The dollar index (DXY) is retreating from the 4-week highs reached yesterday and at the beginning of today's European trading session, near the 103.67 mark: as of writing, DXY futures were trading near the 103.41 mark.

The U.S. Department of Labor report for January, published last Friday, helped the dollar to strengthen and its index to grow. Based on the report, the U.S. nonfarm payrolls added 517,000 jobs in January, while the overall unemployment rate fell to 3.4% from 3.5% the month before. The data was much stronger than forecast (+185,000, after December's +260,000 increase). Meanwhile, the average hourly earnings of Americans continued to rise in January.

Immediately after the publication of this report, the dollar strengthened sharply, and its DXY index closed Friday's trading day at 102.75, 2% higher than the local 10-month low of 100.68 reached the day before. But, according to economists, this is still not enough for the dollar to reverse the negative dynamics. There is still a threat of resuming the decline of the DXY towards the psychologically important mark of 100.00. The breakdown of the recent local low at 100.68 again actualizes this scenario. But the breakdown of the 100.00 "round" level will give a new impetus to the dollar's decline, sending the DXY towards the lows of 2 years ago and the 90.00 mark.

The volatility in the dollar will increase again today at 17:40 (GMT), when Fed Chairman Jerome Powell begins his speech at the Economic Club of Washington. He is likely to explain once again the recent decision of the Fed executives to raise interest rates by 0.25% and outline the near-term outlook for the Fed's monetary policy.

According to the CME Group, the markets estimate the probability of another 0.25% Fed interest rate hike at the May meeting at about 70%. At a press conference following the February 1 Fed meeting, Powell hinted that the strong labor market and rising wages are setting the stage for further monetary policy tightening. At the same time, he admitted that "the process of disinflation has begun," which made market participants think about the possibility of a pause in the Fed's interest rate hike cycle. All in all, Powell could "swing" the dollar up or down today. If Powell doesn't address the monetary policy of the U.S. central bank, the reaction to his speech will be weak.

As for the euro, it is declining today both against the dollar and in major cross-pairs.

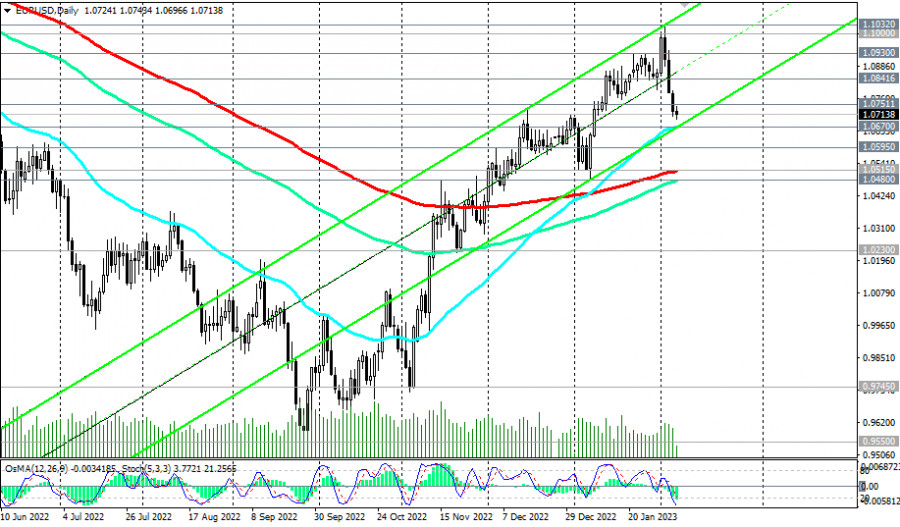

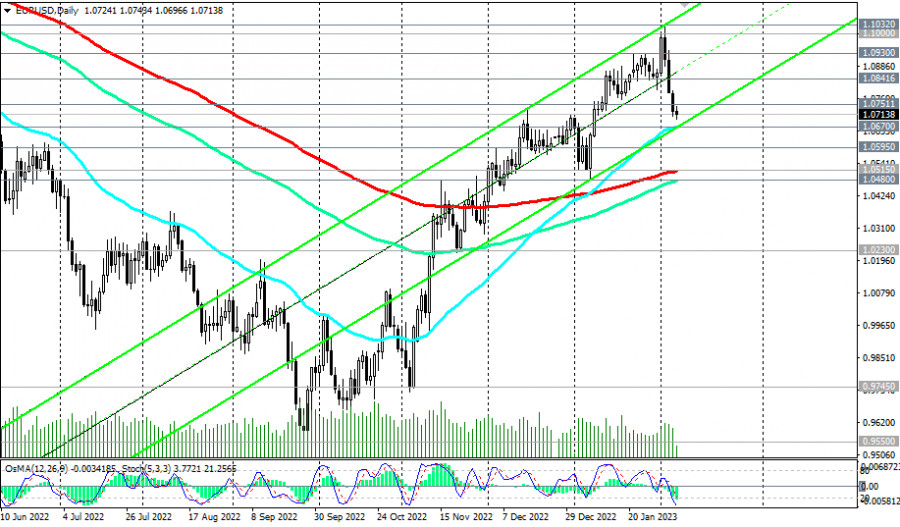

Having reached a local 10-month high of 1.1032 last Thursday, the EUR/USD pair subsequently fell sharply, primarily amid a strengthening dollar.

Over the last four trading days, the pair has lost 2.5% in price, currently trading near the 1.0710 mark.

ECB Governing Council member Francois Villeroy de Galhau said today that inflation in the eurozone is not far from its peak. "I don't think we will have to choose between fighting inflation and avoiding a recession," Villeroy said, noting that the improvement in the economic situation and the slowdown in inflation eases the tasks facing the ECB.

Germany's industrial orders climbed 3.2% in December, higher than forecasts of 2.0% and -4.4% in November, as the German industry is gradually recovering from the crisis, the German statistics office said yesterday. Economists believe that the recovery of the German economy, which is the locomotive of the entire European economy, especially in its industrial sector, will allow the Eurozone economy to avoid recession. Although, there are also negative points. Thus, the December data on retail sales in the Eurozone, also published on Monday, turned out to be negative: worse than the forecast and previous values. According to Eurostat data, retail sales, which form a significant part of consumer spending, which, in turn, is the most important part of GDP, fell in January by -2.7% (-2, 8% in annual terms). Obviously, high inflation forces consumers to limit spending.

As we noted above, EUR/USD is currently trading near 1.0710, having rebounded from today's low at 1.0697 and is trying to rise into the short-term bull market zone above the 1.0751 resistance level. In the alternative scenario, EUR/USD will continue to decline towards the important support level 0.0670, the breakdown of which will give the pair new bearish momentum in its movement towards key support levels 1.0515, 1.0480. Their breakdown will finally return EUR/USD to the long-term bear market zone.