The main news of the weekend was the agreement on the US debt limit, which may serve as a basis for increased risk demand at the beginning of the week. The House of Representatives is expected to vote on Wednesday.

It was reported that the debt ceiling will be approved until the 2024 presidential elections. Non-defense spending will remain at current levels in 2024 and will increase by only 1% in 2025. This is a compromise between Republican demands for sharp spending cuts and Democratic intentions to raise taxes.

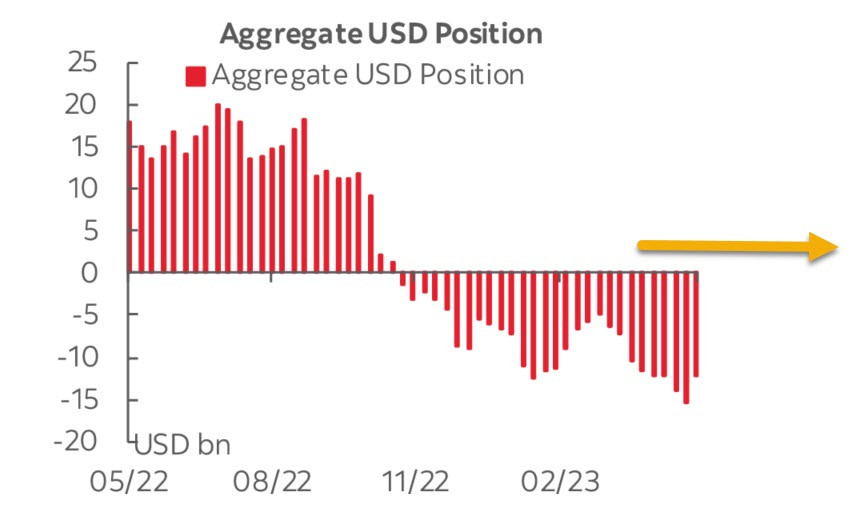

The aggregate short position in the US dollar decreased by 3.3 billion to -12.1 billion during the reporting week. Overall, sentiment towards the dollar remains negative, but the trend may have changed.

Long positions on gold have noticeably decreased by 4 billion to -31.7 billion, which is also a factor in favor of the US dollar.

The core PCE deflator increased by 0.4% MoM, which is slightly higher than the consensus forecast of 0.3%. Despite the faster-than-expected price growth, real consumer spending rose by 0.5% MoM, surpassing the expected 0.3%. The rise in the PCE deflator shows that the fight against inflation is far from over, with the 3-month annualized core PCE deflator at 4.3%, the same amount as a year ago in April 2022.

The combination of higher spending and faster price growth is expected to lead to the Federal Reserve raising rates in June. Cleveland Fed President Loretta Mester, commenting on the released data, stated that "the data that came out this morning suggests that we still have work to do."

The CME futures market estimates a 63% probability of a Fed rate hike in June, compared to 18% the previous week, making the strengthening of the dollar in the changed conditions more than likely.

Monday is a banking holiday in the US, so by the end of the day, volatility will decrease, and we do not expect strong movements.

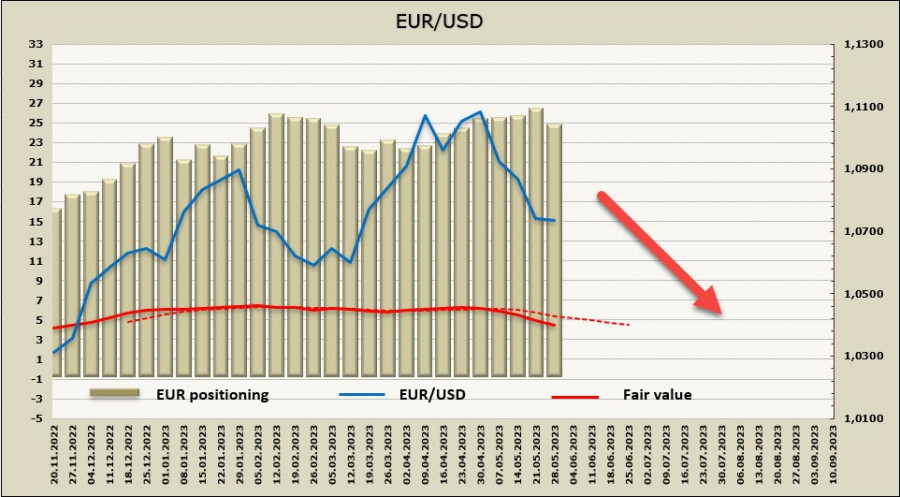

EUR/USD

The European Central Bank maintains a firm stance on continuing rate hikes as part of its fight against inflation. Preliminary inflation data for the eurozone will be published on June 1st, and the forecast suggests a slowdown in core inflation from 5.6% to 5.5%. If the data aligns with expectations, it will lower the ECB rate forecasts and put more pressure on the euro.

The net long position on the euro decreased by 2.013 billion to 23.389 billion during the reporting week, marking the first significant decline in the past 10 weeks. The calculated price is moving further south, indicating a high probability of further euro weakening.

EUR/USD has declined to 1.0730, where support has held firm, but we expect another attempt to test its strength, which will likely be more successful. Within a short-term correction, the euro may rise to resistance at 1.0735 or 1.0830, but the upward movement is likely to be short-lived and followed by another downward wave. Our long-term target is seen in the support zone of 1.0480/0520.

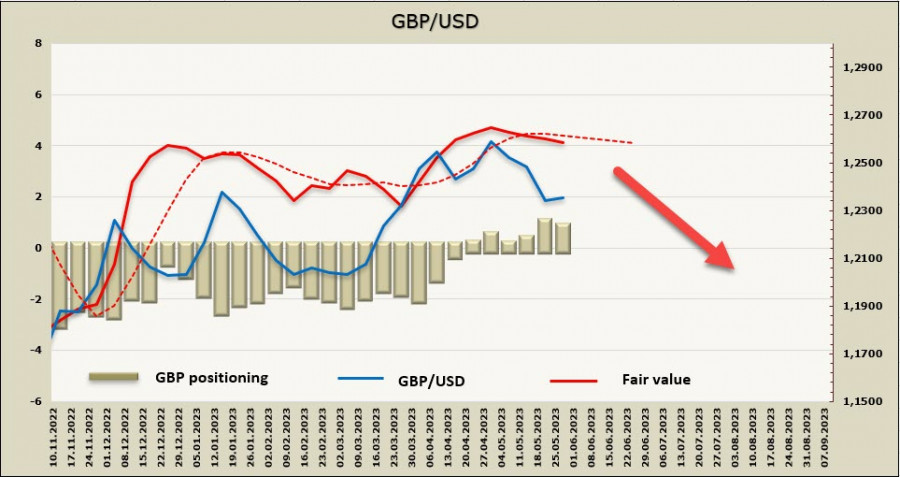

GBP/USD

The decline in UK inflation is once again being called into question. The core Consumer Price Index rose from 6.2% YoY to 6.8% in April, with yields sharply increasing. The retail sales report for April, published on Friday, showed that the slowdown in consumer demand remains more of a goal than reality itself.

Retail sales excluding fuel increased by 0.8% MoM, significantly higher than the forecast of 0.3%. If it weren't for the sharp decline in energy demand, both the monthly and annual retail growth would have been noticeably higher than expected.

Monday is a banking holiday in the UK, and there are no macro data this week that could influence Bank of England rate forecasts. Therefore, the pound will be traded more in consideration of global rather than domestic factors. We do not expect high volatility or significant movements.

The net long position on the pound slightly decreased by 84 million to 899 million during the reporting week. The bullish bias is small, and the positioning is more neutral than bullish. The calculated price is below the long-term average and is downward-oriented.

The pound has moved towards the support zone at 1.2340/50, but the decline has slowed down at this level. We expect the pound to fall, with the nearest targets being the technical levels at 1.2240 and 1.2134. There is currently insufficient basis for reviving growth.