The main event of Tuesday, and maybe the entire week, was the interview of Federal Reserve Chairman Jerome Powell. As soon as he started talking, the markets began to rush, which is a sign of high uncertainty. At the beginning of the interview, Powell's stance was dovish, which caused stocks to bounce and U.S. Treasury yields to fall. However, Powell's concluding remarks were more hawkish, noting that if strong labor data persisted, the peak rate in the current tightening cycle could be higher. Overall, it should be noted that Powell's comments did not exactly provide a lot of new information, he did not delve into the topic of a strong labor market as observers had expected.

The U.S. stock market immediately went up, and the U.S. dollar rolled back down. So far, it seems like the effect of the ultra-optimistic NonFarm Payrolls report has worn off, as well as the Fed's rate forecast, and now it's up to the real macro data, which will show which of the scenarios will develop. The three voting FOMC members (Williams, Kashkari, Waller), plus the non-voting Bostic from the Atlanta Fed are scheduled to speak, they will probably expand on what Powell said on Tuesday.

The next strong driver won't come until next week, since the U.S. inflation report for January will be released on Tuesday. The strong rise in 5-year Tips bond yields showing an average inflation forecast for the next 5 years suggests that the decline in inflation may be slowing, this is also a factor in favor of a stronger dollar.

Until the end of the week, we expect trading to be generally calm.

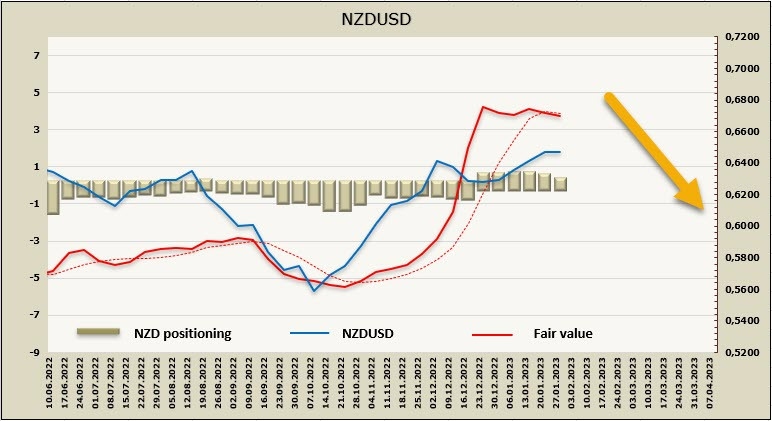

NZDUSD

New Zealand's economy, which until recently seemed to be an example of resilience, is experiencing more and more difficulties. 4Q labor market data was weaker than forecasts (including Reserve Bank of New Zealand forecasts), labor demand outlooks have declined significantly in recent months, and unemployment is now forecast to continue rising slightly in the first half of 2023 and then pick up faster in the second half of the year as the sharp rise in interest rates causes the economy to contract. Unemployment is expected to rise to a peak of 5.4% in 2024 from 3.4% currently.

People are reassessing their projections regarding the RBNZ's rate. Whereas a couple of weeks ago, the Fed peak rate was viewed as 5% and the RBNZ's rate as 5.75%, the situation has now changed. The Fed peak is at about 5.15% and the RBNZ peak is at 5.2%, which means that the expected yield spread is gone and the kiwi has accordingly lost the main driver that has supported its growth since October.

In the absence of CFTC data, the estimated price reversed slightly downwards, which also indicates that the bullish momentum of the NZD has weakened.

The likelihood that NZDUSD can return to the 0.6532 high is getting smaller. At the moment, the most likely scenario is a slight pullback from the low at 0.6263, with the pair moving into a sideways range while 0.6532 will serve as the upper limit as we anticipate new data. The first quarter of this year will provide a lot of new information, primarily regarding the depth of the expected recession, the reaction of both the RBNZ and the Fed is unlikely to be aggressive, so it is unlikely for a new strong driver to form a strong trend right now.

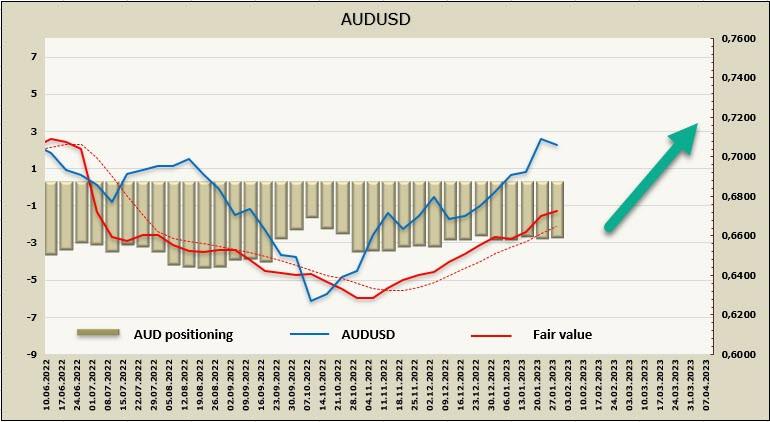

AUDUSD

The Reserve Bank of Australia raised its cash rate by 25 basis points to 3.35%, the ninth consecutive rate hike since May. The accompanying statement was also hawkish, as the RBA expects "...more interest rate hikes will be required in the coming months...". The "plural" form in this wording suggests that the RBA expects at least two more 25bp rate hikes in the coming months, most likely in March, and then possibly another in April or May. The key data to look out for ahead of the next RBA meeting are the wage price index on February 22 and GDP growth rate on March 1.

The aussie rebounded from Friday's Nonfarm, mostly due to the hawkish stance of the RBA. An extremely positive report on inflation is not expected; the forecast is that inflation could fall to 4.75% this year and to 3% by mid-2025, which means it will remain above the target for a long time to come. Accordingly, the RBA's position is unlikely to change much in the coming months.

If the U.S. recession really turns out to be shallow, commodity prices will not collapse, which means that export-oriented countries will get an additional growth factor. As long as financial flows indicate that AUD demand continues to rise, the settlement price is pointing upwards, the aussie has reason to resume growth.

I expect the resistance zone at 0.7140/60 to be tested again, technically, the trend is still bullish. We don't know whether the aussie will be able to go higher. The recent low at 0.6856 will act as support, there is no reason for deeper decline. Bullish momentum on the AUDNZD cross persists.