What is cryptocurrency?

Cryptocurrency is a digital payment system that allows transactions between users. They can send and receive digital assets anywhere in the world. Cryptocurrency operates in a decentralized system where all participants are equal, and banks do not regulate operations.

This currency exists only in digital form and has no physical equivalent. Transactions are recorded in public ledgers, and encryption (cryptography) is used to verify them, ensuring security and reliability.

In 2009, the first cryptocurrency, Bitcoin, appeared. Today, it remains the most popular and well-known digital asset. Many find the cryptocurrency sphere attractive due to the numerous opportunities it offers for earning.

In this article, we will examine what APR is in cryptocurrency and how it affects potential earnings.

What is APR in crypto trading?

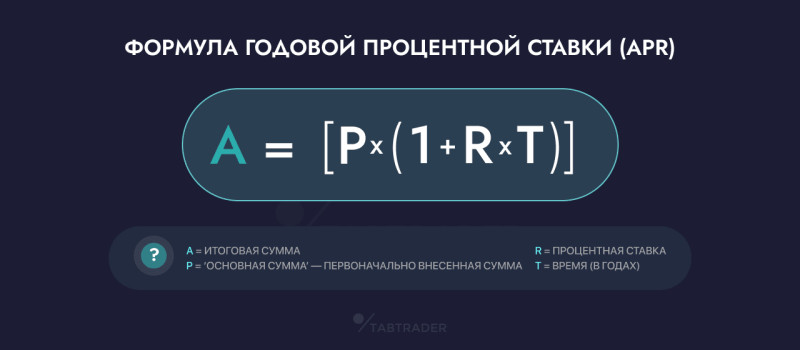

APR is the interest rate at which an investor puts in their money. It helps investors calculate the amount they can earn over a year. In other words, APR represents the income an investor receives from their investment. APR accounts for borrowers' payments but does not include compound interest.

Some platforms offer high APRs to users who stake their digital assets. For example, if we are offered a 10% APR and invest $100, we will earn $10 in profit over the year. If we borrow $100 at the same rate, we will need to repay the borrowed amount plus an additional 10%.

This percentage applies to the amount we invested. If the investment period is six months with a 10% APR, the investor will earn only 5% of the invested amount.

What is APY in crypto trading?

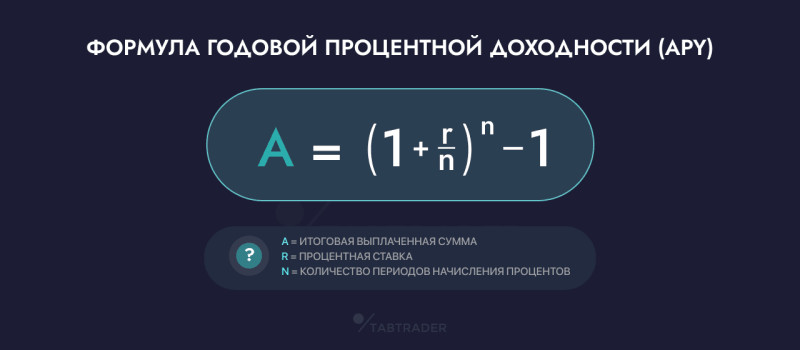

APY is also a percentage used to calculate expected earnings, but it is more complex than APR. If interest is compounded more than once a year, the APY rate will be higher. Simply put, APY represents earnings on previously earned interest.

With APY, you can earn more on your investments than with APR. The frequency of interest payouts affects the total amount earned. The more frequently you invest, the higher the return. For example, daily investments will yield more profit than monthly ones. Over the long term, the benefits of compound interest will be more evident. When calculating potential returns, it is essential to pay attention to the interest rate and its details. With a 10% APY and daily interest, we will earn more in the long run than with a 10% APR, thanks to compound interest.

Overall, APR is a simpler and more stable rate. It remains unchanged during the investment period. APY represents compound interest, which can vary depending on how frequently interest is added.

It is crucial to understand the context in which APY is used. It can mean different things for various cryptocurrency projects. Some products use APY to indicate the exact reward an investor will receive, while in other cases, the term might refer to the potential return in any currency.

It is essential to keep this in mind since the value of digital assets can be volatile. If the value of the currency drops significantly, your investments may be worth less than what you initially invested.

We recommend carefully reviewing what each project offers and what conditions it sets. This will help you understand the risks associated with the investment and what APY means in a particular case.

How to compare interest rates

As discussed earlier, compound interest yields higher returns. However, it is important to note that projects with high APY may not always be more profitable than those with lower APR. To choose the most beneficial rate for yourself, you can use an online calculator.

Therefore, when investing in staking products, it is important to compare APY and APR to find the best conditions. When comparing DeFi products with different APYs, ensure that the profit is calculated for the same period. For example, two projects may offer the same APR, but one compounds interest monthly while the other compounds it daily. The latter will yield higher returns.

Advantages and disadvantages of APR

Pros:

- Easy to use. APR is a yearly rate that does not account for reinvestment, making it easy to use and understand.

- Clear calculation. Since there are no compound interests, investors can easily calculate their expected returns.

Cons:

- Uncertain final profit. Without reinvestment, investors cannot predict their exact income after a year.

- Limited applicability. The absence of compound interest restricts its potential use.

Advantages and disadvantages of APY

Pros:

- APY uses compound interest, making it possible to calculate more accurate overall returns.

- APY allows investors to compare different investment options more easily, taking into account reinvestment.

Cons:

- Difficult to use: APY can be harder to understand and use compared to APR. Many investors find it more difficult to grasp and therefore may avoid using it.

- Confusion: Investors sometimes confuse APY with a simple interest rate, but APY includes reinvestment, unlike standard rates.

- Hard to understand: Although APY offers a better understanding of potential earnings, it is less intuitive. This can make it hard to predict the exact profit.

Key differences between APY and APR

Both APY and APR are used to calculate the interest rate for cryptocurrency investments, but they are quite different.

APR shows the annual earnings without compound interest, while APY calculates profit over a year including compound interest. For example, if both APY and APR offer the same investment amount, interest rate, and investment period, the key difference would be the presence of compound interest in APY.

Compound interest represents the total earnings, including interest on both the principal amount and any accumulated interest. Since APR does not involve compound interest, APY tends to offer higher returns over time.

Investors can allocate funds to liquidity pools on exchanges, hold digital assets in accounts, or invest in yield farms. APR may benefit borrowers seeking favorable terms, but for those investing, it is essential to pay attention to APY to maximize earnings. To make the most of your investments, it is important to understand the difference between APY and APR, allowing you to choose the best product.

A significant portion of investors still use APR. However, if they want to reinvest their earnings daily or weekly, they will have to manually calculate compound interest.

Which rate is better?

We have already discussed what APR and APY mean in cryptocurrency. But which rate is better?

APY allows for the precise calculation of earnings, while APR only shows the expected rate. Both rates are calculated annually, but funds can be withdrawn at any time, along with the interest earned.

Each rate has its advantages depending on the conditions. For example, APR is best for borrowers seeking lower rates. APY, on the other hand, is more beneficial for investing in digital assets, as it includes compound interest, giving a clearer picture of potential returns.

How can a cryptocurrency deposit help preserve and grow your capital?

As the cryptocurrency market grows, crypto deposits have become increasingly popular. Many companies now offer good interest rates for storing funds. Such rates can protect against inflation and help earn money. For example, stablecoin deposits are similar to holding money in dollars.

Currently, there are about 200 cryptocurrency companies, but this does not affect interest rates' competitiveness. Despite the high number of offers, companies still provide better conditions than regular banks. DeFi products stand out for their excellent terms and rates.

To maximize profits, you can invest in altcoins. Unlike stablecoins, altcoins offer greater earning potential, although the value of assets could fall, leading to losses. Cryptocurrency deposits allow passive income generation through staking, yield farming, and passive investments. These methods are known for delivering good returns.

Why do cryptocurrency deposits offer high returns?

Several factors contribute to the profitability of crypto deposits:

- High demand for liquidity: Cryptocurrency companies offer attractive lending conditions. High interest rates lead to favorable deposit rates.

- Diverse earning tools: Crypto companies have numerous revenue-generating tools, such as fiat channels, margin trading, spot trading, and futures.

- High risks: Cryptocurrencies are at risk if a company goes bankrupt. A recent example is the collapse of the FTX exchange. This encourages crypto companies to offer better terms than traditional banks.

How do cryptocurrency deposits work?

Cryptocurrency deposits function similarly to traditional ones, but instead of fiat currency, digital assets like tokens or coins are used. Their value is often pegged to fiat currency. To earn interest, investors need to open an account, deposit funds, and wait for a certain period to gain profit.

The interest formation process for cryptocurrency deposits follows a pattern similar to that of bank deposits. Exchanges lend out the funds deposited by investors at specific rates. This creates a system where there are those who wish to borrow assets and those who are willing to lend them. In this setup, the exchange acts as an intermediary between the borrower and the lender.

Cryptocurrency deposits generally offer higher rates because the funds are lent in cryptocurrency, which is more volatile than fiat currencies. For instance, the ruble's devaluation against the dollar might reach 10-15% annually, while cryptocurrency values can fluctuate from 10% to 90% over the same period.

How to register on an exchange and open an account

To open an account on a cryptocurrency exchange, there is no need to visit a physical location, unlike traditional banks. Everything is done online. Before registering, you need to choose the exchange where you will open your account. It is important to approach this step carefully, as it directly affects the safety of your funds.

Once you have chosen an exchange, go to its main website and start the registration process. Here are the steps:

- Fill out the form with your personal details (full name, date of birth, phone number, email address).

- Upload scanned copies of your documents. The required documents vary depending on the exchange but can include a passport, driver's license, or identification number.

It is recommended to use internationally recognized documents, as this may speed up the registration and verification process. Double-check the information you enter to ensure it matches your documents. In some cases, the exchange may require proof of residence, such as a recent utility bill or a bank statement. If you complete these steps correctly, registration and verification should take about 30 minutes.

Account funding

To create a crypto deposit, you will need to deposit your funds into the exchange. Currently, the most convenient and cost-effective method is P2P (peer-to-peer), as it allows for depositing money without paying the high fees associated with many other methods.

How P2P works

P2P (peer-to-peer) is a currency transfer between users. This method involves no intermediaries. Simply put, one user wants to fund their exchange account, and another wants to withdraw their funds. Therefore, the P2P transaction takes place directly between them without any middlemen.

The seller creates an order, setting the price they are willing to sell their asset for, and the buyer decides whether that price suits them. There will be many sellers listed, and your task is to choose the one with the best terms. After selecting a seller, you will need to transfer the specified amount to their bank card. Once you complete the transfer, you must confirm it by pressing the appropriate button.

The exchange where the transactions take place ensures that both parties meet their obligations and prevents fraud. Before the seller makes the transfer, the amount listed in the order is blocked. Once it is confirmed that the buyer’s payment has been received by the seller, the buyer’s funding account is credited with the digital currency.

How to deposit

Almost every cryptocurrency exchange site has an "earn" section. To invest your funds, you need to go to this section, and select an interest rate, a deposit term, and the cryptocurrency you wish to invest in. Once you complete this process, your funds will be credited. If your crypto assets differ from the ones you want to invest in, you will need to exchange them in the spot wallet.

Profitability of cryptocurrency investments: rates and terms

Cryptocurrency interest rates can be either fixed or floating. With a fixed rate, the amount you invest remains unchanged throughout the entire deposit period. A floating rate, however, can change depending on the supply and demand for a particular cryptocurrency. Crypto deposits can also be fixed-term or on-demand. If you choose a fixed-term or on-demand deposit, keep in mind that you may lose your earnings if you withdraw the funds before the term ends.

We have already explained what APR and APY mean in cryptocurrency. In short, these are the rates used to calculate your investment returns. You will often encounter these terms if you plan to invest at interest. The earnings from your investment will be transferred to your spot wallet, allowing you to use them easily. Some exchanges also offer automatic renewal options.

Risks of deposits

In traditional banking, the deposit guarantee fund protects user rights. If the bank where the investor placed their deposit goes bankrupt, they receive compensation up to a certain amount. However, if a cryptocurrency exchange goes bankrupt, no such guarantees exist. The exchange could collapse or refuse to return funds.

In addition, banks are regulated and supervised, with capital requirements imposed on them. Cryptocurrency exchanges are also required to comply with national laws, but how strictly they are regulated is unclear.

Before an investor decides to invest, they can only research the project and read customer reviews, but no one can guarantee security.

Another risk associated with such deposits is the unpredictability of the market. Cryptocurrency prices can be highly volatile. While fiat deposits can also lose value, they are generally more stable.

How cryptocurrency companies earn

Cryptocurrency deposits are used by exchanges to generate profit. Over time, this profit is shared between the exchange and the investors. When compared to bank deposits, cryptocurrency investments offer more earning tools. Here are some of the key ways exchanges generate revenue:

- Spot trading. The exchange earns commission fees from users who engage in trading transactions.

- Margin trading. The exchange charges fees not only on trades but also on the credit funds it provides to traders to increase their purchasing power.

- Futures trading. This method does not involve buying cryptocurrency. In this case, the exchange earns from traders using derivative instruments.

- P2P trading. The exchange earns from commissions on transactions.

- Fiat channels. The exchange profits from selling crypto assets.

Conclusion

In this article, we have explained what APR is in cryptocurrency trading and how you can use this tool to calculate your returns. Cryptocurrency deposits are easier to use than bank deposits and offer higher profits. However, they also carry higher storage risks.

Based on this, we recommend investing a small amount of money in such deposits and spreading your savings across several exchanges. When choosing a platform for storing your funds, do not chase the highest interest rates, as higher rates also involve higher risks.

Back to articles

Back to articles