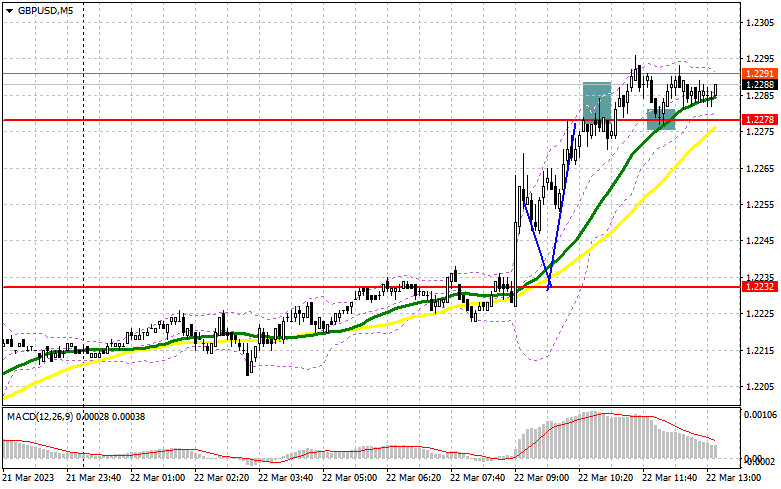

In the morning, I considered entering the market at 1.2232. Let's see what has happened in the M5 chart. The price broke through the level but no retest followed, meaning no signal to buy was made. A false breakout through 1.2278 and buying from this level ended up without any profit. The trading plan for the North American session remains the same.

When to open long positions on GBP/USD:

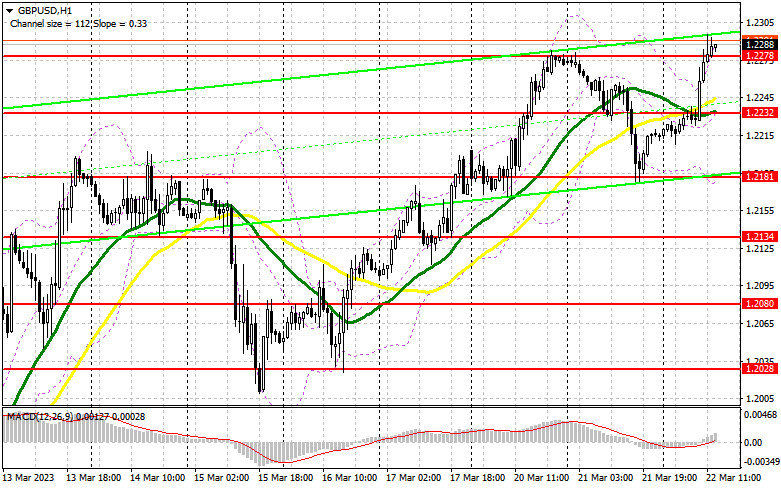

Even if the bulls fail to consolidate at 1.2278, the market will still focus on the Fed's monetary policy decision. No matter how traders behave near 1.2278, Chair Powell's remarks may change everything in the blink of an eye. Therefore, if the pair comes under pressure in the North American session, buying may be considered after a false breakout through 1.2232. The pair will then attempt to settle at 1.2278 resistance. A breakout and a downside test of this barrier will produce a signal to buy, targeting 1.2329. Without this level, the bulls will hardly be able to extend the uptrend. A breakout through 1.2329 with a downside retest will push GBP/USD to 1.2388, where I am going to lock in profits. The most distant target is seen at 1.2450. The pair will test this level only if the Fed takes a dovish stance on monetary policy. If GBP/USD goes down and the bulls are absent at the 1.2232 mark, which is in line with the bullish moving averages, the bears may take the market under control. In such a case, it will become possible to open longs after a false breakout through 1.2181. Likewise, long positions could be considered on a bounce off 1.2134, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

Inflation in the UK swelled despite economists' expectations who predicted a slowdown. This will urge the Bank of England to raise the interest rate at a meeting tomorrow and maintain the hawkish stance in the future. Therefore, it is wiser to stay away from selling today and wait for the Fed's announcement. The bears should take the 1.2278 level under control. A retest of this mark to the upside may trigger a correction to the nearest support level of 1.2232. Activity may increase there as the bulls and the bears both will attempt to establish their control over it. In fact, similar events took place yesterday. A breakout and a retest to the upside of this range will create a sell entry point, targeting the 1.2181 low, which could be a good-enough bearish correction after growth. The more distant target stands at 1.2134, where I am going to lock in profits. In case of growth in EUR/USD and the absence of the bears at 1.2278 in the North American session, the uptrend will extend and the bulls will maintain control over the market. GBP/USD will soar to the 1.2329 high. A false breakout through the mark will create a sell entry point and drive the quotes further down. If there is no activity there, GBP/USD could be sold at 1.2388, allowing a correction of 30 to 35 pips intraday.

Commitments of Traders:

The COT report for March 7 logged a rise in both longs and shorts. However, these data have no weight whatsoever as the CFTC is still recovering after a cyber attack. All that's left is to wait for fresh reports. This week, the US Federal Reserve and the Bank of England will hold monetary policy meetings and make a decision on interest rates. The BoE is expected to stay hawkish due to persistent inflation. If the Fed gets dovish and the BoE does not, we will see GBP/USD reaching a new monthly high. According to the latest COT report, long non-commercial positions increased by 1,227 to 66,513. Short non-commercial positions rose by 7,549 to 49,111. The non-commercial net position came in at -17,141 versus -21,416. The weekly closing price fell to 1.1830 from 1.2112.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating a bullish continuation.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.2181, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.