Persistent advertising on social media featuring well-known personalities, the use of complicated vocabulary, and, most importantly, promises of high returns – how often have you encountered this? Typically, such schemes are employed by fraudsters whose sole goal is to acquire your assets and empty your wallets.

Nature of cryptocurrency scams

A scam involves deliberate deception, a fraudulent project with a cunning scheme where a user does not obtain any promised profit. On the contrary, in the worst-case scenario, all the funds invested vanish irretrievably.

Characteristics of scams

In investment, a scam refers to projects that at some point stop paying promised returns and dividends, grossly violating the agreed-upon conditions. This non-compliance leads investors to lose all their invested funds without receiving the expected profit.

Cryptocurrency scams in essence

Cryptocurrency scams are those projects that consciously do not intend to meet investors' expectations or fulfil their promises. These projects are built solely on outward appearances of success and prosperity. They deliberately deceive users by offering the "best" conditions and showcasing supposedly efficient and highly successful operations, while in reality, they are merely a flashy facade with no substance.

These are hype projects that fail to meet ICO and IFO expectations and are often outright Ponzi schemes. This article will delve into what cryptocurrency scams are and how to avoid falling victim to fraudsters.

According to the FTC, from October 2020 to March 2021, US residents lost over $80 million due to crypto scams. This figure is ten times higher than in the previous year, indicating that scam projects are spreading as rapidly as the interest in cryptocurrencies grows. Fishy companies have proliferated since Bitcoin first reached its record high of $63,000 in April 2021. Reports show that due to cryptocurrency fraud, an individual loses an average of $2,600.

How to protect yourself

Understanding the various types of cryptocurrency scams and staying vigilant is crucial for investors. Look out for too-good-to-be-true offers, thoroughly research any platform before investing, and be wary of unsolicited advice from unknown sources. By being cautious and well-informed, you can better safeguard your assets against potential crooks.

This guide provides a detailed explanation of cryptocurrency scams and practical advice on avoiding them.

Examples of cryptocurrency scams

Common scam schemes in cryptocurrency

Fraudulent websites

Victims who report to the Federal Trade Commission (FTC) describe a common scenario – they are directed to scam websites by third parties, which offer seemingly good conditions and great opportunities for earning on cryptocurrency investments. However, it later turns out that many of these websites merely create an illusion of profitability. In reality, when visitors try to withdraw their money, the website's managers demand token transfers to their accounts, resulting in people losing their money.

How scam websites operate

Scammers often disguise themselves as legitimate organizations, such as crypto exchanges, to gain access to clients' confidential information or convince them to transfer money to already prepared fraudulent accounts.

Social media scams

One of the most common types of scams involves hacking the social media accounts of crypto projects and posting false information. For instance, at the end of April 2022, hackers compromised the Bored Ape Yacht Club account on Instagram. This scam cost investors a significant $3 million. The fraudsters posted a link to a fake website where users connected their wallets, supposedly to launch an NFT. In reality, users were providing the scammers access to their funds through their actions.

Twitter scams

Twitter faces a major issue with spam bots and fake accounts of well-known personalities. According to the Federal Trade Commission, approximately $2 million was stolen through this network over seven months from 2020 to 2021. During that period, scammers frequently used fake Elon Musk accounts. Musk himself has been vocal about combating spam bots and fake accounts. When he acquired Twitter, he decided to make services paid for by all official companies and various government organizations, believing this measure would tackle monkey business.

Fake wallets

To avoid falling into scam traps, always choose non-custodial wallets. These wallets do not store any keys or seed phrases on their servers, making it much harder for hackers to access such confidential information. However, this doesn't mean they are entirely immune to hacking. Scammers can use phishing or social engineering techniques to trick victims into entering their keys or making unauthorized transactions.

A notorious example is the popular MetaMask wallet, widely used for storing ETH, ERC-20 tokens, and interacting with decentralized applications. Unfortunately, such widely-used services are prime targets for scammers. To avoid unpleasant situations and stay safe, follow these guidelines:

- Do not store your recovery seed phrase on a computer that can be easily hacked by malware.

- Avoid visiting suspicious websites and clicking on unknown links.

- Never share your keys or seed phrase with anyone. Remember that official wallets and crypto exchanges will never ask for such information; only scammers do.

- Always limit the access of decentralized applications and smart contracts to your funds. Sometimes, for convenience, users grant unlimited access, but if the application gets hacked, hackers can easily withdraw all the funds.

- Carefully choose applications and extensions, and always download them from official websites.

Since non-custodial wallets do not allow developers to recover stolen funds, it's crucial to follow all precautionary measures. If you lose some funds, immediately create a new wallet and transfer the remaining funds there. Record the seed phrase on paper and store it only offline.

Recently, scammers started impersonating the Wallet Connect platform. What cryptocurrency scam lies behind this method? Users receive SMS and emails about issues with their accounts, containing links to fake phishing pages. These login and account recovery pages are designed to steal the user's personal information and gain access to their funds.

Fake exchange platforms and swaps

Another common type of fraud in the crypto industry is creating fake trading platforms that skillfully disguise themselves as real crypto exchanges. For example, a user receives a message supposedly from Pancake Swap saying, "Crypto giveaway: claim free 45 cakes on your pancakeswap wallet! claim your giveaway via the link below and..." At the end of the text, there is always a link that the user must click. If you pay attention, you can see that the link contains a typo, meaning clicking on it or confirming any transactions through it will lead to a loss of funds or personal data.

Or, for instance, in May 2022, when the popular exchange Binance entered the Turkish market, it warned its users about fake advertisements. The scam reached unprecedented levels: in Istanbul and other Turkish cities, there were plenty of different advertising banners with fake offers from Binance. The ads included a phone number. If dialed, it led to a conversation with scammers. They promised clients various bonuses in exchange for personal data (wallet seed phrases).

Celebrity endorsement scams

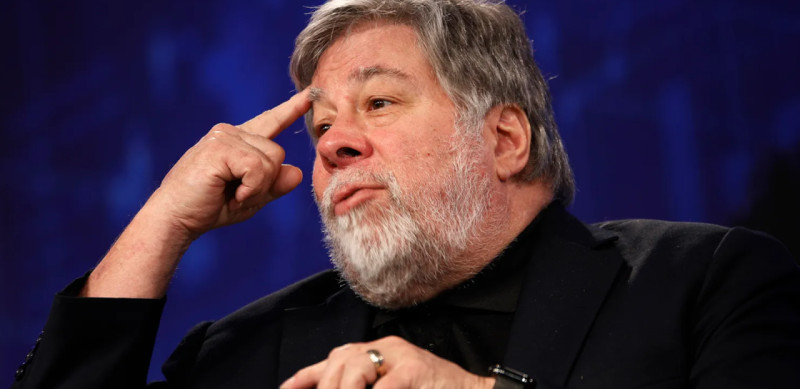

Another common scam involves using the images of famous personalities to promote fake cryptocurrency giveaways. Scammers often impersonate individuals like Elon Musk, Bill Gates, or Steve Wozniak (co-founder of Apple).

According to the Federal Trade Commission (FTC), out of the $80 million stolen during the reported period, approximately $2 million was taken using schemes where scammers posed as Elon Musk. Steve Wozniak, in turn, lost a court case against the company owning the video hosting platform YouTube.

Wozniak filed the lawsuit after a video had been posted on the platform using deepfake technology. In this video, a fake Wozniak "announced" a cryptocurrency giveaway, which turned out to be a scam. Although Wozniak did not participate in spreading this scam, his image was used to popularize the video, attracting a large number of victims. Oddly, the court ruled in favor of YouTube.

Dating websites and apps

Crooks frequently use dating sites and apps as a way to steal cryptocurrency. If you don’t know what a cryptocurrency scam via these services is, here is a simple scheme. On these platforms, fraudsters make connections with users and promote "lucrative" cryptocurrency projects. Often, scammers pose as potential partners and ask for money in digital assets to invest in a promising project. Naturally, all transferred funds disappear, and the promised investments turn out to be fictitious.

Ponzi schemes

Scammers often create large-scale cryptocurrency projects that turn out to be classic Ponzi schemes. They attract new clients, promising high returns that will only be available after some time. One example is OneCoin, a scam project created in the mid-2010s by Ruja Ignatova from Bulgaria. OneCoin was presented as an educational trading service with its own cryptocurrency. To obtain OneCoin tokens, clients had to purchase an educational course, costing between €100 and €118,000. The more expensive the course, the more tokens the client was supposed to receive. However, these tokens could only be exchanged for euros through OneCoin's internal exchange.

At one point, fake versions of global business magazines featuring Ruja Ignatova on the cover began circulating. Without exaggeration, many regarded her as an icon. By 2016, Ignatova was filling stadiums with her followers. She always appeared at events in luxurious silk outfits and expensive jewellery, showcasing wealth and success. One of her most spectacular appearances was at Wembley Arena in London in July 2016.

However, it soon became clear that OneCoin was just a Ponzi scheme. This scam was presented as a cryptocurrency trading platform, but OneCoin did not have its own blockchain, and all the tokens offered to users were bogus. Losses from OneCoin's activities are estimated at around $4 billion. In 2017, the OneCoin exchange suddenly ceased operations without any warning, and Ignatova disappeared. Many observers believe she has undergone several plastic surgeries, drastically changing her appearance.

Main signs of a Ponzi scheme

- The platform promises high returns, minimal risks, or even the absence of risks.

- It claims excessively stable returns, which is uncharacteristic of a normal investment market.

- The company lacks official registration and government licenses.

- It has complex and unclear investment strategies and structures, difficult to understand.

- There are no requirements for investors, only promising easy profits to anyone interested.

- The platform has problems with payouts, which become increasingly rare and need constant reminders (a sign of the looming collapse of the scheme).

Fraudulent ICOs

Another method of deception in the cryptocurrency world involves fraud during ICOs (Initial Coin Offerings), which is a way to raise investments through the sale of tokens. What is a scam in cryptocurrency through initial coin offerings? In these operations, scammers actively collect money from investors and then brazenly disappear without fulfilling any of their promises. In 2018 alone, investors lost approximately $100 million on various fraudulent ICOs.

To illustrate, here are a few examples of ICO fraud:

| Exit scam | Creators initially collect money and then suddenly disappear without any explanation. |

| Bounty scam | Users are promised rewards for helping to promote the project or for finding vulnerabilities in the network, but the promised rewards are never paid. |

| Exchange scam | Scammers launch an ICO on a fake cryptocurrency exchange. |

| White Paper plagiarism scam | Scammers copy the technical document (white paper) of a project, substituting the name from another project. |

| URL scam | Fake websites are created, imitating legitimate ICOs, and they list the scammers' wallet addresses for collecting funds. |

| Ponzi scheme | A financial pyramid where new investments are used to pay previous participants, with promises of very high returns at minimal risks. |

To avoid participating in such projects, it is necessary to:

- Always carefully study and check the uniqueness of the project's White Paper. A legitimate document should clearly state the goals and methods of achieving them, including a financial model, analytics, and implementation timelines.

- Evaluate the feasibility of the project's promises (how realistic they are).

- Always verify the development team. Check if team members have real profiles on social networks (e.g., LinkedIn). Developers of a reliable project will not be anonymous or fake.

Mining scams

The US Department of Justice once brought a high-profile charge against the senior executive of Mining Capital Coin. Luiz Capuci and his team were accused of orchestrating a cryptocurrency investment fraud involving a colossal $62 million. According to the charges, the company misled investors about the profitability of mining contracts and the internal token Capital Coin, which was supposedly backed by the "largest mining farm."

Since January 2018, Capuci sold mining packages to at least 65,000 investors, promising them a daily return of 1%. However, guaranteeing such a return in the mining industry is impossible, as these loud promises (30% per month) are unrelated to real incomes and resemble characteristics of HYIP projects rather than legitimate investments.

The Department of Justice stated that instead of using investors' funds for mining cryptocurrencies, Capuci transferred them to his personal cryptocurrency wallets and spent them on luxury items for himself and his accomplices, including yachts, cars, and real estate. If found guilty on all charges, Capuci could face up to 45 years in prison.

Shitcoins

There is a method of scamming in the crypto industry known as "shitcoins." Interestingly, the creators of so-called shitcoins are not necessarily fraudsters, unlike the organizers of Ponzi schemes and ICO scams. A shitcoin is a term used to describe a cryptocurrency without real value, which is unlikely to ever gain any. These currencies may resemble meme coins like the popular Dogecoin (Elon Musk's favorite cryptocurrency), but the difference is that they lack support from well-known personalities.

Some shitcoins have provocative names, such as ASS, Pussy, and Poo. A notable example is the SCAM coin, which, although created without fraudulent intentions, briefly reached a market capitalization of $70 million at one point.

This is what a scam in cryptocurrency via shitcoins entails – they are often developed to mislead inexperienced investors who know about cryptocurrencies only superficially and have not conducted thorough market analysis. Such investors often invest in useless and relatively cheap virtual currencies compared to BTC and ETH.

More experienced investors sometimes "assist" newcomers by artificially inflating the value of a particular shitcoin, thereby attracting new investors' attention. After such a scheme, they suddenly exit the project, taking their profit. The cryptocurrency's value then plummets to zero. This scheme is known in the crypto world as "Pump and Dump."

NFT scams

Another threat in the cryptocurrency market is NFT scams. In December 2020, the OpenSea platform introduced a feature for free token creation and simultaneously removed the pre-screening of collections. This decision predictably led to a sharp increase in fraudulent activities.

By the end of 2021, OpenSea had to block cloned collections like Phunky Apes Yacht Club and PHAYC and limit the creation of user collections to five. According to the platform, up to 80% of all tokens were either scams or plagiarism.

In early 2022, New York-based NFT collector named Todd Kramer claimed that his collection of sixteen BAYC NFTs, valued at $2.28 million, had been compromised by scammers. As a result, OpenSea froze all his assets, including one Clonex, seven Mutant Ape Yacht Club, and eight BAYC NFTs.

Fake support services

We all know that in case of any issues and for problem resolution, we should contact the support service of the platform (crypto exchange, crypto wallet, or any other service) directly through the official website. Typically, the company provides a special feedback form or email for this purpose on its website.

However, if a user decides to communicate with support through social media, they risk encountering a scammer posing as a support representative. This "representative" may start messaging the user privately and try to obtain their wallet details, login, password, and any other important confidential information.

Importantly, such cases are possible not only in the crypto industry but in any other industry as well. It is highly unlikely that real support will initiate contact through private messages on social media. They will likely ask to create a ticket on the official website.

How to recognize you are being scammed

What is a cryptocurrency scam? It plays on human passions and weaknesses (greed for quick profit, unwillingness to meticulously study the offered conditions and the market state, etc.). Anyone can easily fall under the influence of loud promises, it is human nature. It is important to stop in time.

There are specific indicators that clearly show a user is dealing with a scam and should immediately withdraw their funds and leave the website, platform, etc. Here are some important signs:

- Aggressive marketing scammers typically aim to get as much money as possible as quickly as possible, so they rely on advertising. If a potential client is aggressively persuaded to invest more money with promises of incredible returns with almost 100% guarantees, offering lucrative conditions and not giving time to think, it is almost certainly a scam.

- Promises of high returns. Projects that promise returns significantly above the market rate probably do not plan to pay them at all. If a representative of a dubious project cannot explain where the high returns will come from for the potential client, this should be alarming.

- Lack of transparency. When an investor invests their money, they must know how it will be used. If the investment mechanism remains unclear and lacks specifics, it is definitely a scam project.

- Anonymity. Any investor needs to know exactly who they are trusting with their money. If the organizers decide to hide their real names or use fictional ones, it is a grave cause for concern.

- Problems with withdrawing funds. An investor must always be able to withdraw their funds at any time. If they encounter difficulties in withdrawing their money, it is a clear sign of a scam.

- Lack of feedback. If an investor tries to contact support for a refund and only receives promises or no response at all, it should make them seriously reconsider and possibly seek help from law enforcement.

How to avoid becoming scam victim

According to the Federal Trade Commission (FTC), the most vulnerable age group to cryptocurrency fraud is people aged 20 to 49. However, older individuals in this category are less frequently scammed, but their financial losses tend to be significantly higher, averaging $3,200. In comparison, younger users lose an average of $1,900.

Before investing in any cryptocurrency, it is crucial to conduct thorough research. Discuss potential fraudulent schemes associated with digital assets with family, friends, and more experienced investors (if you have such people in your real-life circle). This collaborative approach can help identify and avoid potential scams.

Back to articles

Back to articles