You require the following to open long positions on the GBP/USD:

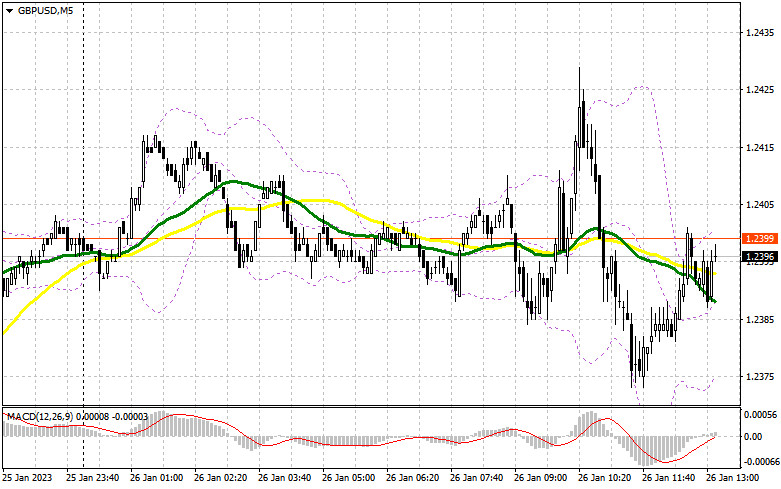

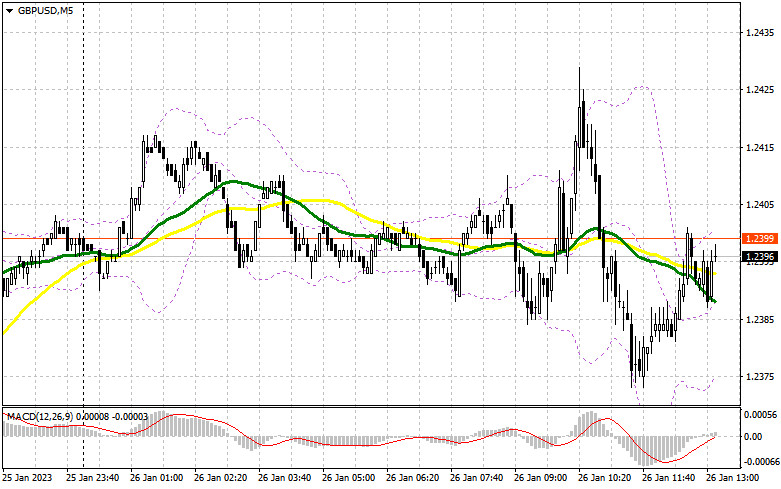

In the early part of the day, there were no signs of a market entry. Let's analyze the 5-minute chart to see what transpired there. The levels I predicted in the morning were not tested because of the market's minimal volatility. There were no entry points from which to open positions as a result. The technical image underwent a major revision in the afternoon.

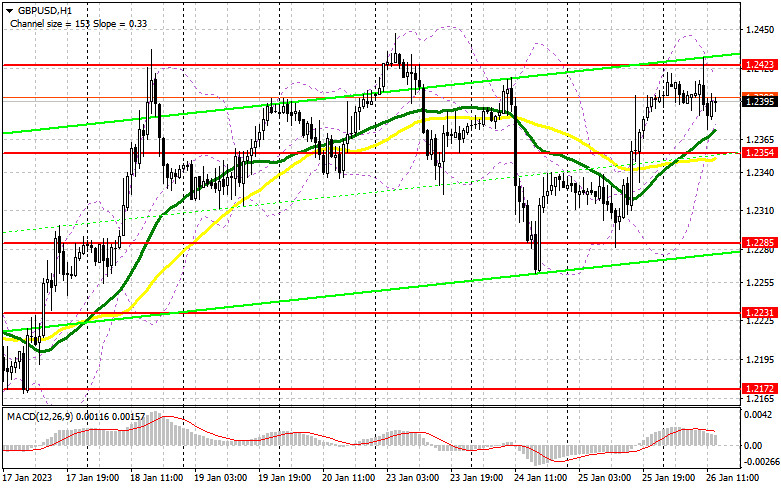

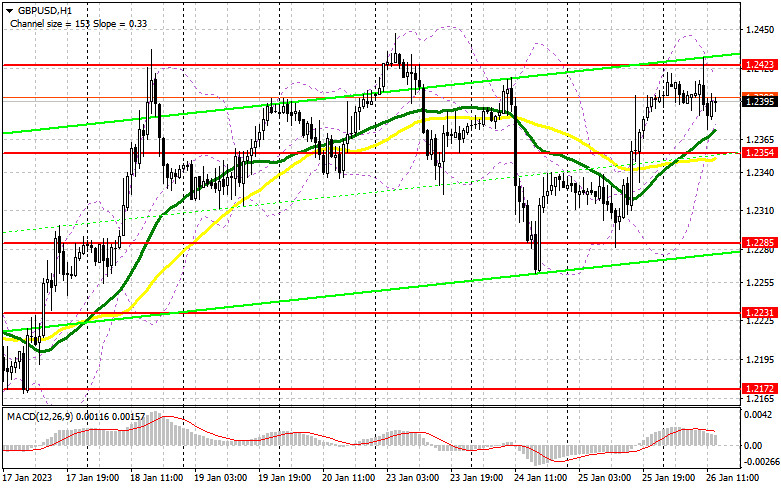

The level of orders for durable goods and the balance of international trade in goods in the United States are two items we are anticipating during the American session, but it will be much more intriguing to see how the US GDP will alter for the fourth quarter of this year. The pair will undoubtedly move sharply lower as a result of its rise exceeding expectations, negating all efforts made by purchasers to create a bull market. The nearest support level of 1.2354, on which a lot of hinges, continues to be the major focus. After missing this mark, it will be possible to firmly say goodbye to the pound's future appreciation, at least up to the Federal Reserve meeting the following week. Therefore, the only way we can bet on gaining bullish momentum and returning to 1.2423 (a new resistance established by today's results) is if a false one forms above 1.2354. The demand for the pound will increase if consolidation occurs above this area since bulls will have another opportunity to update the monthly maximum above 1.2487. At 1.2553, where I am fixing profits, an exit above this range with a top-down test will open up growth opportunities. The scenario will be completely out of the bulls' control if they are unable to accomplish the tasks assigned to them and miss 1.2354, which is also crossed by the moving averages working in their favor. The GBP/USD exchange rate will come under more pressure, which will change the market's trajectory and create a solid negative reversal. Because of this, I suggest that you hold off on making any purchases and instead begin long positions on a downturn and a false breakdown close to the minimum price of 1.2285. With the goal of a drop of 30-35 points within the day, I will purchase GBP/USD as soon as it recovers just from 1.2231.

You require the following to open short trades on the GBP/USD:

Additionally, bears aren't doing much right now, concentrating on basic American statistical data. Only the amount of the British pound's afternoon increase or fall will determine the outcome. The sellers' attention is currently focused on taking back control of the level of 1.2354, but you shouldn't forget to defend the fresh resistance at 1.2423 either. Only the development of a false breakdown around 1.2423 will herald the opening of short positions in the event of an upward movement due to weak US data, with the possibility of a new and more active slide down to 1.2354. A breakout and reverse test from the bottom up of this range will signal a sell signal, generating a sell signal already with a rise to 1.2285. The area of 1.2231 will be my farthest aim, where I will fix profits. The bullish trend will advance due to the possibility of GBP/USD growth and the lack of bears at 1.2423 in the afternoon. In this instance, the sole entry opportunity for short positions is a false breakout in the vicinity of 1.2487. In the absence of activity there, I will sell GBP/USD as soon as it reaches its highest level of 1.2553, but only if I believe the pair will decline another 30-35 points during the day.

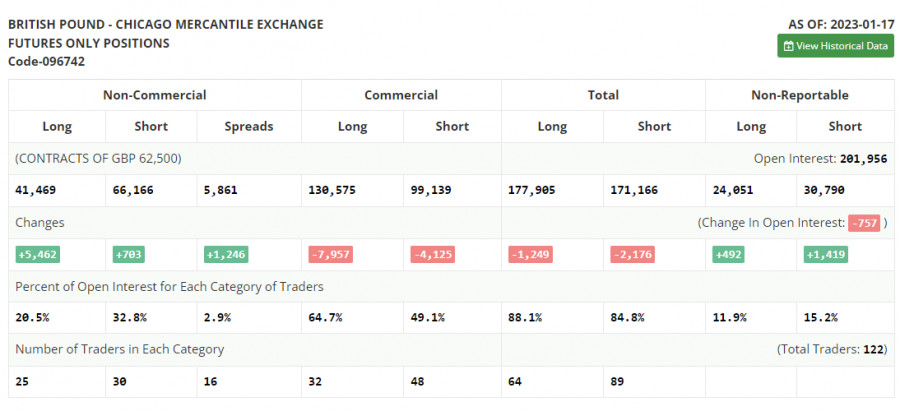

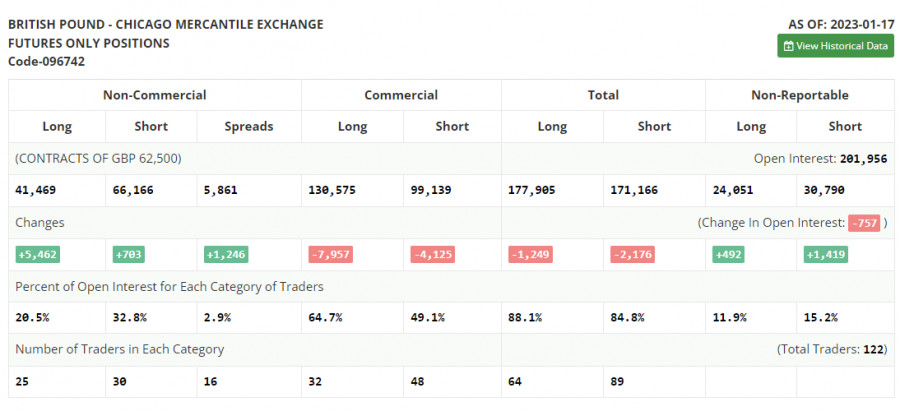

On January 17, short and long positions increased in the COT report (Commitment of Traders). It is important to realize that the Federal Reserve System's formerly effective aggressive strategy is no longer working and that the economy's slowing down and a steep drop in retail sales are the first indications of a possible recession by the end of this year. While all this is going on, the Bank of England in the UK is still dealing with high inflation, which, according to the most recent report, has decreased but is not enough to change the regulator's mind. Rates are projected to continue rising quickly, which will aid the pound in making up for losses it suffered when coupled with the US dollar last year. According to the most recent COT report, long non-commercial positions increased by 5,468 to a level of 41,469, while short non-commercial positions increased by 703 to a total of 66,166. As a result, the non-commercial net position's negative value decreased to -24,697 from -29,456 the previous week. We will continue to closely study the UK's economic data to make inferences about the Bank of England's future policies because such negligible adjustments have little impact on the power dynamic. In contrast to 1.2182, the weekly ending price increased to 1.2290.

Signals from indicators

Moving Averages

Trading is taking place above the 30- and 50-day moving averages, which shows the bulls are trying to keep the pair growing.

Note that the author's consideration of the period and cost of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2423, will serve as resistance in the event of expansion.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.