Having your own forex account is advantageous and useful. Besides, you cannot trade Forex without opening an account.

We will tell you what steps you need to go through, what is the difference between various accounts, and how to choose one that suits you best.

Why it is important to open account

Undoubtedly, many of you have heard about the profits you may gain trading Forex. Why don't you give it a shot?

If you want to try your hand at trading, the first thing you need to do is to open an account. In a nutshell, a trading account is quite similar to a bank one. You can deposit and withdraw money if necessary.

We should pinpoint that you will not be able to open a forex account on your own. You need to find an intermediary that provides access to Forex. To this end, you should find a brokerage company, for instance, InstaForex.

These companies act as an intermediary. By opening an account with them, you will gain access to forex quotes.

If you do not have an account, you will not be able to become a forex trader. It means that you can only dream about potential profit.

There are just general conditions. Let's discuss what opportunities the trading account gives.

After opening an account, you will be able to:

- open and close trades. So, you can actually earn money if these trades are profitable. On Forex, there are both profitable and unprofitable positions;

- deposit money to your account or withdraw it. You may earn a hefty sum and withdraw part of your profit to spend on something;

- use a trading platform;

- receive bonuses and participate in contests and campaigns. As a rule, broker companies have many different interesting options;

- use different services. For example, copy orders of successful traders or take advantage of the PAMM system.

How to open a Forex account

We have already mentioned that you open an account not on the forex market but with a broker that provides access to this market.

If you want to register an account, you need to make the following steps:

- Find a broker and learn all the information you can find about it;

- Choose a company that will suit your requirements and expectations the most;

- Register an account;

- Pass verification;

- Make a deposit;

- Start trading.

It will not take much time - approximately 15 minutes. However, let's talk about them more thoroughly.

Let’s start with the choice of a company that provides brokerage services. We will immediately warn you that there is an abundance of them. So, you should not choose the first company you come across.

What do you need to take into account when choosing a broker?

- work experience. the broker that has been operating for at least 5 years looks more reliable. For example, InstaForex has been rendering services since 2007;

- license. Alas, scammers can trick beginning traders by pretending to be a broker;

- reputation. On their websites, all brokers, without exception, praise themselves showing off their merits. Do not be lazy and read the reviews of those who have already worked with them;

- commission. Everything is clear here: the lower they are, the better;

- trading conditions: available trading instruments, leverage, and so on;

- bonus programs, campaigns. This is not the most important indicator. However, who wouldn't be happy to receive bonuses or win a prize in a contest?

When you have chosen a broker, you need to register an account with it. On the broker's website, you should find the "open account" button and fill out the registration form.

The broker will offer to get acquainted with the Partnership Agreement. It is also sometimes called a Public Offer Agreement.

This is a very important document. Carefully study it before checking the consent box.

After filling out and sending all the necessary docs, you will receive an email. It will contain the account number, as well as instructions on how to top up the balance.

At this point, you will successfully open an account - the first step on the path to successful trading.

In the text below, we will talk about the types of accounts. Whichever you choose, the steps of account opening will hardly change.

Account types

If you are a beginner and want to practice your trading skills, a demo account will be a perfect option for you. In terms of functions, it is quite similar to the live one. The only striking difference is that you use virtual money, while in the real one, you trade with your own funds.

After registration, you will need to download a trading platform and get started. There is no need to replenish your account.

However, bear in mind that the profit will also be virtual. We will tell you more about the demo account below.

Those who plan to trade with their own funds choose a live account. They also top up their accounts. Profits and losses will also be real.

There are three main account types:

- Cent;

- Standard;

- Premium.

Different brokers may give them various names or allow only some of them. Nevertheless, their features remain the same. What is the difference between them?

Cent accounts require a small deposit and modest transaction volumes. Premium accounts are the complete opposite, while standard (classic) accounts are something in between.

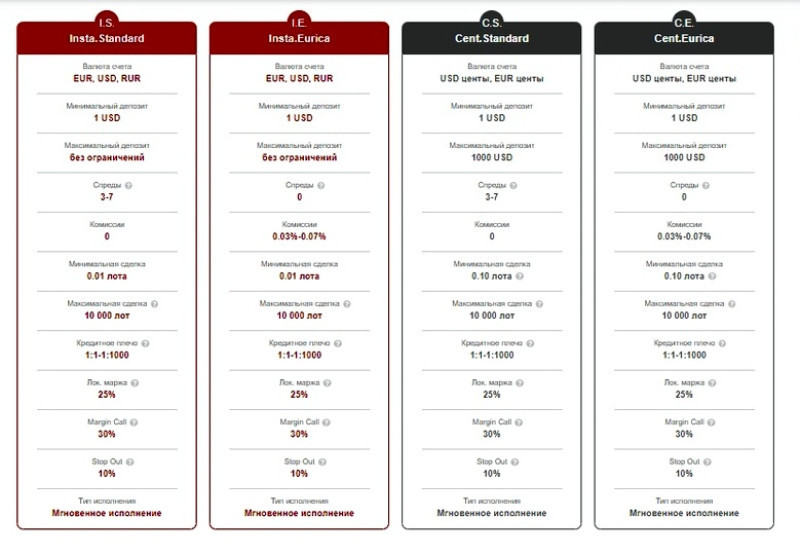

When choosing an account, compare as many indicators as possible. Pay attention to:

- spread;

- order execution time;

- Margin Call и Stop Out levels;

- leverage;

- maximum and minimum trade size;

- commission;

- maximum and minimum deposit.

How to open a Forex account: live account

As you already know, by opening a live account, you trade with your own money. You replenish your account and then start trading. As a result, you may open both profitable and unprofitable positions.

Read about the steps you need to take for registration above. Now, let's analyze them on the example of InstaForex.

Let’s assume you have chosen to trade on Forex with this broker.

How to open a live account:

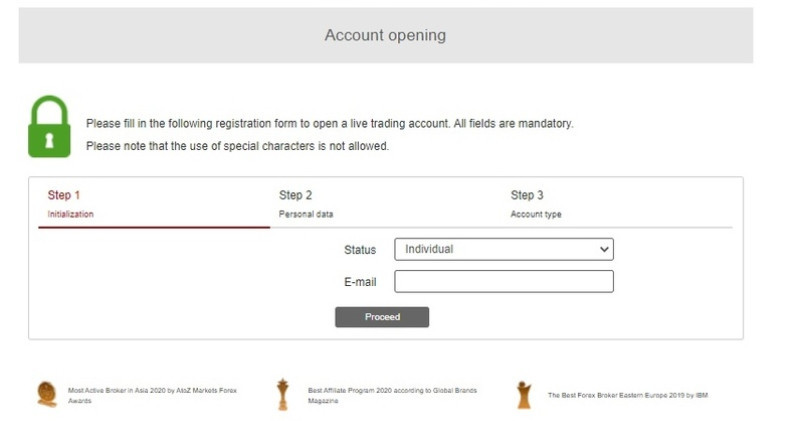

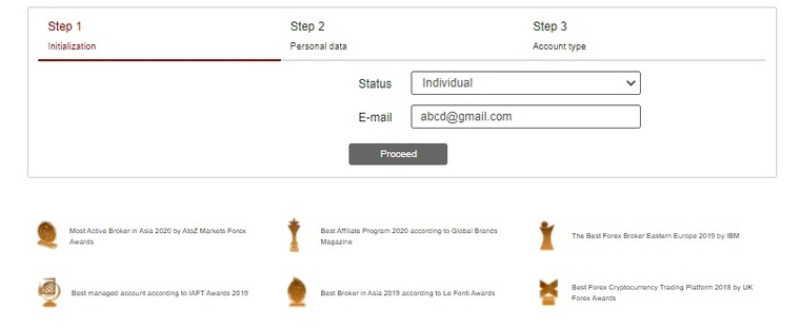

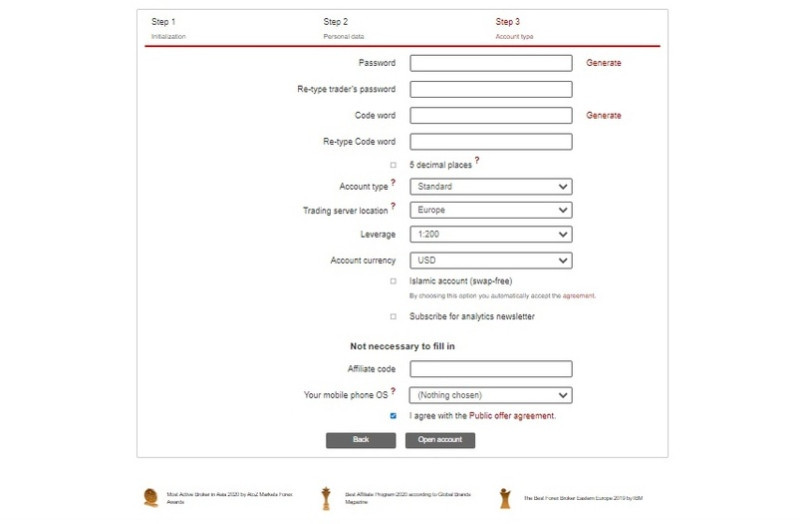

- You need to specify whether you are an individual trader or a legal entity, write an email;

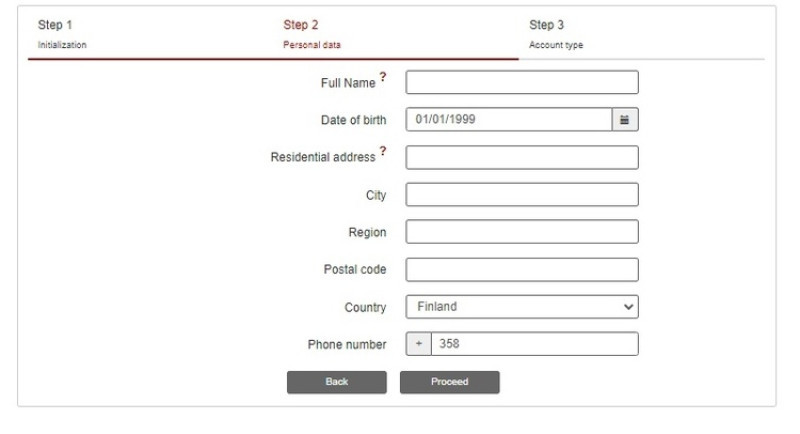

- Enter personal data. Fill in all the required fields;

- Choose an account type. At this stage, you will need to decide on the account currency, leverage, come up with a password, and confirm it.

- When determining an account currency, choose the one that you already have as you will replenish your account balance with this currency. As for the leverage, it can be changed later.

- Some fields are filled in by the system by default: for example, account type, server, and so on. If necessary, make adjustments, it is not prohibited;

- Study the Public Offer Agreement – an important document, which we have already talked about, and confirm the opening of an account;

- Pass verification. With InstaForex, this step is optional. If you pass it, you will receive benefits: bonuses, additional ways to make a deposit, etc.

InstaForex offers two levels of verification. They differ in the number of advantages they give for trading. The higher the level, the more documents you need to provide. - The photos should be clear and personal information specified in the documents should be easy to read;

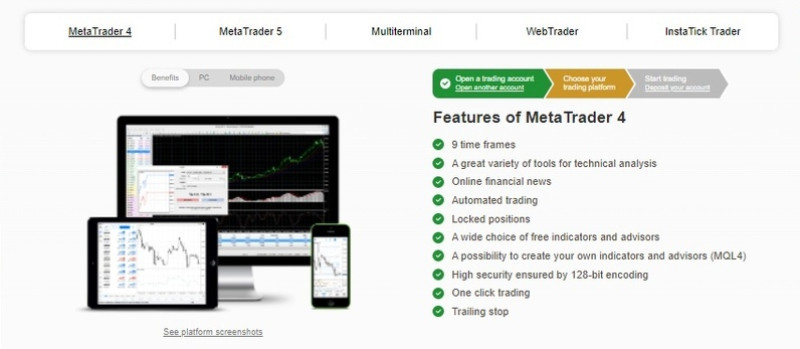

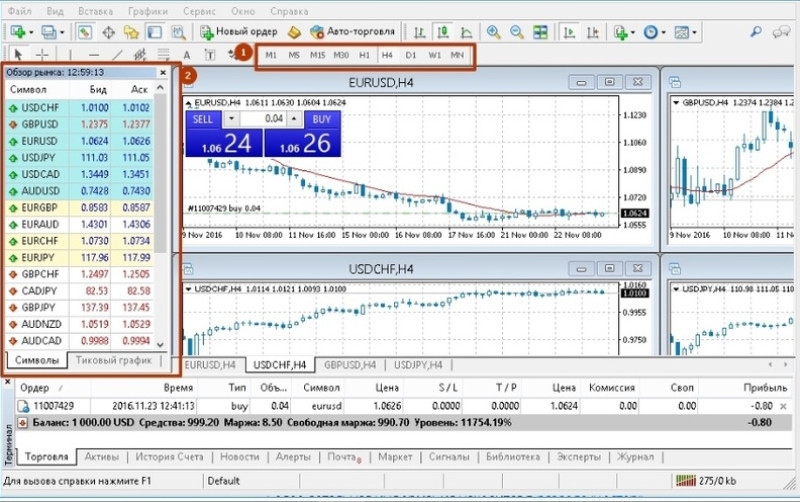

- Install a trading platform. InstaForex makes it possible to compare MT4 and MT5 so that you can choose the best option for yourself;

- Make a deposit and start trading.

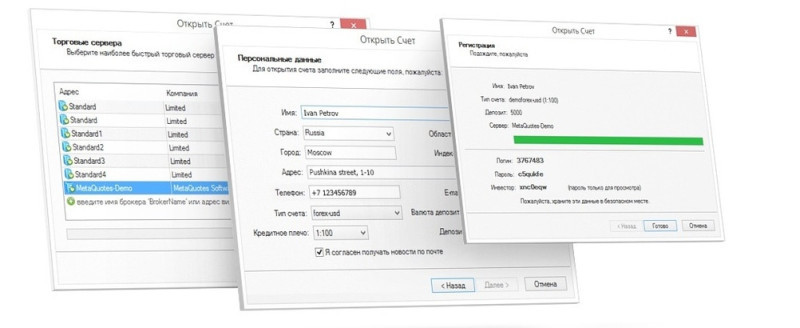

The main steps are shown in the pictures down below. So you can better understand what's what.

If you prepare the documents for verification in advance, you will pass all these rather quickly. When everything is ready and the deposit has been made, you can finally proceed to the final stage - trading on the downloaded platform.

Demo account

It is too risky to immediately switch to trading on a live account. It is better to start with a demo one. You can read about it in our article "What is a demo account on Forex".

If you are a novice trader, you may not be able to cope with emotions and do something wrong. In addition, you may lack experience and knowledge.

It is apparent that nobody wants to lose all the money at the very beginning.

To avoid such a gloomy scenario, you can hone your skills on a demo account. This type of account will enable traders to:

- understand how Forex operates as well as the trading platform;

- discern chart patterns and analyze trends;

- improve their knowledge of technical analysis;

- try out a trading strategy;

- assess trading results and experience.

To put it simply, you trade but risk absolutely nothing. You do not invest even a cent in transactions. In return, you get experience and practice but not profit.

Pros and cons of a demo account

| + | - |

|

|

Let's sum up. It is crucial for beginners to start with a demo account before starting real trading. They need to learn how to do it properly and polish their skills.

However, do not get used to it. You will not receive any profit which makes trading pointless. Besides, you may get used to not being responsible for losses.

How to open demo account on Forex

You have decided to try your hand at trading. As we advised, you want to start with a demo account. You can find more information on how to open it in the article "Forex Demo Account: How to Open?".

Why is it important? It is better to avert mistakes than to correct them later. In trading, where everything may affect your deposit, it is rather crucial.

We have already talked about what steps you need to make to open an account, including a demo one, with a broker.

You can also open a demo account directly in the trading platforms, for example, in the popular MetaTrader 4.

There are two types of МТ4:

- mobile;

- desktop.

Here are the main steps that should be taken to open a demo account on MetaTrader 4:

- Go to the official website of the platform;

- Download it on your device– PC or smartphone;

- Launch the platform;

- On the list of servers, choose MetaQuotes Demo;

- Register;

- Select an account type, leverage;

- Confirm registration.

That's it, now you can embark on your trading journey. There is no need to replenish your account or pass verification.

What do you need a trading platform for?

If you strive to become a successful forex trader, do not wait for a better moment. Start now! We advise you to read our article "How to Open a Real Forex Account on Metatrader 4" in order to avoid initial mistakes.

You have probably noticed that when it comes to trading platforms, MT4 is one of the most popular ones among traders. There are many reasons why it is so.

To start with, this is a free platform where traders from all over the world earn money on Forex. Speculators can use it on their computers and laptops, as well as tablets and smartphones.

Just choose the appropriate option when downloading.

This platform was launched by MetaQuotes in the early 2000s. Since then, it has been gaining popularity, remaining the most popular platform among speculators.

Notably, the platform is constantly being updated.

MetaTrader 4 is a kind of trader's workspace like a piano for musicians.

Here are the functions available on MetaTrader 4:

- real-time quotes;

- timeframes ranging from М1 to MN - from one minute to one month. However, you can also add your own ones;

- all tools for technical analysis: indicators, charts, and so on;

- opportunity to open positions;

- news feed;

- history of closed positions;

- Stop Loss, Take Profit orders, etc.

These are just the main functions that the developers have created for users.

When you use the Metatrader 4 platform for the first time, you may be spooked by the abundance of sections, numbers, and buttons. Hence, you may decide that you will never understand how it all works. However, it is easier than it seems.

Start by exploring the menu sections (file, view, insert, and so on), and you will see that it is not rocket science.

Cent account

Are you unwilling to invest a big sum of money in forex trading? Then make your investments smaller by opening a cent account. You can find more information on this topic in the article "Cent Account Forex: How to Open?".

People with various financial positions can trade Forex. Some traders have thousands of dollars on their deposit, whereas others open an account with the minimum deposit amount.

When it comes to a cent account, profits are calculated in cents. Transactions are also opened in them.

Let's say you top up your account with $10. If you open a cent account, the deposit will total 1,000 cents.

What is the point? - some traders may ask. Just to convert dollars into smaller units?

Of course not. Here is an example.

You want to trade the EUR/USD pair. Its exchange rate is 1.0810;

- You have a cent account ;

- You have opened an order to buy 0.1 lots as you are expecting the euro to rise in price;

- However, your forecast turns out to be inaccurate. EUR fell to 1.0795 or by 15 pips;

- We closed the position and lost 15 cents;

- Yet, if you had opened a standard account, you would have lost $15.

Therefore, a cent account helps trades avoid large losses. That is why it is recommended to beginners after they have completed training on a demo account.

However, mind that the profit you will gain will also be small.

Advantages:

- minimum deposit;

- low risks;

- best way to test a trading strategy and learn how to manage your funds;

- opportunity to assess the trading conditions of a broker.

Disadvantages:

- modest profit;

- low responsibility for mistakes.

Mini account

If you want to learn more about forex trading with a minimum deposit, we recommend that you read the article ”Forex Mini Account" There are a lot of interesting facts about how you can increase your capital even with a small upfront capital.

If you have a broad knowledge of the foreign exchange market and have chosen a broker, you have probably noticed that some companies indicate a minimum deposit amount. It may total $100 or $500.

What if traders don't have such an amount of money even if the sum is not so big? They can open a mini-account.

In general, a mini account enables you to enter the currency market using smaller size (mini lot) positions reduced by 10 times. Therefore, the deposit amount is also 10 times smaller.

The standard lot on Forex equals 100,000 units of any currency, for example, US dollars.

A mini-lot is 10,000 units of the base currency.

A mini account is a good option if you want to test a trading strategy. However, you are unwilling or do not have the opportunity to make a big deposit. The risks are rather low.

Keep in mind that orders are not executed immediately. If you prefer quick trades, a mini account is not exactly suitable for you.

The profit will also be smaller compared to standard lots.

All in all, the trading conditions are similar.

A mini account is a good opportunity for beginners to pave the way for bigger positions.

Micro account

A micro account requires an even smaller deposit amount than a mini account.

If you want to learn more about micro accounts, read our article "Micro Forex Account".

A mini-lot is 10,000 units of currency, whereas the micro lot is only 1,000 units. It means traders need even smaller capital for trading.

If traders use leverage on both mini or micro accounts, they can boost their profit on Forex.

Let’s say you take leverage of 1:100 and the lot size increases 100 times. At the same time, your initial deposit remains the same.

If the lot size is bigger, the potential profit will also rise. However, when using leverage, the risks of losses are also higher.

According to statistics, more than 80% of traders use leverage. If you open your trades wisely and do not use very large leverage, you can significantly enhance your results.

We have compiled a table in which you can see how profits and losses change depending on what kind of deposit you have.

Profit and loss on different account types

| Account | Lot size, $ | Pips, $ | Profit with price increase by 10 pips | Losses with price decline by 10 pips |

| Standard | 100,000 | 10 | $100 | $100 |

| Mini | 10,000 | 1 | $10 | $10 |

| Micro | 1,000 | 0.1 | $1 | $1 |

Micro and mini accounts are definitely suitable for beginners.

Firstly, they do not need to make a big deposit. Secondly, even if there are losses, they are insignificant.

Experienced traders can also open such accounts to try out a new strategy.

Recommendations

In this article, we have shared useful information on trading accounts. It's time to draw conclusions.

How to trade Forex:

- open a trading account with a reliable broker. Your funds will be kept in your trading account;

- store your username and password securely. It is too risky to rely solely on your own memory;

- decide upon how much you are willing to invest. If you want to make a small deposit, open a cent account. There are also mini and micro accounts;

- top up your account as well as withdraw money if necessary;

- the account displays the results of trading and includes a lot of useful functions;

- start with a demo account. After practicing trading on this type of account, you will be able to evaluate your chances and capabilities;

- if you want to make an income but do not have much time, you may copy orders of successful traders or use the PAMM system. Almost all brokers provide access to these services;

- apply leverage but remember about reasonable limits. The most common leverage is 1:100. At the start, you can use 1:10-1:50;

- open positions according to the chosen trading strategy. We have already said that you can test it on a demo account;

- do not expect hefty gains, especially at the very beginning. Be prepared for the fact that there will be unprofitable trades as well.

How to open a Forex account: Conclusion

Every trader should open an account if they want to make money on Forex.

Speculators with different capital can start trading. For this reason, brokers provide access to different account types which we have described in detail in this article.

The profit you have on your account is your money. You can withdraw it if you want.

Do you predict that the euro will rise versus the US dollar? Then open a long position on EUR /USD and monitor the movements of the quotes.

If you are inclined to become a trader, it does not mean you should invest thousands of dollars in trading. You can start with $10-50 on the account.

It sounds promising, isn't it? Why don't you give it a try?

In order not to waste time looking for a brokerage company, we advise you to choose InstaForex. However, the choice is yours.

Back to articles

Back to articles