In recent years, the decentralized finance (DeFi) sector has experienced a real boom, offering new opportunities for investment, lending, and trading without intermediaries. This suggests that in the near future, we might be able to obtain loans and make payments without the intermediation of banks.

In this context, the Unifi Protocol DAO stands out with its unique approach to blockchain economics, aiming to create a stable system that can serve as the foundation for the development of modern finance. The platform's efforts are focused on eliminating transaction volatility and inflation.

This article discusses what the Unifi Protocol is and its key features. To learn more about other cryptocurrency platforms, their own currencies, and their standings in digital currency rankings, one can refer to the article "Cryptocurrency rankings."

What is DeFi

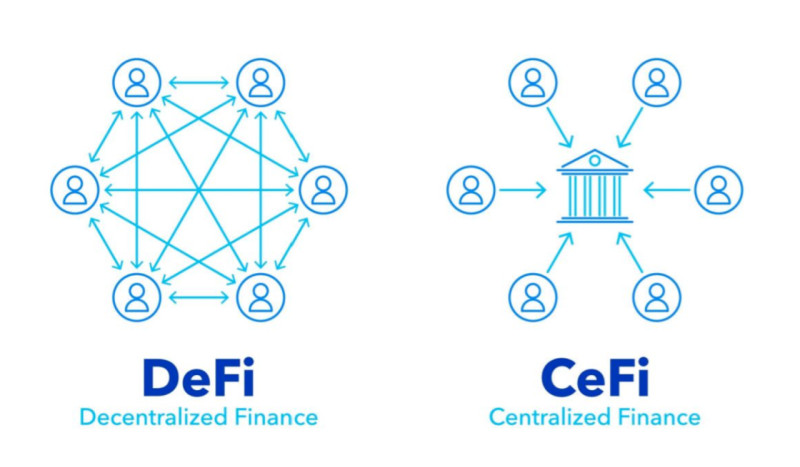

Decentralized Finances (DeFi) represent an alternative to the traditional financial system, where banks and other financial institutions play a key role.

Each bank or organization has central management, meaning all decisions are made centrally and depend on the management. In the DeFi system, on the contrary, all processes are fully decentralized, i.e., under the control of users, not the management.

The foundation of all projects in the decentralized finance sphere is blockchain technology. This distributed ledger technology stores data not on a single centralized server, but on several independent devices that can be located in different corners of the world.

Thanks to this, transactions no longer require intermediaries such as banks or other financial institutions. Operations are conducted directly between parties, and to send or receive digital money, one only needs the address of a special wallet and nothing more.

Transactions can be performed anonymously and confidentially, as no personal data is required to send or receive payment. In contrast, banks require personal data of the payer to confirm their identity for any payment.

Banking operations can take up to several days, especially if they are international. Using blockchain technology in modern networks, transactions are almost instantaneous (from a few seconds to a few minutes).

Another significant advantage of decentralized finance is the reduction of costs. Bank fees significantly exceed the fees for transactions in blockchain networks, which constantly work on scaling and reducing the size of fees.

Why DeFi cannot replace banks

We have mentioned several aspects where cryptocurrency platforms have advantages over banks and other traditional financial institutions. So, why can't all payments and settlements be conducted in the realm of decentralized finance?

This is impossible for several reasons. Firstly, cryptocurrencies are still not a universal payment method accepted in all countries. The legal regulation of digital currencies varies across countries, and crypto has a different legal status, being outright banned in some.

Secondly, transactions with currencies, including sending and receiving, are just part of the operations we perform with money in everyday life. The traditional financial sector also offers tools for lending, earning interest on deposits, and other services that expand its functionality.

Regarding digital currencies, at this stage, their key areas of application are exchange and transfer (sending and receiving coins or tokens), investments, or trading. Another way to earn income with crypto is staking, which somewhat resembles a bank deposit.

Additionally, platforms for obtaining loans in digital currencies and equivalents of savings accounts that allow earning passive income are already emerging in the decentralized finance sphere.

Thirdly, decentralized platforms almost entirely lack security guarantees. In the event of a bank's bankruptcy in a particular country, the government covers its debts to depositors. If a cryptocurrency exchange or platform is hacked or attacked, the money will be lost forever.

Furthermore, there are other risks associated with cryptocurrency wallets. "Hot" wallets, which have internet access, can be hacked, leading to money loss. As for "cold" wallets, they are more secure, but if a user forgets the password, recovering the data is impossible.

What is DAO

DAO stands for Decentralized Autonomous Organization. This term refers to any organization that operates with distributed, rather than centralized, management based on the principles of independence and anonymity. One prominent example of a DAO is the Unifi Protocol and its utility token, the UNFI cryptocurrency.

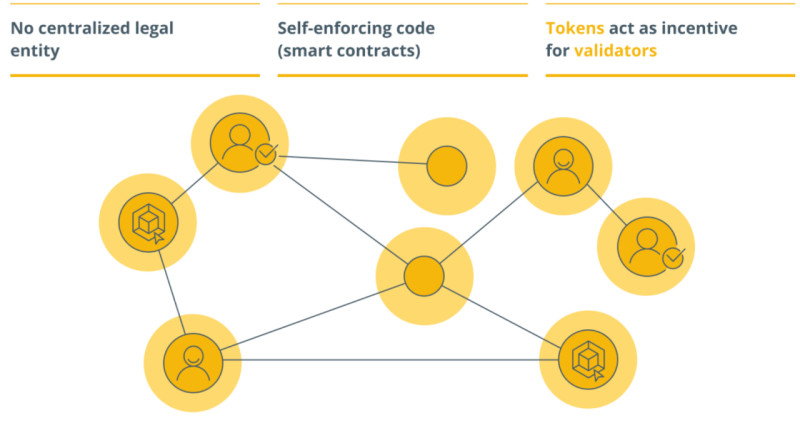

Control and coordination functions within a DAO are entrusted to a special program without human intervention. Transactions are executed using smart contracts, and tokens (specific to each chain) act as "shares" that allow holders to participate in governance through voting.

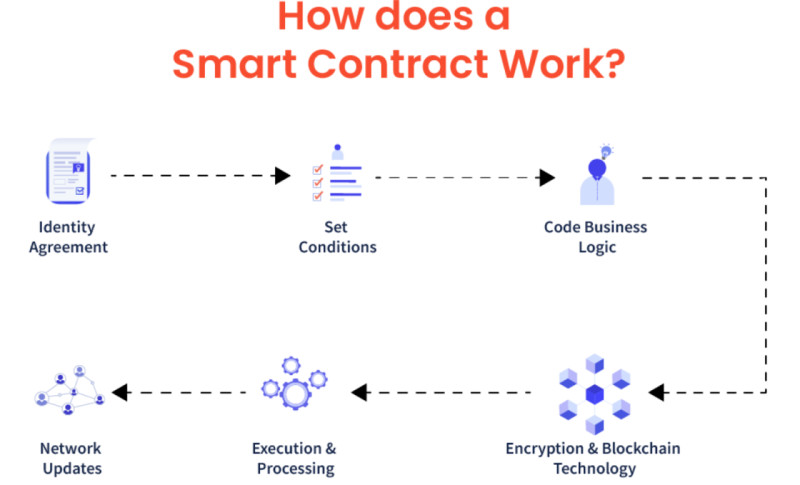

Smart contracts facilitate automatic operations when the conditions they contain are met. These contracts precisely describe the entire algorithm for a transaction between two users, helping to prevent fraudulent or other criminal actions by either party.

Every DAO structure has several key characteristics:

- Accounting for members' votes in decision-making;

- A flexible management system;

- The absence of centralized control and pressure;

- Efficient communication and interaction;

- Fast transaction processing;

- Pooling of resources to solve tasks.

Each token holder of a given platform can participate in votes on the platform's development. Generally, the more coins a user has, the more weight their vote carries. Moreover, participants can not only vote but also propose their ideas for the platform's development.

This approach achieves decentralization, with platform users themselves making key decisions regarding its further development. As a result, a loyal community of users is formed, who not only use the platform's resources but also wish for it to be successful and flourish.

What is Unifi Protocol DAO

The Unifi Protocol DAO represents one of the most innovative projects in the decentralized finance space, aiming to rethink blockchain economics by offering unique technological solutions. Let's take a closer look at this project and its utility token, the UNFI cryptocurrency.

The project's main goal is to facilitate inter-network interactions among various platforms in the DeFi sector. This will allow transactions between different platforms with minimal costs and without complications.

Unifi Protocol is a group of multi-chain and decentralized smart contracts. These contracts act as building blocks, enabling several networks to connect into one decentralized market.

The protocol allows for the integration of different projects in the DeFi space thanks to a cross-chain bridge, SEED Bridge. The SEED currency has the same value across all blockchains and can act as a universal token.

Unifi Protocol is unique because it has its liquidity fund, a currency to reward loyal users, and manages fee distribution. It also offers a platform for cross-chain exchange and a lending platform. These features enable it to rival traditional banking systems.

The project was initiated in 2018 by a team of experienced developers in blockchain and finance. Juliun Brabon, co-founder and CEO, has extensive experience in company management and strategy development.

Kerk Wei Yang, responsible for smart contract development, and Daniel Blanco, lead developer, both have deep knowledge in blockchain technology and programming. Their combined efforts are focused on creating a safe and sustainable DeFi platform.

How Unifi protocol works

This section details the key technological features and innovations underlying the Unifi Protocol DAO and its utility currency, UNFI cryptocurrency, making this project unique and distinct from others.

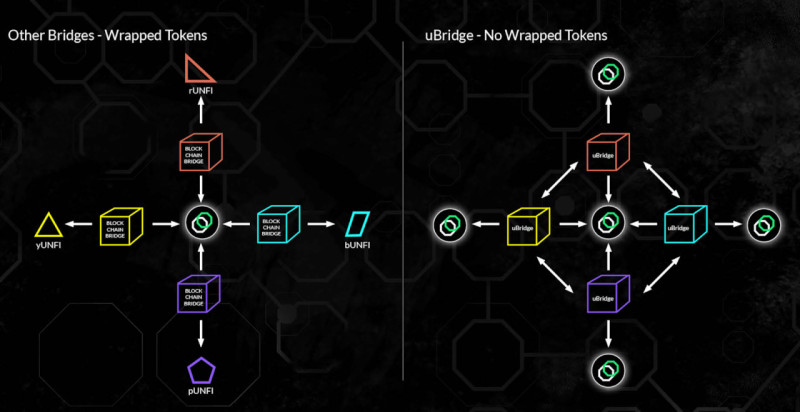

Unifi Protocol introduces several technological innovations, one of which is uBridge. This is a wrap-free cross-chain bridge that facilitates the transfer of assets between different blockchain networks.

Using other bridges with wrapped coins, users assume third-party risk by relinquishing control of their assets, compromising capital efficiency. uBridge addresses both of these issues.

Another feature is the multi-chain automated trading platform, uTrade, designed for liquidity exchange (AMM). It allows users to trade and invest in various assets. What sets this platform apart is that liquidity providers can expect a share of the total revenue generated by the protocol, not just from a single trading pair.

The project circulates two proprietary cryptocurrencies. One is the UP token, fully backed and integrated into the Unifi system to encourage participation and ensure stability. The other is the UNFI cryptocurrency, which we will discuss in the next section.

Additionally, the project features a lending platform, uLend, for obtaining loans. The loan application process is simplified as users do not need to undergo credit history checks. Applications are created anonymously, and a loan from one blockchain can be used on another.

In Unifi Protocol, a proof-of-stake (PoS) consensus algorithm is used to ensure the network's security and efficiency. Unlike proof-of-work (PoW), PoS requires significantly less energy and resources, making mining more accessible and environmentally friendly.

UNFI cryptocurrency

Another unique feature of the Unifi Protocol DAO is that it uses not one, but two proprietary tokens. UP is a currency used to reward users, which can be exchanged for UNFI on any cryptocurrency platform at any time.

UNFI is a utility currency designed for the governance of the Unifi protocol. This currency serves not only as a governance token but also plays a key role in the economy and security of the network.

UNFI coin holders have the exclusive right to propose changes to the protocol and participate in governance voting. This ensures decentralized and democratic management of the project, allowing the community to directly influence its development and strategy.

Furthermore, currency holders can earn additional income from staking. This involves holding tokens in a special account within the protocol and receiving UP coin rewards, as mentioned earlier.

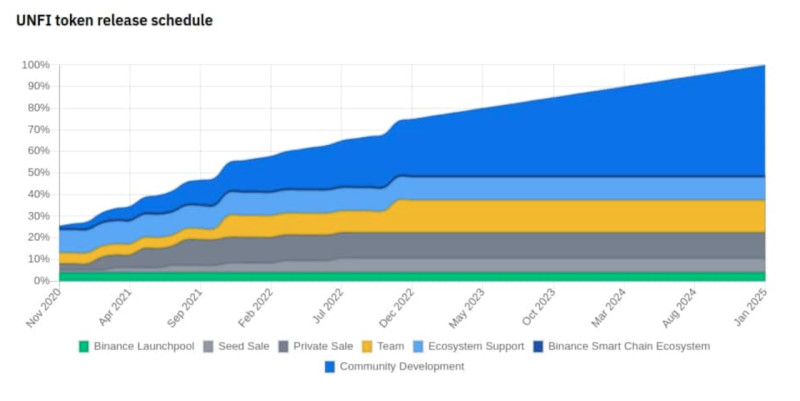

The total supply of UNFI tokens is limited to 10 million, of which a significant portion (almost 80%) is already in circulation. Tokens are distributed among network participants through staking mechanisms and participation in Launchpool on Binance, promoting their decentralization and distribution.

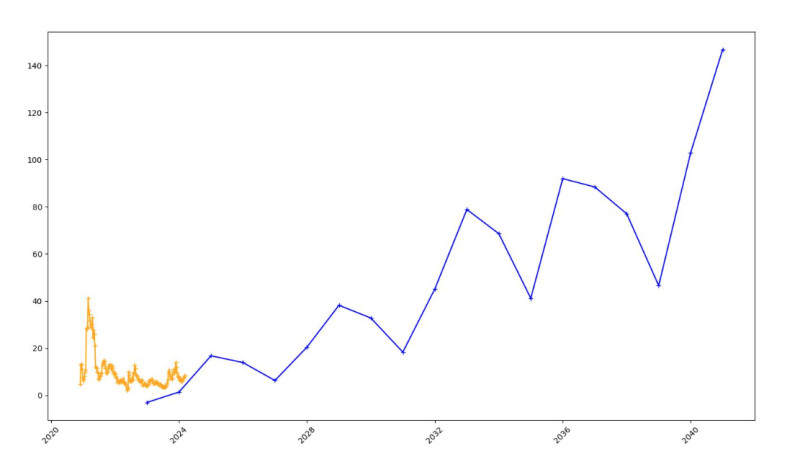

At the time of writing this article, the value of one UNFI token is over $7. However, the value of this currency has fluctuated, dropping to just over $1.3 and rising to more than $43 at different times.

UNFI farming

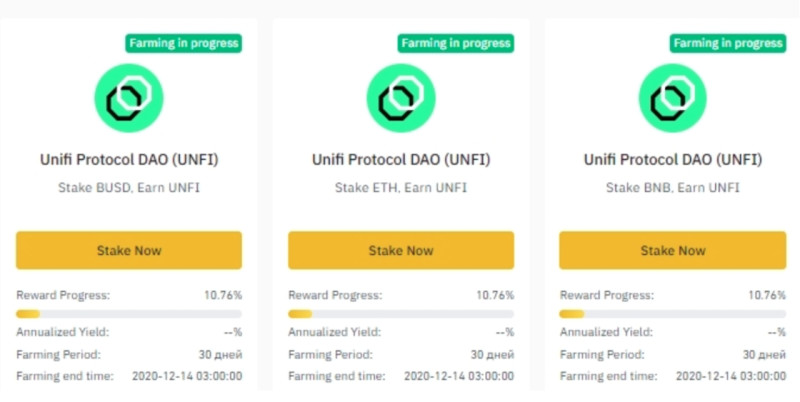

Besides staking, the Unifi Protocol DAO offers another interesting option for users – farming its proprietary currency, UNFI cryptocurrency. This section will detail what this entails and how one can earn from it.

Farming involves contributing a specified amount of cryptocurrency into a special pool formed from the contributions of users. These funds are used for the platform's operation, namely for executing smart contracts.

Funds can either be simply stored or issued as loans with interest. This is similar to a bank savings account: funds from several users are accepted by the bank and can be issued to other users as loans with interest.

The Unifi protocol offers users the opportunity to participate in liquidity pools, providing their tokens for exchange on the platform. Participation allows users to earn interest from transaction fees generated within the platform, creating an additional incentive for UNFI holders to invest their tokens in the ecosystem's development.

For token holders, this offers the possibility of earning passive income, as all that is required from them is to purchase coins and transfer them to a special fund. However, it's important to understand that these funds will be locked on the platform and unavailable for any other use.

Unifi Protocol continuously develops new tools and mechanisms to enhance the farming and staking experience within its platform. This includes developing advanced strategies for maximizing farming revenues and offering unique financial products that allow users to efficiently manage their investments.

Notably, participating in UNFI farming and staking can involve certain risks associated with the volatility of the cryptocurrency market. Therefore, it is recommended to thoroughly understand all terms and potential risks before participating in these processes.

Advantages and disadvantages

Like any other project in the cryptocurrency world, Unifi Protocol DAO has its pros and cons. Let's explore them in more detail in this section.

Advantages of the Unifi protocol include:

- The ability for cross-chain trading. The platform has several technological features that enable the transfer and exchange of assets across different blockchains;

- Opportunities for additional income. The platform offers broad opportunities for active users. Earnings can come from staking or farming the project's proprietary cryptocurrency – UNFI token;

- The possibility of obtaining loans. On one hand, farming allows some users to earn by placing their tokens in a special pool. On the other hand, these funds can be issued as loans to other users;

- High level of security. Thanks to the PoS consensus algorithm used in this protocol, network security is ensured by nodes of token holders;

- High transaction speed is also achieved through the use of the PoS mechanism. It allows for faster operation processing and lower transaction costs than the PoW algorithm.

Main disadvantages of the platform include:

- Incompleteness. Some ideas are still in the development stage, so it is uncertain whether they will succeed or not. Developers need to continue developing and promoting their platform;

- The need for further promotion. To succeed in the modern cryptocurrency world, it is not enough to just create and launch a good project; it must be correctly promoted. This requires the loyalty of a user community interested in the platform's development;

- Synchronization difficulties. According to some reviews, a few users have faced issues with synchronizing Unifi across registries, though this is not a common problem.

Prospects

After discussing the key features of the Unifi Protocol DAO platform and its proprietary token – UNFI cryptocurrency, it's time to talk about their development potential. The project is promising as it addresses some challenges faced by users.

For example, it offers lending opportunities without the paperwork and numerous checks carried out by banks. Thanks to the special uLend platform, loan applications can be made anonymously, and funds obtained on one blockchain can be used on another.

Moreover, the project's technologies enable asset transfers from one platform to another using a special cross-chain bridge. This is convenient as it allows users to reduce their costs by choosing platforms with lower commission fees.

For holders of the project's currency, there are opportunities to earn additional income through staking and farming. In the first case, funds support the platform's operation, while in the second, they are used as loanable funds to other users.

All these innovative solutions indicate the project's significant potential. It is a serious contender against the traditional banking system and the services it provides. If the project continues to develop its ideas, it stands a great chance of success.

As for the project's internal currency, its value primarily depends on the supply and demand ratio. It can be confidently stated that as the platform's popularity increases, the demand for its tokens will grow. Meanwhile, its supply is limited to 10 million units, which will contribute to its value increase.

Therefore, experts predict an increase in the value of this asset: some foresee it reaching up to $10, while others predict up to $66 and higher in the coming years. Whether the price of this cryptocurrency reaches such levels depends on many factors, including the development of the decentralized finance sector as a whole.

Conclusion

The Unifi Protocol DAO represents a promising project in the DeFi sector, aiming to solve some of the main problems of existing blockchain systems. Its utility token – UNFI cryptocurrency is used for the operation of the entire system and for conducting some operations.

Apart from using the project's own currency for exchange and settlements, it can also be used to earn and generate additional income. This can be achieved through staking or farming.

An interesting feature of the Unifi Protocol platform is also the presence of a second proprietary currency – the UP token. These coins are used to reward active users of the platform.

The project offers its clients various opportunities that can provide real competition to banking services. The platform offers cross-chain token trading and has its own liquidity pools, a lending platform, and other services.

With the application of innovative technologies, Unifi Protocol has the potential to become a central player in the decentralized finance market, offering clients secure, efficient, and convenient tools for managing their digital assets.

Back to articles

Back to articles