Stock markets provide both short and long-term investment opportunities. Market players can make a profit every day from short-term trading or gain income over several years.

However, no matter what you choose, you will still need a trading strategy. You can learn more about different strategies and choose the one that fits you best in the following article, “Forex strategies for beginners”

Trading strategies on the stock exchange

There are many ways to trade on the stock exchange. The equities market attracts both long-term investors and speculative traders.

Usually, when people think about stock exchanges, they mean investing in equities. However, stocks can be traded, even on quite short time frames.

However, long-term and short-term stocks are very different and require their own specific trading strategies.

Highly liquid and volatile equities are suitable for short-term trading. Their value can swing wildly, sometimes even in the span of a single trading day, bringing profits to traders employing short-term strategies.

Long-term investors favor more reliable assets with stable but small returns.

A person can do both trading and investing at the same time. However, some people find long-term investing undesirable due to their personality.

Certain traders prefer realizing profits within a week or a month, and not several years.

Short-term speculative trading is a better option for them. However, it should be noted that such trading demands much more time and effort.

A trader must always follow the situation in the market to be able to react to changing factors.

If you build an investment portfolio correctly, you will only have to balance it between various types of assets or add new ones if necessary.

Types of investments

Distinctions between various investments strategies are generally quite arbitrary. However, they help novice investors understand the subject.

According to the investment horizon, investments are divided into three types:

- Long-term investments are held for several years. Investors must take many factors into account when making investment decisions, such as energy prices, global conflicts, GDP of other countries, etc.

- Medium-term investments are those that one expects to hold for 1 month to a year. Investors with a medium-term investment horizon use technical analysis for choosing financial instruments.

- Short-term investments are assets that are held from several weeks to several months.

Investment assets are divided into several classes:

- Equities

- Bonds

- Precious metals

- Currencies

- Exchange Traded Fund (ETF) securities

- Derivatives (futures, etc.)

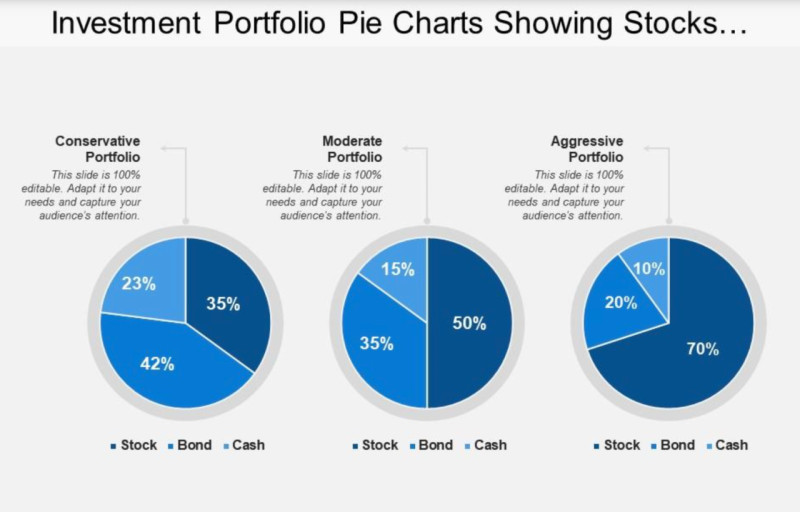

According to the investment strategy, investments can be conservative and aggressive:

- Conservative investments are held long-term and are not liquidated for several years. Usually they are blue chip stocks, such as large-cap companies in tech, financial, and commodity sectors.

- Aggressive investments are made into riskier, more volatile assets. They can bring large returns to the investor very quickly, but can also lead to significant losses.

Depending on the risk, investments are divided as follows:

- High-risk investments (equities);

- Medium-risk investments;

- Low-risk investments (government bonds).

According to the potential returns, there are three types of assets:

- High-yield assets;

- Medium-yield assets;

- Low-yield assets.

The investment’s risk and returns are correlated. High-risk assets can offer higher yields to investors willing to risk their funds.

Low-risk investments, on the other hand, can bring lower returns. Investors unwilling to take risks should choose medium or low-risk equities.

Long-term stock trading strategies

There are several basic investment strategies, with each of them having unique features. Investors should choose a scheme fitting their preferences.

1. Asset allocation – traders divide their investment portfolios based on criteria such as time horizon, risk, potential returns, etc. This strategy focuses on domestic and international stocks, low and high-cap equities, government bonds, and other instruments.

Aggressive portfolios focus on equities. For example, half of the portfolio could be allocated to US stocks, with the other half allocated to stocks from emerging markets. A moderate portfolio could allocate 40% to US stocks, 40% to emerging market stocks, and 10% to gold.

2. A dividend investment strategy involves acquiring stocks of companies that pay dividends to their shareholders. Investors holding dividend stocks earn constant returns and do not have to worry about share price fluctuations.

However, dividend stocks are quite expensive, and getting proper returns would require acquiring a sizeable number of shares. The investor must have a large amount of liquid capital to use this strategy.

3. Growth investing focuses on stocks of promising companies whose earnings and share prices are expected to increase. These companies generally do not pay dividends on their stocks and spend all their capital on developing their business.

Buying a stock when it is low and selling it when it is high may seem a quite attractive strategy for an investor. However, it demands scrupulous analysis. The investor would need to find a stock that would advance in the future and not vanish from the market, wiping out the investment.

Advantages and disadvantages of long-term strategies

Long-term investment strategies have their advantages and disadvantages. Let us look at them in detail.

Here are the advantages of long-term strategies:

- Very low brokerage fees. Unlike short-term trades, long-term investments have low brokerage fees that do not have a big impact on potential returns.

- Long-term strategies are not affected by market noise. Long-term price changes of stocks are influenced by global factors, such as increases in production, higher export volumes, etc.

- Larger time frames allow for extended market analysis. Long-term investors can see a wider picture than those at the heart of the action. Furthermore, investors using long-term strategies are not limited by time constraints, unlike short-term traders, who need to make decisions quickly.

- Long-term strategies take less time and energy. If you are a long-term investor, you only need to build a good investment portfolio, which would then bring you returns. A long-term investor does not need to spend time behind a computer tracking market movements in order to enter or exit the market at the right time.

- Long-term traders can diversify their portfolios with various asset classes. Both lower and higher risk assets can be mixed. Losses brought by one asset can be covered by gains from other assets.

Here are the main disadvantages of long-term investment strategies:

- Investors using long-term strategies have to wait a long time for buy signals, sometimes several weeks or more, unlike short-term traders, who can receive signals in the span of several minutes. It all depends on the investor’s demeanor and patience.

- Long-term investment strategies focus on assets with low and medium-term risks, which have correspondingly lower returns. Medium risk strategies typically bring yields of about 100 points.

- Long-term strategies are not suitable for beginners. Novice traders or investors do not have a deep understanding of market conditions and cannot fully analyze the influence of various factors on the long-term price of an asset. They can struggle with choosing the right asset to invest in.

- A long-term trader must have a sizeable initial capital. Low-risk assets bring low returns, and only a large investment can produce significant gains. Putting large amounts of money into several such assets can bring enough profits for a carefree retirement.

Is long-term investing for you?

It is easy to find out if long-term investment and its strategies really fits you.

If you have a large amount of idle cash that can be invested for several years, you should choose large-cap stocks. These stocks can bring stable passive income.

Equities of major companies are reliable and less volatile. A shareholder with a big enough stake can receive additional income from dividends every quarter or financial year.

If you don’t have enough cash for these stocks, you can try finding promising companies to invest in.

However, a trader planning to buy such stocks low must have a deep understanding of the market and should know how to find them.

When it comes to personality traits, long-term investing is not suitable for people who expect to get returns immediately. Such people would find waiting years to make a profit unacceptable.

On the other hand, these strategies would fit composed and cautious people.

Shrewd investors with enough patience and an ability to make quick decisions under pressure could likely succeed in both short-term trading and long-term investment.

Building an investment portfolio

The success of long-term investment strategies largely depends on how well you build your asset portfolio.

Experienced traders recommend following certain rules and regulations when building a well-allocated portfolio.

Notably, there is no ideal portfolio that would fit every single person. Each investor has their own unique portfolio composition that would fit them.

Here are the 4 steps for building an investment portfolio:

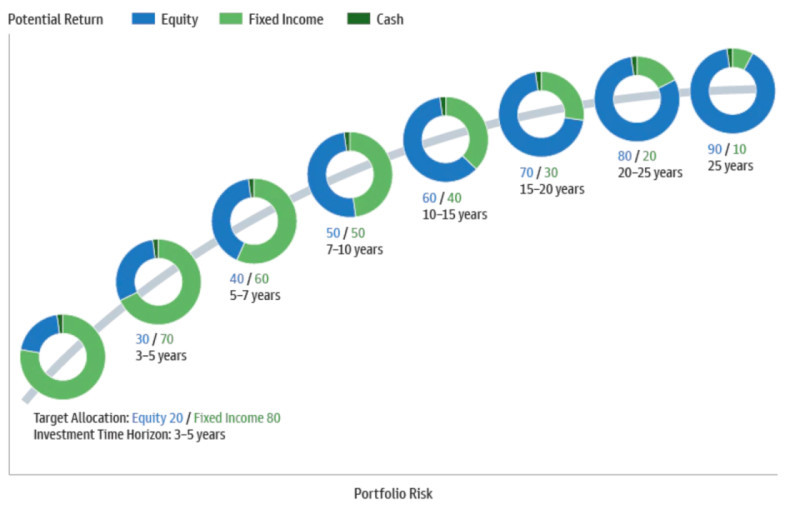

1) Choose your investment goals and an investment horizon. An investment goal is the amount of money that you plan to gain in the future.

The investment horizon is the period of time over which you are planning to hold assets, such as 5 years, 25 years, etc.

2) Determine your risk profile. An investor’s willingness to take risks is important for calculating a proper investment asset allocation for a portfolio.

There are three types of investors depending on their risk profile:

- Conservative investors accept a 5-10% drawdown. Their portfolios are focused on low-risk instruments such as bonds.

- Moderate investors have both bonds and stocks in their portfolios, with a potential drawdown of no more than 15-20%.

- Aggressive investors focus on high-risk assets such as equities. The potential drawdown of an aggressive portfolio can reach up to 50% during periods of crisis.

3) Determine your appropriate asset allocation. This step correlates with the previous two steps.

The higher your investment horizon and higher the risk profile, the more weight high-risk assets could have in your portfolio, and vice versa.

4. Choose assets for the investment portfolio. You should pick a diversified selection of instruments, such as assets from different economic sectors, countries, etc.

This would minimize the impact of the situation in one country on all your assets.

A portfolio should have assets from both developed countries and emerging markets, as well as such economic sectors as banking, commodities, the tech sector, etc.

An investor should take into account the liquidity of high-risk assets when building a portfolio. Highly liquid assets can be quickly and easily sold at any time.

Investing in PAMM accounts

Generally, investors do not consider the forex market to be a money-making opportunity. However, there is a setup that allows both traders and investors to cooperate.

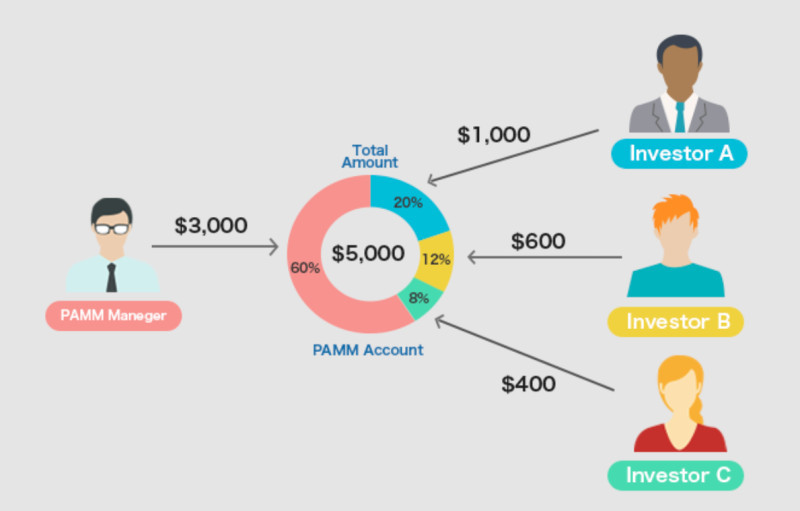

A PAMM account, shorthand for “percentage allocation money management”, is a special account in the FX market which is run by a professional trader or money manager. Besides using their own money, they attract funds from other investors.

The PAMM manager trades in the market using pooled funds. The profits are divided between the manager and investors.

By attracting investors, the managing trader can have a larger trading capital. The PAMM manager also receives a charge on profit from every profitable trade.

PAMM accounts allow investors to make gains on Forex without devoting their time to trading in the market. They can earn income while focusing on other business.

However, if the PAMM manager suffers losses, they are distributed between all investors as well. The trader managing the account does not receive their take unless they turn a profit.

At the same time, the PAMM manager does not limit risks for the investors, who have full responsibility for their invested funds.

To minimize risks, investors invest in several such accounts, thus creating a PAMM portfolio.

Losses incurred by one PAMM account can be covered with profits from other accounts.

PAMM managers are usually ranked and listed on the websites of brokerage firms. These rankings contain information about the account’s age, the amount of money managed, the number of investors, etc.

Before investing in a PAMM account, you should find information about it, as well as its terms and conditions. An account with an age of more than 6 months is considered reliable and stable.

Furthermore, you should note the manager’s risk profile. Conservative accounts can have returns below 60% and drawdowns up to 30%.

Aggressive trading accounts can have drawdowns above 50% but can offer returns exceeding 200%.

Choosing a reliable broker is also very important to ensure problem-free withdrawals.

Stock trading strategies rules

All experienced traders and investors follow certain rules, which are listed below:

- Any trader or investor must have a personal trading strategy to succeed. You should develop this strategy on your own through trial and error.

- While you can study strategies of more experienced and successful traders, only your personal trading system would be ideal for you.

- Choose the trading system based on how much it fits you, and not its profitability. Take into account your personality, your free time and your risk profile.

- Follow the chosen strategy and its buy/sell signals precisely. A trading strategy allows you to clearly identify when to enter and exit the market, which is one of its main advantages.

- Follow your system’s trading signals instead of trying to predict market movements. The market can move in any direction, and no one can definitively foresee what will happen.

- Do not rely on the opinions of analysts and experts too much. They are people just like you, and their forecasts can turn out to be incorrect.

- Think like a trader, even if you follow long-term strategies. Follow the market, set stop orders, and do not wait out big downtrends hoping that the market will recover.

- Diversify your portfolio to minimize risks. Thus, losses from one asset could be covered by gains from other assets, keeping you in the black.

Conclusion

In this article, we have looked at long-term strategies and how to use them.

An investor must correctly build their portfolio in order to successfully make a profit.

It is important to define your investment goal and risk profile first. Then, you should choose the right assets and allocate them correctly.

Exchanges offer various assets for long-term investments, each with its own yield and risk.

You must choose the assets that fit you, taking into account your personality, spare money, and other factors.

If you want to invest money in the forex market, but do not want to devote your time to studying it, you can use a PAMM account. You should make investments in several accounts and create a PAMM portfolio.

Read more

Forex swing trading strategies

Back to articles

Back to articles