Imagine that you have obtained some valuable information that you can use to make hefty profits. Will you seize such an opportunity?

Would your attitude change if you knew it's illegal or unethical? Everyone has their own answer to this question. Traders and brokers who use front running are ready to take any measures to make a profit.

In this review, we provide a detailed description of this of type of trading. You can learn more about other trading styles that are legally and ethically correct by reading our other article about types of trading.

What is front running?

To be precise, front running is not a trading style. It is rather a trading technique that enables its users to get bigger profits in a shorter period of time.

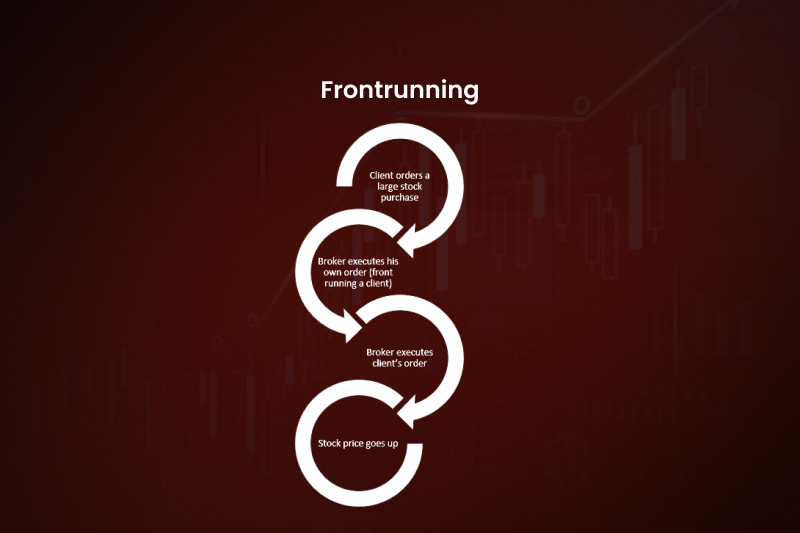

For this purpose, a trader places an order of a small volume, followed by an order of a bigger volume. The later one is placed by a large market player.

By doing this, a trader expects the bigger transaction to result in the asset price rising sharply. The trader will be able to sell the bought asset at a better price and make profit on the difference.

This technique is used by scalpers and intraday traders who obtain insider information or any other kind of information that can give them an advantage. However, the information on the basis of which such transactions are made is not always confidential.

Quite often, the insider information is used by dishonest brokers. They buy assets on a personal account right before the execution of large client orders in the same direction.

At the same time, this practice is illegal for a broker. It is prohibited both internationally and nationally. The punishment for such an offense for a broker may be cancellation of a license.

Besides, employees of large corporations can take advantage of the insider information on a stock exchange. However, they may trade assets on the accounts of relatives or other accomplices in order to conceal themselves.

Traders who cannot access sensitive information have another option. They can analyze orders in the book of orders of a particular asset.

Front running implies searching for bulk orders and opening your trade right before they get executed. This is a legal method, as a trader does not apply any additional tools and acts at their own risk.

Scalping and front running

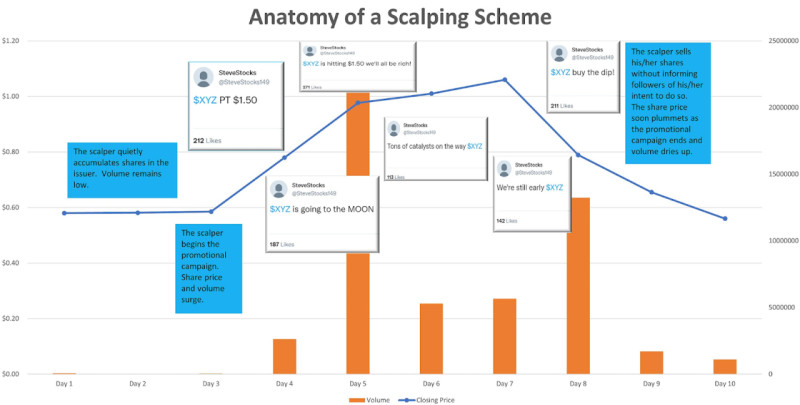

As already mentioned, front running is widely used by scalpers. Let us provide more details about the specific features of this trading technique.

Scalping is a type of short-term trading. Scalpers make a big number of short-term trades that last for no longer than 5 minutes on average.

Of course, it is impossible to get a big profit in such a short period of time. Therefore, scalpers take advantage of the quantity, not quality. That is, earnings from one trade may amount to only a few points.

The most important aspect in scalping is the speed of decision making. In order for these decisions to be correct, a trader need to get prepared by analysing the market in detail.

Scalpers do not miss the release of important news, because they fuel increased volatility and sharp movements in the market. For this type of trading, even small price fluctuations matter, though in other styles they are considered market noise.

To reduce the negative impact of this noise, traders analyse the market dynamics on longer time frames to confirm a signal. Shorter time frames such as M5-M15 are used for opening trades.

The scalping method helps traders acquire valuable experience. It enables them to train reaction, develop intuition, as well as conduct fast and effecient market analysis.

At the same time, this method has certain disadvantages. The key ones are an increased level of stress and strain, dependence on the technical parameters of the network and computer, as well as redrawing of indicators.

Another significant drawback is the impact of market makers on the movement of quotes. They can reverse the trend in the direction they need by placing orders of a large volume.

One of the varieties of scalping is high-frequency trading. This method implies that trades are made in a fraction of a second. However, this type of trading cannot be performed by a human, it can only be carried out by computer programs.

Other tactics similar to front running

Scalping is a legal method of trading. Under certain conditions and given that it is allowed by a broker, traders can freely use scalping.

That is, a brokerage company allows you to make fast transactions, providing the ability to track quotes in real time, high speed of execution, and other conditions.

The key requirement in this case is that a user should aim to generate income from a large number of short-term transactions.

There are situations when scalping is prohibited by a broker. Violation of this rule can lead to suspension from trading and even blocking of a trading account.

If such tactics are used to manipulate the market, they become illegal and prohibited at the level of state regulation. In such cases, frontrunning is considered as one of scam methods.

Here are some other illegal tactics that can be used by dishonest traders:

- The Whipping scheme involves one user placing orders for the purchase and sale of an asset at the same price. This artificial increase in market activity is done in order to inflate the asset price.

- The Intermarket Manipulation scheme involves trading in one market in order to manipulate the price of an asset in another market. Profit is obtained due to the artificially created effect of quotes movement.

Many states issue relevant laws prohibiting the use of such fraudulent methods of trading. Specifically, the US Stock Exchange Law of 1934 prohibited front running.

The difference between front running and insider information

The misuse of insider information and front running have a lot in common, but there are also certain differences. A broker cannot be employed in any corporation, therefore it cannot have access to any insider information.

There are the following types of the insider information:

- trade secrets;

- plans for a merger or acquisition;

- plans for a change of the company's management;

- information about a launch of new products;

- and other types.

This kind of information is confidential, so employees of large corporations often sign non-disclosure documents in regard to such information.

At the same time, the insider information does not include financial reports, and estimates or forecasts regarding the company's activities. This information is public and anyone can use it.

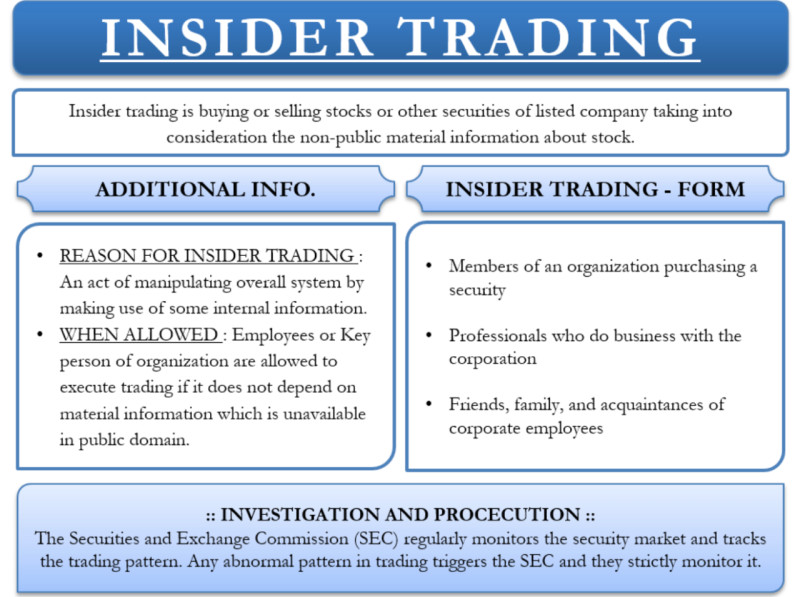

According to the US Securities Commission, only some employees can have access to the insider information. Namely, they are most likely those people who own at least 10% of the company shares. Due to this fact that, such shareholders can take an active part in the management and have access to classified data.

So, insiders can be executives and top managers, as well as major shareholders. However, employees of any level, not only managers can get access to classified information.

In addition, it can be people who do not work directly in the company: employees of banks and insurance companies, accountants working on the outsourcing basis, auditors, and so on.

Insider trading involves making trades based on classified information that is not available to the general public. The possession of this information gives traders a certain advantage.

At the same time, the use of such information can have a negative impact on both the company and other traders, as well as the stock market in general. Therefore, in many countries this trading method is illegal and prosecuted under administrative or criminal law.

How to use the insider information legally?

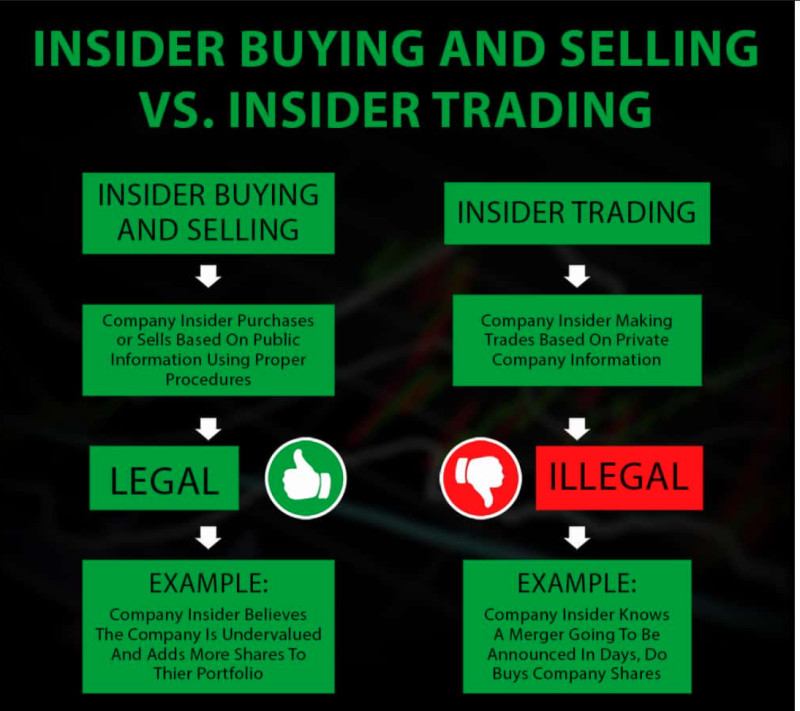

As already mentioned, the insider trading is illegal and punishable by law in most cases. However, there are cases when such trading is legal, and there is nothing wrong about using the insider information.

The insider trading is considered legal when it is carried out by traders holding at least 10% of the company's shares, provided that they trade these assets themselves.

This is a fairly common practice when employees or company executives purchase their securities. However, they are required to report these trades to the Securities Commission.

Therefore, the information about their shares, conducted trades, and other operations in the company becomes publicly available. With this information being unveiled, traders can use it in making their trading decisions on whether to buy or sell any particular asset.

However, it does not mean that all market participants should follow actions of such executives or top managers. Nonetheless, this information should be factored in, the more so when it relates to some standalone trades in the open market.

Despite the fact that such trades may affect the quotes, this does not contradict the corporate principles of the companies and is not considered illegal.

During the publication of corporate financial statements, employees of companies are prohibited from making exchange trades. These are so-called closed periods.

Such activity becomes illegal when the insider information is used to generate income before it is revealed to the public.

Quite often, employees of companies who have access to the insider information, in order to conceal their personality, make transactions not on their own, but on the accounts of relatives or friends.

In such a situation, some traders have an unfair advantage over others. This allows them to artificially influence the value of the company's securities.

How to make use of the insider information?

We already mentioned that the insider trading is considered legal only when the information is publicly available. That is why such information can be used in combination with the fundamental analysis of the company's data.

Trades made by shareholders of at least 10% of the company stocks as well as executives and top managers in the open market are of great importance for market participants.

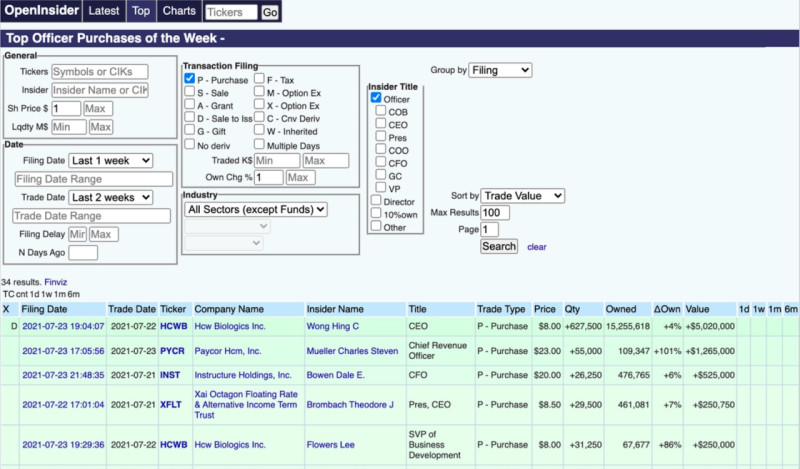

There are even special web services that provide information about insiders' actions. Such websites are openinsider, gurufocus, finviz, and other. However, some of these services are paid.

On these websites, you can filter the information about trades of executives, select the biggest buy or sell trades, and also separate automatic trades from the trades made in the open market.

If an executive or an employee of a company buys the shares of this company, it is a good sign for other market participants. However, it is purchases on the open market that really matter.

If they buy shares in their companies or increase their stake in them, then they really believe in the reliability and stability of the corporation. In this case, you can follow their example and also buy shares in the company.

You can also find information about the sale of securities of companies by insiders. However, this information is a little more difficult to analyse than the data about buy deals.

The thing is that the sale of shares by its management or employees does not always mean that the company is doing poorly. Sometimes they just urgently need money for various purposes such as real estate purchases, paying taxes or other payments.

At the same time, when insiders begin to simultaneously and very actively get rid of the securities of their companies, this is actually a bad sign. It is highly probable that other market participants will do the same.

It is also worth paying attention to the total volume of buy and sell deals of insiders in the US and Asia, as this is closely related to the overall stock market returns going forward.

As a general rule, insiders buy securities if they expect the economy to expand and the corporate cash flows to increase.

Cryptocurrency front running

Traditionally, the concept of front running is associated with stock markets, as well as decentralized platforms for trading shares. However, this scheme applies to cryptocurrency exchanges as well.

The cryptocurrency market is decentralized, and a big number of new participants have been joining it lately. Some of them are stock traders.

This was due to the fact that the cost of the most famous cryptocurrencies, bitcoin and ether, has increased significantly. New participants have entered this market hoping to make high profits quickly.

These new participants also introduced the trading tactics new for the cryptocurrency market, including scalping and other intraday strategies. These strategies cause no concerns and problems.

However, intraday traders also began to use another tactic, which is a kind of front running called tailgating in crypto trading.

The concept of this tactic is similar to front-running in the stock market. however, the approach to implementing this scheme is slightly different.

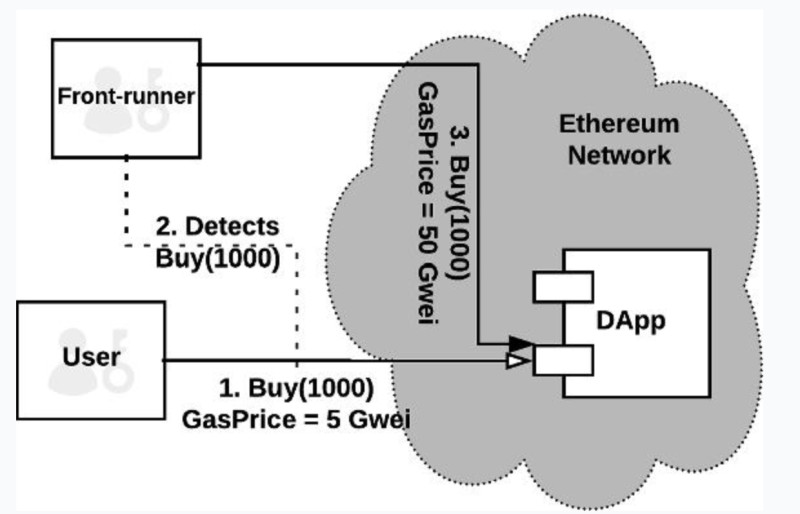

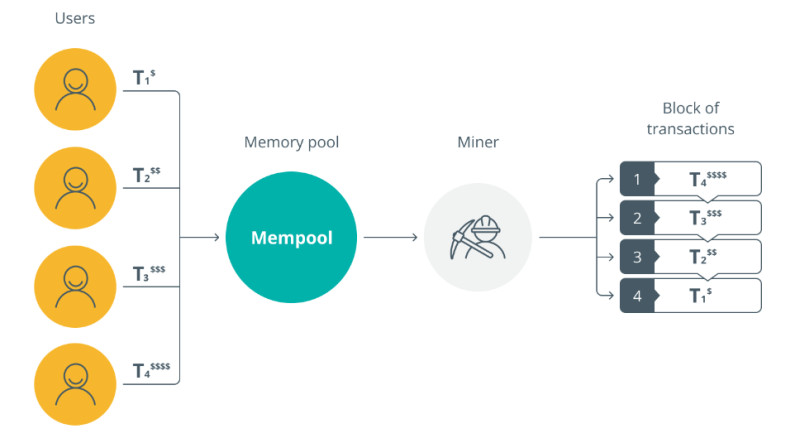

As a rule, trading bots are used to implement this tactic, as they are able to respond to a situation faster than a person.

Robots analyze and evaluate the market situation and help traders to stay ahead of the curve. They are used to bypass the queue of transactions of other traders and place your order in front of them.

For example, if a trader becomes aware of an upcoming large deal to purchase a cryptocurrency, he or she adjusts a bot to buy this asset just before this deal.

As soon as a larger transaction is made, the value of the crypto increases significantly. The robot places a sell order, and the trader get hefty profits.

To prevent front-running practices, you can avoid placing large orders in one transaction, but split them into several parts. Thus, they become less attractive to tailgating bots and traders using them.

What is tailgating?

On the one hand, tailgating is very similar to front running, on the other hand, they have certain differences. Literally, tailgating means "chasing a tail" or "following a tail."

Unlike front running, this practice is not illegal. However, it is considered unethical. Let us provide more details about this tactics and explain why it is unethical.

As a rule, this technique is used by brokerage companies. After they receive a request for a large transaction from a client, they make a similar transaction on their personal account.

Quite often, it happens when a client obtains some insider information that will have a serious impact on the asset price in the near future. That is, there is a direct connection between tailgating and insider trading.

However, not only brokers can use this tactic. It can be any intermediary or consultant who receives requests to make transactions for the sale or purchase of assets from clients.

In fact, tailgating is a kind of copying trading by a brokerage company or any other intermediary of client transactions.

The key difference between tailgating and front-running is that in the first case, the broker makes its deal after placing the client's order. In the case of front running, this happens before the client's deal.

That is, in the case of tailgating, the intermediary simply profits from the client's information, but this does not affect the client's order. In the case of front running, the client receives less profit due to the fact that the intermediary makes a deal in front of him. It may also happen that the client will have to buy an asset at a higher price.

Auto trading bots

As we already mentioned, trading bots can be of help to traders who use tactics such as front running and tailgating. This is due to the fact that they are able to quickly respond to changing market conditions.

The human brain is simply not able to quickly analyze large amounts of information and respond to it. A computer program can easily do this.

It is especially relevant in markets with high volatility, such as cryptocurrencies. The situation in such markets can change rapidly, and a quick response becomes an important advantage.

Trading bots can also be used to copy trades. In this case, they will simply copy the trades of the selected traders. However, one should understand that bots copy both profitable and losing trades.

Therefore, it is recommended to keep watch upon trading bots' activity, even if they are fully automated and can trade without human intervention.

However, bots are not able to foresee everything. For example, bots can fail in cases when some unforeseen events or emergencies occur in the world that affect all areas, including markets.

Such events make adjustments to the situation on the market, while a trading bot continues to trade according to the previously set algorithm. This is due to the fact that computer programs do not conduct fundamental analysis.

Most bots are based on technical analysis, that is, a certain set of indicators that allow you to analyze the situation in the market.

Conclusion

In this review, we have provided a detailed description of what front running is and what other illigal trading practices there are. These schemes, used by some traders and brokers, are prohibited by law in most countries.

The front running technique implies placing orders ahead of a trade of some major market participant. To conduct such operations, one should have access to the insider information.

At the same time, not only executives or top managers may possess the insider information, but also other employees or outside organizations that may have access to this data.

The above-mentioned people are called insiders, and the information that they possess is the insider information.

Notably, trading with the use of the insider information is not considered illigal. It is a common practice when employees or the management buy the securities of their companies.

Moreover, such purchases are a good sign for other market participants, as they indicate the management strong confidence in the company's good performance. At the same time, if insiders sell their security, it is not always a bad sign unless they damp the securities.

There is another trading tactics that is legal but also unethical. It is tailgating that implies that a broker or any other intermediary places a buy order following a similar trade of their client.

In other words, an intermediary copies trades of their clients. Front-runners place orders ahead of other traders' deals, while tailgaters make a trade following it. This is the key difference between these two techniques.

Back to articles

Back to articles