Details of the economic calendar of November 2

The Fed raised the interest rate by 0.75%. Now the target rate range is 3.75–4.00%. This is the sixth rate increase this year and the third consecutive increase of 75 basis points.

What was interesting in the regulator's press release?

In general, everything is the same as before—the Fed focuses on statistical indicators and inflation, which it is currently struggling with.

An excerpt from the statement states, "In determining future hikes, the Fed will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity." In simple words, the regulator understands that it has already raised the rate too much and is now waiting for its effects, although it might not show soon. The market regards this as a signal that the rate hike rate may slow down.

In fact, as soon as the press release appeared, the US stock indices began to strengthen, and the dollar started to lose positions.

The joy of the bulls did not last long. Literally 30 minutes later, Fed Chairman Jerome Powell gave a press conference, and the fall began.

The reason for the sell-off lies in Powell's hawkish attitude, where he does not give a clear answer to the slowdown in the rate hike. According to him, the Fed will continue to fight inflation because if it is not stopped, it can remain at a high level for a very long time. That is, the rate increase range can be revised—it scares investors, which puts pressure on the markets. As a result, the US stock indices collapsed, and the dollar began to strengthen.

Still, there was good news in all this negativity. The example of the Fed can dramatically change its policy and start cutting the rate and turn on the printing press. Powell almost stated this in plain text during the press conference, referring to the experience of the COVID-19 pandemic, that the regulator can quickly start the economy—this is not a problem. Only investors and traders at the moment refused to think rationally—the US stock market was declining.

Analysis of trading charts from November 2

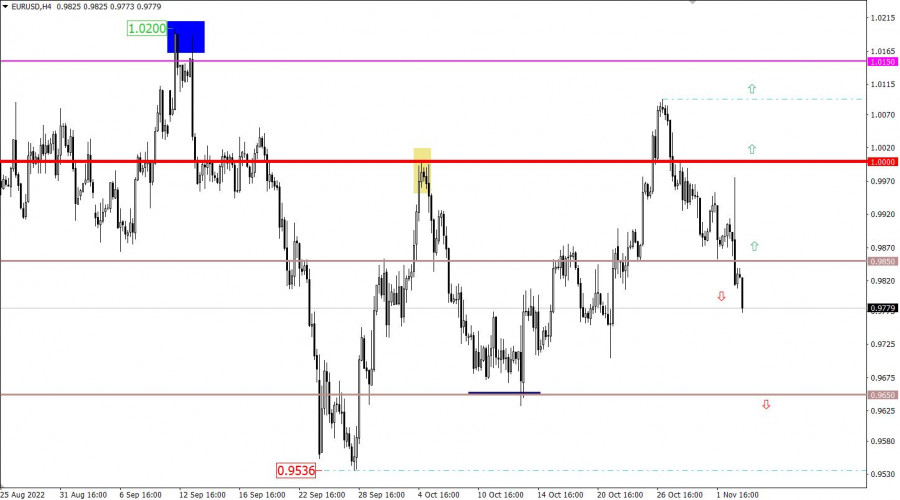

The EURUSD currency pair showed high activity, as a result of which the variable support level of 0.9850 was broken. Thus, the last day closed at 0.9815, prolonging the current downward cycle from the middle of last week.

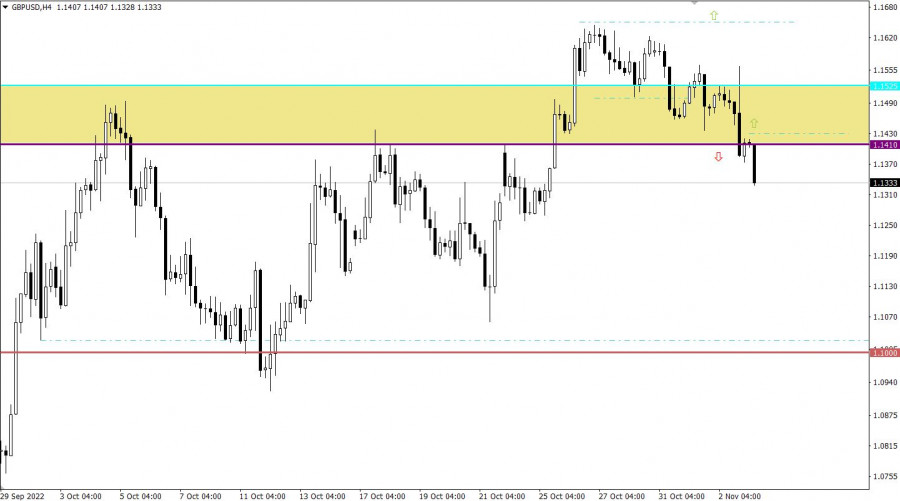

The GBPUSD currency pair, following the market, flew down, eventually holding below 1.1400. In fact, this step indicates the possibility of a new downward spiral in the pound sterling.

Economic calendar for November 3

Today, the Bank of England will hold a meeting where the regulator will almost certainly raise the interest rate from 2.25% to 3.00%. This event has already been priced in, so special attention will be paid to comments from the regulator. So, if there are comments about the intention to continue to raise the rate at the same pace, then the pound sterling will sharply strengthen. But if there are no such statements, there is a high probability of consolidation or temporary up/down activity.

In terms of statistics, unemployment data in the eurozone is expected, with forecasts of stabilization in the region of 6.6%. In the United States, weekly data on jobless claims will be published, which are expected to rise.

Note that the outcome of the Bank of England meeting is considered to be the key event. Thus, the statistical data may not gain much attention.

Time targeting:

EU Unemployment rate – 10:00 UTC

Bank of England meeting results – 12:00 UTC

US Jobless Claims – 12:30 UTC

Trading plan for EUR/USD on November 3

From the opening of the European session, the downward move continued, despite a clear technical signal about the euro being oversold. In this case, we are dealing with an inertial move, so many technical signals can be ignored by speculators in vain.

Trading plan for GBP/USD on November 3

In this situation, much will depend on the outcome of the meeting of the Bank of England. It may launch a new round of speculative activity in the market, depending on the rhetoric of the regulator.

As for the technical picture, at this stage there is a signal that the pound is oversold, but it is successfully ignored by speculators. For this reason, the occurrence of a full-scale inertial motion along a downward trajectory is not excluded.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.