresolved in these networks to this day, as solving them in networks of this type would require sacrificing decentralization and, consequently, security. Thus, the so-called blockchain trilemma arises. How to increase chain throughput and scalability while maintaining decentralization?

Meanwhile, the cryptocurrency market continues to evolve, with new chains and digital currencies appearing daily. Every new project aims to solve all blockchain problems using various technologies.

Thanks to such technological solutions, new chains manage to increase transaction speed. This enables them to increase network throughput and significantly reduce transaction costs.

As a result of these improvements, competition arises among various digital currencies. Each project seeks to attract more users and offers them favorable conditions for using their platform.

In addition to blockchain capabilities, transaction speed, and fees, users also pay attention to other factors. For example, the development team's expertise, their reputation, and the currency's longevity.

EOS project

The EOS project aims to become one of Ethereum's competitors. What are the specific features and advantages of this platform and its native token – EOS cryptocurrency? Let's try to understand this in the following section.

So, EOS is a network based on blockchain technology that enables fast and free transactions. In addition, the platform supports the development of decentralized applications (dApps). However, it is far from the only blockchain with such capabilities.

Nevertheless, the network being considered has some features that have already allowed users to call it the "Ethereum killer." Firstly, it has serious scalability capabilities - the platform has the potential to process up to 1 million transactions per second while Ethereum processes 15-30 transactions per second.

Secondly, there is no gas fee on this platform, meaning there are no transaction fees. Consequently, the platform can be used completely free of charge or with minimal fees. This is convenient for conducting small payments, which in other chains may exceed the fee amount.

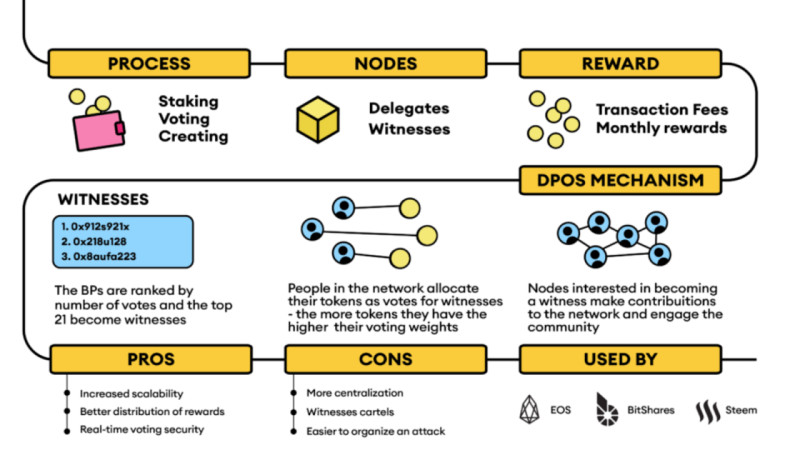

Thirdly, EOS applies a special consensus algorithm in its network. Unlike many major blockchains using the PoW mechanism, the considered chain uses DPoS. We will delve into this algorithm and its operation principles more deeply in the following sections.

Fourthly, even not-so-savvy developers can work with the platform and create decentralized applications. This is because one of the simplest programming languages – C++ – can be used on this platform.

History of EOS

The development of the project began in 2017 by Block.one, and in the same year, an ICO of the platform's native currency – EOS cryptocurrency – was launched to attract funding.

The project was authored by Daniel Larimer, already known for developing the decentralized exchange Bitshares and the social network Steemit. These projects allowed him to gain invaluable experience in development, and he ambitiously named his new project the "Earth Operating System" (EOS).

As mentioned earlier, funds were raised through an Initial Coin Offering, making it the longest ICO in cryptocurrency history - almost a year. The company sold 1 billion EOS tokens for a total of $4 billion.

However, creating a new cryptocurrency is not such a complicated process nowadays. There are specialized programs that help create tokens within minutes.

At the same time, many currencies emerge, but few of them achieve real success. This is because to make a project popular and in demand, it needs to be promoted, and for that, a good team of specialists is needed.

Therefore, one of the key success factors became the figure of the project leader, who has a good reputation thanks to his previous successes. The second factor is a revolutionary approach promising users unprecedented scaling opportunities.

In addition, the company does not plan to stop here. Developers plan to add new programming languages, connections between different blockchains, and other tools.

EOS cryptocurrency

Now that we know a lot about the platform itself, it is time to talk about its native currency - the EOS token. It serves several important functions on the platform, including:

- First and foremost, it serves as a means of exchange and the platform's utility currency, which can be sent, received, or simply held in a wallet;

- However, the main function of this currency is to provide voting rights to its holders. Each token is akin to a share, and its holders are akin to shareholders. Consequently, the more coins a user possesses, the greater weight their vote has.

EOS tokens cannot be mined, as the delegated PoS consensus algorithm is used in the considered chain. Validators in the network verify transactions and add blocks, receiving rewards for this. Thus, new tokens are introduced into circulation.

Additionally, EOS currency holders can participate in staking by locking a portion of their coins in platform accounts to ensure their functioning. For this, they also receive rewards in the form of a portion of the fees paid for using the network.

The value of the EOS currency has fluctuated significantly over the years of the project's existence: at its initial offering, the price of 1 token was less than $0.01. During the ICO, the price rose to $4, and the maximum value reached $16.6. At present, the price of 1 token is just over $0.70.

Total coin emission is capped at 10 billion units. However, currently, only a portion of a total number of coins is in circulation - around 2 billion. According to the chain's rules, the total number of tokens in circulation cannot grow by more than 5% per year.

How to buy EOS

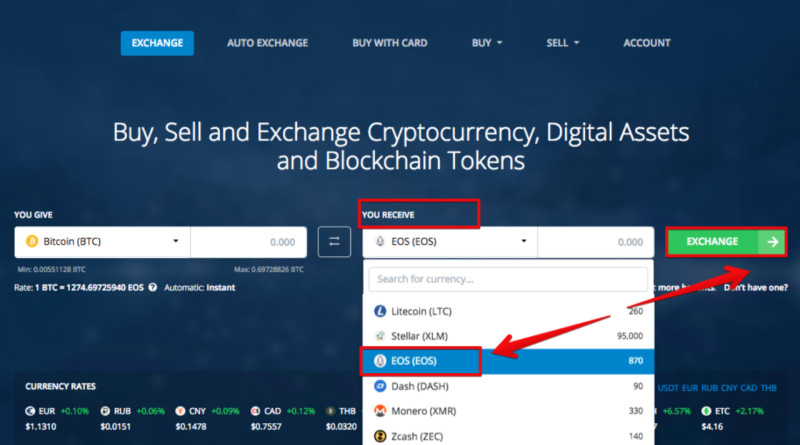

The platform's native currency EOS is an integral part of it and performs several important functions. To use the considered chain and its functionality, you need to have this currency in your wallet.

However, this digital currency cannot be mined; it can only be bought. Nevertheless, this is not a problem, as the EOS cryptocurrency is traded on many well-known platforms.

To buy cryptocurrency, you need to register on one of the cryptocurrency exchanges or exchangers. The registration procedure is simple and does not require any special actions, but after that, you will need to go through the verification process.

To confirm your identity, it is usually required to upload a scanned copy or photo of your passport or another document. Some platforms also require proof of address, for which you need to provide scanned documents such as utility bills.

After completing all the necessary procedures, you need to fund your account. Usually, if you are registering and trading cryptocurrencies for the first time, the account is replenished with fiat money: dollars, euros, or the national currency of your country.

After funding your account, you can purchase digital assets, including EOS cryptocurrency. Then you can transfer the tokens to other wallets or platforms for further use. Within the chain itself, validators receive tokens as a reward for their work.

Additionally, tokens can be earned by participating in educational programs on the Earn platform or by playing the online game Knights. The simplest and most common way is to buy coins on cryptocurrency exchanges for fiat money or other digital currencies.

How EOS works

As already mentioned, the basis of the operation of the blockchain under consideration and its utility currency – the EOS cryptocurrency – lies a special consensus algorithm – delegated PoS. What this means and how exactly this mechanism functions, let's find it out in this section.

In the early blockchain networks that emerged at the dawn of digital currencies, a PoW consensus mechanism was used, directly linked to cryptocurrency mining. Its essence lies in the verification of transactions and recording them in blocks, which subsequently form the network, requiring solving complex mathematical problems.

Significant computational power is required to solve these problems, making mining a costly endeavor. After a solution is found, other miners verify its correctness before the blocks are added to the chain, and the miner receives a reward for their work.

However, an increase in users in the network and, consequently, the transactions they make, slows down the chain's operation, as all transactions are verified by all nodes. When using the PoS algorithm, the right to process transactions is acquired by users who hold a large number of tokens.

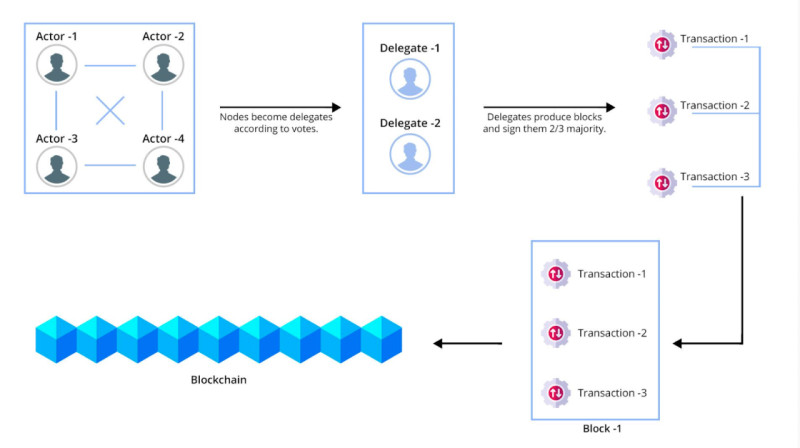

Thanks to this, computational power is not required, and this method is more economical and environmentally friendly in terms of energy consumption. The DPoS mechanism is similar, but it has one more feature: EOS token holders do not confirm transactions themselves but choose those who will perform these tasks.

We have already discussed that owning the network's native currency gives the right to participate in its governance. One such right is the selection of delegates to service the chain. The delegates, in turn, must ensure the uninterrupted operation of nodes and have a good reputation in the community to receive votes.

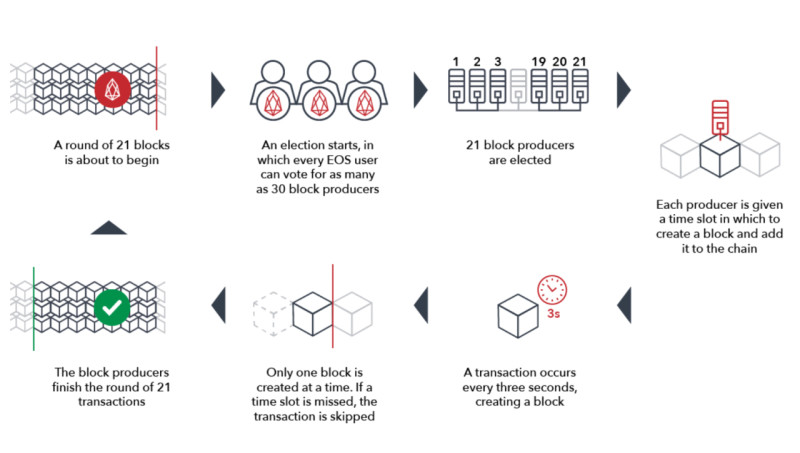

In the EOS chain, 21 validators participate in adding a new block, each of which adds 12 blocks. However, there are significantly more contenders for this position. In each round, validators with the highest number of votes participate.

How validators are selected

Owners of the platform's native currency, which is the EOS cryptocurrency, have the right to vote and choose validators. They, in turn, verify transactions and add blocks to the blockchain. This is the key difference between the DPoS and PoS algorithms.

In the first case, not all token holders can participate in adding new blocks. The process of adding new blocks is divided into rounds, and different validators participate in each round.

To select validators, a special procedure has been developed. EOS currency holders vote for candidates called block producers. Candidates who receive the maximum number of votes enter a special pool of validators.

From this pool, specific performers are subsequently selected to perform their functions in the next round. During one round, 252 new blocks are added by validators, after which the process repeats.

We have already mentioned that the weight of each holder's vote is directly proportional to the number of tokens: the more units of currency, the greater the weight of their vote. Votes can also be transferred to other candidates at any time or vote for multiple producers at once.

Validators who lose votes or receive fewer than others cannot continue to participate. This is done to encourage validators to refrain from abuse and work as best as possible for the benefit of the entire community. Such actions give them a chance to participate again in adding new blocks.

In this mechanism, the reputation of the validator and their actions aimed at community development are of paramount importance. The more users in the community support them, the greater their chances of being elected as a validator. This system is also called "digital democracy."

Pros and cons

Like any other blockchain project, the platform and its native EOS cryptocurrency have both positive and negative aspects. Let's examine them in more detail in this section.

So, the key advantages of this chain are:

- Huge scalability potential – thanks to its technological solutions, this network can process up to a million transactions per second. Such capabilities are not available to all blockchains.

- Low transaction costs – there are no fees for transactions in the EOS network. Instead, users need to stake a certain amount of tokens or participate in staking. This allows for conducting even small transactions without the risk of paying a large fee relative to the transaction size.

- Convenience and ease of use – thanks to the experience of the project's lead developer Daniel Larimer, gained from creating previous projects, he managed to develop a user-friendly platform interface.

- Account recovery – users' accounts can be restored using a special protocol, which allows for doing so without much effort and gaining access to their wallet and the currency in it.

- Providing opportunities for developing decentralized applications using ready-made templates – the platform has a wide range of tools for creating interfaces and client databases.

- Energy efficiency – thanks to a special consensus algorithm, the network consumes significantly less electricity to confirm transactions and create new blocks.

The main disadvantages of EOS include:

- Criticism regarding excessive centralization – the project is fully managed by the company Block.one, which was involved in its development. Only 21 validators participate in block creation, which is a small number compared to other chains.

- Restrictions for small investors – when the chain's throughput reaches its limit, the network starts imposing restrictions on operations. These restrictions primarily affect accounts with small token balances.

- High competition, especially from the more popular Ethereum network – thanks to the capabilities of this platform, it is used by over 30 million users, and several thousand new tokens have already been issued on it.

Prospects

The EOS platform and its native cryptocurrency are considered a young project in the cryptocurrency market. Therefore, it is still too early to say that it has fully demonstrated its potential; it still has room for development.

Developers continue to work on the platform's functionality and its constant upgrades. The faster and more reliable the network becomes, the more users it will attract.

The growing interest in decentralized finance and dApps creation potentially can attract new users to the project. Even at this stage, the platform offers a large number of tools for working with user interfaces and other aspects of applications.

However, competition in this sector is quite high. The closest and largest competitor, which consistently ranks much higher in cryptocurrency lists, is Ethereum. In some aspects, Ethereum outperforms other blockchains. However, it should also develop to remain among the top blockchains.

The main task of competitors is to emphasize those aspects that are underdeveloped or not developed at all in the Ethereum domain. Therefore, the area of smart contracts and decentralized applications is developing rapidly and will continue to do so.

Each blockchain offers its opportunities and innovations. The key feature of the EOS platform is its unlimited scalability. Another advantage is the absence of transaction fees.

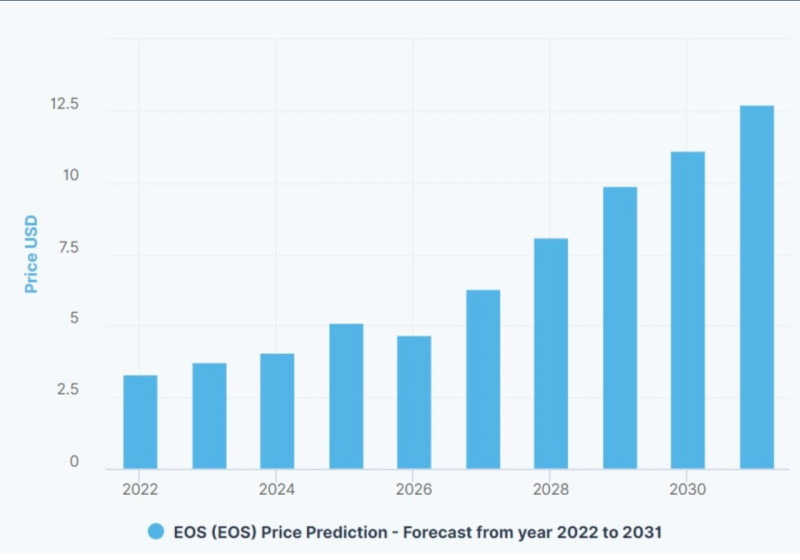

As for the value of the project's currency, it is still quite difficult to predict its movement. Over the years of its existence, it has experienced both strong rises and serious falls. Therefore, we cannot talk about the investment value of EOS, although it is possible to earn from short-term fluctuations.

At the same time, since the token not only performs a service function but also acts as a share on this platform, as it develops, the demand for this currency will grow. The more coins there are, the more weight the voice of its owner carries.

Conclusion

In this article, we have examined a fairly new and promising blockchain network and its utility token – EOS cryptocurrency. The key features of this project are its huge scalability potential and low transaction fees.

This chain has a special consensus algorithm – delegated PoS. While in traditional PoS, network validators are holders of native tokens, in this case, they have the right to vote and choose who will process transactions and create new blocks.

EOS tokens play an important role in the functioning of the platform. They act not only as a medium of exchange but also give holders voting rights. Moreover, the more tokens a user owns, the greater weight their vote carries.

The platform provides extensive opportunities for developing decentralized applications. It has ready-made templates and special tools for developing and improving user interfaces and client databases.

Back to articles

Back to articles