Analysis of previous trades and trading recommendations

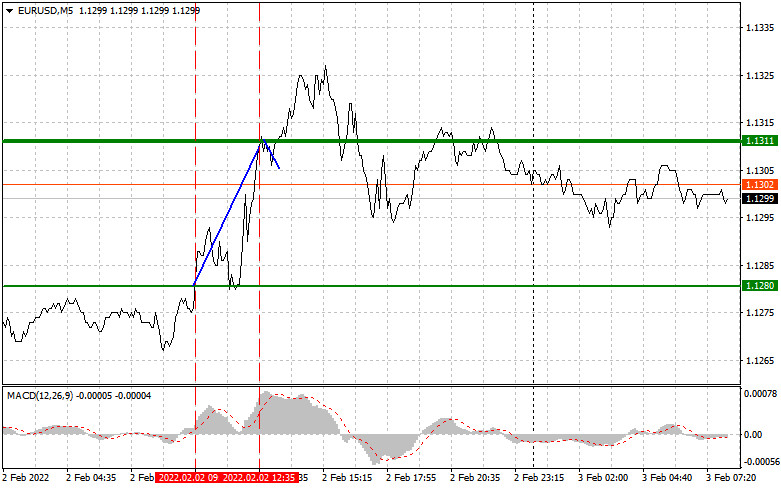

The price tested 1.1280 when the MACD indicator just began moving upwards from the zero level. This proved a right entry point for long positions on the euro. Strong data on the eurozone inflation supported the bullish trend, thus causing a new jump towards fresh highs. As a result, the euro/dollar pair added around 30 pips. Sell orders opened at 1.1311 failed to bring the expected result. However, there were no other signals to enter the market.

In both Italy and the eurozone, inflation exceeded not only the forecasts, but also its yearly highs. This may force the ECB to revise its approach to monetary policy. Data on the US ADP non-farm employment change disappointed traders. The number of new jobs slumped in January.

Early today, the eurozone is going to disclose preliminary estimates on the producer price index as well as on the services and composite PMI. The reports will hardly have a significant influence on the market since market participants are focused on the ECB meeting. If the regulator switches to a more hawkish stance to combat the surging inflation, demand for the euro may jump, thus boosting the euro/dollar pair.

If the regulator does not announce new measures, pressure on risky assets may soar. In the second part of the day, traders should pay attention to the US unemployment claims figures as well as on the services and composite PMI data. Notably, the ISM services PMI report will be more significant than the previous ones. Strong fundamental data may allow the greenback to recoup some of its losses.

Buy signals

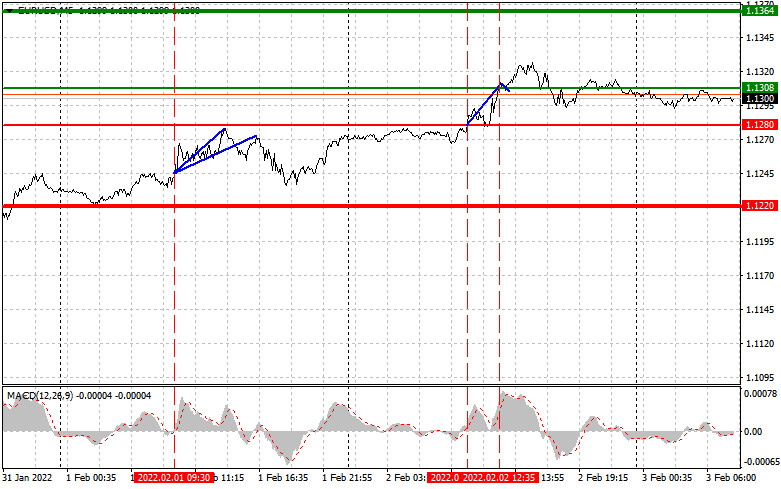

Scenario 1: today, it is possible to buy the euro when the price hits 1.1308 (a green line on the charts) with the target at 1.1364. Once the price touches 1.1364, traders should lock in profits and open sell positions. The price may lose 10-15 pips. Today, the euro may rise only amid a positive report on the eurozone inflation and faster tapering of stimulus programs by the ECB. Importantly, before opening buy positions, make sure that the MACD indicator is above the zero level and is just beginning rising from it.

Scenario 2: today, it is also possible to buy the euro when it hits 1.1280. The MACD indicator should be in the oversold area. This may cap a downward potential of the pair and cause the market reversal. The price may climb to 1.1308 and 1.1364.

Sell signals

Scenario 1: It is possible to open sell positions on the euro after it hits the level of 1.1280 (a red line on the chart). A target is located at 1.1220, where it is recommended to leave the market and buy the euro. The price may slide by 10-15 pips. Lower inflationary pressure and zero reaction from the ECB to the inflation rise may provide a strong signal about a decline in the euro. Importantly, before opening sell positions, make sure that the MACD indicator is below the zero level and is starting to move from it.

Scenario 2: it is also possible to sell the euro after it touches 1.1308. At this moment, the MACD indicator should be in the overbought zone to cap the upward potential of the pair, thus causing the market reversal. The pair may decline to 1.1280 and 1.1220.

What we see on the chart:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.