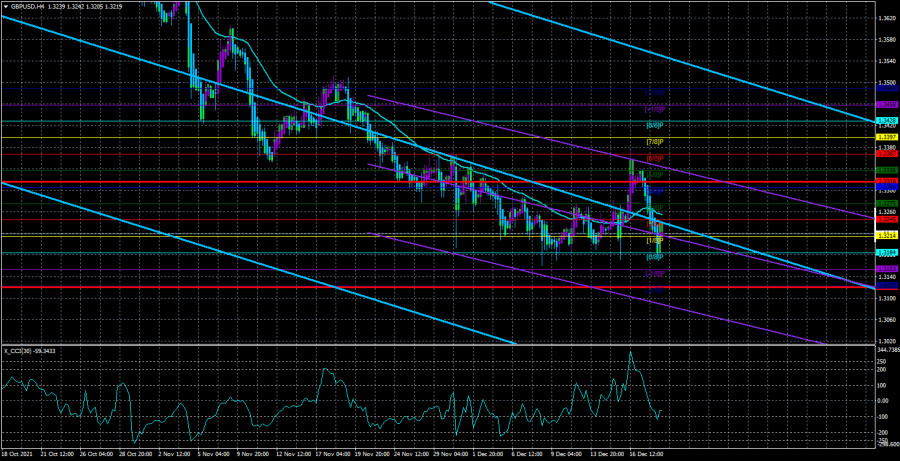

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

The GBP/USD currency pair on Monday collapsed down to the Murray level of "0/8" - 1.3184. This was followed by a rebound and an equally strong growth of the British currency. And if you look carefully at the illustration above, it becomes clear that the pair has already bounced five times from the Murray level "2/8" and stopped two more times a few points from this level. This means, at a minimum, that the price has found a strong support level. However, we believe that the pair has found a side channel. Yes, although no sideways movement is visible on the 4-hour timeframe, we believe that, as in the case of the euro/dollar pair, the price is now and will be inside the side channel. To be more specific, inside channel 1.3184 – 1.3275. The fact is that last week, the pound sterling quite unexpectedly received strong support from the Bank of England, which decided to raise the rate before even completing the quantitative stimulus program. Thus, solely thanks to this event, the pound sterling grew stronger than the technical picture required. However, as we can see, the pair very quickly returned to the designated range. For example, on Friday, when there was no reason for the pound to fall, the pair's quotes went down about 100 points. Therefore, in the next two weeks, we believe there is a fairly high probability that the pair will trade in a narrow side channel. The reasons are the same as for the euro currency. Two festive weeks, a small amount of macroeconomic statistics, the departure of some traders from the market (due to holidays and vacations).

There is a state of emergency in London, and there are not enough beds for patients in the USA.

Unfortunately, the year 2021 ends not on a positive note. Although this year the world has received several vaccines against the "coronavirus" at once, the situation with the epidemic has not become better or easier. The only plus is the reduction in mortality rates and the number of hospitalizations. However, the virus also adapts to its environment and its new mutations turn out to be more contagious, which negates the entire effect of creating vaccines. It turns out to be a situation in which the number of infections, hospitalizations, and deaths falls since people are vaccinated, but immediately increases since new strains are more contagious than the previous ones. This means that more people are infected, and more people are admitted to hospitals even with a lower percentage of hospitalizations. Unfortunately, the situation is getting worse in both the US and the UK. In America, several states report a shortage of beds in hospitals, and the country's chief epidemiologist Anthony Fauci calls for preparing for a "hard winter," calling omicron a "serious problem." In the UK, on December 17, the anti-record for the number of cases of the disease was broken from the very beginning of the pandemic, and an emergency regime has already been introduced in London since more than a third of all sick Londoners have already picked up omicron. According to doctors, the new strain is spreading very quickly and may become dominant in the near future in all countries of the world. Both the US and the UK are not going to tighten quarantine measures yet, but if the situation continues to deteriorate, then this step will have to be taken. This is especially true of Boris Johnson, who is unlikely to be forgiven for another defeat as Prime Minister. Recall that after the first "wave" Johnson came under a barrage of criticism, as the country was simply not ready for such an emergency, and Johnson himself refused to take it seriously at the very beginning of the pandemic. Thus, potentially, the US or UK economy may start to slow down again. And how much this or that economy will slow down will depend entirely on how strong the new "wave" of the pandemic will be and how well the authorities of each country will resist it, first of all.

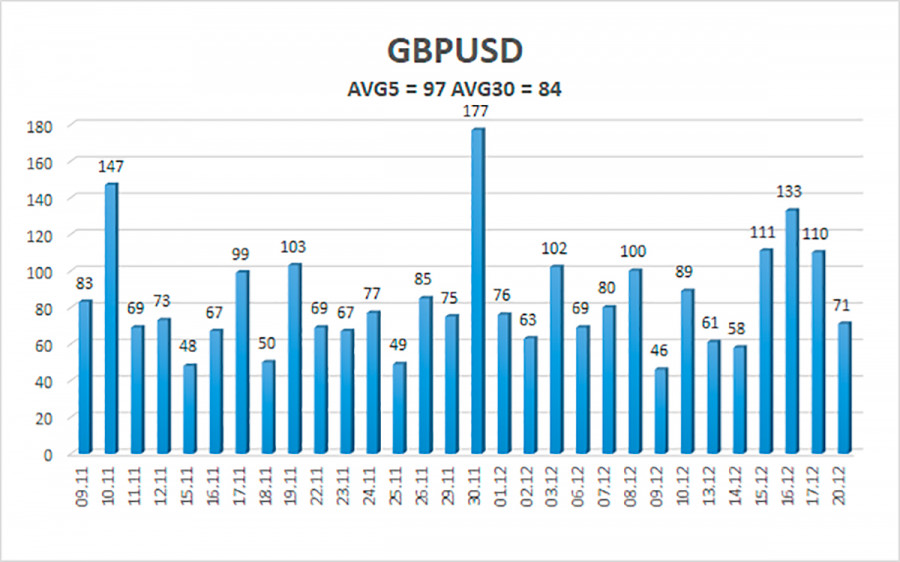

The average volatility of the GBP/USD pair is currently 97 points per day. For the pound/dollar pair, this value is "average". On Tuesday, December 21, therefore, we expect movement inside the channel, limited by the levels of 1.3122 and 1.3316. The reversal of the Heiken Ashi indicator downwards signals a round of downward movement inside the side channel.

Nearest support levels:

S1 – 1.3214

S2 – 1.3184

S3 – 1.3153

Nearest resistance levels:

R1 – 1.3245

R2 – 1.3275

R3 – 1.3306

Trading recommendations:

The GBP/USD pair returned to the side channel on the 4-hour timeframe. Thus, at this time, you should trade for a rebound from any of the boundaries of this channel of 1.3184 - 1.3275. Or wait for the pair to exit it to form a new trend.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.