Trade Review and Tips for Trading the Japanese Yen

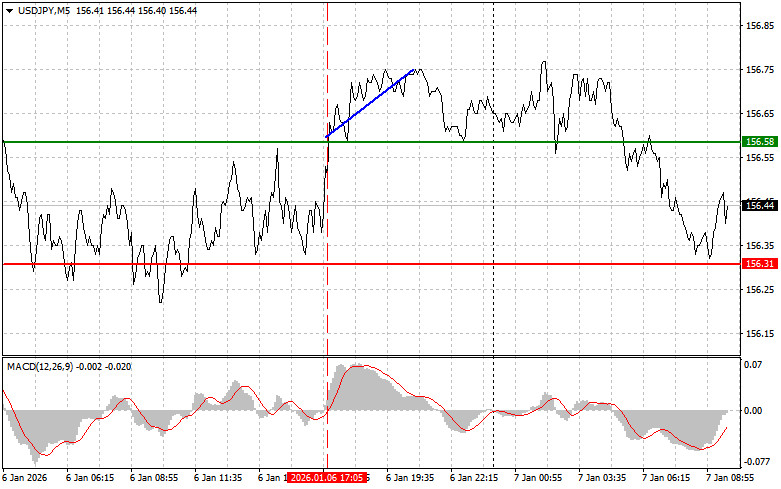

The test of the 156.58 price level coincided with the moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the dollar. As a result, the pair rose by 15 points.

Yesterday, the yen continued to trade within a sideways channel against the dollar after news that the U.S. services PMI came in below economists' forecasts. This created some uncertainty among investors about the strength of the U.S. economy, increasing expectations of further interest rate cuts by the Federal Reserve.

Today's data showing a decline in Japan's services PMI was also ignored by traders. At first glance, such a market reaction may raise questions, since macroeconomic indicators traditionally serve as a guide for investment decisions. However, there are explanations here as well. First, the decline in Japan's PMI may have been perceived as a temporary phenomenon that does not reflect long-term trends. The market tends to ignore one-off fluctuations and focus on more sustainable trends. In addition, the decline could have been linked to seasonal factors or technical adjustments. Second, traders' attention may have shifted to other aspects that are more important to them—namely, the future actions of the Bank of Japan regarding interest rate hikes. Third, it is also possible that market participants had already priced in the expected decline in the PMI.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

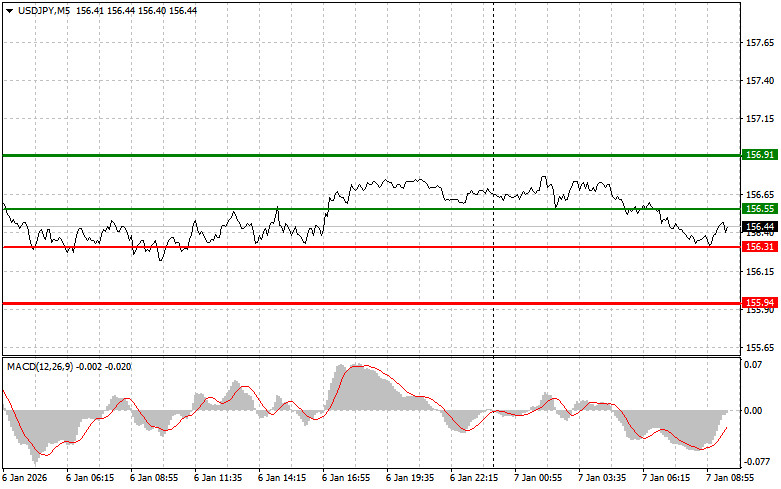

Scenario No. 1: Today, I plan to buy USD/JPY when the price reaches the entry area around 156.55 (green line on the chart), targeting growth toward the 156.91 level (the thicker green line on the chart). Around 156.91, I plan to exit long positions and open short positions in the opposite direction, targeting a move of 30–35 points from that level. It is best to return to buying the pair on corrections and significant pullbacks in USD/JPY. Important: Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today if there are two consecutive tests of the 156.31 price level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to an upward market reversal. Growth toward the opposite levels of 156.55 and 156.91 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell USD/JPY today only after a break below the 156.31 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 155.94 level, where I plan to exit short positions and immediately open long positions in the opposite direction, targeting a move of 20–25 points from that level. It is better to sell as high as possible. Important: Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if there are two consecutive tests of the 156.55 price level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 156.31 and 155.94 can be expected.

What's on the Chart

- Thin green line – entry price at which the trading instrument can be bought

- Thick green line – projected price where Take Profit orders can be placed or profits can be locked in manually, as further growth above this level is unlikely

- Thin red line – entry price at which the trading instrument can be sold

- Thick red line – projected price where Take Profit orders can be placed or profits can be locked in manually, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones

Important:Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly—especially if you do not use proper money management and trade large volumes.

And remember: successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.