On Friday, the EUR/USD currency pair traded extremely calmly, exhibiting no sudden movements, volatility, or trend. However, the pair ended the day above the moving average, and both linear regression channels point upward. Therefore, the development of the European currency is entirely justified from a technical standpoint. Another concern is that it is obvious that the macroeconomics and foundation do not provide the euro currency with enough support for it to grow almost continuously. But since this issue has already been brought up several times, there is nothing new to add now. As we have repeatedly stated, any fundamental hypothesis should be supported by specific technical signals. It is not worthwhile to test this hypothesis if there are no signals. We can wait as long as we like for a correction, but if the majority decides to buy the euro for any reason, there won't be one.

However, a correction could still start soon. The fact is that there are currently no fundamental or macroeconomic justifications for the appreciation of the euro currency. Of course, they can be "discovered" or "invented," but if that doesn't happen, how can one explain, for instance, why the European currency increased last week? Whatever it was, we are still watching for the pair to fall and consolidate below the moving average line.

The most intriguing report of the week concerns inflation in the EU.

The situation will be more intriguing this week than it was last week because of the macroeconomic backdrop. The European Union will host Christine Lagarde's speech on Monday. With the ECB's final meeting of the year scheduled for December, her speeches are gradually regaining importance. The market currently anticipates an additional 0.75% rate increase because, even if inflation slows by the end of November, it is unlikely that it will be able to return to 2% at the same rate level. As a result, several more significant increases are necessary, as Vice-Chairman of the ECB Luis de Guindos discussed last week. Lagarde will likely use "hawkish" language, which could theoretically support the euro. The word "theoretically" is because the market is confident that the rate will continue to grow at its fastest rate even without Lagarde's new rhetoric. There are numerous reasons why the Fed needs to catch up. First, a higher rate abroad causes an imbalance in cash flow and investment. Money comes to the US. Second, a higher Fed rate causes the dollar to rise while the euro declines. Thirdly, a high rate is necessary to reduce inflation, which is still very high and must be done. Therefore, increasing it at the fastest possible rate is necessary since it is ineffective for the European regulator to "pull the rubber."

The November inflation report will be released on Wednesday. The consumer price index is expected to slow to 10.3–10.4% y/y, which can be seen as the first step toward success, according to forecasts made by experts. Nevertheless, since this is only a prediction, it might not pass. And now for something interesting. Recall that a few months ago, the US dollar started to decline relative to its rivals when US inflation started to slow down. Since the beginning of the decline in inflation, the likelihood of further aggressive tightening of monetary policy by the central bank has decreased. It can be concluded that a decrease in inflation = a fall in the exchange rate of the national currency. The European currency could lose market support if inflation in the European Union starts to decline.

The European Union will release its unemployment rate and business activity index (manufacturing sector) on Thursday. There will be more significant events this week than these reports in the present context. Luis de Guindos and Christine Lagarde will perform as usual on Friday. It's more intriguing this way. As a result, there will be a lot of intriguing events this week in the European Union alone that could cause a market response.

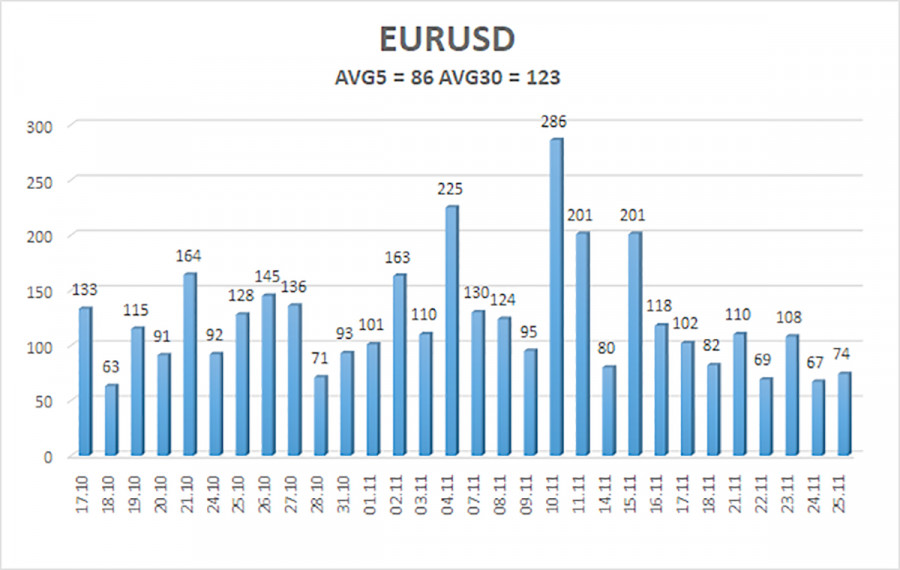

As of November 28, the euro/dollar currency pair's average volatility over the previous five trading days was 86 points, considered "average." So, on Monday, we anticipate the pair to fluctuate between 1.0310 and 1.0482 levels. A potential continuation of the upward movement will be indicated by the Heiken Ashi indicator turning back to the top.

Nearest levels of support

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest levels of resistance

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading Suggestions:

The EUR/USD pair is still above the moving average. In light of this, we should now consider long positions with targets of 1.0482 and 1.0498 if the Heiken Ashi indicator reverses direction and moves upward or the price recovers from the moving. Only after fixing the price below the moving average line with targets of 1.0254 and 1.0132 will sales become significant.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.