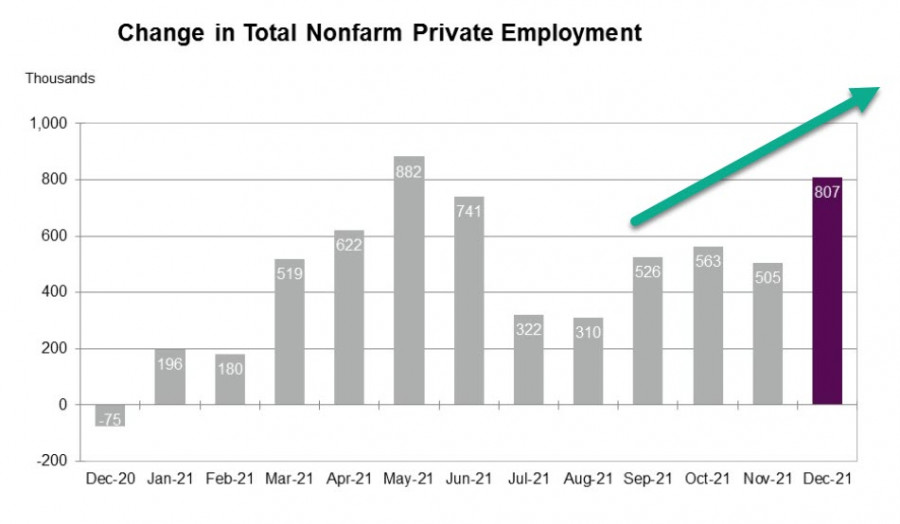

The employment data in the US private sector for December noticeably exceeded forecasts, the growth of 807 thousand new jobs is the highest in the last 7 months. It is clear that there is no direct connection between ADP and Nonfarm data, but as it often happens, weak Nonfarm data come out after a strong ADP report or vice versa. Now, it can be assumed that the probability of seeing strong employment figures on Friday has become higher.

The strong ADP is quite correlated with yesterday's ISM employment data in the industry, where growth is also noted. At the moment, we should wait for the ISM report on the services sector, which will be released at 12.00 Universal time today.

The markets reacted to the ADP report quite sharply. The yield of 10-year UST reached 1.744%, which is the maximum for more than 9 months. Global yields increased, which indicates that the market is convinced that the Fed will withstand the previously announced pace of normalization.

As for the Fed's plans, the minutes of the December meeting published yesterday evening did not provide any new information. The opinion was expressed (perhaps in order to prevent sharp fluctuations in the markets) that once the pandemic weakens, structural factors that kept inflation low in the previous decade may begin to emerge. This phrase is likely to slightly lower inflation expectations, as soon as the command is given to end the pandemic hysteria.

What's particularly interesting are the Fed's plans to reduce the balance sheet. Preliminary, this process may begin after the first rate hike. It is unclear how the Fed will technically ensure this process without the threat of a collapse of stock markets and the threat of stagnation, but as long as this is a matter of the future, the demand for the US dollar will remain steadily high.

Today, the US dollar is expected to continue to strengthen, the dynamics of which may change after the publication of the ISM report. The demand for risk may fall if the probability of strong Nonfarms increases according to the results of the ISM report.

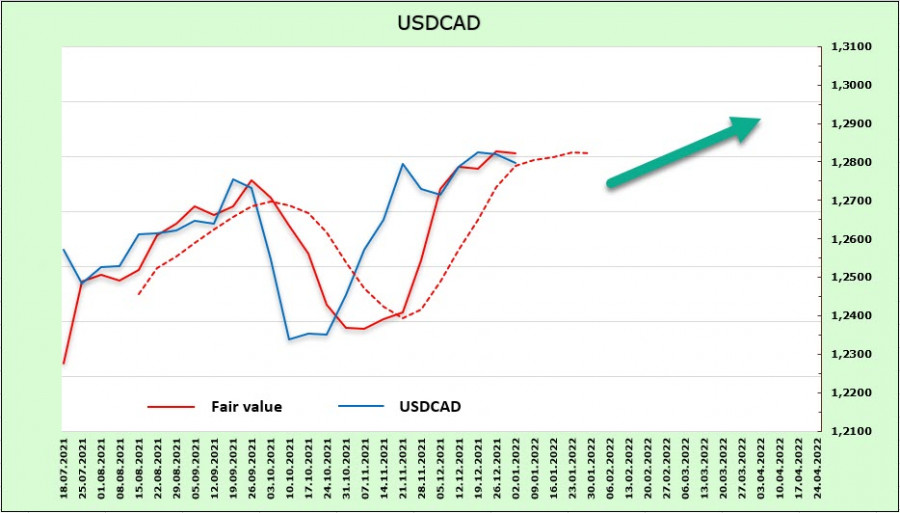

USD/CAD

The growth in oil prices and the overall positive mood of the markets failed to give the Canadian dollar enough reason to counter the expectations of the Fed rate. In this case, the USD/CAD direction looks more upward than downward. In the futures market, the dynamics are weak. A small short position in CAD remains, and the target price in growth seems to have stopped but is above the long-term average.

Any attempts to fall will be considered as corrective. The targets are still higher than the current levels, not lower. The USD/CAD pair found support at the level of 1.2620 (50% pullback from growth at the end of 2021). There might be an attempt to strengthen the bullish pressure and to test the resistance zone of 1.2940/50. The next target is set at 1.3020.

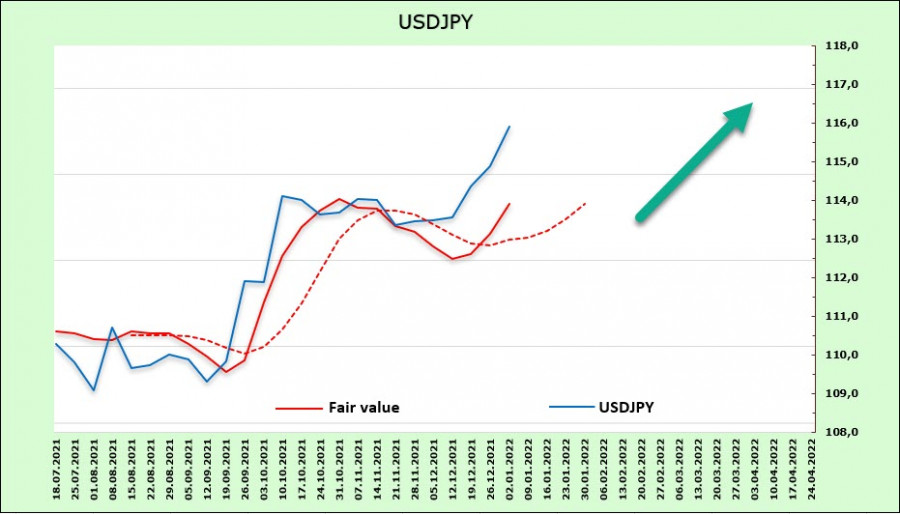

USD/JPY

Japan is one of the few countries that are not yet preparing for the curtailment of stimulus measures. The head of the Bank of Japan Kuroda said after the December meeting that "none of the decisions made abroad will not have an immediate impact on the policy approach of the Bank of Japan." Each country strengthens the economy and stabilizes prices in its own way, which means that the normalization of policy in Europe and North America does not automatically require the same actions from the Bank of Japan.

The withdrawal from stimulus contributes to the strengthening of the currency, but on the contrary, Kuroda says that a slight depreciation of the yen is actually positive for the Japanese economy. There is no reason to believe that BoJ will somehow change its position, which means that the most natural behavior of the yen in the current conditions is its further weakening. The net-short position is declining, but very slowly. According to the CFTC report, the speculative bearish advantage is still evident. The target price is going far up, reacting to the growth of US Treasury yields.

It is assumed that the update of the local high of 115.54 will not end. The target of 118.60 is still far from it, but the further upward scenario looks much more convincing than the correctional ones.