In the expansive landscape of blockchain-based projects, a myriad of initiatives vies for attention. Yet, while some ascend to the coveted top 10 positions in various digital currency rankings, others struggle to even breach the top 100. What distinguishes success and what pivotal factors drive it?

The case of Solana platform, currently positioned at 5th place in cryptocurrency rankings, is interesting indeed. Its ascent can be attributed to pioneering technical advancements adopted by project developers, enhancing transaction speeds and mitigating associated costs.

To explore further insights into the rankings and factors influencing a currency's ascent, delve into the article titled "Cryptocurrency List." Here, one can uncover the standings of other coins and tokens, alongside discerning the determinants shaping their trajectory in these rankings.

What is Solana?

Solana is a platform enabling swift and secure execution of a multitude of operations concurrently. Powered by a distinctive consensus algorithm, it stands toe-to-toe with established behemoths like Bitcoin and Ethereum.

The primary hurdle haunting "conventional" blockchains is scalability—limited capacity to process transactions. As transaction volumes surge, so does the processing time per transaction, culminating in a backlog of unprocessed transactions. This conundrum not only elongates transaction processing times but also escalates transaction fees.

Solana strides into this arena, poised to tackle these challenges head-on. With the potential to process an astonishing 700,000 operations per second in the future, Solana's network currently boasts a robust capacity of 50,000 to 65,000 transactions per second—a commendable feat in its own right.

Solana operates through a network of validator nodes responsible for verifying transactions and appending new blocks to the chain. To become a validator, one must stake a specific quantity of the platform's native currency – SOL tokens – within their account. Further elaboration on SOL tokens and their primary functions will follow in subsequent discussions.

However, Solana's utility extends far beyond mere cryptocurrency transfers. It constitutes an expansive ecosystem encompassing diverse industries such as applications, gaming, music, and more. Moreover, the platform facilitates smart contract execution and facilitates the creation and exchange of NFTs (Non-Fungible Tokens) and various other digital assets.

Project history

Programmer Anatoly Yakovenko, a former key employee of Qualcomm, began working on the project back in 2017. He initially worked on increasing capacity in cellular networks, but quickly realized that these technologies could be applied to the blockchain to increase its scalability.

Yakovenko bolstered the team by bringing aboard two seasoned professionals, Greg Fitzgerald and Eric Williams. The inception of the test network dates back to 2018, coinciding with the establishment of Solana Labs.

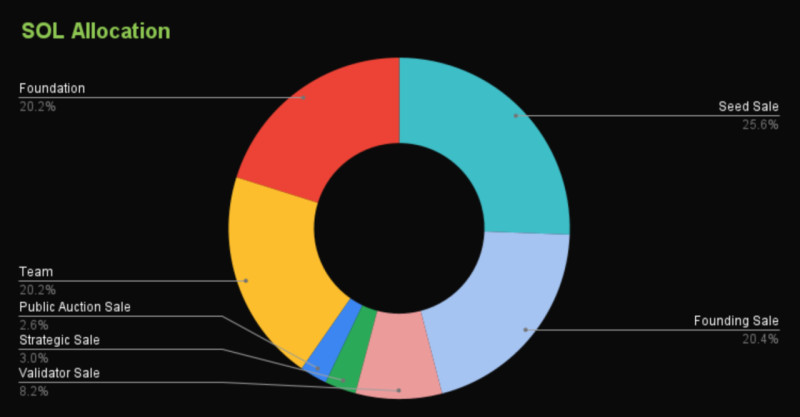

Between 2018 and 2019, developers conducted multiple rounds of private token sales, amassing over $20 million in funding. Subsequently, the mainnet was launched the following year.

In tandem with these developments, the Solana Foundation was established, with a primary mandate to foster platform development alongside research and educational initiatives. Solana Labs allocated 167 million SOL coins to facilitate its operations.

The platform swiftly garnered attention within the cryptocurrency sphere. Notably, in 2020, FTX crypto exchange disclosed plans to introduce a decentralized exchange built atop the Solana blockchain.

Moreover, a pivotal achievement in the fall of 2020 was the introduction of a cross-chain bridge connecting the Solana and Ethereum networks, enabling seamless asset transfers between the two ecosystems. The platform's robust NFT creation capabilities attracted a significant developer community, fueling the notable surge in SOL's value throughout 2021.

How Solana work?

The Solana platform operates on a first-level blockchain, devoid of sidechains or auxiliary networks, ensuring its independent functionality. Its success in the cryptocurrency realm can be attributed to a combination of factors, including its unique design and utilization of the SOL cryptocurrency.

At its core, Solana leverages the proof-of-stake (PoS) consensus algorithm, a more expedient and eco-friendly alternative to the energy-intensive proof-of-work (PoW) model. This choice reflects a commitment to efficiency and sustainability, as PoS consumes fewer energy resources.

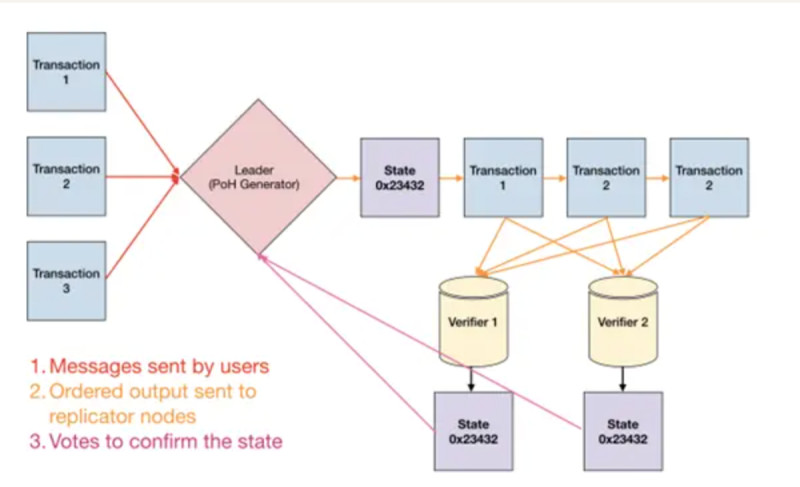

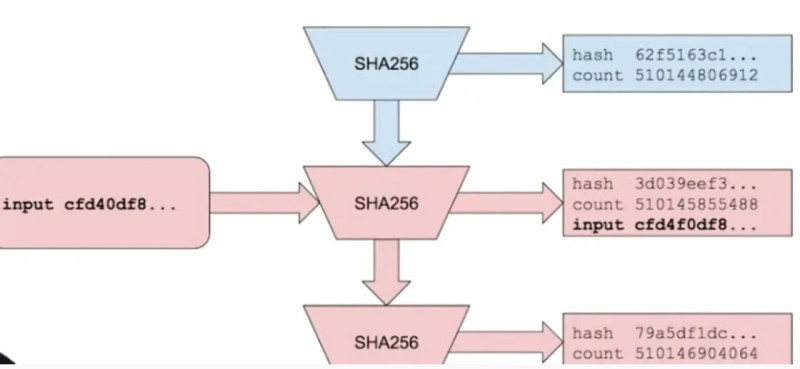

Yet, Solana's innovation doesn't stop there. To enhance transaction throughput, it employs a specialized auxiliary algorithm known as proof-of-history (PoH). This distinctive feature allows multiple transactions to be processed concurrently within the chain, subsequently inscribing them into blocks in a synchronized sequence. This parallel processing capability significantly boosts operational speed, distinguishing Solana within the blockchain landscape.

Indeed, the implementation of the proof-of-history (PoH) mechanism plays a pivotal role in Solana's operational efficiency. By timestamping each operation, PoH facilitates seamless synchronization, enhancing the platform's overall performance. While PoH serves the purpose of streamlining operation synchronization, it diverges from the conventional notion of a consensus algorithm.

For achieving consensus within the chain, Solana relies on the previously discussed proof-of-stake (PoS) mechanism. PoS ensures the integrity of transactions and block creation, complementing the role of PoH in maintaining continuous platform functionality and optimizing block creation times.

One notable advantage of Solana stems from its ability to support parallel node operation. This allows for the seamless addition of new nodes to the chain, thereby bolstering the platform's scalability. Unlike other networks where the addition of new nodes may impede performance, Solana's architecture enables uninterrupted scalability.

In traditional networks, the consensus process necessitates extensive communication among nodes to validate transactions and append new blocks. Solana's innovative approach accelerates this synchronization process, consequently elevating transaction speeds and overall platform efficiency.

Specific features

Let's delve into what distinguishes the Solana platform from its counterparts and fuels the popularity of its native currency, SOL cryptocurrency. Explore the unique features that set this platform apart and draw in a significant user base.

Let's delve into the distinct qualities that set the Solana platform apart and contribute to its popularity among users:

1. User-Centric Approach: Solana prioritizes user experience by proactively addressing potential challenges encountered within the blockchain ecosystem. This commitment to user satisfaction drives continuous improvement and refinement of the platform's functionalities.

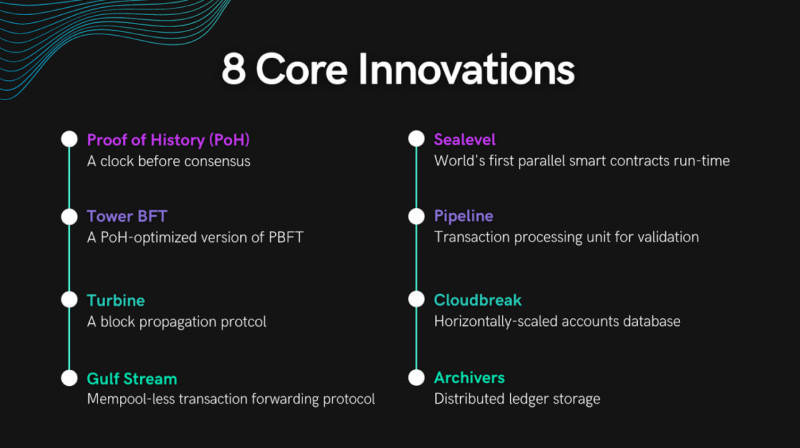

2. Innovative Scaling Mechanism: Solana employs a pioneering approach to scaling, eliminating the need for second-layer solutions. Unlike many other networks where transaction volume inversely affects processing speed, Solana's leader nodes effectively distribute workload, ensuring consistent throughput. This is facilitated by the unique Turbine transaction transfer protocol, which optimizes data distribution using the UDP protocol.

3. Efficient Transaction Protocol: Solana streamlines transaction processing through its Gulf Stream protocol, bypassing the need for a mempool. With predetermined validators and future leader nodes, transaction confirmation times are reduced, enabling faster operations.

4. Sealevel Virtual Machine: Solana boasts its proprietary Sealevel virtual machine, enabling parallel transaction processing. This innovative technology identifies non-overlapping transactions, processes them concurrently, and consolidates them into a single shard, optimizing efficiency.

5. Pipeline Optimization: Solana's validation process benefits from the Pipeline optimization method, which divides data processing into sequential stages. Each stage is handled by specialized equipment, ensuring streamlined and efficient validation.

6. Archiver Network: Solana incorporates a dedicated network of archiver nodes tasked with data storage, distinct from consensus participation. This segregation alleviates resource strain associated with data storage in traditional networks, enhancing overall network efficiency and scalability.

Comparative Analysis of Solana and Its Counterparts

While Solana stands out as a prominent blockchain platform, it's essential to recognize that several comparable projects exist within the ecosystem. Each possesses unique attributes catering to diverse user needs and objectives. This section aims to conduct a thorough comparison between Solana and other blockchain platforms offering similar functionalities.

Ethereum, as the foremost competitor, predates Solana but lags behind in transaction speed and cost-efficiency. Ethereum mitigates these shortcomings by leveraging auxiliary chains.

Cardano, like Solana, employs a PoS-based consensus mechanism for swift transaction processing. However, Cardano relies on sidechains for scalability, whereas Solana achieves scalability without auxiliary networks.

Polkadot serves as an interoperable network facilitating the integration of various chains. While it adopts parallel processing akin to Solana for scalability, Solana's advantage lies in its ability to interact with other networks via cross-chain bridges.

Tron, akin to Solana, supports decentralized application development, but its focus leans towards the entertainment industry, notably decentralized online betting.

Cosmos pioneers a cross-platform system to address blockchain scalability. By combining multiple chains seamlessly, Cosmos enhances user convenience, though Solana's direct scalability approach remains distinct.

SOL cryptocurrency

The SOL token, native to the Solana ecosystem, serves as the backbone of the platform, encompassing several critical functions. Here's a detailed exploration of why and how this currency is integral to the Solana network:

1. Transaction Fees and Smart Contract Execution: SOL tokens are utilized for paying transaction fees within the network and executing smart contracts seamlessly.

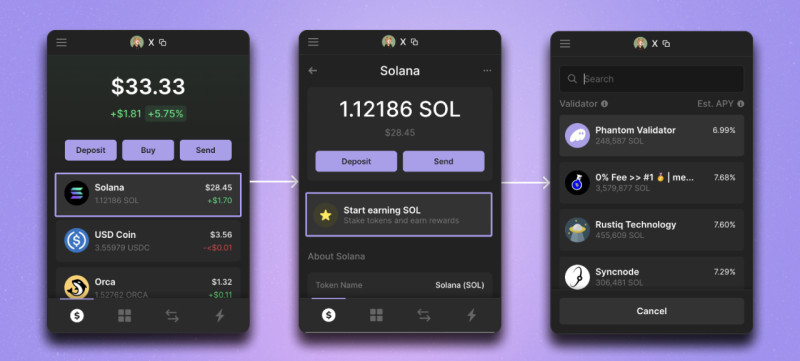

2. Staking: Holders have the opportunity to participate in staking, becoming validators to secure the network. There's no minimum requirement for staking, but higher staked amounts enhance potential earnings and increase the likelihood of becoming a prominent validator.

3. Rewards Distribution: Validators receive SOL tokens as rewards for verifying transactions and adding new blocks to the blockchain, incentivizing network security and participation.

4. Governance and Utility: SOL tokens are instrumental in governing the network, facilitating program execution, application launches, and data verification.

SOL tokens cannot be mined due to the platform's consensus mechanism. Instead, they can be acquired through trading platforms or earned as staking rewards, reinforcing the platform's robust and decentralized ecosystem.

The total coin supply of Solana is capped at 500 million units, but not all tokens are currently in circulation. A portion of the tokens was allocated to the Solana Foundation, some were distributed to private investors, and another segment was earmarked for the project team. As a result, approximately 39% of the tokens are freely circulating in the market.

Furthermore, the platform implements a gradual token burning mechanism to counteract inflationary pressures. As of the latest update, the value of one SOL token surpasses $153. However, it's noteworthy that during the platform's inception in 2020, the token was priced at a mere $0.50, underscoring the remarkable growth trajectory of the Solana ecosystem.

How to earn with Solana?

Cryptocurrencies, distinguished from fiat money, not only serve as a medium of exchange among users but also offer avenues for wealth generation. The SOL cryptocurrency exemplifies this, presenting diverse income-generating opportunities, which we'll explore in depth in this section.

1. Investing: This strategy involves committing capital for a relatively extended period, spanning from several months to years. Investors anticipate the asset's value to appreciate over time. Given the Solana project's youthfulness and substantial potential for further advancement, long-term investment in its native currency emerges as a prudent choice.

2. Trading: Generating income through short-term fluctuations in asset value characterizes trading. Digital currencies, owing to their pronounced volatility, offer fertile ground for speculative transactions. While the returns from trading may be less substantial than those from investment, traders can profit from both upward and downward movements in currency value. Accurate prediction of price direction and identifying optimal entry points into positions are pivotal for success in trading endeavors.

3. Staking: Staking offers an avenue for earning additional income by acquiring and holding coins in a dedicated account. Functioning akin to a traditional bank deposit, staking involves depositing funds and receiving a percentage of the deposit amount in return. Presently, staking in the Solana network yields approximately a 7% annual return.

4. Validator Node Creation: Validator nodes play a crucial role in the blockchain network, verifying transactions and appending new blocks. Participants in this role earn rewards in the form of newly minted SOL coins.

While there are currently no stringent prerequisites for establishing a validator node in the Solana network, holders with larger holdings of the native currency stand a higher chance of selection for validating transactions and adding blocks, thus garnering greater rewards.

Advantages and drawbacks

As with any blockchain network, the Solana platform, along with its native utility token, SOL cryptocurrency, exhibits a blend of strengths and weaknesses. Let's delve deeper into these aspects in this section.

Advantages:

- Scalability: Solana boasts remarkable scalability, with nearly boundless potential for network expansion. Operating at a staggering rate of up to 65,000 transactions per second, the platform achieves this feat without relying on third-party chains or additional infrastructure.

- Low Fees: Notably, Solana offers significantly reduced transaction fees compared to other prominent blockchains. While Ethereum transactions may incur fees as high as $8, Solana's costs are mere fractions of a cent, enhancing cost-efficiency for users.

- Environmental Sustainability: Leveraging a unique consensus algorithm, Solana minimizes the need for extensive computational resources, thereby reducing energy consumption and mitigating environmental impact.

- EVM Compatibility: Solana's compatibility with the Ethereum Virtual Machine (EVM) facilitates seamless asset transfers between blockchains, enhancing interoperability and expanding utility.

Drawbacks:

- Potential Centralization: Solana's hybrid blockchain architecture raises concerns regarding potential centralization, as significant amounts of the platform's native currency could concentrate within a limited number of nodes, potentially undermining decentralization.

- Limited Community: The platform's success hinges on the presence of a vibrant and engaged user community. A smaller-than-desired user base may hinder Solana's growth trajectory, necessitating concerted efforts to cultivate a robust and loyal user community invested in the platform's advancement and promotion.

Prospects

The Solana project is quite new, but in just a few years of its existence, its own token - SOL cryptocurrency - has already managed to firmly occupy a position in the top 10 digital currencies. This indicates that the project is developing successfully and has good prospects in this area.

The key advantages of the platform under consideration are high speed of transactions, low costs and potential for scalability without the involvement of sidechains and other auxiliary networks. This platform is suitable for applications designed for a large number of users and transactions.

Thanks to the technical innovations introduced into this platform, it is attracting an increasing number of developers who can use it to create decentralized applications, smart contracts and NFT tokens. The support of large and well-known platforms such as OpenSea increases the prestige and popularity of the Solana platform.

In addition, recently there has been concern around environmental issues around the world, and therefore cryptocurrency mining has been banned or limited in a number of countries. Such problems do not arise with the SOL token, since this project requires much lower energy costs, which makes it more environmentally friendly.

One of the negative aspects was the collapse in 2022 of the FTX cryptocurrency exchange, with which Solana had been cooperating since 2020. At that moment, the value of the SOL currency fell sharply, but gradually it began to increase in price and reached its current value in just a few months.

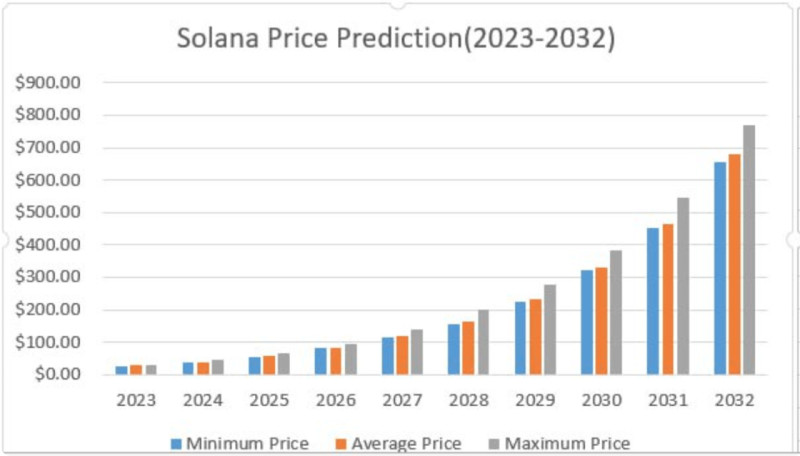

Presently, experts offer a spectrum of estimates regarding the potential growth of the SOL token's value, spanning from $334 to $3200. Only time will elucidate which of these projections materializes into reality. Nevertheless, it's crucial to acknowledge that the valuation of cryptocurrencies is subject to a multitude of variables and factors.

Conclusion

In this article, we've delved into the Solana cryptocurrency project and its native currency, SOL. Leveraging innovative technological advancements, Solana has achieved impressive transaction speeds coupled with minimal transaction fees.

Furthermore, Solana offers expansive opportunities for developing decentralized applications, engaging with smart contracts, and facilitating the creation and exchange of NFT tokens. Through the utilization of a cross-chain bridge, seamless data transfer between the Ethereum network and Solana is facilitated.

Solana's current throughput already surpasses 65,000 transactions per second, with developers aiming to push it beyond 700,000 transactions per second—a benchmark significantly higher than most other blockchains. Notably, Solana boasts independent scalability without the need for sidechains.

The platform employs a unique hybrid consensus mechanism enabling parallel processing of multiple transactions, each assigned a timestamp for later synchronization upon arrival.

Integral to the platform's operation, the utility token, SOL, serves several pivotal functions. It is utilized for transaction fee payments, rewarding validators, and facilitating staking. Staking offers token holders the opportunity to earn additional income through interest accrued on staked amounts.

Back to articles

Back to articles