On Monday, the GBP/USD currency pair showed no desire whatsoever to react to Maduro's arrest by US military forces and his deportation to the United States for trial. Overall, we believe this is absolutely justified, since there was essentially no geopolitical conflict. The military operation in Venezuela lasted five hours and ended very quickly. A trial of Maduro will take place in the near future, but it is already clear that Washington will install a government suitable to itself in Caracas. Therefore, from now on Venezuela will "breathe" only as much as the United States allows it to.

Thus, 2026 has begun very energetically (in the bad sense of the word), and Donald Trump immediately showed that 2025 was merely a warm-up. The most interesting events still lie ahead. The White House leader now intends to "save the Cuban people" from a criminal regime and also to take control of Greenland. With both Cuba and Greenland, he may face serious problems, since it is no secret that the former has close and friendly ties with Russia, while the latter is a territory of Denmark—that is, part of the European Union.

That said, the controversial US president has already stated that no military intervention against Cuba is planned, and the European Union is unlikely to sit idly by and watch American warships move toward Greenland. Therefore, we believe that no coup in Cuba or seizure of the Danish island will take place. It should be understood that Trump is not aiming for prolonged military conflicts. Throughout 2025, he positioned himself as the world's leading peacemaker and even seriously sought the Nobel Peace Prize. He did not receive it. Thus, carrying out a blitzkrieg in a neighboring state and quickly achieving the objective is one thing; entering into open confrontation with Russia (over Cuba) or with the European Union (over Greenland) is hardly possible.

Most likely, Trump's actions in Venezuela are meant to show the entire world how far he is willing to go to achieve his goals. His opponents, after these events, should take a softer stance in any negotiations. Trump is clearly planning to gain control of Greenland through peaceful means, and the European Union has already shown in recent trade negotiations that it finds it easier to concede and accept "onerous" deal terms than to fight and defend its own interests. However, all of this is high-level politics, and we are convinced that no one knows all the details. We can judge events only very superficially.

Let us return to the British pound and its prospects. They have not changed, and the current week will show how "dovish" the Fed will be at its next two meetings. We remind readers that this week data on the labor market and unemployment will be published, on the basis of which the Federal Reserve will make decisions in January and March. The market does not yet believe in another key rate cut in January, but it is not the market that sets rates—it is the Fed, based on economic data.

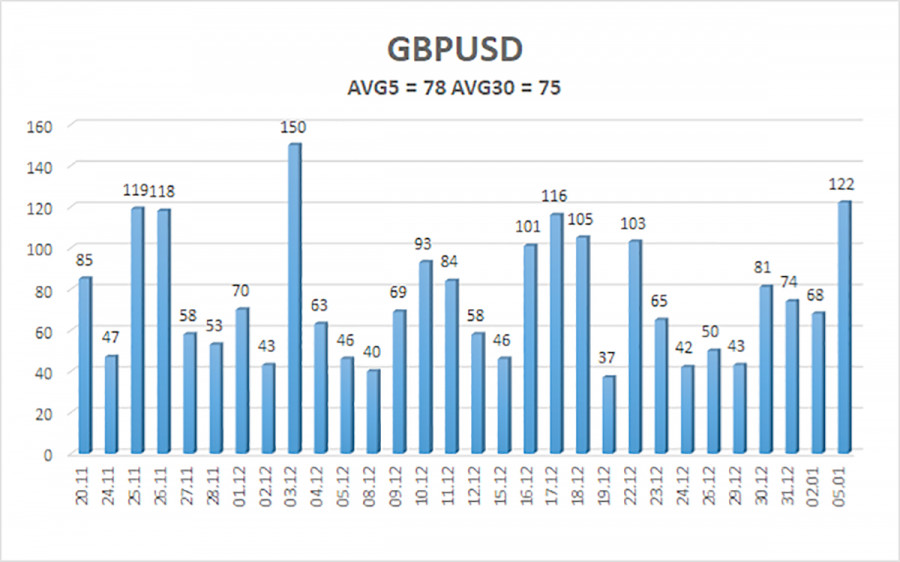

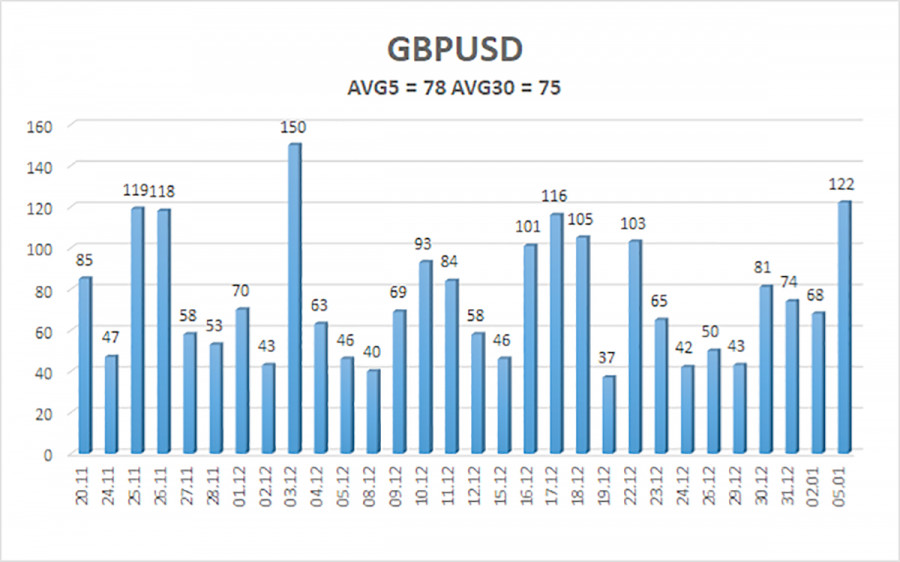

The average volatility of the GBP/USD pair over the past five trading days is 78 points. For the pound/dollar pair, this value is considered "average." Thus, on Tuesday, January 6, we expect movement within the range bounded by the levels of 1.3443 and 1.3599. The higher linear regression channel has turned upward, indicating a recovery of the trend. The CCI indicator has entered the oversold zone six times in recent months and has formed numerous bullish divergences, constantly warning traders of the continuation of the upward trend.

Nearest Support Levels:

S1 – 1.3489S2 – 1.3428 S3 – 1.3367

Nearest Resistance Levels:

R1 – 1.3550

Trading Recommendations

The GBP/USD currency pair is trying to resume the 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the US economy, so we do not expect growth from the American currency. Therefore, long positions with targets at 1.3550 and 1.3599 remain relevant in the near term as long as the price is above the moving average. When the price is below the moving average, small short positions may be considered on technical grounds with a target of 1.3367. From time to time, the US currency shows corrections (on a global scale), but for trend-based strengthening it needs signs of the end of the trade war or other global positive factors.

Explanations to the Illustrations

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong.

- The moving average (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- The CCI indicator: when it enters the oversold zone (below ?250) or the overbought zone (above +250), it signals that a trend reversal in the opposite direction is approaching.