The Canadian dollar continues to systematically win back positions from its American counterpart. The USD/CAD downward trend is consistent – the pair has been steadily declining since September 30, allowing only minor and short-term corrections. If the Canadian dollar was at the level of 1.2773 at the end of September, then today, traders have already tested the level of 1.22, marking at 4-month lows. It is supported not only by the Bank of Canada, whose representatives are voicing hawkish comments, but also by the oil market, which "keeps the commodity currency in good shape". The key Canadian macroeconomic indicators are also allies of this currency. In other words, the current fundamental background allows the USD/CAD bears to claim at least the 22nd mark.

The 450-point decline in the pair is primarily due to hawkish market expectations. All other factors listed above play an important but secondary role. The growth of oil prices is also viewed by the market through the prism of prospects for tightening the parameters of monetary policy by the Canadian regulator. The same can be said about the assessment of key macroeconomic reports: the positivity of a particular publication suggests that the Bank of Canada will decide on the first rate hike a little earlier relative to earlier forecasts. According to currency strategists of the financial conglomerate Wells Fargo (which is part of the so-called "big four" US banks), the Canadian regulator will raise the rate by 25 basis points in July next year, and by another 25 points at one of the last meetings of 2022. As for the prospects of the stimulus program, the Bank of Canada will reduce QE to 1 billion at the next meeting, which will be held next week (October 27), and will announce the completion of the program at the first meeting of next year, that is, in January.

The recent key macroeconomic reports have only increased the probability of this scenario coming true.

Here, Canada's unemployment rate declined to 6.9% in September. The indicator has been declining for the fourth month in a row. And although the indicator has not yet reached pre-crisis values (unemployment was around 5.8%-6.2% before the pandemic), the trend is positive. The growth in the number of employed is also pleasing – it surged to 157 thousand last month, with a forecasted growth of 60 thousand (the maximum growth rate since June). Moreover, the indicator grew due to the component of full employment, while the component of part-time employment was in the negative area. The share of the economically active population has also grown. The indicator has updated the one-and-a-half-year high, reaching 65.5%.

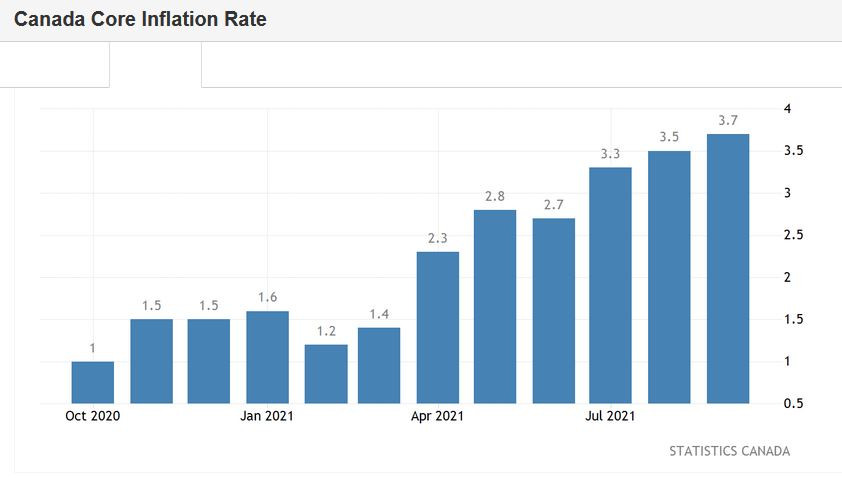

The data published yesterday on the growth of Canadian inflation also pleased the sellers of USD/CAD. In particular, the overall consumer price index remained at 0.2% in monthly terms (with a slowdown forecast to 0.1%). It also rose to a record target of 4.4% in annual terms. The last time this indicator was at such high values was back in 2003. Core inflation also showed a good result. The core index, excluding volatile energy and food prices, also increased, reaching 3.7% year-on-year.

The key releases that were published before the October meeting of the Bank of Canada inspired the USD/CAD bears: the pair updated the 4-month low, heading towards the main support level of 1.2250 (the lower line of the Bollinger Bands indicator on the D1 timeframe).

This target is expected to be tested before October 27, that is, before the meeting of the Canadian regulator. The Bank of Canada's business activity survey for the third quarter, which was published on Monday, showed that an increasing number of respondents are planning to raise wages to attract and retain the workforce. In addition, according to entrepreneurs, the pressure of increased demand amid the supply problems "stimulate investment, hire staff and raise prices." In general, most companies still expect healthy growth in the country's economy.

Given the growth of key macroeconomic indicators, this review only complemented the positive fundamental picture for the Canadian dollar. Therefore, it is advisable to use the USD/CAD upward pullbacks to open short positions above the support level.

From a technical point of view, the pair on all "higher" timeframes (from H4 and higher) is between the middle and lower lines of the Bollinger Bands indicator, which indicates the priority of the downward direction. As for D1 and W1 timeframes, the Ichimoku indicator has formed a bearish "Parade of Lines" signal, which also indicates the bearish mood. As mentioned above, the strongest support level is at 1.2250 (lower line of the Bollinger Bands on the daily chart). It is important for sellers to break through this target in order to consolidate within the range of 1.2180-1.22 and indicate further downward prospects. However, it is necessary to consider that when approaching the level of 1.2250, the pair may slow down and correct downward.