UMI cryptocurrency, short for Universal Money Instrument, stands out as a decentralized digital currency facilitating nearly instantaneous and entirely secure transactions, with the added benefit of being cost-free.

Functioning as a comprehensive blockchain platform, UMI possesses the capability to generate and execute smart contracts, relying on master nodes and a distinctive Proof-of-Authority (PoA) model for its operation.

What sets UMI apart is its utilization of smart contract staking technology within its system, enabling users to form collaborative structures. This unique feature allows individuals to mint new coins (listed cryptocurrencies) at a rate of up to 40% per month, simply by storing them in their wallets.

However, it's crucial to note that UMI has sparked debates within the crypto community. Despite its compelling descriptions, the project faces skepticism as it lacks concrete evidence to validate its purported success and widespread popularity.

How UMI was created

UMI cryptocurrency stands out as a fully transparent open-source asset operating on the Proof of Authority algorithm.

Founded by Amir Taaki and John McAfee, the project is boldly positioned as "a solution to multiple problems within the global financial system," aiming to address the limitations observed in major cryptocurrencies.

The inception of UMI dates back to June 2020 when passionate developers initiated the genesis block, subsequently listing the new coin on the SIGEN.pro platform, granting accessibility to users for trading.

Within a mere year, UMI witnessed a substantial turnover of 180 million coins, with the number of transactions soaring to an impressive 8.5 million.

Initially, the project developers asserted to the public that the cryptocurrency's throughput would soon surpass 10,000 transactions, positioning it ahead of conventional payment systems such as MasterCard and Visa.

Specifics of UMI

Amir Taaki and John McAfee proudly emphasized key attributes of their virtual coin, with paramount importance placed on its exceptional transaction speed.

In stark contrast to the often sluggish Bitcoin network, where users endure wait times of up to half an hour, sometimes stretching into hours or even resulting in unconfirmed transactions, UMI cryptocurrency positions itself as a remarkably successful alternative. Developers are dedicated to simplifying the trading process, prioritizing both speed and safety, aspiring to create an ideal solution.

UMI transactions occur swiftly, irrespective of the initially declared transaction amount. The developers' efforts resulted in the UMI network processing transactions at a staggering speed—300 times faster than Bitcoin, boasting up to 4,369 transactions per second. Notably, UMI's ambitious aim is to eventually surpass the transaction speed of industry giants VISA and MasterCard.

The UMI network exhibits the capacity to process 500 million transfers in just a few days, a feat that took Bitcoin 12 long years to achieve. The creation of a new block takes a maximum of 15 seconds, reflecting the project's efficiency. Such claims are boldly stated on the official website of the project.

In addition to its speed, UMI cryptocurrency allures users with its commission-free system. Unlike conventional cryptocurrency transfers that often incur substantial fees, UMI has successfully eliminated commission charges from its network, thanks to the implementation of the Proof of Authority algorithm. This translates to the fastest transactions with no associated fees—an appealing combination.

Further enhancing its appeal, UMI introduces staking as an alternative to traditional mining. Users are only required to hold a certain amount of funds in their electronic wallet, and in return, they receive rewards akin to bank interest, potentially reaching up to 40%. This innovative approach involves pooling coins by attracting new participants to the network, fostering asset growth. The combination of speed, fee-free transactions, and unique staking features contributes to the distinctive allure of UMI cryptocurrency.

To generate passive income through UMI investments, consider the following steps:

1. Individual Investment:

- Acquire UMI coins and store them in the project's electronic wallet.

- Optionally, move the acquired coins to a shared pool with other depositors, keeping in mind a maximum limit of 50,000 coins.

- Once the pool is formed, the user receives income credited to their account.

- Users can also independently create structures for additional profit.

2. Joining Existing Structure:

- Participate in an already-formed structure that is not yet complete.

- Organizers of such structures receive a 20% bonus on the invested funds.

The staking reward is contingent on the structure's size, determined by the total UMI coins within. Here's a breakdown:

- Structure with 50,000 UMI – Monthly growth from 5% to 9%

- Structure with 100,000 UMI – Monthly growth from 10% to 14%

- Structure with 500,000 UMI – Monthly growth from 15% to 19%

- Structure with 1,000,000 UMI – Monthly growth from 20% to 24%, and so forth.

For instance, a structure of 1,000,000,000 UMI promises profits ranging from 36% to 40% per month, as per the project's official website.

Developers emphasize that staked money remains solely in the client's wallet, under their control, allowing withdrawal at any time. Staking rewards are distributed every second, irrespective of the participant's location or activity, enhancing its appeal.

In terms of security, UMI demonstrates resilience against various hacker attacks, ensuring robust protection for user information. The system's integrity aligns with Bitcoin's track record of no successful attacks. Developers assert that they cannot influence the UMI system's functioning, thanks to its open-source code.

Similar to other virtual coins, UMI operates as a decentralized asset, avoiding control by government agencies. All transactions within the UMI system maintain anonymity, eliminating the need for user registration, verification, or the provision of personal contact information.

In essence, UMI offers a straightforward, secure, rapid, and fee-free investment environment, presenting an alluring proposition that might seem too good to be true.

How does Proof-of-Authority (PoA) work?

The landscape of the crypto world has undergone significant transformations since the initiation of the first blockchain transaction on the Bitcoin network. Following the widespread adoption of Proof of Work (PoW) and Proof of Stake (PoS) algorithms, novel consensus mechanisms have emerged, each with distinctive approaches to achieving agreement.

While the Proof-of-Work (PoW) consensus algorithm, employed by the Bitcoin network, stands out as the most reliable and secure, its scalability is notably limited. Despite its decentralized nature, Bitcoin's performance is constrained, resulting in a relatively small number of transactions per second.

The constraint arises from the necessity for the distributed network of nodes to reach consensus and validate the current state of the blockchain before confirming a new block of transfers. This process inherently takes time, showcasing the trade-off between decentralization and scalability.

Although PoS blockchains generally outperform the Bitcoin network in terms of transactions per second, the difference is marginal, and PoS fails to provide a comprehensive solution to the scalability challenge.

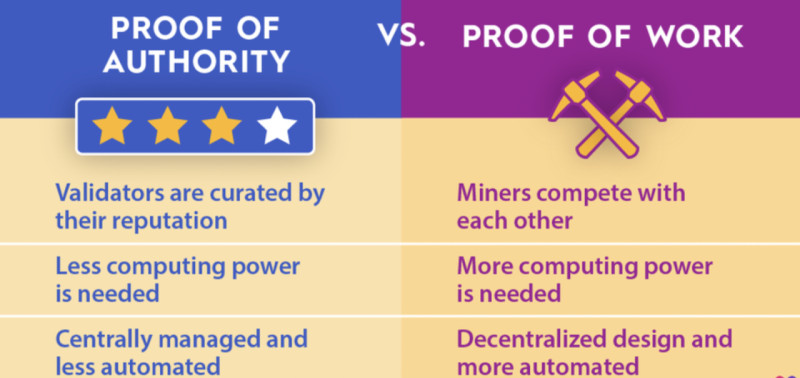

In this scenario, the most promising alternative currently is Proof of Authority (PoA) technology, recognized for its ability to execute an impressive number of transactions per second. Coined in 2017 by Ethereum co-founder Gavin Wood, the PoA algorithm prioritizes decision makers' significance.

Unlike traditional PoS, where validators stake coins, PoA relies on the reputation of validators. The PoA model, grounded in a limited number of block validators, inherently addresses scalability concerns. Approved network participants, who serve as system moderators, scrutinize blocks and transfers in advance, ensuring a secure and efficient process.

The PoA consensus algorithm finds application in diverse scenarios and is particularly indispensable in logistics applications. Its prevalence in supply chain systems attests to its effectiveness, making it a preferred solution in those domains.

Often considered a modified version of PoS that emphasizes identity over coins, PoA stands out as a practical choice for private blockchains. Its enhanced performance positions it as a superior option compared to other systems, especially in use cases where decentralization is not the primary focus, catering to the needs of businesses and corporations.

The Proof-of-Authority (PoA) algorithm boasts distinctive features that underpin its effectiveness:

1. Validator Qualification:

- Emphasizes valid and trustworthy individuals, i.e., validators, who must authenticate their identities.

- Rigorous selection criteria require candidates to invest money and stake their reputations, ensuring a motivated and reliable pool of validators.

- A universal standard for validator approval is applied uniformly to all candidates, maintaining consistency in the selection process.

2. Reputation Mechanism:

- Establishes confidence in the identity of validators through a reputation mechanism.

- Ensures a standardized procedure for all validators, promoting the integrity and reliability of the entire system.

3. Publicly Available Validator Identity:

- The identity of validators in PoA is made public, offering transparency.

- However, this openness poses a potential disadvantage, as third parties might manipulate publicly known validators, risking internal system compromise.

Proof-of-Authority technology forms the bedrock of the UMI network, providing essential security without which the project would not attain the envisioned safety and efficiency.

In contrast to other algorithms such as Proof-of-Work and Proof-of-Stake, PoA stands out by minimizing risks and mitigating potential issues.

Within the UMI project, master nodes generate new blocks, while validator nodes sustain network operations, ensuring both functionality and security. Users can launch lightweight nodes for viewing and sending transfers, with a remarkable capability to process over 4,000 transactions per second, facilitating high throughput and instant transaction confirmation.

Furthermore, PoA technology guarantees security by minimizing the likelihood of fraudulent activities. Each project node possesses a unique identifier, enabling prompt identification and blocking of any attempted attacks or unauthorized access. This robust security measure adds an extra layer of protection to the UMI network.

Possibilities and advantages of UMI in DeFi

UMI cryptocurrency has made a significant foray into the decentralized finance (DeFi) sector, leveraging tokenization on the Ethereum blockchain to broaden its accessibility across various DeFi applications.

The tokenized UMI (WUMI) is actively tradable on the Uniswap exchange, providing users with the flexibility to engage in staking or farming activities.

DeFi staking opens avenues for participants to earn commissions from trading transactions, while farming presents an additional incentive in the form of tokenized UMI rewards.

The strategic tokenization of UMI across diverse blockchains is particularly advantageous as it attracts a growing user base to the project.

Specifically, the tokenization of UMI on the Ethereum blockchain introduces novel possibilities for DeFi enthusiasts. By exchanging UMI coins for tokenized UMI (WUMI) on the Uniswap exchange, users seamlessly integrate with other tokens and actively participate in decentralized financial applications.

DeFi staking further stands out as a unique opportunity, enabling network participants to stake their tokens and generate passive income through commission fees from trading transactions.

Moreover, UMI's tokenization contributes to expanding the cryptocurrency's market reach. Its availability on different blockchains not only draws in more users but also extends opportunities for participation within various ecosystems.

The integration of UMI cryptocurrency in online stores and various services

UMI presents a plethora of opportunities. Leveraging API and SDK tools, it seamlessly integrates into existing infrastructures.

The project's developers envision the creation of HD wallets and universal smart contracts, enhancing the versatility of UMI tokens in online commerce. HD wallets empower network members to make purchases and receive cashbacks, contributing to a user-friendly experience.

UMI cryptocurrency pledges numerous advantages, including secure storage and usage. Developers commit to elevating security levels by introducing additional authentication layers such as Face-ID, Touch-ID, and PIN codes.

Upon successful implementation, UMI is poised to emerge as one of the most convenient and effective tools for online trading and various services.

Key advantages of employing UMI in online stores include:

1. Instant and secure fund transfers without commission fees.

2. Cashback functionality for completed purchases.

3. Integration with a variety of payment systems.

4. Creation of new business opportunities, attracting fresh clientele.

The cashback feature, in particular, stands out as a significant boon for online stores and services. Users making purchases will have the chance to reclaim a portion of their expenditure in UMI, fostering customer loyalty and encouraging repeat business.

While these prospects sound promising, a lingering question remains: Is it prudent to place trust in a project that makes such ambitious promises? This question will be addressed further below.

UMI crypto – is it a gem or s scam?

The annual trajectory of UMI cryptocurrency's value speaks louder than the descriptive narratives found on its official website.

Despite proclaimed achievements and promising plans, the token's price trend persistently heads downward, currently standing at $0.00114 (UMI/USD trading pair).

In the summer of 2021, a year after its inception, UMI was listed at $0.56, reaching its peak at 65 cents. However, for the subsequent three months, the price consistently declined. By mid-November 2021, the cryptocurrency's value plummeted by 94%, reaching a mere 3.25 cents.

Determining the market capitalization of UMI proves challenging due to insufficient data, adding a layer of confusion to the overall assessment.

Contradictions arise when the official UMI project website asserts significant growth and heightened demand, despite the ongoing high emission. The token's price chart, from August to November 2021, tells a different story, casting doubt on the developers' statements.

Despite active promotion on social media, particularly Twitter, and detailed descriptions of achievements on the official website, the published events fail to influence UMI's coin rate. Typically, positive news boosts the value of most cryptocurrencies, but this pattern does not seem to hold for UMI.

While the addition of UMI to the decentralized exchange Uniswap expands its availability, other touted features, such as UMI cards for everyday use, appear incongruent with the cryptocurrency's lack of popularity and development, as indicated by its exchange rate dynamics.

Presently, UMI can only be traded on two exchanges, BitGlobal and Bibox. The CoinMarketCap confidence level, reflecting trading volume reliability, is at an all-time low. The liquidity rating from these exchanges is a mere 143 out of 1000.

Performance indicators provided by UMI developers lack external verification, contributing to skepticism. The continuous decline in the UMI rate throughout its existence, coupled with its absence from major exchange listings, raises concerns.

Despite the project's ambitious plans, the economic aspects of the coin are troubling, especially the unclear mechanism behind the creation of new staking coins with zero commissions, reminiscent of a Ponzi scheme, where existing investors receive funds from new investors.

Back to articles

Back to articles