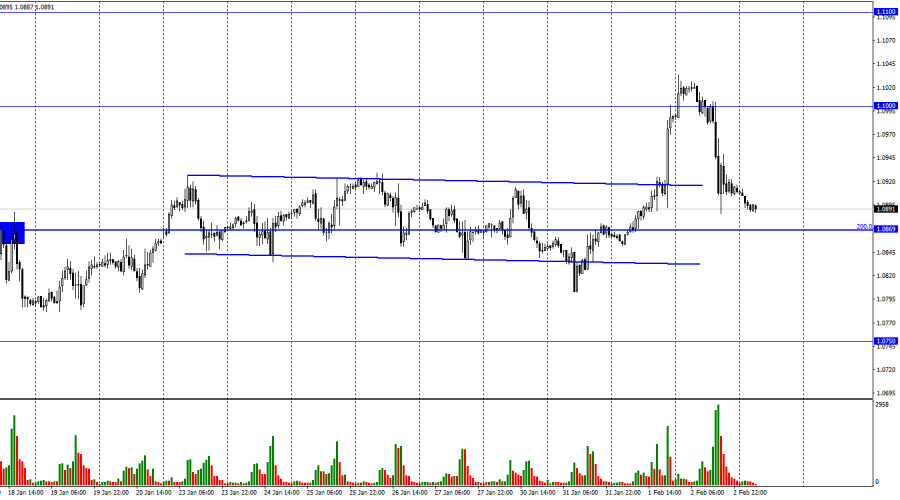

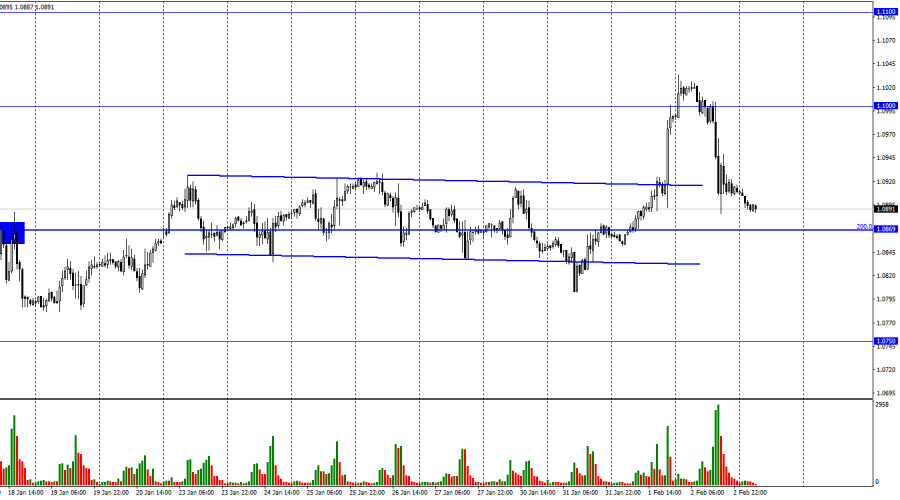

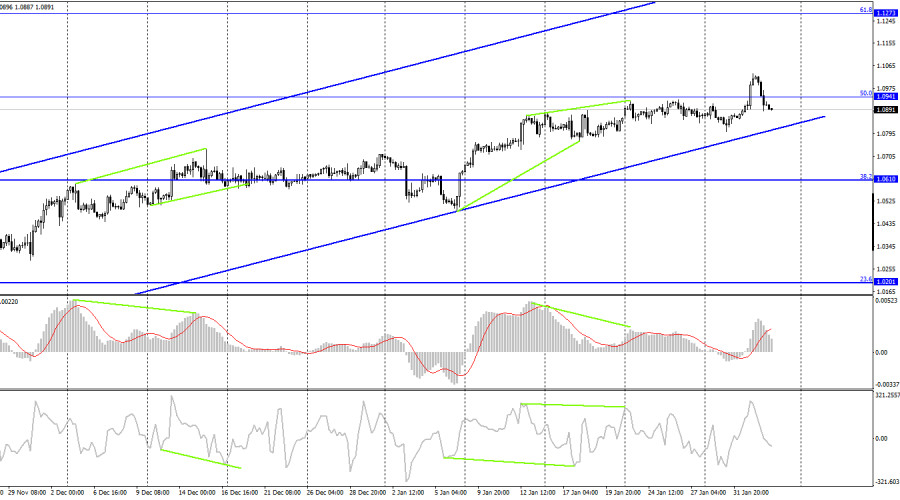

On Thursday, the EUR/USD pair reversed in favor of the US dollar and started a strong decline toward the corrective level of 200.0% (1.0869). The EU currency will benefit from the rebound in prices from this level and the restart of growth in the direction of the 1.1000 level. The likelihood of a further drop will grow if the pair's rate is closed at 1.0869.

The following chart emerges when we take a quick look at the outcomes of the meetings between the ECB and the Fed. The Fed increased interest rates by 0.25%, as expected by markets, and the currency dropped. The rate increase by the ECB was expected by traders and resulted in a decline in the euro. Why is the market acting this way? The only difference is that the ECB and the Fed worked out all of their decisions in advance. This has been covered by numerous experts in their writing. The core of this phenomenon is that throughout January, regulators' representatives were almost openly outlining their upcoming decisions. There was virtually no chance that the ECB or Fed would increase rates by less than 0.50% or 0.25%, respectively. As a result, all of these modifications to the PEPP were developed back in January, as I said above.

Trading was no longer possible according to the information background from yesterday and the day before; hence, opposite trades were made. I believe that the euro may now begin to decline, but it is important to recognize that the movement of the pair over the last two days is an exception. If the background information from America turns out to be weak, the pair's decline from yesterday can be replaced by growth today. I think decisions should be taken by Monday when all of the reports will be finished. The dollar is attempting to take the lead, but it is too soon to make any judgments.

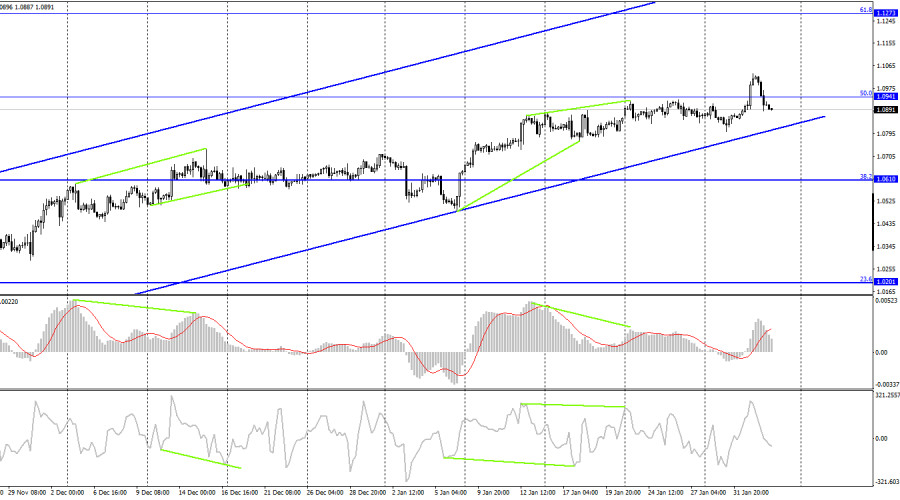

On the 4-hour chart, the pair reversed course in favor of the US dollar and started to decline. The upward trend corridor continues to describe the trading environment as "bullish." Resuming growth in the direction of the corrective level of 61.8% (1.1273) will be aided by the quotes' recovery from their lower line. The likelihood of a further decline in the direction of the Fibo level of 38.2% (1.0610) would rise if the pair is closed under the corridor. No indication shows any new emerging divergences.

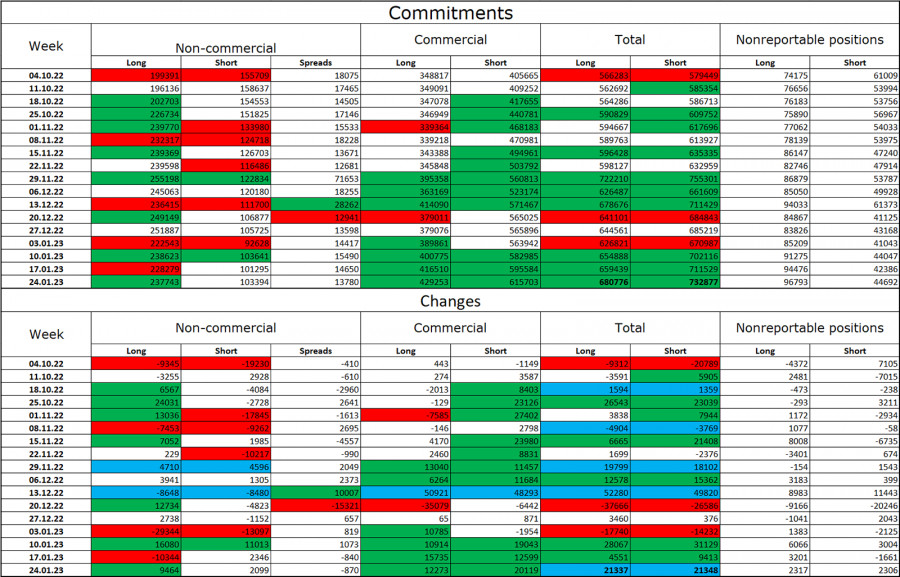

Report on Commitments of Traders (COT):

During the previous reporting week, traders opened 2,099 short contracts and 9,464 long contracts. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now increasing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, therefore its prospects are still good. At least until the ECB gradually raises interest rates by increments of 0.50%.

News calendar for the USA and the European Union:

EU – index of business activity in the service sector (09:00 UTC).

US – average hourly wage (13:30 UTC).

US – change in the number of people employed in the non-agricultural sector (13:30 UTC).

US – unemployment rate (13:30 UTC).

US – ISM Purchasing Managers' Index for the non-manufacturing sector of the USA (15:00 UTC).

On February 3, there are no economic events scheduled for the European Union, and at the same time, numerous crucial reports will be released in the USA. The information background may once again have a significant impact on how traders feel today.

Forecast for EUR/USD and trading advice:

On the hourly chart, I suggested selling the pair when it closed below the 1.1000 level with a target of 1.0869. This point is nearly attained. New sales – when closing under the corridor on the 4-hour chart. With targets of 1.1000 and 1.1100, purchases of the euro currency are possible at a rebound from the level of 1.0869 on the hourly chart or upon a rebound from the lower line of the corridor on the 4-hour chart.