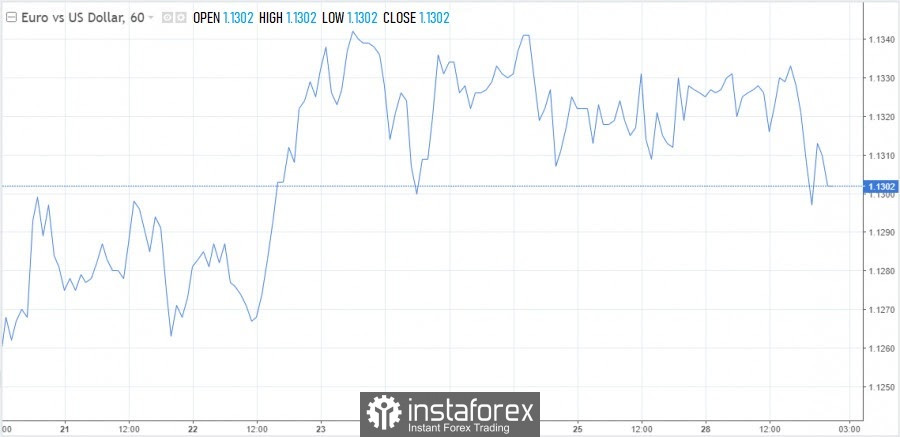

The dollar remains under pressure mainly due to the positive mood of stock markets, which increases the demand for high-yielding currencies. There is still nothing interesting happening in the EUR/USD pair, the range of movement has been narrowed in recent sessions. Traders cannot decide on the direction in the conditions of an empty economic calendar and a pre-holiday market.

By the end of the week, the borders are expected to expand to 1.1290-1.1360. During the hours of today's US session, it was noticeable that the euro was leaving the so-called comfort zone. Bearish sentiment will increase in the event of a breakdown of 1.1295, and approaching 1.1380 may attract bears.

Support levels are marked at 1.1295, 1.1250, 1.1210. Resistances are 1.1345, 1.1380, 1.1425.

Euro: with an eye on past experience

It is quite difficult now to predict the movement of the European currency at the beginning of next year. On the one hand, the euro gave a hint of a possible recovery, on the other hand, it does not have strong fundamental foundations.

The euro pulled up following the demand for risk. It is clear that there is a Santa rally and stock markets are growing. However, there is reason to believe that the demand for risk is associated, among other things, with the so-called Omicron optimism. The new strain, despite its high contagiousness, proceeds more easily.

A year ago, the euro rose on coronavirus optimism, or rather vaccine optimism. Despite the fact that a new, tougher wave of the pandemic swept the world in November and December, the markets tried to go a few steps ahead, playing off the supposed victory over covid through vaccines. The EUR/USD pair rose from 1.1650 to 1.2350, while the eurozone was plunging into recession at that time due to quarantine measures.

Theoretically, the current situation is very similar to past experience. Investors may believe that a new less dangerous strain will displace its more dangerous predecessors, and the pandemic will thus end. As it came, so it went – the problem will go away by itself. As an option, such a scenario can play on the side of the euro, but there are at least two "buts".

The dollar has a lot of chances to continue growing in the new year

Firstly, it is the Federal Reserve. What if the US central bank decides to raise the rate earlier than the recently predicted deadline, for example, in March or April. A hint in this direction has already been received.

A member of the Fed's Board of Governors, Christopher Waller, made it clear yesterday that, given inflation expectations and the state of the labor market, a rate hike would look appropriate immediately after the completion of the asset repurchase process in March. The head of the Federal Reserve Bank of New York, John Williams, gave a similar comment. He did not specify the timing, but said that a rapid reduction in incentives would give the central bank more flexibility to raise rates earlier.

This could trigger a new wave of dollar growth in 2022.

Secondly, we pay attention to the profitability of treasuries. A decline in the dollar is an increase in yields. Yes, there was an increase last week, but even at the level of 1.5%, they will be considered paradoxically low. On Tuesday, by the way, the yield of "ten-year-olds" decreased and stays near 1.47%.

Yields may remain under upward pressure due to the curtailment of incentives and the beginning of an increase in debt placements by the US Treasury after raising the debt limit. There are three auctions this week – on the 27th, 28th and 29th. The Treasury offers historically record volumes of securities to the market: 2-, 5- and 7-year notes, as well as 10-year notes. The total volume of investments at the end of the month will amount to $ 149.96 billion. This will provide short-term support to the dollar, so it is unlikely that the EUR/USD pair will be able to move up out of the range, and not only before the end of the year, but also at the beginning of the next one. As long as the Treasury focuses on bonds, not bills, the dollar should not fall.

The dollar index tried to fight back and move further from the 96.00 mark. Given the moderate nature of trading, some exorbitant bounces are not expected now. The bullish character will finally manifest itself and come to the fore at the beginning of next year, then the bulls' potential target will be the 98.00 mark.