In the global online trading environment, the popularity of trading in the forex market is increasingly on the rise. One of the key tools that assists traders in overcoming challenges is MetaTrader 4 (MT4). As of today, MT4 is the most popular, intuitive, and user-friendly trading terminal. It offers traders a fresh approach to understanding markets and provides a wide range of resources and methods for online analytics and transactions.

A significant feature of MT4 is the ability to use trading advisors, often referred to as expert advisors or EAs (Expert Advisors). These advisors in MT4 are software solutions designed to automate trading strategies.

They have the capacity to analyze market data, identify trading signals, and automatically execute trades without the active involvement of the trader. This means that even those who are just beginning their journey in the trading world can benefit from the advantages of automated trading.

In this article, we will delve deeper into how to add expert advisor in MT4 and the opportunities available to traders when using these tools. We will also discuss the various types of trading advisors, their benefits and drawbacks, as well as important aspects such as combining multiple advisors and concerns about accuracy and efficiency in the context of automated trading.

The main objective of this article is to provide traders with a comprehensive guide on how to add expert advisor in MT4. This material will be of great value to anyone interested in online trading as it compiles detailed instructions, useful tips, and recommendations that will aid in effectively using a trading robot.

MetaTrader 4

MetaTrader 4, often referred to as MT4, has established itself as the gold standard in the realm of online trading. Crafted by the renowned developer MetaQuotes Software, this trading terminal grants access to a myriad of markets, encompassing forex, indices, stocks, cryptocurrencies, precious metals, and more. Beyond mere access, the platform facilitates sophisticated online analytics and empowers traders to execute transactions on their selected assets. In this section, we will delve deeper into the salient features and advantages of MT4.

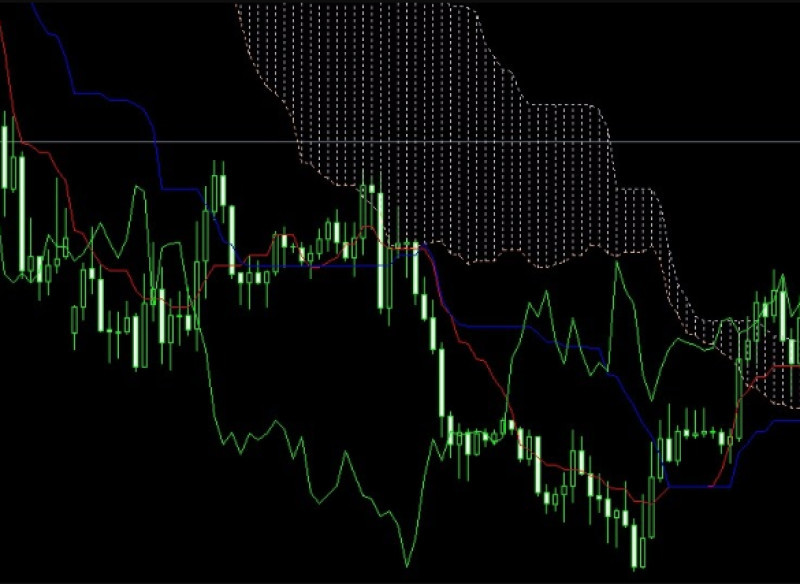

- Charts and analysis

One of the competitive edges of the terminal lies in its provision for both fundamental and technical analysis, essential tools in any specialist's arsenal. Traders can craft interactive charts across diverse time frames, apply technical indicators and trend lines, and conduct profound analysis using an array of fundamental data, encompassing news and economic events.

- Automated trading

Among MT4's most salient features is its capability for integrating automated trading and analytical programs, commonly referred to as Trading Advisors. These programs autonomously execute trades on the trader's behalf, rooted in pre-defined strategies and criteria. The principal advantage here is the potential to develop bespoke advisor robots. Additionally, users can opt from a plethora of ready-made solutions from the MetaTrader repository. Leveraging such experts facilitates the automation of trades, eliminating emotional biases and enhancing responsiveness to market fluctuations.

- Protection and security

MT4 ensures the absolute safeguarding of a trader's financial data and assets. The platform harnesses cutting-edge encryption technologies and guarantees a secure connection to broker servers. This is paramount for those trading with tangible funds.

- Mobile and Web trading

Beyond its desktop rendition, MT4 offers mobile and web versions, empowering traders to execute trades from virtually anywhere. The MetaTrader 4 mobile application is available for devices running Android and iOS, ensuring convenience on the move.

- Advanced order execution

MT4 boasts a diverse range of order types, including take-profit, stop-loss, pending, and market orders. This flexibility allows traders to manage their positions and risks with precision. Moreover, the platform prides itself on rapid order execution, a crucial feature for intraday traders.

Presently, MT4 stands globally recognized as the most user-friendly and intuitive trading platform. This acclaim is attributed to its reliability, functionality, and widespread broker support. Catering to both budding traders and seasoned professionals, it enables seamless interaction with financial markets, delivering confidence and efficiency.

MT4 Expert Advisors

As we've previously highlighted, trading advisors represent an avant-garde approach, offering the potential for trading process automation and its overarching enhancement. Trading advisors, colloquially termed as Expert Advisors or EAs, are software scripts devised to orchestrate trades based on pre-determined strategies and guidelines. In this section, how to add expert advisor in MT4 and the arsenal of opportunities they present to traders. Subsequently, we'll elucidate how to integrate an advisor into MT4.

- Trade automation

The cardinal advantage of these advisors lies in trade automation. Veteran traders can forge their bespoke advisors, anchored in trading proclivities, or simply opt for ready-made solutions from the MT4 repository. Such robots are adept at independently navigating trades. This proves invaluable for those with a limited bandwidth for continuous market surveillance and for sidelining human emotions from the decision-making tableau.

- Wide choice of strategies

Advisors within MT4 can be tailored to execute an array of trading strategies. These experts can leverage diverse market analysis types or synergistically integrate them. Consequently, traders can cherry-pick robots based on their personal predilections.

- Backtesting

Prior to commissioning an advisor for live-market trading, traders can conduct backtesting on historical datasets. This facilitates gauging the advisor's retrospective performance and prognosticating its prospective efficacy. Backtesting also aids in discerning the advisor's optimal parameters.

- Flexibility and settings

Advisors within MT4 are characterized by a high degree of adaptability and tailorability. Traders can tweak advisor parameters to align with specific market conditions or shifts in strategy. Thus, each advisor can become the embodiment of a distinctive trading strategy.

- Accessiblity

MetaTrader 4 stands as the most recognized and among the most intuitive trading platforms in the digital trading realm, with a plethora of brokers extending support for this platform. This signifies that traders can effortlessly pinpoint a broker proffering MT4 trading services and commence utilizing advisors without the compulsion of platform migration.

- Risks and limitations

Despite their myriad advantages, advisors aren't without constraints and inherent risks. The performance trajectory of advisors can be contingent upon prevailing market conditions; hence, placing unwavering faith in past performances can be myopic. Past success is not an indication of the same results in future. Traders ought to meticulously test and supervise advisors, armed with a comprehensive understanding and oversight of strategies wielded in automated trading.

In summation, MT4 advisors bestow traders with a formidable apparatus for trading automation and augmentation. Nonetheless, their efficacious deployment mandates expertise and prudence to pare down risks and realize desired outcomes.

Types of MT4 Advisors

Advisors in MetaTrader 4 (MT4) offer traders a broad spectrum of strategies and trading styles. In this segment, we'll explore the diverse kinds of MT4 advisors, their attributes, and application domains.

1. Indicator-based advisors

Robots based on indicators leverage various technical indicators, like the Relative Strength Index (RSI), moving averages, stochastic oscillator, among others, for market data analysis. They generate trading signals based on the indicators' values and strategy rules. These advisors are tailored for those who incorporate technical analysis and monitor price and volume fluctuations.

2.Expert Advisors (EA)

Expert Advisors are the most popular type of trading robots within MT4. Their widespread acclaim stems from their capacity to execute intricate strategies that might encompass both technical and fundamental analysis. These advisors are designed for automated market entry and exit decisions and position management. Traders can craft their custom expert advisors or procure them from the marketplace.

3. Grid-based Expert Advisors

Grid-based advisors employ the grid strategy to initiate and close positions at specific price thresholds. They can operate in both sideways markets and trending conditions. Advisors of this ilk might maintain multiple concurrent open positions, rendering them potentially lucrative but simultaneously more risk-laden.

4. Scalping EAs

Scalping advisors focus on executing short-term trades for modest profits, often within a few minutes. They actively respond to minuscule price shifts, rapidly initiating and concluding trades, sometimes in mere minutes or even seconds, capitalizing on the slightest market price oscillations. These advisors necessitate low order execution latency and a brisk internet connection.

5. Arbitrage EAs

Arbitrage advisors scout for price discrepancies between different brokers or online platforms, striving to benefit from this gap. These advisors can operate at high frequencies and require low latency with swift order execution.

6. News Trading EAs

News-centric advisors keep tabs on economic news and events with potential market impacts. They can autonomously react to news, orchestrating trades as per pre-defined rules. Such advisors are frequently harnessed for trading during pivotal economic events.

The choice of a specific advisor type hinges on a trader's strategy and style, coupled with market conditions. Traders can amalgamate various advisor types in their portfolio, cultivating diversity and risk mitigation.

Installing a trading advisor in MetaTrader 4

Installing an advisor (also known as Expert Advisor or EA) in MetaTrader 4 (MT4) might seem like a complex task for beginners, but it's actually a pretty straightforward process. In this section, we'll go step-by-step on how to add expert advisor in MT4.

Step 1: Downloading an advisor

Before installing the advisor, you need to obtain its file. Advisors usually come in the .ex4 or .mq4 format. You can create your own advisor or download a ready-made one from online libraries or from your broker.

Step 2: Open Experts folder

Once you have the advisor file, navigate to the folder where your MT4 is installed. This is usually the path C:\Program Files\MetaTrader 4 on Windows-operated computers. Then, find the experts folder.

Step 3: Copy the advisor file

Copy the downloaded advisor file (with the .ex4 or .mq4 extension) into the experts folder. This is where MT4 looks for advisors to load.

Step 4: Restart MT4

For MT4 to detect the new advisor, restart the software. You can do this by selecting File from the top menu and then choosing Restart.

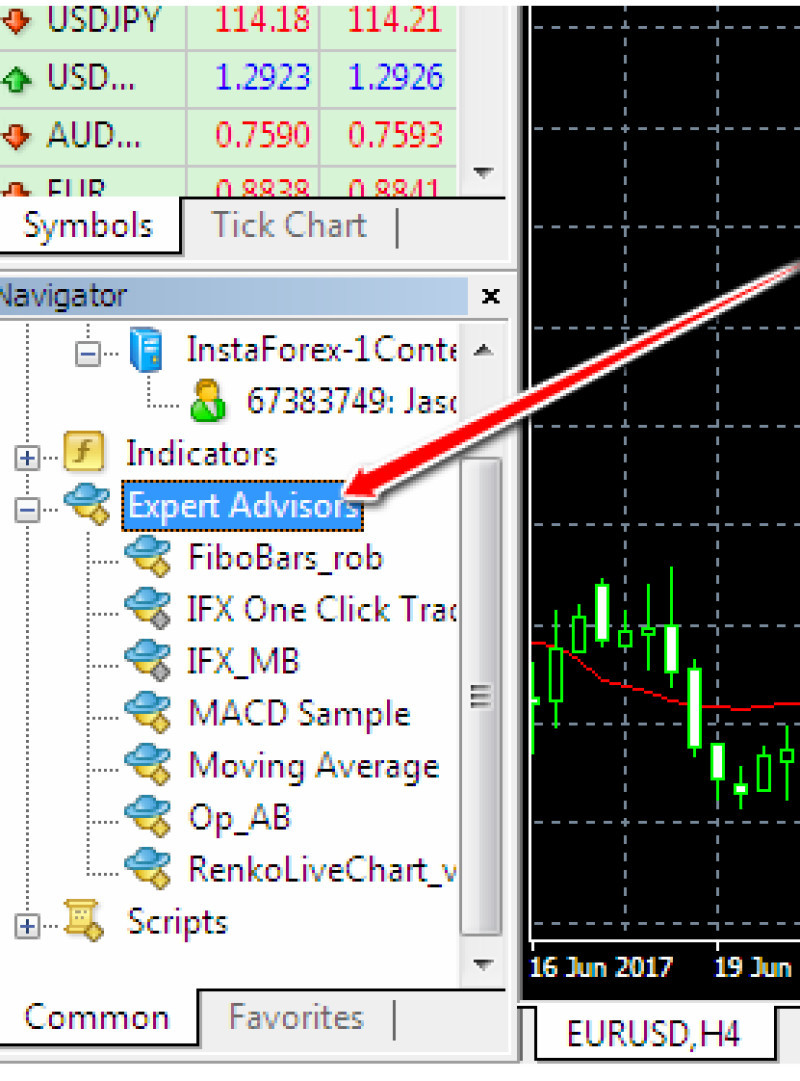

Step 5: Open the Navigator

In the bottom left corner of MT4, you'll find the Navigator tab. Click on it to open the navigation panel.

Step 6: Find your advisor in the Navigator

In the Navigator panel, select the Advisors tab, and you'll see a list of available advisors. Your advisor should appear here.

Step 7: Drag the advisor onto the chart

To use the advisor on a specific chart, simply drag it from the Navigator panel onto the chart of the chosen financial instrument. A window with the advisor's parameters will appear, where you can configure its operation.

Step 8: Adjust the advisor's parameters

Once the advisor is added to the chart, you can adjust its parameters in line with your trading strategy. This includes setting parameters such as lot size, stop-loss, take-profit, and others.

Step 9: Enable auto trading

For the advisor to begin trading automatically based on the set parameters, ensure that the Auto Trading option is activated in the top right corner of the main MT4 window. This will allow the advisor to open and close trades automatically.

Step 10: Monitoring and management

After activating the advisor, monitor its operation and results. It's crucial to consistently watch its performance and, if necessary, make changes to the settings.

How to add expert advisor in MT4 is just the beginning. For successful automated trading, it's important to continue monitoring and optimizing the advisor, as well as understanding the strategy on which it's based. It's recommended to start with a demo account to test the advisor in real but risk-free conditions before transitioning to real funds.

Pros and cons of trading advisors

Trading Advisor, aka Expert Advisors, have become an integral part of financial markets, offering traders a range of advantages. At the same time, they come with certain drawbacks.

Advantages of trading advisors:

- Automated trading: One of the most evident benefits of advisors is the ability to automate trading. Advisors can operate 24/7 without the constant need to monitor the market, which is especially useful for traders who don't have time for full-fledged trading sessions.

- No emotions involved: Advisors make decisions based on predefined rules and parameters, eliminating human emotions like fear, greed, and indecision. This can help avoid many mistakes made by traders due to emotions.

- Quick response to market signals: Advisors can instantly react to trading signals and market condition changes, crucial for certain strategies like scalping.

- Ability to test on historical data: Before launching an advisor in real market conditions, traders can conduct backtesting on historical data to evaluate its performance and efficiency.

- Advanced features and strategies: Advisors can implement intricate strategies that would be challenging or impossible to execute manually. This includes strategies based on mathematical calculations, statistics, arbitrage, and other complex methods.

Drawbacks of trading advisors:

- Need for constant monitoring: It's important to understand that even automated advisors require oversight. The market can change abruptly, and an advisor relying on historical data may not cope with new conditions.

- Low adaptability to market changes: Some advisors might be too rigid in their strategies and not adapt to shifting market conditions. This can lead to capital loss in volatile market situations.

- Risks of software errors: As software, advisors are susceptible to technical glitches or programming mistakes. This can lead to unpredictable results and losses.

- Complexity in creation and setup: Creating and setting up your own advisor may require in-depth knowledge in programming and financial markets. For beginners, this can be a challenging task.

- Reliance on historical data: Results from backtesting might not always be predictive since they are based on past data, which doesn't always indicate future market events.

In conclusion, trading advisors provide traders with a convenient tool for automation and enhancing trading, but they have certain flaws. Before using an advisor, it's essential to test it rigorously and take measures to manage risks.

Combining trading advisors

Combining trading advisors, also known as a portfolio approach to automated trading, is a strategy where several advisors are used simultaneously to achieve more complex and diverse results. We already know how to install an advisor in MT4; what remains is to understand how to combine them. This method can help traders enhance performance and reduce risks. Let's consider the advantages and characteristics of combining trading advisors.

Advantages of Combining Trading Advisors:

Diversity of strategies: Combining advisors allows traders to use different strategies on various financial instruments or time frames. For example, one advisor might be set for scalping on EUR/USD, while another for a trending strategy on gold. This diversification reduces risk and allows a variety of strategies.

Decreased likelihood of losses: Since different advisors may have different approaches to the market, the probability of simultaneous losing trades is reduced. If one advisor is in a loss, another might offset that loss.

Risk management: Combining advisors allows for each to be adjusted considering risk tolerance and capital, aiding in more precise risk management. A trader can set different lot sizes and stop-losses for each advisor.

Market adaptability: different advisors might perform better under different market conditions. For instance, one advisor might be effective in a sideways market, while another thrives in trending conditions. Combining them offers better adaptability to market changes.

Diversity of assets: By combining advisors, traders can operate across various assets and markets. This can be beneficial for diversifying an investment portfolio and distributing risks.

Characteristics of combining trading advisors:

Choosing the right advisors: A key aspect of successfully combining advisors is selecting the right ones with compatible strategies. Consideration should be given to how the advisors will interact with each other in the market.

Setting parameters: Each advisor might require individual parameter adjustments to harmonize within the portfolio. Lot sizes, stop-losses, and take-profits need to be determined in line with the overarching strategy.

Monitoring and analysis: When several advisors are working in tandem, it's essential to regularly monitor their performance and analyze the results. If one of them underperforms, it could impact the others.

Advisors accuracy

Precision of Expert Advisors (or EA) in automated trading is a key factor determining their success in the financial markets. Precision indicates how well an advisor can predict market movements and generate profitable trades. In this section, we'll look at the factors affecting advisor precision and how it can be improved.

Factors influencing the accuracy of advisors:

Trading strategy: The primary strategy upon which an advisor is based plays a pivotal role in its precision. Different strategies may be more or less effective depending on the current market conditions.

Used indicators and analysis: Advisors can use various indicators and analysis methods, such as technical or fundamental analysis. The effectiveness of these tools in the context of the chosen strategy impacts the advisor's precision.

Advisor settings: The parameters on which an advisor is set can significantly influence its precision. Optimal parameters might depend on the current market conditions and the assets the advisor trades.

Backtesting: Conducting backtesting on historical data helps assess an advisor's past precision. However, it's essential to remember that past results don't guarantee future profits.

Market conditions: An advisor's precision can greatly depend on the current market conditions. For instance, an advisor designed for sideways market trading might not work well in trending conditions and vice versa.

Order execution speed: The time required to execute orders can also affect an advisor's precision, especially for strategies demanding quick responses to market changes.

Improving Advisor Precision:

Parameter optimization: Regularly optimizing an advisor's parameters based on current market data can enhance its precision. This might involve adjusting lot sizes, stop-loss levels, and take-profit points.

Portfolio diversification: Using multiple advisors with different strategies and settings in one portfolio can reduce risks and boost precision.

Monitoring and analysis: Regularly monitoring and analyzing advisor performance helps identify issues and adapt to shifting market conditions.

Learning and strategy updating: Understanding the market and continually updating strategies based on new knowledge and data can significantly enhance an advisor's precision.

To sum up, the precision of advisors in automated trading plays a crucial role in achieving successful results. Understanding the factors influencing precision and continually refining strategies and settings can aid traders in improving the effectiveness of their advisors in the financial markets.

Conclusion

In this article, we have taken an in-depth look at the world of trading advisors (Expert Advisors, EA) in the popular platform MetaTrader 4 (MT4). These automated tools have become an integral part of modern financial trading and provide traders with numerous opportunities and challenges.

MetaTrader 4, being one of the most popular trading platforms, offers a convenient and functional environment for creating, configuring, and using advisors. This powerful software allows traders to automate strategies based on technical and fundamental analysis and also to develop their own algorithms.

We discussed various types of advisors, including technical, scalping, arbitrage, and many others. The choice of the appropriate advisor depends on the trader's strategy and market conditions. Combining different advisors into a portfolio allows diversifying risks and enhancing trading efficiency.

The advantages of advisors include trade automation, eliminating emotional influence, fast response to market signals, and the ability to backtest strategies. However, there are also disadvantages, such as the need for constant monitoring, risks of software errors, and the complexity of creating one's own advisors.

The precision of the advisors is a key factor for their success. Many factors, including the strategy, parameters, market conditions, and order execution speed, affect the precision of advisors. Regular optimization, monitoring, and analysis of results, as well as training and strategy updating, can help improve advisor precision.

How to add expert advisor in MT4 is a powerful tool, but it requires attention, knowledge, and experience. It's essential to remember that there is no universal advisor that guarantees profit. Successful automated trading demands continuous work, analysis, and adaptation to changing market conditions.

You may also like:

How to install an indicator in MT4

How to install two MT4 terminals

Back to articles

Back to articles