In his second speech to Congress, Federal Reserve Chairman Jerome Powell confirmed that the U.S. central bank is committed to cutting prices. "Inflation is coming down, but it's very high, and the final rate should be higher," Powell said yesterday. At the same time, he made some reservations that caused overly optimistic buyers of the dollar to reduce their aggressive expectations for the U.S. currency. Powell said the Fed "has yet to make any decision about the March meeting, it depends on the incoming data."

"Slowing the pace of rate hikes this year is a way to better monitor such (lagging monetary policy) effects, and more data is needed for analysis," Powell concluded.

After these comments by the head of the Fed, the dollar came under moderate pressure, and today its DXY index is falling, reaching 105.40 as of writing, losing 0.43% from yesterday's local and 14-week high of 105.86.

The euro occupies the largest share in the DXY dollar index (57.6%). Followed by the yen, which accounts 13.6% at the moment, and economists attribute its current strengthening to the fall in the Japanese stock market after Wednesday's release (at 23:50 GMT) of data that indicated growth of Japanese GDP in Q4 by +0.1% year-on-year. While economists expected growth of +0.8%, after growth of +0.6% in Q3 2022. GDP shows the value of all goods and services produced in the economy for a certain period of time (in this case, for a quarter), indicating its growth or decline. In this case, the participants of the Japanese stock market regarded the decline in GDP as a negative factor, which, in turn, increased demand for the yen, including as a defensive asset.

Also, note the next meeting of the Bank of Japan during tomorrow's Asian trading session, at which a decision on the current monetary policy will be made. This will be the last meeting of the Japanese central bank under the leadership of its current head Haruhiko Kuroda.

"The bank will not hesitate to continue easing monetary policy if necessary," Kuroda has traditionally stated following the results of previous meetings of the bank for several years, and it is "premature" to discuss the possibility of curtailing economic stimulus measures.

However, his term in office expires in early April, and Kazuo Ueda, a former professor at Tokyo University and a renowned expert on monetary policy, will become the next head of the Japanese central bank. Ueda is considered a follower of the Bank of Japan's loose monetary policy led by current central bank governor Haruhiko Kuroda. Ueda recently said that the Bank of Japan should not rush to curtail economic stimulus, and last month, when he appeared before the Japanese parliament as the government's candidate for the position of the new central bank chief, confirmed that the Japanese central bank "will continue to ease monetary policy in order to realize wage increases."

Still, some economists expect more decisive steps from Ueda to curb rising inflation in the country. Although Ueda believes that "a weak yen is good for exports, inbound tourism and some service sectors," at the same time, "a weak yen has various negative effects, such as hitting households due to rising import costs."

"Japan's economy is recovering from the effects of the COVID-19 pandemic. However, uncertainty about the economy, prices and markets is extremely high. Consumer inflation is at 4%, which is higher than the Bank of Japan's target, but the increase is mainly due to rising import prices. The growth is not driven by high demand," Ueda said.

Tomorrow, at his last press conference under his leadership, Kuroda will likely make some unexpected announcements about the outlook for monetary policy, such as the imminent start of the unwinding of stimulus measures. That might send the yen sharply higher, and maybe some market participants are already betting on it, building up long positions on the yen little by little.

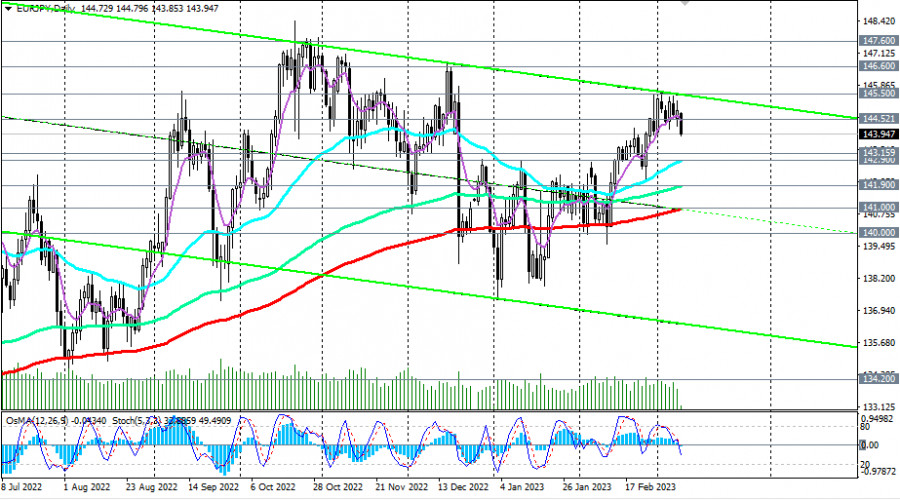

For example, the euro is rising against the dollar today but declining against the yen, despite the long-term bullish trend of EUR/JPY. As of writing, EUR/JPY was trading near 144.00, breaking through important near-term support at 144.52 during the Asian session.

In general, the pair maintains its bullish momentum, trading in the bull market zone above the key support levels 132.45, 134.20, 104.00, 141.00, 141.90. However, today's decline may become a precedent and signal the emergence of a new, so far medium-term, bearish trend (within a more global bullish trend). The breakdown of the next support levels 143.16, 142.90 will be a confirming signal of our assumption.