The USD/JPY pair reached a six-month high, approaching the 141 level. After peaking at 140.93, USD/JPY bulls started to lock in profits, dampening the upward momentum. Bears then took the initiative and pushed the pair towards the 140 level. However, despite the intraday downward retracement, bullish sentiment persists. This is not only due to the strengthening of the US dollar index but also the weakness of the yen.

Echoes of the inflation report

The USD/JPY pair has been demonstrating a clear uptrend since May 11. In less than 2.5 weeks, the price has risen by nearly 700 pips. The pair is influenced by various fundamental factors. Let's highlight the main ones. Firstly, there is a divergence in the policies of the Federal Reserve (Fed) and the Bank of Japan. Secondly, there is a rise in risk-off sentiment amid the threat of US debt default. All the fundamental factors that impact USD/JPY are in one way or another connected to these major themes mentioned above.

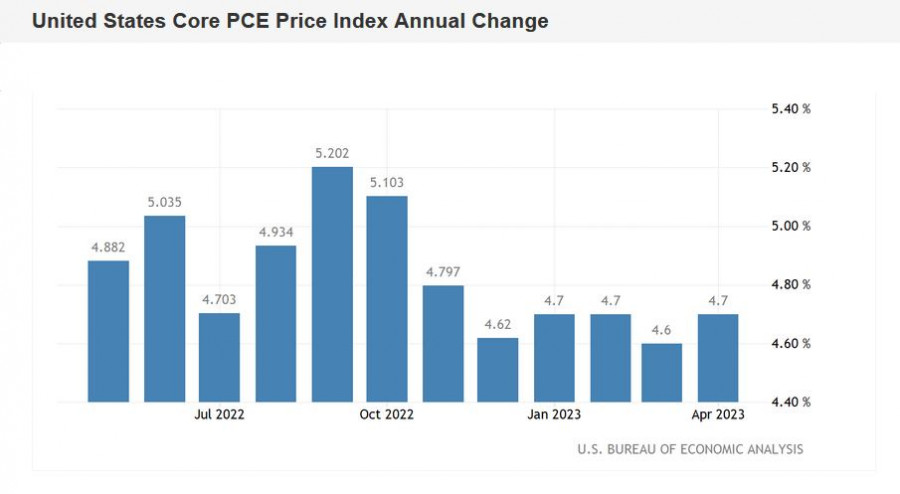

For example, Friday's inflation report on PCE growth (one of the key inflation indicators tracked by the Fed) neutralized the ambitions of USD/JPY bears regarding the development of a significant bearish counterattack towards the 139 level. The Friday low was recorded at 139.50, but after the report, bulls once again took the initiative as the data reflected an acceleration of this crucial inflation indicator for the Fed. Recall that from September to December of last year, the index consistently declined from 5.2% to 4.6%. Then in January and February, it reached 4.7%, and in March, it returned to the December level of 4.6%. And now, in April, the index is back at 4.7%, despite the forecasted decline to 4.5%.

The published report plays an important role, especially amid the hesitation of some Fed members.

Let's go back to the main theses of the Fed's May meeting. The minutes turned out to be quite contradictory. On the one hand, members agreed that the need for further interest rate hikes "has become less certain." Fed officials also noted that the quarter point rate hike in May "may be the last one in the current tightening cycle." On the other hand, some members warned that the Fed needs to remain open to the possible realization of a hawkish scenario, considering the risks of sustained inflation.

Interestingly, as a result of Friday's report, hawkish expectations regarding the Fed's future actions increased again. According to data from the CME FedWatch Tool, the probability of a 25-basis-point rate hike at the June meeting increased to 65%. This is quite significant, considering the recent dovish statements made by Fed Chairman Jerome Powell. He highlighted the relevance of the banking crisis in the United States, stating that the banking stress has diminished the need for interest rate hikes.

At the same time, many of Powell's colleagues have voiced quite hawkish comments throughout May. For example, Dallas Fed President Robert Kaplan stated that incoming data "support an interest rate hike at the next meeting." This position, in one interpretation or another, was also supported by other representatives of the US central bank, such as Loretta Mester, Thomas Barkin, Raphael Bostic, and John Williams.

It is evident that the core PCE index has strengthened hawkish positions, leading to a noticeable increase in the probability of a 25-basis-point scenario being implemented in June.

BOJ remains cautious about changes

Under the leadership of Kazuo Ueda, the BOJ continues to implement an accommodative monetary policy. According to a number of experts (including UBS), the Japanese central bank may adjust its yield curve control this year, possibly in the second half, meaning autumn or winter. It is expected that the central bank will raise the target level of the 10-year Japanese government bond yield from the current 0.5% to (at least) 0.75%.

Ueda essentially echoes the rhetoric of Haruhiko Kuroda, at least in assessing the near-term prospects. According to Ueda, it is currently appropriate to implement accommodative monetary policy to achieve the target two percent inflation level "in tandem with wage growth." Ueda also regularly reiterates his predecessor's signature phrase, stating that the central bank will continue to ease its monetary policy parameters without hesitation if necessary.

Conclusions

The established fundamental backdrop for the USD/JPY pair supports further development of the uptrend. On the daily chart, the pair is above the Kumo cloud of the Ichimoku indicator and above all its lines. The bullish Parade of Lines signal indicates the potential for further price growth. Additionally, the pair is between the middle and upper lines of the Bollinger Bands indicator, which also indicates bullish sentiment among traders.

We can consider the 141.20 level as the nearest target of the upward movement, which corresponds to the resistance level of the upper Bollinger Bands line on the 1D chart. The next target is 142.00, which is the upper limit of the Kumo cloud on the 1W chart.