The EUR/USD currency pair easily continued its downward trend on Wednesday. Many anticipated a minor pullback after the euro fell 2 cents against the dollar on Tuesday. However, we cautioned that when the market accelerates and "gains momentum," a strong movement can easily persist for several days. Essentially, we witnessed this exact scenario on Wednesday. The European currency declined for no apparent reason, and the Heiken Ashi indicator did not attempt to turn higher. Moreover, the CCI indicator entered the oversold region, which typically indicates that the price is about to roll back at least slightly in the opposite direction, but nothing occurred afterward. Both linear regression channels point downwards, and the price is significantly below the moving average.

What does this all mean? All current technical indicators indicate that the euro will continue to fall. Unfortunately, 99 percent of the time, technology represents the current state of the market. Rarely can the end of a trend be predicted using technical indicators. Thus, the trend could theoretically end tomorrow. After all, the market is comprised of many players, and no one knows what the largest players, who drive the market, are thinking. Therefore, it is preferable to focus on those factors that can truly "predict the future." This is both geopolitics and the "foundation." Unfortunately for the euro, these factors continue to favor the dollar strongly.

There is nothing that can be done about the European Union's dependence on Russian oil and gas.

In recent articles, we have attempted to simulate a scenario in which the euro will stop depreciating against the dollar and concluded that such a scenario is unlikely under the current circumstances. From our perspective, the difference between the ECB and the Fed's monetary policies will be the primary factor in the global devaluation of the euro in 2022 (and earlier). Recall that the Fed has been steadily increasing its key rate and will continue to do so until it achieves a significant reduction in inflation. Simultaneously, the ECB continues to consider whether it will raise rates once or twice in 2022. Christine Lagarde appears to have already promised that the interest rate will be increased in July, but what will that accomplish? Indeed, this will not result in a decline in the consumer price index and an equilibrium between the euro and the dollar. Consequently, the dollar's potential growth is proportional to the Fed's rate-hiking vigor and duration.

The second extremely significant factor is geopolitics. Nevertheless, "geopolitics" is a broad term. We have previously stated that sanctions also affect the nation that imposes them. The impact of sanctions on the sanctioned country is greater than their effects on the sanctioning nation. In contrast, the situation is dire for the European Union, which is highly dependent on Russian oil and gas.

Nonetheless, it remains unclear whether a complete embargo will be imposed on these energy resources and, if so, what the European Union will use to replace them. Plans for the resumption of nuclear energy and the transition to "green" energy have been announced, but implementing these plans will take years. The Ukrainian civil war may be over by the time the EU completely abandons Russian oil and gas. Moreover, if oil can be replaced by oil from other countries, gas is a needle that is extraordinarily difficult to remove. Even within the European Union, it is acknowledged that refusing gas from the Russian Federation, even for several years, is impossible. Certainly, LNG supplies from the United States, Scandinavia, and even the United Kingdom are increasing, but their volumes are unlikely to be sufficient to offset the losses resulting from a complete break in relations with Russia. Also, many experts believe that Chinese and Indian buyers of "black gold" will flood the European market with Russian oil this winter. In the future, these nations will be able to sell (at market prices) oil comparable to that of India or China to the EU. Nonetheless, the European economy remains at risk due to the unpredictability of its functioning in the aftermath of the rupture of oil and gas contracts with Russia.

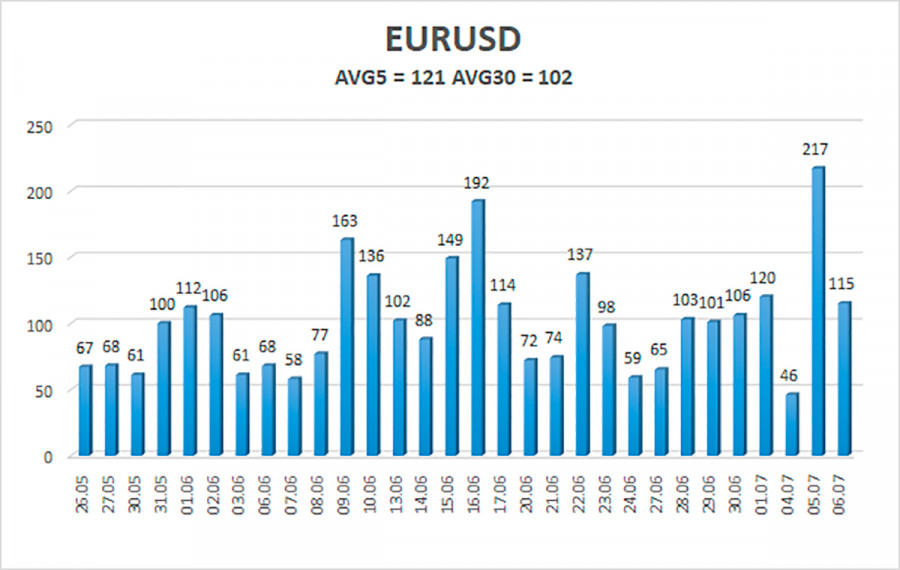

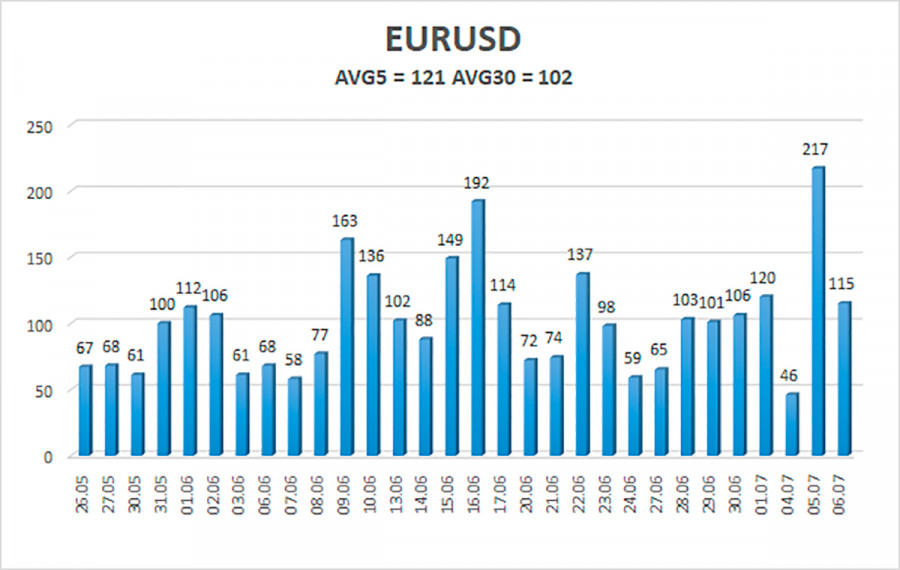

As of July 7, the average volatility of the euro/dollar currency pair over the previous five trading days was 121 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0049 and 1.0291 today. A reversal of the Heiken Ashi indicator upwards indicates that the pair will attempt to correct it again.

Nearest support levels:

S1 – 1.0132

Nearest resistance levels:

R1 – 1.0193

R2 – 1.0254

R3 – 1.0315

Trading recommendations:

The EUR/USD pair continues its strong downward trend. As long as the Heiken Ashi indicator points downwards, it is necessary to maintain short positions with targets of 1.0132 and 1.0049. Purchases become relevant when the pair is fixed above the moving average with targets of 1.0437 and 1.0498.

Explanations for the figures:

Channels of linear regression – aid in determining the current trend. The trend is currently strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the likely price channel the pair will trade within for the next trading day, based on the current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.