EUR/USD 5M

The EUR/USD pair showed the strongest upward movement on Wednesday. What should be noted right away is that the pair did not demonstrate it within the framework of an upward trend, but as part of a one-time action, which was provoked by the US inflation report. We do not mean to say that the euro's growth cannot continue further. We're just saying that the euro's growth from yesterday was caused solely by one event. So whether an upward trend will now start is the big question. We still believe that there are more factors in favor of the US dollar, but still traders made it clear yesterday that they are set for long positions on the euro. And after all, the market understands that the Federal Reserve will continue to raise the rate, but they still massively got rid of the dollar. We believe this could be a tipping point for a long-term downward trend. However, it will be easy to understand from the pair's movements in the near future. There will be no important events in either the US or the EU on Thursday and Friday. If the euro/dollar pair continues to grow, it will speak volumes and is already in favor of the euro...

As for trading signals, everything on Wednesday was decided by 1 point. Quotes fell to the Kijun-sen line in the middle of the European trading session, but did not reach it by 4 points (if there were 2-3 points, it would be another matter). Such a "loss" cannot be considered a bounce, so traders should not have opened long positions here. All subsequent signals were generated after the inflation report was published, therefore, it was possible to work out only those that occurred at the time two hours after the release. All of them turned out to be correct, but did not bring much profit, since the main movement occurred in the next hour after the release.

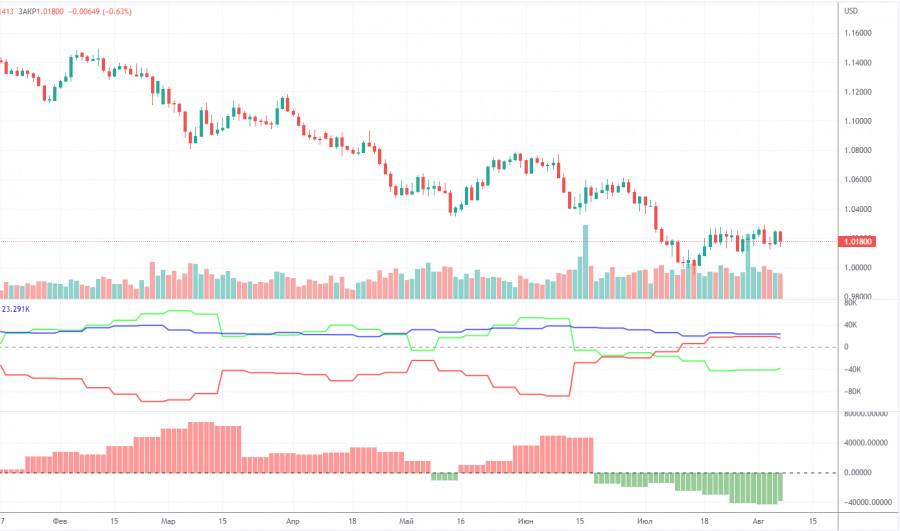

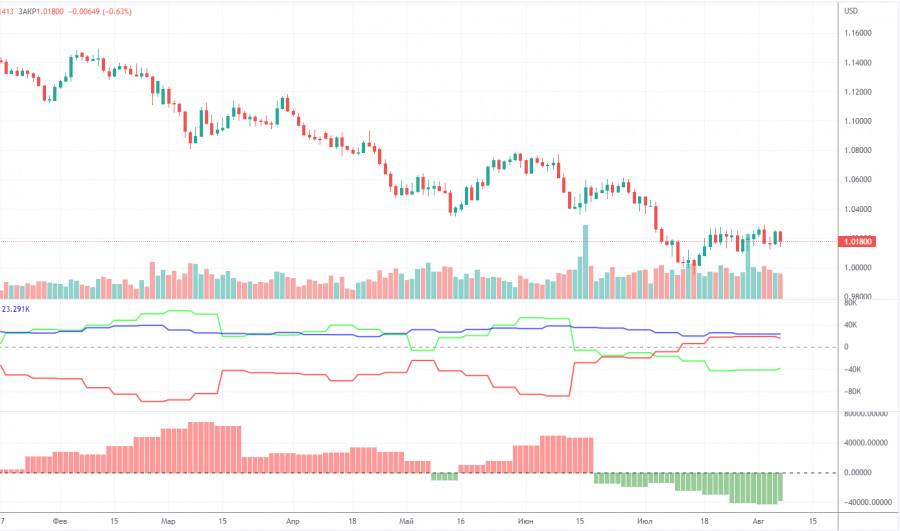

COT report:

The Commitment of Traders (COT) reports on the euro over the past six months have raised a huge number of questions. The chart above clearly shows that for most of 2022 they showed an open bullish mood of professional players, but at the same time, the euro was falling at the same time. At this time, the situation has changed, but NOT in favor of the euro. If earlier the mood was bullish, and the euro was falling, now the mood is bearish and... the euro is also falling. Therefore, for the time being, we do not see any grounds for the euro's growth, because the vast majority of factors remain against it. During the reporting week, the number of long positions decreased by 6,300, while the number of shorts in the non-commercial group decreased by 9,100. Accordingly, the net position increased by about 3,000 contracts, which is a meager change. The mood of the big players remains bearish and has steadily intensified in recent weeks. From our point of view, this fact very eloquently indicates that at this time even commercial traders do not believe in the euro. The number of longs is lower than the number of shorts for non-commercial traders by 39,000. Therefore, we can state that not only the demand for the US dollar remains high, but also the demand for the euro is quite low. This may lead to a new, even greater fall of the euro. Over the past six months or a year, the euro has not been able to show even a tangible correction, not to mention something more. The highest upward movement was about 400 points. Over the past three weeks, the pair has managed to correct by 300 points.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. August 11. There is contact! US inflation began to slow down!

Overview of the GBP/USD pair. August 11. The British pound soared higher, but it has yet to outlast the UK GDP data.

Forecast and trading signals for GBP/USD on August 11. Detailed analysis of the movement of the pair and trading transactions.

EUR/USD 1H

The pair finally broke out of the horizontal channel of 1.0120-1.0269 on the hourly timeframe. Therefore, the flat has been completed for the time being, but now it is still impossible to talk about a clear upward trend. Perhaps in the coming days it will be possible to form an upward trend line, which will help with reference points. We highlight the following levels for trading on Thursday - 1.0120, 1.0269, 1.0340-1.0366, 1.0485, 1.0579, as well as Senkou Span B (1.0195) and Kijun-sen (1 .0255). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. No important publication or fundamental event scheduled again in the European Union and America on Thursday. Traders will again have nothing to react to, so we can watch a downward correction today.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.