The EUR/USD currency pair on Thursday continued to remain in the same side-channel as before. Nothing can penetrate the pair now. Whatever happens in the market, nothing helps it get out of the 130-point side range. In fairness, it should still be noted that the pair still has a minimum upward slope. In principle, we can even say that it has risen by 110 points in the period from November 24 to January 6. That is, in almost a month and a half, the euro currency has grown by 110 points. It is this upward bias that is now present. Thus, in technical terms, absolutely nothing changes for the euro/dollar. This week, there were several macroeconomic publications in the United States and the European Union, which did not affect the pair's movement. More precisely, the reaction of the markets may have been but did not exceed 30 points. And what are 30 points, and even inside the side channel? Therefore, we continue to conclude that market participants are currently in prostration and do not understand what to do with the currency pair next. On the one hand, the Fed is increasingly signaling its readiness to further tighten monetary policy, unlike the ECB. Therefore, the US currency once again has reasons to grow against the euro. On the other hand, the dollar cannot grow forever on the same factor. What if the Fed's rates in the next five years will be constantly higher than the ECB's rates? Will the dollar growth in the next five years? This is not usually the case. Usually, a new factor that has appeared is worked out by the market for a certain time, after which it no longer attracts attention. Therefore, we believe that the growth of the dollar may come to an end in the near future. But still, the technical factor should not be overlooked for a minute. And it talks about maintaining a downward trend in the medium term.

The Fed minutes made it clear that the regulator is ready for more serious tightening in 2022.

In the last few months, only the lazy have not speculated about what measures the Fed can take in 2022. Almost no one doubts that the QE program will be fully completed in March of this year, although it was initially expected to be completed by July. However, after the Fed fully realized the threat of inflation, which is already almost 7%, which has not been in the States for about 40 years, it immediately began to cut back on economic stimulus to cool it down. Moreover, rumors have been actively circulating recently that not only will the key rate be raised several times this year, but the Fed will also begin to unload its balance sheet slowly. What does it mean? This means that now the Fed will sell Treasury and mortgage bonds, thus withdrawing excess money supply from the economy. This should provoke the opposite effect of stimulation, that is, a decrease in inflation. However, the unloading of the Fed's balance sheet is, rather, only plans and rumors so far. Although the minutes of the last meeting contained hints that this issue would be discussed at the January meeting. In general, the Fed members agreed that taking into account the increase in inflation in recent months, a faster first increase in the key rate and a faster rate of increase in the future will be needed. This suggests that the rate may be raised as early as March-April for the first time, and in total, in 2022 it may increase by 0.75%. The members of the Fed are also "hawkish" about the next year. During it, most Fed members also expect at least 3 increases. Thus, the tightening of monetary policy in the United States is gaining momentum. This is bad for risky assets such as bitcoin but good for the national currency. The dollar was already growing for most of 2021, do its buyers still have the strength?

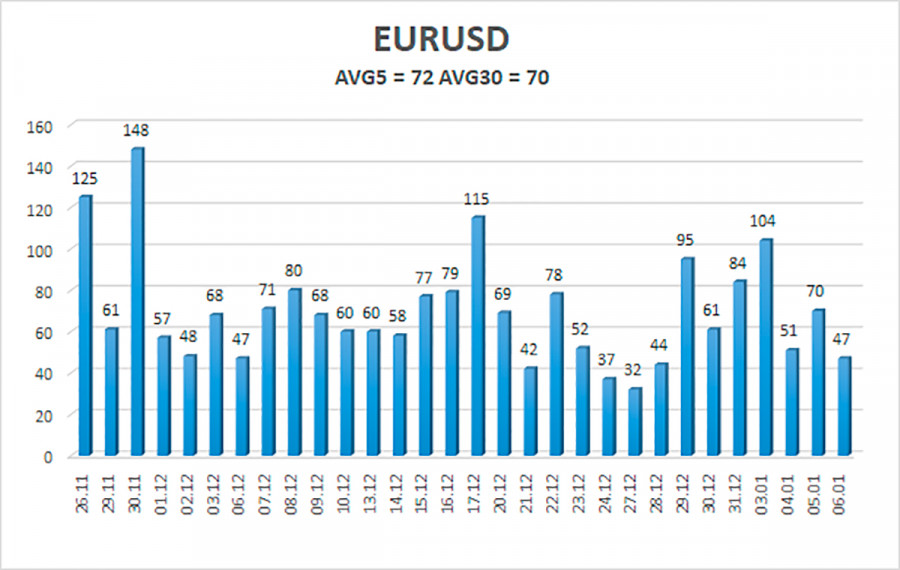

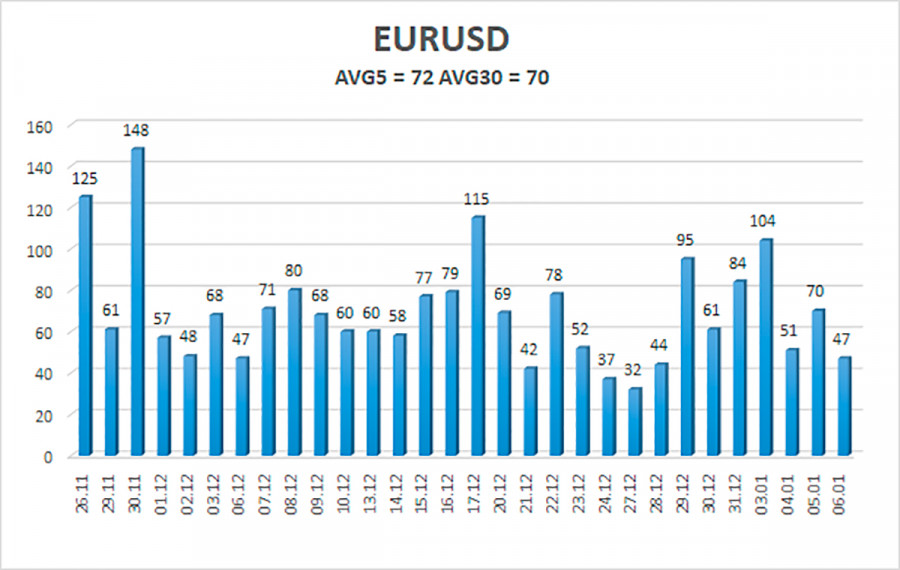

The volatility of the euro/dollar currency pair as of January 7 is 72 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1235 and 1.1379. The upward reversal of the Heiken Ashi indicator signals a new round of upward movement in the limited range of 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230 - 1.1353 channel. Thus, the movement now remains as lateral as possible and inconvenient for trading. Given the strong fundamental background, there may be movement in any direction today. It will be very difficult to catch a signal in the form of a bounce from any channel boundary.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.