Are you unaware how to accumulate your savings? Prove yourself as a trader in the currency market and read the article "How to Trade Forex with $100 for any Trader"

Moreover, you do not need a considerable sum of money to start trading. We will discuss how you can increase it, and what are the risks and advantages of using leverage.

Basics of forex trading

Generally, forex is a virtual market where foreign exchange transactions take place. This is a huge financial space and its market makers are banks, investment funds, and corporations from all over the world.

Forex is much bigger than all stock markets put together. Moreover, trades there are also more substantial and total millions and billions of dollars.

It would seem that trading on Forex is not suitable for an average person. It is possible to exchange dollars, euros, and other currencies in the bank or the exchange office.

However, the view that this market is not accessible to minor market makers is wrong.

The fact is that it is not obligatory to buy and sell currency assets on Forex. Moreover, you can make money by opening trades to increase or decrease the price of currency pairs.

That aspect gives a chance for traders with small capital to generate profits on Forex.

What do traders do? Having analyzed the market trends, they predict the further price change of a currency pair.

A trade is opened and if the prediction comes true, a trader makes a profit.

To start trading, you need a computer, access to the Internet, time, and an installed terminal. This is the basic minimum required for trading.

We are not going to focus on knowledge and experience which is extremely important for successful trading. Every trader should realize that there is very little chance to increase the capital without these aspects.

How to trade with leverage?

Many people are tempted by generating profits on Forex at home, which certainly will benefit their personal or family budget.

If you want to trade on Forex and do not have a huge capital, you can use leverage.

In fact, these are borrowed funds provided to traders by brokers. Notably, the brokerage companies are the link between the virtual currency market and individuals.

Moreover, leverage is considered one of the brokerage services.

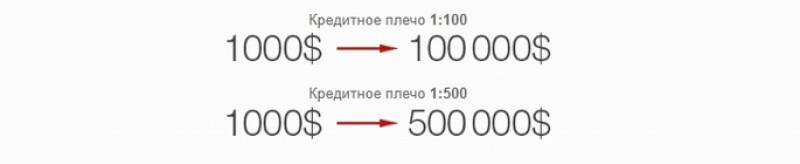

For example, you have $500 and you want to invest $10,000. In that case, you need to use 1:20 leverage.

To grasp this point, it is advisable to provide an analogy to the business of reselling pears. You buy fruit from vendors and then sell it with a mark-up, making a profit.

When you do not have a lot of money, you will not generate much profits either. But if you get a loan from the bank, you can increase the volume of purchases, and therefore your income.

To put it simply, you may increase your capital by 20 times using 1:20 leverage. The leverage size is the ratio of traders’ money to the funds they trade with.

At the same time, traders do not receive these funds on their deposit: they are immediately used to execute a trade.

Using Leverage with $500 in account

| Leverage | Trade size |

| 1:20 | $10,000 |

| 1:50 | $25,000 |

| 1:200 | $100,000 |

| 1:500 | $250,000 |

It means that a trader gets unique opportunities using leverage. In fact, it is a no-interest loan.

When the trade is closed, the money borrowed automatically goes back to the broker. The trader makes either a profit or a loss.

The question is why the broker provides this service if all the profit is transferred to the trader who later returns the borrowed money. The fact is that the broker's income also includes trading commissions.

Their size depends on the trade volume. It turns out that brokers want traders to use borrowed funds and open a lot of trades.

Another key aspect is swaps. We will discuss them below.

Notably, financial leverage is used in the foreign exchange market as well as on cryptocurrency and stock exchanges.

Major points

To use leverage in trading, you need to know some key aspects. They will make trading with borrowed money more evident and transparent.

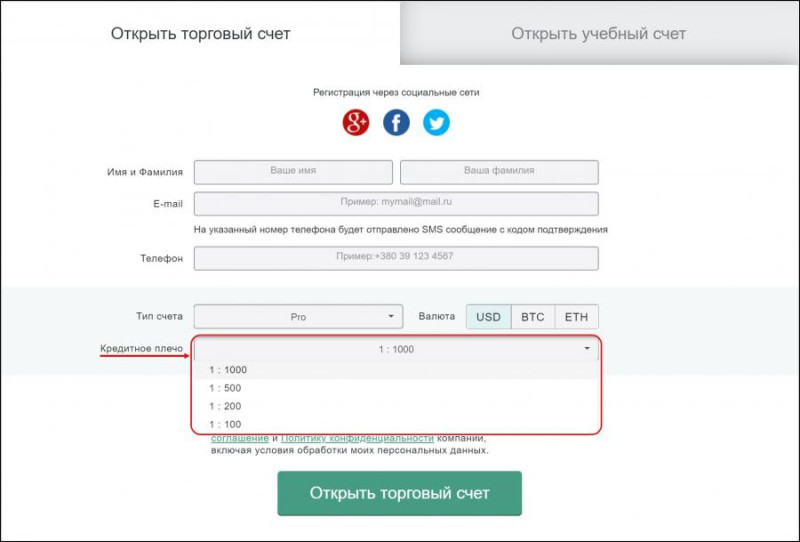

First, you choose your leverage size. Each broker defines only the maximum possible bar.

Secondly, the trader does not need to take any additional steps as the leverage function is embedded in the account.

Thirdly, leverage is not a prerequisite. So, you can trade without it.

Fourthly, it is not possible to use leverage with zero deposit. You must have a minimum sum of money on your account, which will be a margin, i.e. a kind of pledge.

The margin is immediately blocked and this money cannot be used for opening new trades.

It depends on the trade volume and the leverage size. For example, to open a trade of one lot, i.e. $100,000 with 1:20 leverage you should have at least $5,000 on your deposit.

If you use 1:50 leverage, the deposit will total $2,000, i.e. 2% of the trade's amount. It turns out that the higher the leverage, the lower the margin.

Fifthly, Margin Call and Stop Out are significant. In the first case, the broker warns the trader that the sum of money on the account has dropped below a certain threshold due to unprofitable trades.

In the second case, trades are automatically closed up to the liquidation of the trader’s account.

Margin Call and Stop Out are individual for every brokerage company. Their values are registered in the user agreement.

For example, at a particular broker Margin Call is 50% and Stop Out is 15%. For example, the margin is defined at the level of $1,000 and the total amount of deposit is $10,000.

When the sum of money is reduced to $500 i.e. half of the margin due to unprofitable trades, the trader will get a Margin Call from the brokerage company. If he does not replenish his account and the amount of money declines to $150 (15% of margin), trades will be forcibly closed.

Sixthly, there is such a term as swap. If the position is carried over to the next day, a certain amount of money is deducted from the deposit. This is a swap.

Therefore, it is a payment for using leverage like the interest rates when extending credit.

The point is that at the end of the day the broker needs to restore the balance by giving the trader financial leverage. Therefore, he sends the purchased currency to a deposit and takes the sold currency as a loan.

Interest is accrued in both cases. The swap is the difference between the interest rates.

Pros and cons

According to statistics, financial leverage is very common in the trading community. Nearly 80% of market makers use this trading tool.

Some traders use it on a regular basis, while others apply it occasionally. However, there are also opponents of using this method of increasing the capital.

The point is that along with its obvious advantages, leverage also has its disadvantages.

Some traders, especially beginners, assume that leverage is a good option to reap huge profits without significant investments. On the one hand, this is true.

Many large trades are made available to some traders due to this trading tool. The size of a standard lot on Forex is 100,000 currency units, for example, US dollars.

It is necessary to deposit the account by $10,000 even to execute a trade with 0.1 lot volume. However, having this amount of money and using 1:10 leverage, it is possible to trade the whole lot.

Advantages of leverage:

1. Access to trades for market makers who do not have a large initial capital;

2. Possibility to increase the volume of trade and, accordingly, the profit margin;

3.Increase of investment efficiency;

4.Savings not invested in the trade can be utilized for other purposes and trading tasks. They can be used at the trader's discretion due to application of leverage.

5.Minimization of effects of low volatility as exchange rate fluctuations form the basis of traders' earnings. If volatility is low, leverage allows traders to increase their profits from small changes in asset values.

However, the obvious advantage of financial leverage, that is the ability to significantly increase the volume of trade, can be considered its major disadvantage. The risks double along with the increase of possible transaction volume.

If you have a small sum of money and use a high leverage, you can lose money even with minor exchange rate fluctuations.

GBP/USD buy trades with and without leverage

| Leverage | Without leverage | |

| Leverage size | 1:30 | 0 |

| Deposit amount, USD | 6,000 | 6,000 |

| Trade volume, USD | 180,000 | 6,000 |

| Profits in case of 5% asset growth | 9,000 | 0,3000 |

| Loss in case of 5% asset decline | 9,000 | 0,3000 |

Therefore, leverage produces a positive effect only if the price changes in the proper direction. Otherwise, losses only increase when using leverage.

Thus, it is advisable for novice traders who are afraid of making a mistake when forecasting currency exchange rates, to avoid lending large sums of money. For example, it is recommended to limit your leverage to 1:50 or 1:20.

Moreover, it is a very common misconception that leverage size has a direct effect on potential losses. In fact, risks double in case the trade volume increases.

For example, you open a trade for $100,000. In the first case, you have $50,000 on your deposit and you use leverage of 1:2. In the second case, you have $10,000 on your account and apply leverage of 1:10.

In both cases, the risk will be the same as the pip value depends on the trade volume. Only if you increase the volume, the risks will also double.

For instance, you have $1,000 on your deposit and you have used a 1:10 leverage in the first case and a 1:100 leverage in the second one.

The pip value will total $1 and $10 respectively, while the trade volume will be $10,000 and $100,000. Accordingly, your potential losses will also increase by 10 times.

How to use leverage

If used properly, the financial lever forms a basis for executing large trades if you do not have a big sum of money on your deposit. It is important to follow simple rules to have a profitable trading tool.

1.Evaluate the risks taking into account the deposit amount. Remember that the risk per trade should not exceed 2-5%.

This refers to the ratio of its volume to the length of Stop Loss. For example, if the volume of position is one lot, the maximum reasonable stop loss for a deposit of $1,000 is five pips.

It is not significant what leverage size is used;

2. Do not apply high leverage. Despite potential profits, keep in mind that a total loss of the deposit may be at stake;

3.Remember about the 2% rule: only 2% of your deposit should be invested in a single trade. Never spend all your money on a single position, even the most attractive one;

4. Stick to your chosen trading strategy;

5.Never trade without a Stop Loss. It will protect your finances from losing.

Let's provide an example of the correct use of Stop Loss. Let's assume you have $1,000 on your deposit, the leverage used is 1:100, the pair is EUR/USD.

You have analyzed the market, decided not to spend the whole deposit and opened a position with a volume of 10,000, that is 0.1 lot.

Each pip in this case is $1. The starting price is 1.0764 and a stop loss is fixed at 1.0864.

The set margin is equal to nearly $108.

If the price changes against your expectations, you will lose about $100 if the Stop Loss is reached. If you do not use the Stop Loss, you will lose much more, depending on when you close the trade.

The important advantage of the Stop Loss is that it can be applied to long and short positions. Moreover, it is up to the trader to decide at what point to set it.

Optimum size

It is logical that the bigger financial leverage, the more attractive it is for traders, especially beginners. However, as it has been already mentioned, using a big leverage is also fraught with big losses.

Therefore, market makers often tackle a question: what is the most appropriate leverage?

Notably, there is no straightforward answer to this question. The key point is that it should meet the trader's needs and expectations.

The applicable trading strategy is significant when choosing a trader's leverage size, i.e. the methodology used by the trader on Forex.

Thus, adherents of scalping and breakout strategies prefer the largest possible leverage size. This is explained by the fact that they are focused on short-term trades and earning fast profit.

For example, supporters of calm position strategies use a small leverage in trading.

Therefore, the choice of leverage should be combined with your strategy, trading style, and risk management.

To test the effectiveness of leverage and make the right choice, you can practice different sizes of leverage on a demo account. The major aspect is to record all of your results.

However, it is not advisable to focus on trading on a demo account as the risk of losing savings is minimal, and traders can open rash trades.

The studies show that the most common size of leverage on Forex is 1:100. This is the leverage most often used by traders.

However, this does not mean that this size is universal for all traders. Experience, available capital as well as assessment of potential risks are important.

Experienced traders believe that when choosing financial leverage, you should follow the golden mean rule. You can execute large trades only if you feel comfortable in the market and the rate of your successful trades is over 75%.

Tips for choosing leverage:

- open a demo account and practice opening trades with different leverage levels;

- compare trading results of higher and lower leverage levels;

- keep in mind that you can change your leverage size in your Personal Area.

How to start

If you have decided to trade with leverage and you have never encountered the foreign exchange market before, first you should choose a brokerage company.

For example, it may be InstaForex. It is significant to consider the experience and the image of the intermediary. Moreover, the above mentioned brokerage company satisfies all the requirements.

After you have created an account and installed the terminal, you need to open an account and make a deposit. This will be your initial capital.

To transfer money, study the deposit options on your broker's website. You can increase the amount of money on your account at any time.

You will receive profit to your account during trading. However, in case of loss-making trades, losses will be deducted.

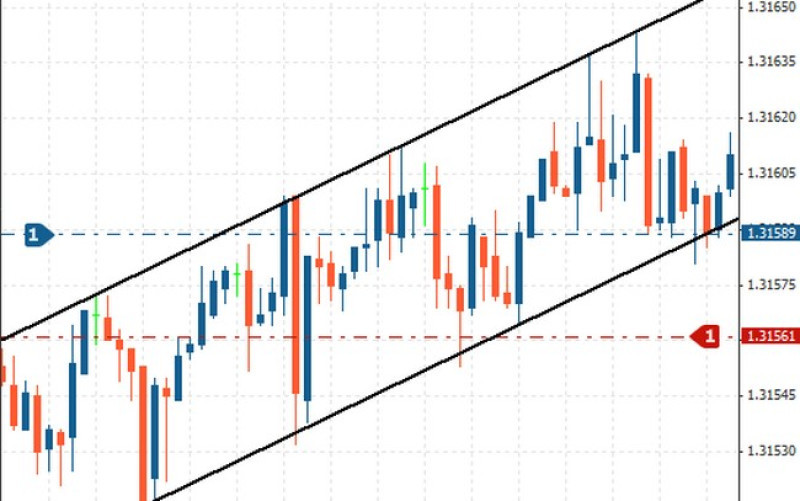

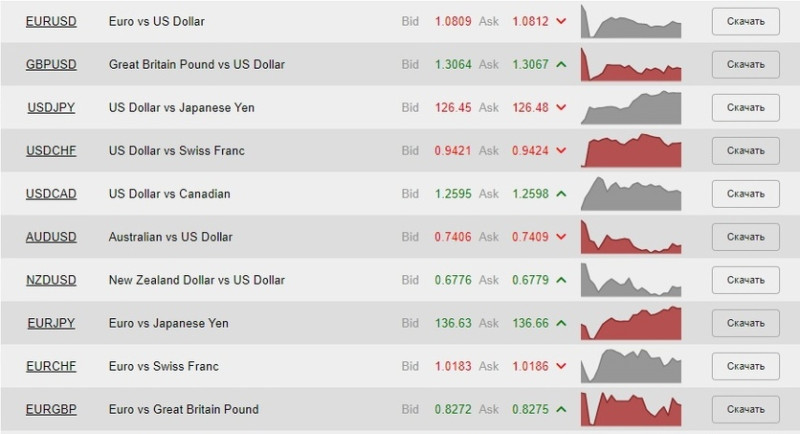

The next step is choosing a currency pair. As for Forex, base and quoted currencies are involved in trades.

For example, EUR is the base currency in the EUR/USD pair, while USD is the quoted one. The trader's goal is to predict the ratio of their prices in the future.

At the time of writing, the value of EUR/USD is 1.0812. That is how many dollars it takes to buy one euro.

If you believe that the EUR is going to rise, you open a buy position. If the exchange rate goes up, you will make a profit, depending on how much the price has changed.

If you predict a weakening of the euro against the dollar, it is advisable to start selling.

It is significant to realize that the cost of buying and selling is different. For example, we have already mentioned that it takes $1.0812 to buy the euro, while you can get $1.0809 for selling the euro.

You can track the price chart in real time on the broker's website.

If you plan to trade using leverage, you can choose its size both when you open your account and during the trading.

Moreover, remember that its size can be subsequently adjusted. For example, if you have decided that a 1:200 leverage is extremely risky, it can be reduced.

It is logical that this can only be done after you close open positions using the current leverage.

What to keep in mind

To summarize all the above mentioned, leverage is a significant benefit for traders if used properly. Therefore, it is applied by the vast majority of forex participants.

However, the use of this trading tool also includes risks. It means that applying borrowed funds the trader must assume great responsibility.

Let us list the basic rules which at least minimize potential risks.

1. Forex is not a lottery or gambling. Trying to make a profit by guessing the exchange rate is a waste of time which will probably lead to financial losses.

If you use financial leverage, those losses will increase exponentially;

2. At first, do not choose a leverage larger than 1:50. This is the maximum size that you can apply at the start;

3.Do not invest all your savings in trading. Remember that you can both make and lose money on Forex;

4.Find time to practice using leverage on a demo account. This way you will learn to feel the market and choose the best leverage size for you;

5. Use a stop loss. If the price moves against your expectations, you should exit the position;

6. If the risks are not significant, do not be afraid to use borrowed money;

7. Do not panic under any circumstances. Remember that losses as well as profits are integral parts of trading.

Conclusion

How to trade with leverage? It may seem that leverage is complicated, unprofitable, and beyond your control due to a lot of terms and caveats. However, you should remember that only those who make an effort will succeed.

This trading tool is not new, and many market participants have increased their initial capital due to it.

You need to have a minimum deposit to use leverage, while the costs can raise doubts about its profitability. On the other hand, leverage gives you the opportunity to invest a much larger amount of money than you have at your disposal.

If the market moves well, you can get a more attractive return as well as spend less time on it.

Read more:

Best Way to Trade Forex Profitably

Back to articles

Back to articles