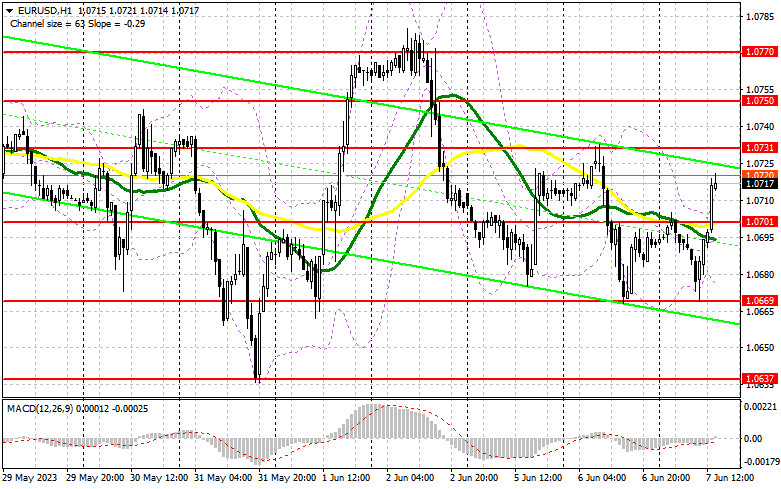

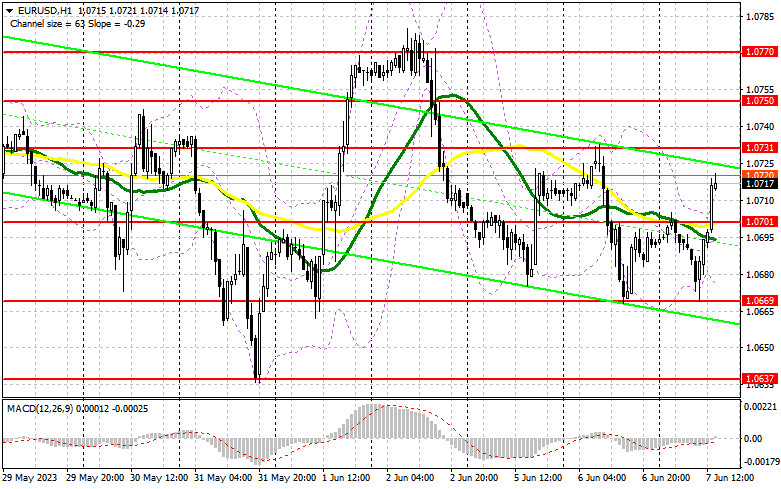

In my morning article, I turned your attention to 1.0669 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A decline and a false breakout of this level gave a buy signal, which resulted in an upward movement of more than 50 pips. For the afternoon, the technical outlook has changed slightly.

When to open long positions on EUR/USD:

Germany's Manufacturing PMI Index turned out to be better than expected. It helped the euro regain ground. In the afternoon, the US will reveal trade balance data as well as imports and exports figures. If the reports are upbeat, it could lead to a decrease in EUR/USD, which will provide an excellent entry point into long positions. The pair is likely to rise to yesterday's highs.

A false breakout of 1.0701 will indicate that there are large traders who are willing to push the euro higher. It will give new entry points into long positions with the prospect of an upward movement to 1.0731, a new resistance level formed yesterday. A breakout and a downward retest of this level will boost demand for the euro, creating an additional entry point for building into long positions. The pair may reach 1.0750. A more distant target will be the 1.0770 level where I recommend locking in profits. If EUR/USD drops and bulls fail to protect 1.0701, the pressure on the euro will return. The moving averages are passing in positive territory at this level. Therefore, only a false breakout near 1.0669, the lower border of the sideways channel, from where the pair has already rebounded once today, will give new entry points into long positions. You could buy EUR/USD at a bounce from 1.0637, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears failed to push the pair to the weekly lows. As a result, it slid into the sideways channel. Fresh US macro stats will hardly help the US dollar climb. This is why it is better not to rush with short positions in the afternoon. I would advise you to go short only on a rise after an unsuccessful consolidation above the resistance level of 1.0731. A false breakout at this level will provide a sell signal that could push the pair to 1.0701 - the middle of the sideways channel. The moving averages are benefiting bulls at this level. A decline below this level as well as an upward retest could trigger a tumble to 1.0669. A more distant target will be the 1.0637 level where I recommend locking in profits.

If EUR/USD rises during the American session and bears fail to protect 1.0731, which is unlikely, the euro is likely to advance. In this case, it is better to postpone short positions until a false breakout of 1.0750. You could sell EUR/USD at a bounce from 1.0770, keeping in mind a downward intraday correction of 30-35 pips.

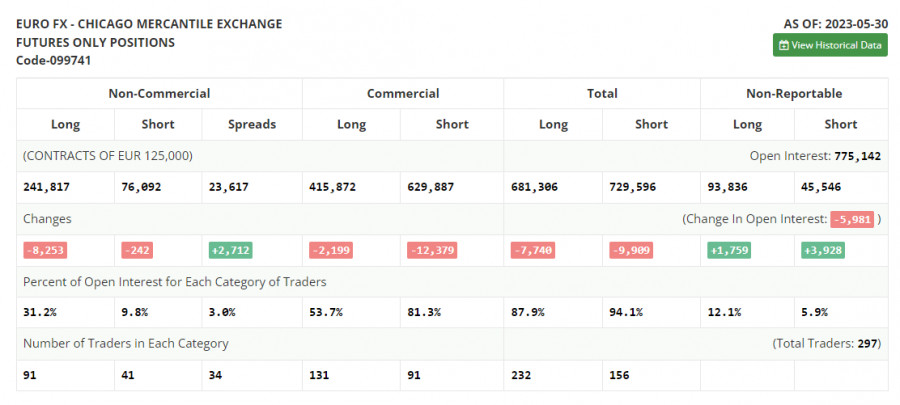

COT report:

According to the COT report (Commitment of Traders) for May 30, there was a decline in long and short positions. However, a drop in long positions was bigger. It indicates falling demand for risk assets. Traders are unwilling to buy the euro due to fears of a slowdown in the European economy and a recession. What is more, the ECB sticks to aggressive monetary tightening even despite the first signs of a steady decline in inflation. Therefore, they prefer a wait-and-see approach. Meanwhile, the US labor remains resilient. Even if the Fed takes a pause in June, it is likely to keep raising rates, boosting demand for the US dollar. The COT report showed that long non-commercial positions decreased by 8,253 to 241,817, while short non-commercial positions fell by 242 to 76,092. At the end of the week, the total non-commercial net position amounted to 163,054 against 185,045. The weekly closing price slipped to 1.0732 against 1.0793.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates the likelihood of a further increase.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.0680 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.