Today's main event is the publication of consumer inflation data, which is forecasted to rise to 7%. Core inflation is also expected to grow to 5%. If confirmed, both indicators will exert strong pressure on the position of the Fed members. During his speech to the Senate yesterday, Fed Chairman J. Powell tried to ease tensions, saying that the regulator has the opportunity to reduce inflation without noticeable damage to the economy, but avoided announcing any deadlines regarding the Fed's next actions.

Yesterday, it turned out that China's inflation fell in December from 2.3% to 1.5%, which is a good sign for world markets as this may indicate a weakening of global inflationary pressures. The reaction of the market was immediate – global yields decline, stock indices rebounded up, and March Brent futures firmly consolidated above $ 83/bbl. Thus, an attempt to update the October high of $ 86.7/bbl is getting closer.

Risk demand is helping to weaken the US dollar, but this is unlikely to last long. The weakness of the US dollar is temporary since conditions have not yet developed for broad and long-term positivity.

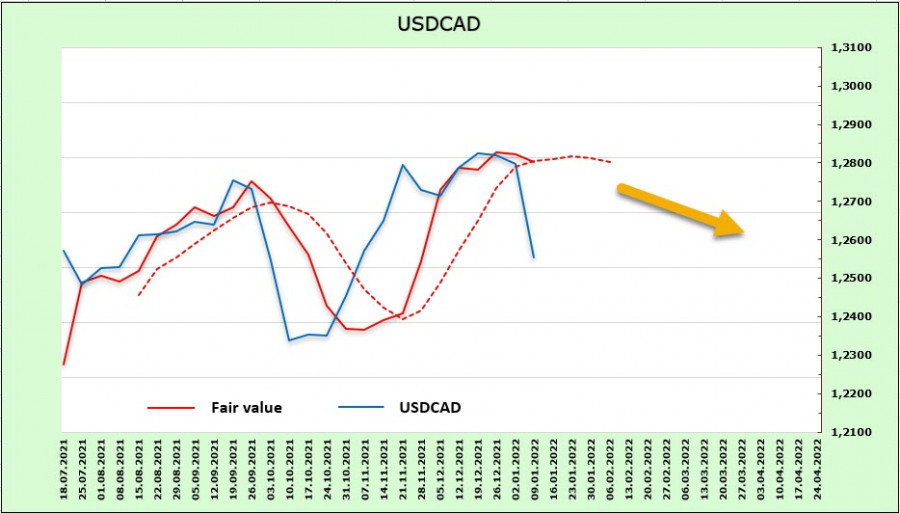

USD/CAD

The first important event this month was the labor market report, which turned out to be unexpectedly positive. In December, 55 thousand new jobs were created, full employment increased by 123 thousand, unemployment dropped to 5.9%, and the employment rate is already 1.25% above the pre-pandemic level.

The only negative in the report is the decline in the rate of wage growth to 2.7% y/y, which is significantly lower than the official inflation rate.

Meanwhile, the positive foreign trade balance for the sixth month in a row also added optimism. A surplus of 3.1 billion is the largest surplus since the fall of 2008.

As for negative factors, we have fears about COVID-19. Omicron is spreading much faster than the Delta, which has already led to the introduction of some restrictions in the service sector. This will clearly affect the pound. In any case, it is probably early to wait for the Bank of Canada's decisive action despite the recovery of the labor market.

The CFTC report does not yet show a reversal in the Canadian dollar. The net short position increased by 62 million to -868 million, that is, speculative interest in buying this currency has not yet been formed. At the same time, the lack of dynamics makes all attempts to strengthen the Canadian corrective.

The overall demand for positivity and the steady growth of oil allowed the Canadian dollar to decline to the support level of 1.2540. The next support is 1.2550/70, but it should be assumed that a return to the bullish trend can occur anytime.

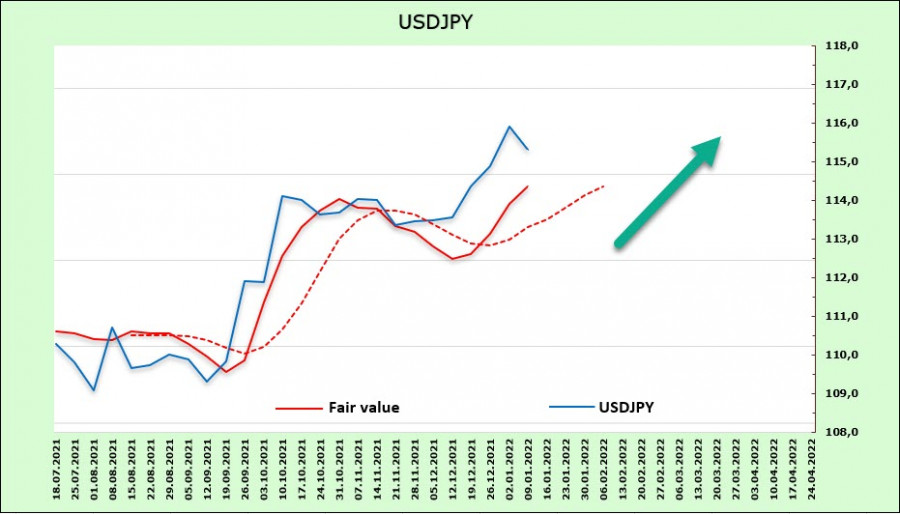

USD/JPY

Anxious expectations are rising again in Japanese business circles. The Eco Watchers poll conducted by the Cabinet of Ministers gave an unexpected result – respondents assessed the current condition in the economy even higher than forecasts (+ 56.4p against + 56.2p), and at the same time, the forecast for the near future sharply fell (+ 49.4p against + 55.7p), dropping into the negative zone. This means that business is expecting a deterioration in economic conditions, despite the fact that the weak yen allowed maintaining a positive trade balance, a decrease in household spending, and a zero growth in average wages, that is, deflation is returning.

Worsening economic outlooks will further weaken the Japanese yen as the Bank of Japan will avoid any hints of curtailing stimulus in the near future.

The yen is being sold on the futures market again. According to the CFTC review, the net short position during the reporting week increased by 919 million to -6.7 billion. The long-term trend for the yen is clearly bearish, but the estimated price is sharply directed upwards.

The strong bullish trend continues. The USD/JPY pair has updated its 5-year high and obviously, this is not the limit. The strong resistance level at 118.60 is getting closer, so it is highly possible it will be reached soon.