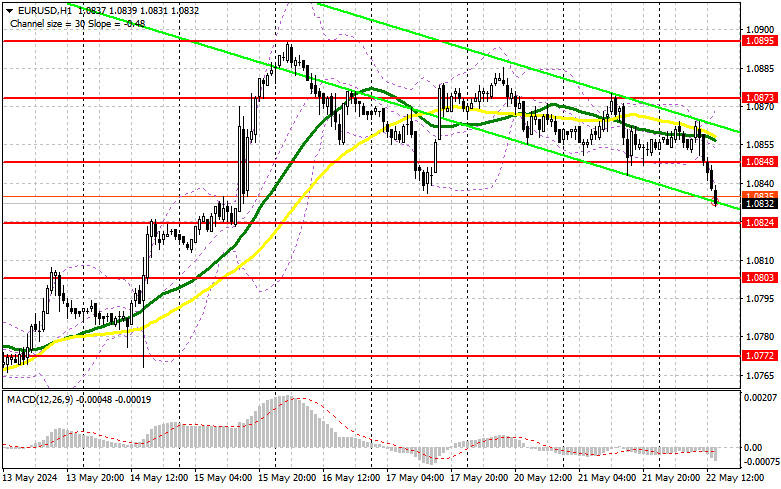

In my morning forecast, I paid attention to the 1.0845 level and planned to decide to enter the market based on it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there gave a buy signal, but it never reached growth, which resulted in fixing losses. In the afternoon, the technical picture was revised.

To open long positions on EURUSD, you need:

Unfortunately, the euro did not reach for the British pound, and after an unsuccessful attempt to protect the daily minimum, buyers completely "gave up." Statements by American politicians and the risk of maintaining high interest rates for a longer time, despite the news of lower inflation in the United States, are gradually returning demand for the US dollar. In the afternoon, data on the volume of home sales in the US secondary market is expected, as is the publication of the minutes of the Fed meeting. If traders find hints of a tougher policy, most likely, the euro will continue to fall, so it's better not to rush into purchases. I will open long positions after the decline and the formation of a false breakdown in the area of the new support of 1.0824, where the pair is heading now. Only the protection of this level will be a suitable option for entering the market in the expectation of a return to the area of 1.0848 – the resistance formed at the end of the first half of the day. A breakout and a top-down update of this range will strengthen the pair with a chance of a breakthrough to 1.0873. The furthest target will be a maximum of 1.0895, where I will fix the profit. If EUR/USD declines and there is no activity around 1.0824 in the afternoon, the pressure on the market will only increase, leading to a larger drop in the pair to the 1.0803 area. After that, discussing building a new bearish trend will be possible. I'm also going to enter there only after the formation of a false breakdown. I plan to open long positions immediately for a rebound from 1.0772 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, you need:

Sellers have every chance of bringing the market back under their control. To do this, you need to show yourself in the resistance area 1.0848, where a movement can occur after the release of American statistics. With the false breakdown and hawkish statements by the Fed representatives, we can count on new short positions with the prospect of a decline in the euro and an update of support at 1.0824. A breakout and consolidation below this range and a reverse bottom-up test will give another selling point, with the pair moving to the low of 1.0803, where I expect to see a more active manifestation of buyers. The farthest target will be a minimum of 1.0772, where I will record profits. In the event of an upward movement of EUR/USD in the afternoon and the absence of bears at 1.0848, buyers will be able to regain the market, but it is unlikely that they will be able to count on a larger trend development today. In this case, I will postpone sales until the test of the next resistance of 1.0873, below which the moving averages playing on the side of the bears pass. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately for a rebound from 1.0895 with the aim of a downward correction of 30-35 points.

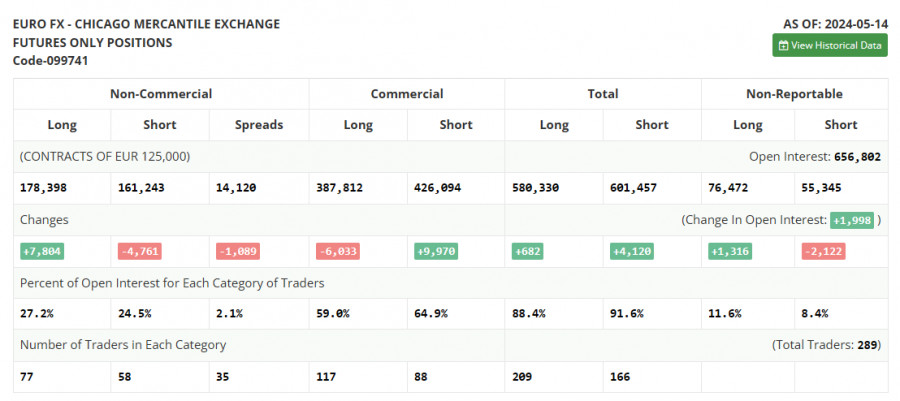

The COT report (Commitment of Traders) for May 14 showed an increase in long positions and a reduction in short ones. It is obvious that recent statements by representatives of the European Central Bank regarding possible scenarios for lowering interest rates, as well as good figures indicating a continued slowdown in price pressure in the region, were interpreted in favor of buying risky assets. However, at the moment, lower rates may put pressure on the euro. However, now everyone is talking more about the need to restore the economy through its stimulation so that the growth of the euro, in case of a softening of the cost of borrowing, will be ensured in the medium term. The COT report indicates that long non-profit positions increased by 7,804 to 178,398, while short non-profit positions collapsed by 4,761 to 161,243. As a result, the spread between long and short positions fell by 1,089.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, which indicates a further decline in the pair.

Note: The author considers the period and prices of the moving averages on the hourly chart H1, which differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower limit of the indicator in the area of 1.0833 will act as support.

Description of the indicators

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.