Nowadays, there is immense interest in digital assets, regardless of the apparent price volatility of Bitcoin and other cryptocurrencies.

Many users struggle with understanding how and where to buy cryptocurrency. There are numerous ways to purchase Bitcoin and altcoins. These options include various platforms, crypto exchangers, and even money transfers. The key is to avoid mistakes while purchasing digital assets to prevent losing some or all of your investment.

In this article, we will explore all possible methods for buying and exchanging cryptocurrencies, discuss the advantages and disadvantages of each method, list the main options for storing, withdrawing, and transferring cryptocurrencies, explain how to create a digital asset and discuss the specifics of sending money transfers.

How cryptocurrency is used in modern world

Today, cryptocurrency has become an almost ubiquitous way to preserve and expand one's funds. Despite being an almost ideal instrument for speculation, cryptocurrencies also serve as a viable alternative to traditional financial systems.

Crypto payments are increasingly integrated into many aspects of modern life, including areas that previously only accepted conventional fiat money. In Western countries, a large number of companies now accept payments in unusual digital cryptocurrency without hesitation—these include mobile operators and even mortgage banking structures.

The list of such companies is complemented almost every week. But what can you buy with cryptocurrency today? Virtually anything. At Microsoft, for instance, you can easily buy games and applications using cryptocurrency. Interestingly, it was the first company to adopt this method back in 2014.

At Whole Foods, you can pay for groceries with cryptocurrency. The same payment method is also accepted by the mobile operator AT&T.

The Virgin Group has also welcomed the trend of crypto payments and added the option to pay with virtual cryptocurrencies. Now, Virgin Mobile's mobile and internet services (available to all customers) and even space flights with Virgin Galactic (for a much smaller group of affluent clients) can easily be paid by particular cryptocurrencies.

Let's take a look at various cities. In Vancouver, for example, you can enjoy a cup of coffee or grab a bite to eat at a diner and pay with blockchain money. Vancouver is considered one of the most advanced cities in Canada when it comes to integrating cryptocurrency into society. You can even pay for arranging a corporate event or a wedding with virtual money (for example, Man About Town Entertainment easily offers this option).

Switzerland is equally forward-thinking, where you can also pay with cryptocurrency, even at McDonald's.

But it's not only developed countries that are actively integrating crypto payments into society. In Latin America, for instance, such payments have become almost the only way to cope with economic crises and protect money from rampant inflation. In Venezuela, the average annual inflation rate in 2018 reached a mind-blowing 1,370,000%. Today, more than 5,000 different companies in Venezuela accept crypto payments.

In Venezuela, you can use digital currencies to pay at cafes, medical institutions, for housing and car rentals, mobile and internet services, buy air tickets, and purchase any food or non-food items in stores. In other words, Venezuela, far from a high standard of living, is integrating cryptocurrency into almost all areas of life.

Residents of Western countries and some Eastern and Asian states can use cryptocurrency even where it is not officially recognized as a means of payment. People in these countries use various methods to convert unauthorized virtual money into familiar fiat currency, often on the buyer's side. To sum up, you can pay for almost anything with cryptocurrency.

Of course, the question of how to buy cryptocurrency is not an issue there, as residents of these countries are well-informed about all possible methods of purchasing and exchanging such money.

Crypto debit cards can be found on popular centralized exchanges like Binance or Crypto.com. The same conversion system is offered by BitPay, Revolut, and Wirex.

Major payment systems like VISA are also not staying on the sidelines and are already testing the possibility of converting cryptocurrencies on their platform. Unfortunately, such options are not available to residents of all countries. Only the European Union and the United States are currently privileged in this regard.

In New York, residents are incredibly fortunate – even government agencies can legally accept payment for various services or operations in cryptocurrency. Additionally, there are states in the US where residents are even luckier, as they can pay for electricity with digital currency.

Where can you buy cryptocurrency?

All of the above clearly shows how cryptocurrency has become entrenched in society and the everyday life of any ordinary person from anywhere in the world. For this reason, today there are many options where you can buy cryptocurrency:

| Using a bank card | With cash |

| Through a cryptocurrency platform | By courier |

| Through an exchange office | Via terminal |

| Via P2P | In the office |

| Through payment systems | Through money transfer systems |

We will talk about each specific method in detail.

Cryptocurrency exchanges

You can purchase cryptocurrencies on trading platforms – exchanges. This method is both convenient and quite safe. When buying cryptocurrency on an exchange, the risk of falling into the hands of fraudsters is minimized.

However, exchanges do charge fees for using their trading platform, which can be significantly higher than those offered by other methods of buying digital assets, such as exchanges. The issue is that many crypto platforms do not provide the opportunity to sell cryptocurrency directly. They only collaborate with other similar services.

In other words, you transfer your funds to a third-party organization that facilitates the transaction with the crypto exchange. The exchange then credits you with virtual coins. As a result, you end up paying a double commission. Therefore, it is crucial to thoroughly check all the exchange's terms before agreeing to any transaction.

There are exchanges with built-in p2p services, like the popular Binance. On such platforms, you can make direct deals between buyers and sellers of cryptocurrency without involving third parties.

Although exchanges are considered the safest way to acquire cryptocurrency, they cannot guarantee 100% security. Unfortunately, their leaders can turn out to be crooks. Crypto exchanges can easily go bankrupt or be hacked.

In the past couple of years, dozens of cryptocurrency exchanges have been terminated for various reasons. For example, the founders of the Einstein crypto platform vanished, grabbing $16 million of clients' funds with them. QuadrigaCX also collapsed, leading to a complete loss of access for users to their virtual coins, totaling $140 million.

CoinExchange announced its closure, citing feasible reasons. Representatives of the exchange noted that running the business had become economically unjustifiable because the costs of maintaining a high level of security and liquidity far exceeded the company's profits.

FTX declared bankruptcy in the fall of 2022, and its CEO, Sam Bankman-Fried, was found guilty of fraudulent schemes. Before its collapse, FTX was one of the flagships of the crypto market.

At the end of January 2024, the new management of the defunct exchange announced that no further attempts to restore the platform would be made. Users who lost their funds after the bankruptcy are promised at least partial compensation. However, the digital assets will be paid out in dollars at the exchange rate at the time of the bankruptcy, which was $17,000 per Bitcoin.

To maintain liquidity, exchanges are forced to keep some of their funds in cryptocurrency. For this reason, many crypto exchanges faced serious financial difficulties during sudden drops in cryptocurrency prices.

Now, let's discuss how to buy cryptocurrency without losing your investment and which exchanges to avoid to prevent falling victim to fraud. So, which crypto platforms are not worth our attention, do not inspire trust, or are simply "dying"?

The main indicator of an exchange's looming bankruptcy is excessively high withdrawal fees for virtual money. By charging high fees, crypto platforms try to improve their precarious financial situation. For example, on the Bitflip exchange, which declared bankruptcy in 2018, users had to pay a withdrawal fee for Bitcoin that was twice as high as that of competitors.

When looking for an optimal platform to safely store cryptocurrency, pay attention to inflated rates. Many exchanges, in an effort to attract more clients, offer large orders, resulting in cryptocurrency prices that are 5-7% higher than adequate market rates.

Another indicator of a "dying" platform is either a completely absent support system or one that performs poorly. Likewise, the exchange team is aware of the company's problems and is simply abandoning the "sinking ship" while they still can.

A very negative indicator is low trading volumes. If there are no trades on the crypto platform, it means it has no main source of income from commissions. This raises the question of how the company maintains the website and all servers. Without the main source of profit, it becomes either economically unfeasible or simply impossible. When you see such a sign, it means there will soon be announcements of the platform's closure.

An obvious sign of a "sinking ship" is low liquidity and spreads, meaning the difference in cost between open buy or sell orders for cryptocurrency. This indicates that there are very few clients left on the platform today. A small number of active users means a small number of completed trades – the platform is barely trading, and therefore not making money.

Another important sign of problems on a crypto exchange can be the sudden disappearance of fiat withdrawal methods. Usually, payment systems are the first to learn about a platform's problems when capital starts "fleeing" quickly. When this happens, payment systems actively terminate all existing agreements with the exchange.

This was observed with the ailing Bitflip exchange. About six months before the public bankruptcy announcement, significant sums of fiat money began disappearing from the platform without explanation. The situation escalated so quickly that at one point there were no fiat funds left on the exchange, and the only withdrawal option was cryptocurrency.

You can also detect financial difficulties on an exchange if you notice the emergence of unknown digital coins or cryptocurrencies from untrustworthy projects. Since crypto exchanges take a commission for listing digital coins, this method may be used to fill budget gaps, even if it harms the platform's reputation.

Another sign of impending bankruptcy is serious withdrawal delays, especially if they occur regularly. This indicates that the platform is already facing a deficit of available capital and has to buy cryptocurrency from external services to fulfill withdrawal requests.

Undoubtedly, all the above signs cannot guarantee the insolvency of your chosen exchange with 100% certainty. However, they can indicate financial difficulties within the company that it might overcome. The main thing is to monitor the situation closely and ensure that the platform does not exhibit several of these indicators simultaneously. In such a case, it is advisable to take precautions and transfer your digital assets to a more reliable crypto platform.

Profit from cryptocurrency

How to start making money on cryptocurrency? It is important to analyze the different types of cryptocurrencies from the very beginning - Bitcoin, Ethereum, Solana, Litecoin, and others.

The level of your earnings and the level of risk will depend on which cryptocurrency you choose to earn.

For beginners, the following methods of making a profit in the crypto world are suitable:

| Trading | Mining | Staking and DeFi |

| You buy a digital asset on a crypto exchange and then sell it for a profit. | You use the computing power of your computer or other computing device to validate and add transactions to a single network (blockchain). | You store cryptocurrency in your wallet to support the operation of the entire network and receive a reward for participating in the consensus. |

Choosing right platform for buying and selling assets

The choice of platform for buying and selling assets depends on several important factors such as ease of use, the size of the fees charged, the availability of various cryptocurrencies, the level of security, and, of course, the reputation of the platform.

The most popular crypto platforms for purchasing digital assets are Bybit, Kraken, Binance, and CoinEx.

Always check the security of your trading account. To avoid losing funds, be sure to use two-factor authentication and store digital assets only in reliable wallets.

How to safely buy cryptocurrency? Try never to invest more than you are willing to lose and always follow your initially chosen strategy.

Do not neglect communication with those who have been successfully investing in cryptocurrencies for a long time. Spending time studying communities and forums will definitely not be in vain – you will get useful advice and gain new valuable knowledge.

Income from cryptocurrency investments

How much can you earn from cryptocurrency in a month? This question concerns many. In fact, almost everything depends on the specific method of earning and the amount of initial investment.

While it is difficult to make a profit of $500 per month from faucets, you can easily earn $5,000 per month through arbitrage and trading.

And this is no joke. According to a Coinbase survey, 62% of crypto traders pumped up their capital through investments in digital assets in 2022.

To make it clear, let's look at some examples.

For instance, Andrew lives permanently in Bali, where he is actively engaged in crypto asset arbitrage. His capital is just over $20,000. Andrew believes that in 12 months, he can enlarge his initial capital by 150% – increasing it by 1.5 times. At one point, the rupiah’s rate dropped sharply, and Andrew earned $2,000 from this event in just 4 hours.

Here’s another example. On July 13, 2020, a crypto trader significantly increased his capital through a token sale – earning an impressive $500,000 in just 30 minutes. At that time, the BZRX digital asset was listed on the crypto exchange, and the trader decided to aggressively buy up the coin, preventing others from purchasing it immediately. The trader bought almost 2 million coins and then easily sold them at a higher price.

Sometimes trading cryptocurrency can also bring a good income. For instance, the Bitcoin price surged by 62.23% from January 1 to September 21, 2023. This means that in less than 12 months, you could have doubled your capital.

However, when considering potential gains, always bear in mind the possible losses. Cryptocurrencies are highly volatile, with prices changing by as much as 10% or more within minutes. This instability is due to the fact that many cryptocurrencies are not backed by anything. The value of many digital assets depends only on supply and demand, and nothing else. For this reason, any investment in such assets is always very risky, as all invested funds can be lost very easily and in a matter of seconds.

Practical investment strategy in cryptocurrencies for beginners

For those who are not very familiar with financial management but want to know how to invest in cryptocurrency with maximum benefit, we recommend allocating no more than 5% of your capital for investments.

Considering that the crypto market is highly volatile and making forecasts is quite difficult, there is a high probability of entering at the peak of prices and a significant risk of being enticed into fraudulent schemes.

The most optimal and perhaps time-tested method is to invest in digital assets regularly and in equally small portions. Set a certain price threshold for yourself, which you will not exceed under any circumstances, and invest in cryptocurrencies periodically, from time to time.

With this strategy, we recommend looking at popular assets like Bitcoin and Ethereum. You can also consider other top altcoins. Investing in cryptocurrencies is not only about putting money into the assets themselves but also investing in shares of companies related to blockchain. Always choose only reliable projects with the highest capitalization.

By the way, for many beginners wondering "how to buy cryptocurrency," the interfaces of exchange services are usually more understandable than those of crypto exchanges.

Let’s consider a simple and effective HODL strategy, which is ideal for beginners. The HODL strategy involves buying cryptocurrencies for long-term holding.

For example, Bitcoin appreciated by 6,271,333% from 2011 to 2020. This means that simply holding Bitcoin in a wallet during this time was the most profitable strategy. Those who invested in this asset at its inception have now significantly increased their capital.

To invest in cryptocurrencies, it is enough to know how to transfer funds from one card to another or how to deposit funds into electronic wallets. All these options are available in the P2P network, which we will discuss later. With P2P, the balance in the exchange will only be credited after transferring funds to a specific person (referred to as a trusted representative of the exchange).

With the HODL strategy, you can forget about the coins for a while after purchasing them and occasionally monitor their price using a convenient mobile app from any crypto platform.

Cryptocurrency mining

The main idea of blockchain is decentralization and distribution. It is an open-distributed network that contains a database. It is practically impossible to hack or falsify the transactions implemented on it.

The principle of decentralization (i.e., the absence of a central supervising authority) is reflected in the very architecture of the blockchain: blocks are connected in a single chain, each block contains a reference to the previous block, and they are all securely protected by hashing.

Regardless of the number of participants involved in the mining process, a block is generated every 10 minutes. This supports the stability and resilience of the entire process. Each specific block contains transaction information and a Nonce. Nonce means a standard hash with a 256-bit step.

Mining involves selecting a hash that must have the first 70 bits as zeros. This requires significant computational resources. With every 2016 blocks, the network adjusts the "mining power," thereby changing the mining conditions. The complexity of the entire process gradually increases.

How to mine cryptocurrency on your own:

- To start mining cryptocurrency, you need powerful graphics cards or specialized ASIC chips. Some graphics cards can effectively process blocks without any additional components. The difficulty is that ASICs can be very hard to obtain. But a good idea is to assemble a mining rig yourself from the available graphics cards on the market. These could be high-quality cards from Nvidia or AMD. Remember: the more powerful your device, the more efficient your mining will be.

- Next, you need to get specialized mining software and choose a suitable pool. A pool is a server that distributes the calculation task among mining participants.

- Then create a wallet to store your cryptocurrency.

It is also important to decide which cryptocurrency you are going to mine. Although the mining process is almost always the same, different cryptocurrencies will affect the rewards and the overall difficulty of the process.

Exchangers

One of the most common answers to the question "how to buy cryptocurrency" is through exchangers.

This method helps to exchange or buy the most popular digital assets, which are in the top 20 by capitalization. The so-called flagships include well-known Bitcoin, Ethereum, XRP, and the popular stablecoin USDT, whose rate is pegged to the US dollar.

You can pay for virtual coins in various ways:

- Bank cards

- Payment systems (e.g., PayPal)

- Phone number

- Cash

Remember that when buying cryptocurrency through exchangers, you will be charged a commission. It can range from less than 1% to 10% or more, but typically it is a small 1-2%.

The commission you ultimately pay will depend on which cryptocurrency you are buying, the payment method you choose, and which specific exchange service you use.

If the cryptocurrency you are interested in is not in high demand among investors, the commissions will be higher.

It makes sense to acquire digital assets for regular fiat money after a significant market decline. For example, from May to June 2019, the Bitcoin rate was around $14,000, and exchanges at that time were paying users an average of 4-5% for buying coins through their service. However, when cashing out digital assets, users received 4-5% less.

When buying cryptocurrency through exchangers, you must specify the address where these crypto coins will be sent. You can create a wallet on any convenient crypto exchange, a cold wallet, or use other options.

It is crucial to be attentive and not make mistakes when filling out personal and user data during the purchase and transfer of virtual money. If you make a mistake, your funds will be lost, likely without any possibility of recovery.

If such a situation occurs, you should contact the support service of the platform you are using.

To maximize your safety when using exchange services and making transfers, we recommend using stablecoins. A reliable example is the USDT token, which is pegged to the US dollar. By following this recommendation, you protect yourself from unexpected losses during sharp drops in cryptocurrency value while transferring between wallets.

Some exchangers, to protect their clients and prevent unpleasant situations, offer an option to temporarily fix the cryptocurrency rate. This means that the digital asset rate is fixed for a while (usually 15 minutes). This allows you to avoid the negative impact of the market during periods of volatility.

However, the service may charge an additional fee for this useful option. Therefore, we recommend carefully studying all the rules of the exchange you choose to avoid unexpected losses when withdrawing virtual assets.

It is also important to remember that when purchasing digital assets through exchanges, there is a high risk of falling victim to fraud. When choosing a suitable service, we recommend researching forums and reading user reviews. Prefer only those exchangers that have established themselves in the market and have a good reputation.

Additionally, investigate whether the exchange has been involved in any illegal activities.

Once you have chosen a service, do not rush to deposit large sums of money. Be sure to test it with a small amount first.

P2P platforms

Exchangers are merely intermediaries that provide cryptocurrency exchange services, charging clients a fee for their services. However, you can also obtain cryptocurrency directly from other individuals without any intermediaries.

How to obtain cryptocurrency directly? One such option is P2P platforms. The term "P2P" comes from the phrase "person to person," meaning direct transactions without intermediaries.

The most popular and in-demand P2P platform is LocalBitcoins. On this platform, you can conduct buy/sell transactions of digital assets with another participant. The service acts as a guarantor of reliability, ensuring that neither party cheats the other.

However, P2P platforms have their disadvantages:

|

|

As a rule, P2P platforms can offer more profitable deals, but the risk of receiving money obtained through fraudulent means is higher than on exchangers or trading platforms.

Exchangers, for example, safeguard their reputation because they have built it over many years (reputation is probably their main marketing tool). The arrival of "dirty" money on their platforms can damage their market position and even lead to termination, so these services carefully monitor the funds entering their platforms. Additionally, exchanges and trading platforms have a wide range of tools to help them avoid regulatory pressure and control.

But how can you transfer cryptocurrency without intermediaries and without the risk of using shady funds? Unfortunately, P2P platforms cannot solve this nuance. On these platforms, regular users can often be less responsible, so many clients on these platforms use "drops," engage in so-called "triangles," and often exchange not only stolen money but also drug money.

Electronic payment systems

There are payment systems that help you exchange fiat money for cryptocurrencies and vice versa. Moreover, they can facilitate the deposit and withdrawal of funds from any bank card.

Popular electronic payment systems that can answer the question "how to buy cryptocurrency" include:

| PayPal |

| Advanced Cash |

| Perfect Money |

| Payeer |

| WebMoney |

However, the PayPal system may not be suitable for everyone because all its cryptocurrency-related services are available only to US residents.

Courier

Another way to buy cryptocurrency is to use a courier service. This option is very popular among those who do not want to be "visible" and fall under the control of financial monitoring organizations and various bank security services. This method is often used when intending to exchange a significant amount of money (at least $10,000).

In any major city with an airport, it is easy to request a courier who will arrive from any cryptocurrency exchange point. However, you must consider travel expenses (tickets there and back) from the nearest city with an exchange office – all these costs will be covered by the customer of such a service.

These expenses will be deducted from you as a fixed commission for the exchange process. It is clear that due to these additional costs, this method of purchasing digital assets is not suitable for everyone and only makes sense when you are going to buy cryptocurrency for a substantial amount.

The process of buying cryptocurrency through a courier is quite simple:

|

| 2. Specify the country and city you need. |

3. Choose the most suitable option from the proposed ones. Note that the exchange rate is not the main reference point here, as the time between placing an order and meeting with the courier can vary significantly, and by the time of your actual meeting, the rate may already be at a completely different level. |

| 4. Go to the exchange's website, create an order, and discuss the terms of the meeting. This usually happens in the exchange's website chat. |

ATM

The terminal is another way to buy cryptocurrency. Today, there are two ways to interact with terminals:

- Crypto ATMs

- Regular ATMs

If you decide to use a crypto ATM, look for functioning ATMs in your city through which you can perform cryptocurrency transactions. For example, there is a network called RusBit, which was quite active not long ago. The entire interaction process is not complex and is very similar to using a regular ATM.

If you intend to use a regular ATM, look for exchange points that support the cash-in function from various banks.

It is important to remember that this method of buying cryptocurrency may attract the attention of various financial monitoring organizations. However, the good news is that you cannot receive a "dirty" transfer through this method.

The terminal is the answer to the pressing question of "how to buy cryptocurrency without the controlling authorities knowing?" The process of obtaining digital money through a terminal usually rarely falls under the control of regulatory authorities, as it is formally carried out as the most ordinary cash deposit into your personal account, which means this process is not defined by the system as a money transfer.

Office

The office is one of the simplest ways to cash out cryptocurrency. The process of obtaining digital assets through an office is almost the same as using courier services. The difference is that in megacities, some exchange points also have physical cash desks that you can visit.

Such offices can easily be found in any major financial hub. There will be especially many such offices in countries where there is a high demand for cryptocurrency.

Money transfer systems

There is another way to buy cryptocurrency. One of the most unusual and perhaps least used methods is purchasing and withdrawing cryptocurrency through money transfer systems like Western Union, Contact, Zolotaya Korona, and other similar systems.

The process of transferring funds through such systems is the same as when using regular ATMs: first, you find a suitable exchange service, and then a payment system office where you can send or receive cash.

It all seems simple and straightforward, but in reality, the convenience of this method is quite questionable, especially considering that this type of operation is almost indistinguishable from a regular bank transfer, which can easily attract the attention of regulatory authorities.

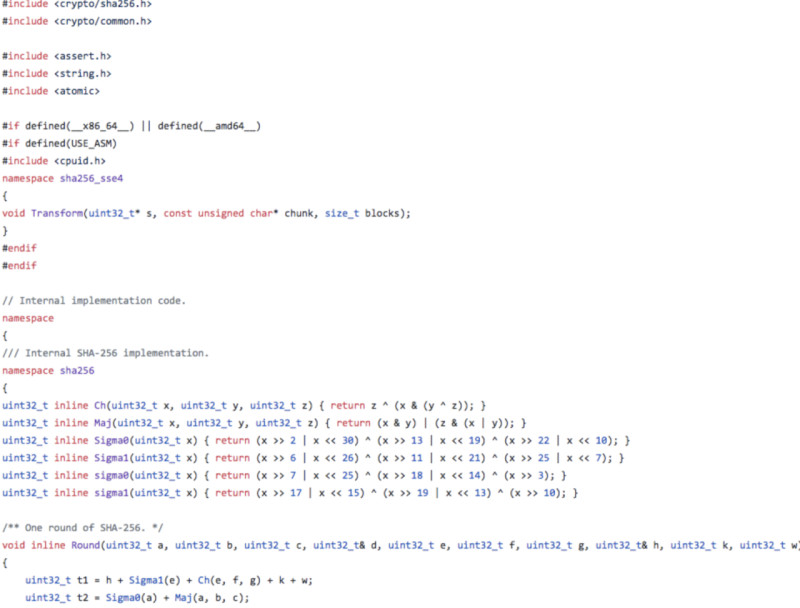

Creating your own cryptocurrency

With the rapid development of blockchain technologies, materials on how to buy cryptocurrency are no longer rare and hard to find. Moreover, you can easily find step-by-step instructions online on how to create your own cryptocurrency. In modern reality, new crypto coins are constantly being invented, and new crypto projects pop up every week.

But let's be honest, creating a cryptocurrency from scratch is a thankless and lengthy task.

We recommend not wasting too much effort and looking for available and well-known websites that offer the most suitable and high-quality source code.

Based on the data from there, you can build a network, with the source code acting as the foundation that you will significantly modify in the process of creating your digital asset.

Currently, the market offers a wide variety of already created (written) products that can help you save time. There are ready-made codes that can save you both time and money.

When you find and finally get the code you need for the crypto program, study the properties of your personal computer. Today, you can even prepare your computer – load the necessary libraries for the proper functioning of the software. By the way, such systems are most often created on Linux.

Preparing the system is not difficult; you will need boost, db48, qt4-mac, etc. After this, you can set the commands and start the process.

Next, you will need to process (i.e., edit) the source code. The source code is in a ready state but will still need significant changes. The most creative task at this stage is to come up with a name for your digital currency.

Then, in the program code, you will need to replace the old (already outdated) names with the name of the cryptocurrency that you invented.

However, do not rush to change all these fragments manually; you will tire before reaching your goal, as this process is incredibly long and, naturally, very tedious (for reference: there are more than 10,000 fragments in the code). There are specialized software tools that can help you replace all mentions with just one click.

When this stage is complete, meaning all names have been replaced, congratulations – you have completed the first important stage of creating your digital currency.

Next, you need to implement the technical execution of the code. In other words, you will need to configure the necessary network settings and create open network ports. You can specify all the ports with network access that will perform the main procedures.

You will need to choose 4 ports that will be used for other purposes. Typically, RPC, P2P and similar ports are chosen.

Often, "cryptocurrency creators" encounter difficulties at this point. The issue is that they often decide to choose already occupied ports.

Once a series of ports has been selected, changes must be made to the prepared code.

These changes mark the final stage of creating a new cryptocurrency. At this stage, you can already think about advertising and even start launching it.

Next, we start the process for generating currency units in the form of blocks that will be deciphered later. Then we manually set the amount of the new asset. This amount is transferred to the miner after the necessary data volume is processed and an answer regarding 1 block is obtained.

Next, change the following characteristics: the time required to solve a block, the emission volume of the new cryptocurrency, the number of blocks per day.

If you have executed the code correctly and without a single error, your efforts will lead to powerful software like GUI. It will use the standard client-server methodology in its operation.

Storing cryptocurrency

We have discussed how to buy cryptocurrency and even how to create it. Now let's move on to the question of where to store cryptocurrency.

There is a wide variety of options for storing digital assets, so there are plenty to choose from:

- Crypto exchanges;

- Crypto wallets, one of the most popular and reliable being Trust Wallet;

- Hardware wallets, we recommend checking out Ledger Nano S, which provides a high level of security;

- Software crypto wallets, such as Exodus (ideal for PCs and mobile devices);

- Browser extension MetaMask, a mobile application from ConsenSys;

- Popular cross-platform wallet Atomic Wallet, suitable for storage, staking, and exchange;

- Hardware storage Trezor is recognized as reliable;

- Capital platform, highly demanded by users.

To trade and store cryptocurrencies, you need to use a cryptocurrency wallet, preferably several.

We store real (physical) coins and banknotes of fiat money in a wallet that we can see, touch, and put in our pocket or bag. A crypto wallet, on the other hand, is a special computer program; it is not real, but virtual. Through it, users gain direct access to blockchain systems where their virtual coins are stored.

A crypto wallet is not actually a place to store cryptocurrency. Rather, it is a tool that allows users to view records of digital assets on the blockchain. A crypto wallet can be compared to a bank card, which does not contain money itself but allows you to make payments with those funds and transfers.

Any crypto wallet consists of two elements (keys):

| Public key | Private key |

| is accessible to every user, is a set of letters and numbers (similar to a plastic card number). | is used to confirm transactions with cryptocurrency (similar to a password or digital signature that services request when paying for purchases). |

There are a few types of crypto wallets.

| Custodial | Non-custodial |

Keys to custodial wallets are usually stored on centralized exchanges (for example, Binance), where cryptocurrency trading takes place. Disadvantages: vulnerable to hacking and blocking | They are not tied to a specific exchange and can be either single-currency or multi-currency. The most popular non-custodial wallets: Metamask Trustwallet Phantom Non-custodial wallets are: Hot wallets are connected to the Internet and are quite convenient to use, but the security will be low Software wallets are installed on the device. They are more secure than hot wallets, but can only be used on a specific device Hardware (cold) wallets do not have a constant connection to the Internet, but at the same time provide the highest level of security. |

Step-by-step guide to withdrawing cryptocurrency to card

In this section, we will step-by-step review two main ways to withdraw cryptocurrency to a card: from an exchange service and from a cryptocurrency exchange.

Exchange services typically offer users a straightforward exchange algorithm, regardless of the bank card you plan to use.

Note: If you want to transact with USDT, be sure to specify which protocol is being used: TRC20 or ERC20. Be sure to review the fees on the selected service (these will already be considered in the exchange), then click “Exchange”. |

2. Enter your bank card number where the funds will be credited. Exchange services usually work seamlessly with Visa and Mastercard. Double-check the data you entered, then click “Exchange” again. |

| 3. Log in to the system. You may be asked to complete a simple authorization (provide Email, phone number, and password). Then click “Continue”. |

| 4. Choose a payment method that suits you and pay the request on the payment system's website. Then click “Pay”. |

5. The final step is receiving the requested funds on your bank card. Exchange services execute transactions quickly, but processing speed will depend on network load and the bank’s verification process for the card you are using. |

Now, let's look at how to withdraw cryptocurrency to a card from a cryptocurrency exchange. We will not use a specific crypto platform as an example but will outline the general steps applicable to any exchange. So, how to withdraw cryptocurrency from an exchange:

|

| 2. Choose “Withdraw”. |

| 3. Since you are transferring money to a bank account, select the fiat option. |

| 4. Enter your card details: number, expiration date, security code, and address. Then add the card. |

| 5. Enter the withdrawal details: the amount you want to withdraw and the account number to which the money will be transferred. |

| 6. Enter the security confirmation codes. To verify your phone number, the system will send an SMS. If the system needs to verify your email, it will send a code to the provided email address. Enter the codes in the field, then confirm your withdrawal request. |

Transferring cryptocurrency to another wallet

If you are wondering how to transfer cryptocurrency to another person (for example, to donate, pay for services, return a debt, or give a gift), it is best to transfer it to their electronic wallet. It’s quite simple, even a school student can handle it.

This transfer is done as follows:

- Open your crypto wallet and go to the “Send” section.

- Paste the recipient's wallet address in the recipient field.

- Enter the amount you intend to transfer.

- Adjust the commission size (if your wallet provides such an option).

- Verify all entered data and confirm the operation.

You can also use mobile crypto wallets, which offer a convenient option to send digital coins to another person via QR code scanning.

When choosing a crypto wallet for fund transfers, always consider the fees charged for provided services. However, do not confuse these with network fees.

If you transfer virtual funds to a wallet of the same service used by the recipient, you can significantly save on fees.

Always ensure that the wallet you are sending money from and the wallet receiving the funds are in the same cryptocurrency. For example, do not transfer Ethereum to a Bitcoin wallet address, as you might lose these funds irretrievably.

Always copy the transfer address in its entirety. This is important because users often select a string of characters with a mouse and, in a rush (which should be avoided), may not notice that they missed the last few characters. The built-in address copy function is there for a reason.

Specifics of sending and receiving transfers

Any bank is required to monitor all your financial transactions, but most of them are checked not by people but by specialized automated systems (essentially robots). For this reason, certain patterns can be identified that will definitely attract the attention of both banks and their regulatory authorities.

How to buy cryptocurrency through exchange points and P2P while avoiding bank control? The robot only records the transfer between two individuals and nothing more. It cannot know the purpose of the payment. It can only find out if you or the exchange service you are using provide this information in the payment comments.

The security system may examine such transactions and draw conclusions about potential suspicious activities based on metadata.

It is important to note that the tracking and control system of a particular method of obtaining cryptocurrency does not consider specific situations, conditions, or even the amount you withdraw or deposit. Most often, the robots built into the monitoring system analyze volumes over a day, week, and month. A single transaction for an insignificant amount will not be considered by the robot.

Back to articles

Back to articles