The GBP/USD currency pair moved identically to the EUR/USD pair on Thursday. In the last few days or even weeks, both major pairs have been moving very similarly to each other, which suggests that they are influenced by the same fundamental factors. Since there have been no particularly important events recently in either the US, the EU, or the UK, we assume that this factor may be the monetary policy of the Fed. It is the "Fed" and only the "Fed". After all, the fact that the euro and the pound move in the same way suggests that the factor of influence on them is also the same. Consequently, the factor of monetary policy changes by the Bank of England, for example, is not taken into account now. We are increasingly inclined to the point of view that the entire last period of growth of the British currency was caused by two factors. First, by raising the BA key rate at the end of last year. Second, the nature of the movement of the pound/dollar pair over the past year. On the 24-hour TF, it is visible that the pair was moving in the style of "500 points down 400 up" during this period. The corrections were quite frequent and quite deep. Thus, in late 2021 - early 2022, we just saw another round of correction. If this is the case, then the main movement may resume now. The growth of the US currency. Even though the Bank of England has implemented a rate increase more quickly, we don't have to expect too much from it now. Market participants do not expect that the British regulator will continue to raise the rate in 2022, and everyone treats the December increase almost as an accident. Of course, this was not an accident, but BA does not have a clear plan to tighten monetary policy now. This means that the British pound exceeded its plan when it rose by 600 points during the month.

Omicron has not passed yet, but all restrictions are already being lifted in Britain.

Meanwhile, another significant event took place in the UK. We have already said in previous articles that now almost all the attention of traders are focused on the figure of Boris Johnson. And even if all the news related to the British Prime Minister does not provoke serious changes in the exchange rate of the British currency, in the long term, they can have an impact on both the economy and the pound. Now it has become known that at the height of the pandemic in the UK, almost all "coronavirus" restrictions are being lifted (from January 27). Now it is not necessary to wear masks in the country, you do not need to present COVID certificates, and the recommendation for remote work ceases to apply. And this is although it is at this time that Britain is at its peak in the number of omicron diseases. Of course, the figures are not as terrible as a week ago, nevertheless, on January 18, almost 100 thousand Britons fell ill. However, the British government believes that it is no longer necessary to work from home, you can visit nightclubs and any other public places even without masks. Although the British themselves do not treat this decision of the government as something bad. Many of them support the lifting of quarantine restrictions, and many, when asked how they feel about the government's decision, talk about Boris Johnson's parties, of which, as it turned out recently, there was quite a large number and many of them fall during periods of "lockdown". Thus, the British do not understand not why quarantine restrictions are being lifted or introduced, but why they are being introduced only for them, whereas they do not seem to apply to members of the British parliament. Well, we can only observe the development of the situation. Although the decision is as strange as possible, given that a couple of weeks ago there was news about overcrowded hospitals and the involvement of the military to help doctors, as many hospital workers became infected and had to go into self-isolation.

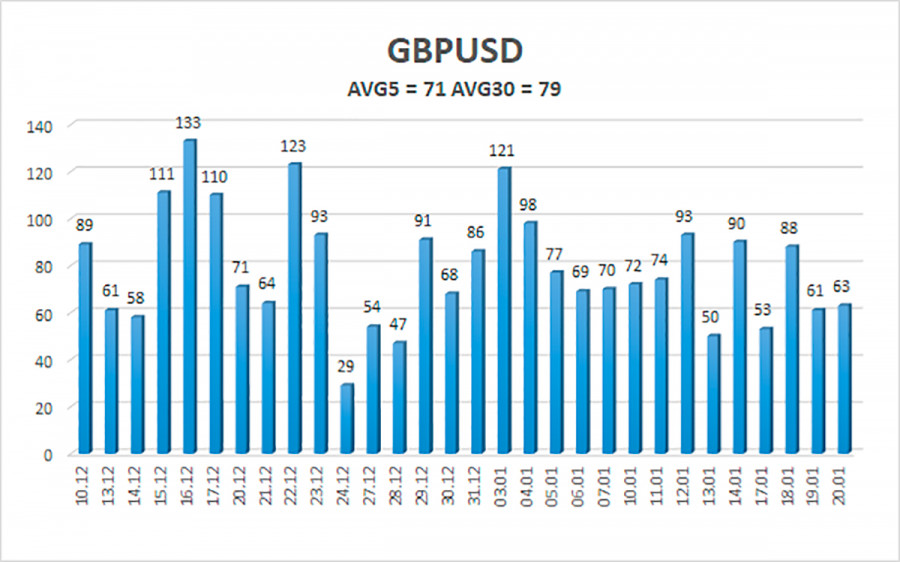

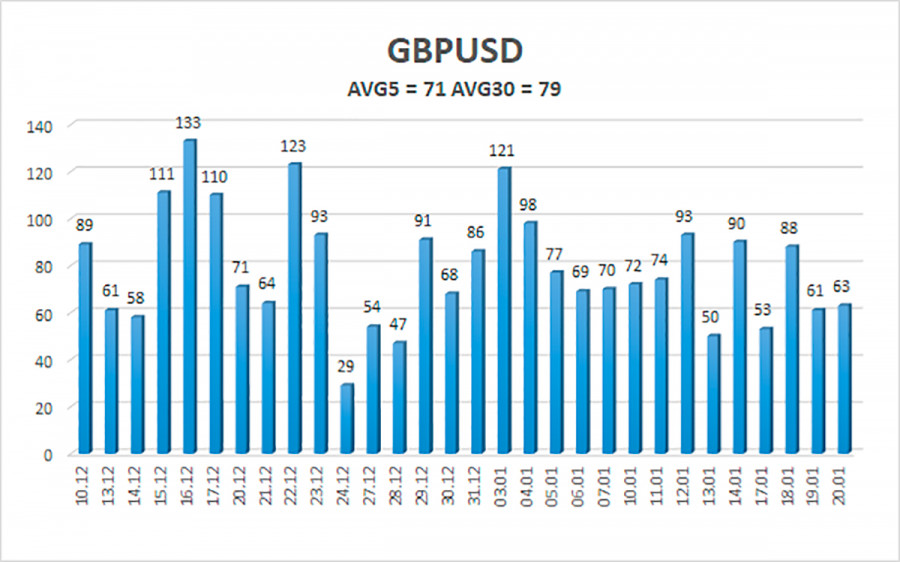

The average volatility of the GBP/USD pair is currently 71 points per day. For the pound/dollar pair, this value is "average". On Friday, January 21, thus, we expect movement inside the channel, limited by the levels of 1.3538 and 1.3680. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3611

S2 – 1.3550

S3 – 1.3489

Nearest resistance levels:

R1 – 1.3672

R2 – 1.3733

R3 – 1.3794

Trading recommendations:

The GBP/USD pair adjusted slightly to the moving on the 4-hour timeframe. Thus, at this time it is recommended to open new shorts with targets of 1.3550 and 1.3538 in the event of a price rebound from the moving average. It is recommended to consider long positions if the pair is fixed above the moving average line with targets of 1.3680 and 1.3733, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.